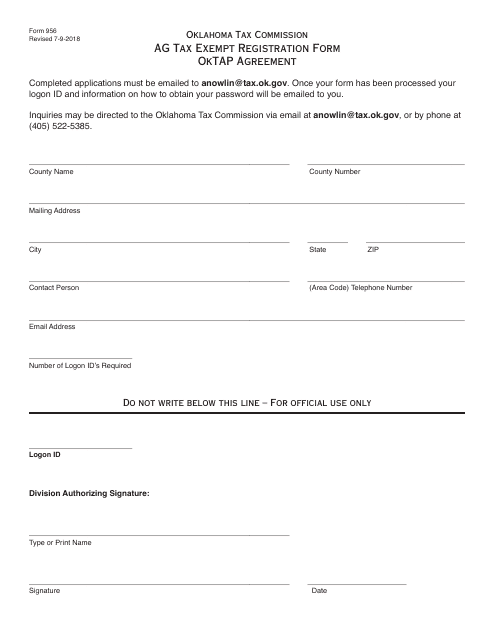

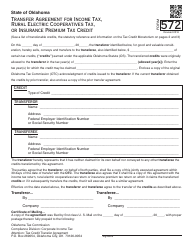

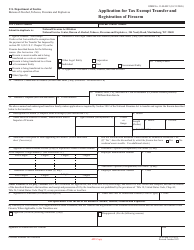

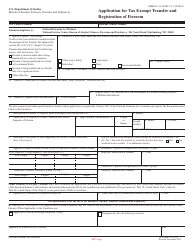

OTC Form 956 Ag Tax Exempt Registration Form Oktap Agreement - Oklahoma

What Is OTC Form 956?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 956?

A: OTC Form 956 is the Ag Tax Exempt Registration Form that is used in Oklahoma.

Q: What is the purpose of OTC Form 956?

A: The purpose of OTC Form 956 is to register for agricultural tax exemption in Oklahoma.

Q: Who needs to fill out OTC Form 956?

A: Anyone who wants to claim agricultural tax exemption in Oklahoma needs to fill out OTC Form 956.

Q: What is an Oktap Agreement?

A: An Oktap Agreement is an agreement between the Oklahoma Tax Commission (OTC) and a taxpayer regarding agricultural tax exemption.

Q: Is agricultural tax exemption available in other states?

A: Yes, agricultural tax exemption is available in other states as well. The requirements and forms may vary.

Q: What documents do I need to fill out OTC Form 956?

A: You may need to provide documents such as proof of ownership or lease of agricultural land, proof of agricultural production, and other supporting documents when filling out OTC Form 956.

Q: Are there any fees associated with filing OTC Form 956?

A: There are no fees associated with filing OTC Form 956.

Q: Can I claim agricultural tax exemption if I don't own the land?

A: Yes, you can still claim agricultural tax exemption if you lease the land for agricultural purposes and meet the eligibility criteria.

Q: Who can I contact for more information about OTC Form 956?

A: You can contact the Oklahoma Tax Commission (OTC) for more information about OTC Form 956.

Form Details:

- Released on July 9, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 956 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.