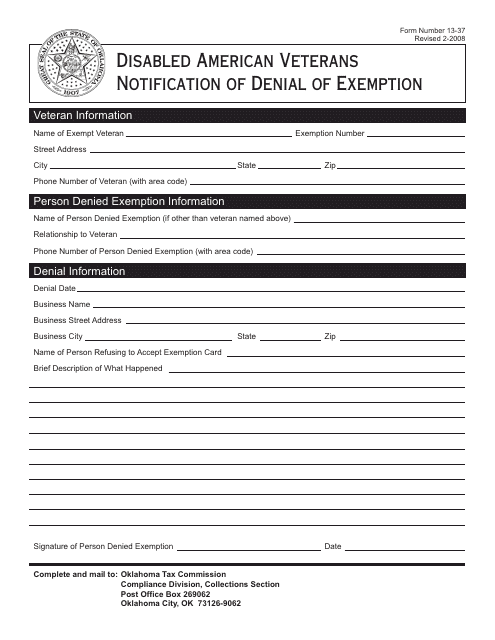

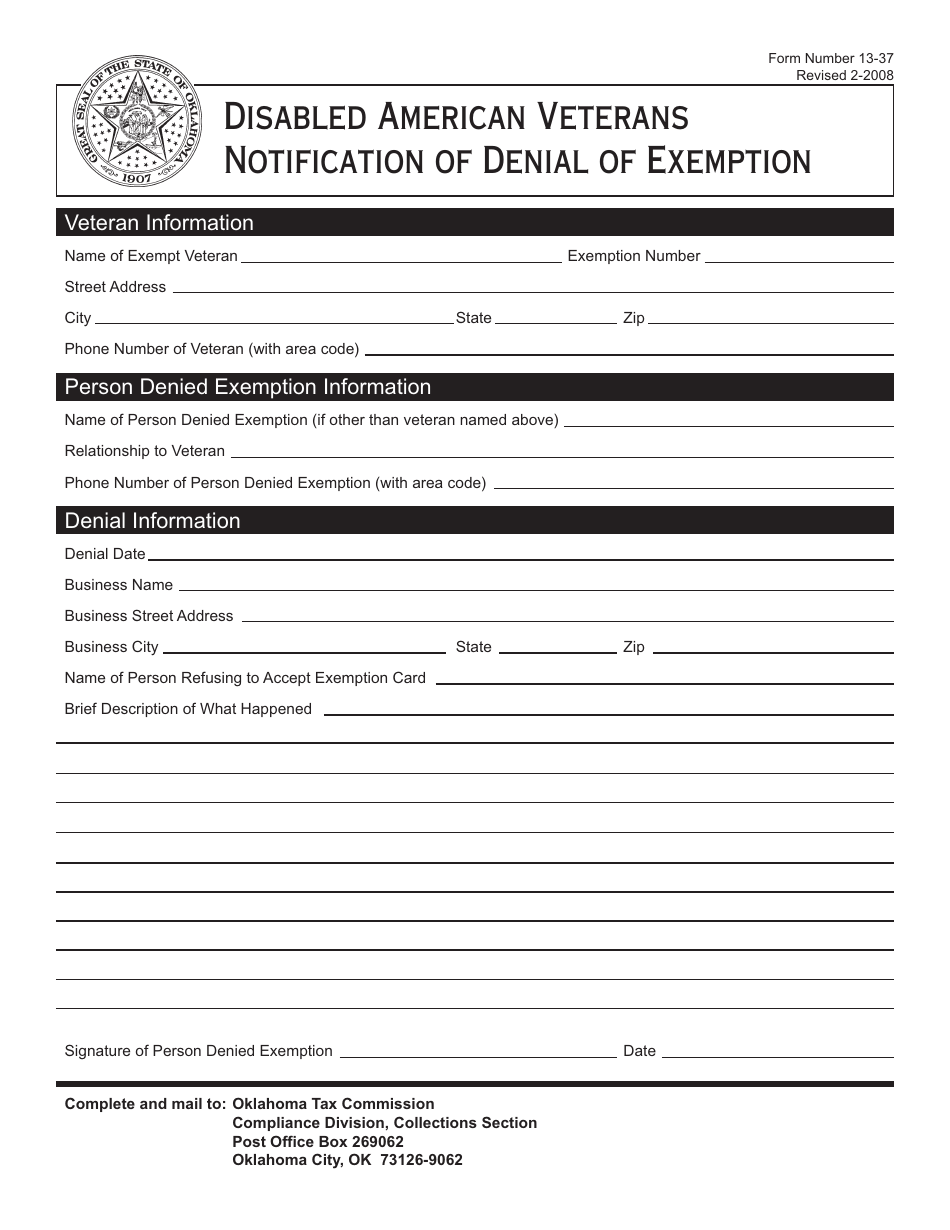

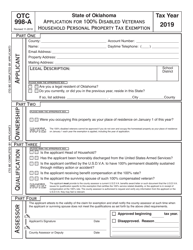

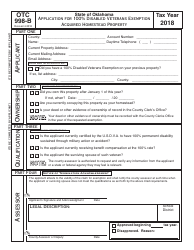

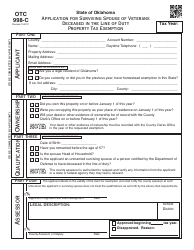

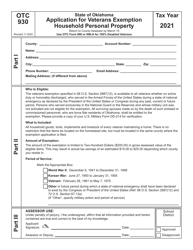

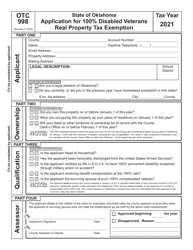

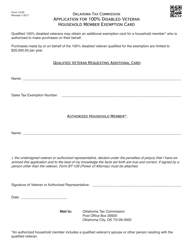

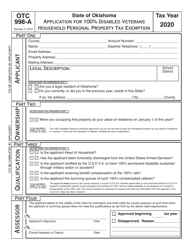

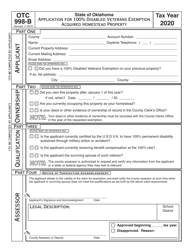

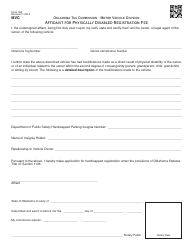

OTC Form 13-37 Disabled American Veterans Notification of Denial of Exemption - Oklahoma

What Is OTC Form 13-37?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 13-37?

A: OTC Form 13-37 is a form used for Disabled American Veterans Notification of Denial of Exemption in Oklahoma.

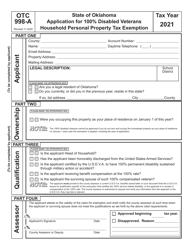

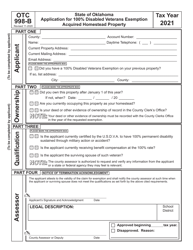

Q: Who is eligible for the exemption?

A: Disabled American Veterans are eligible for the exemption.

Q: What does the form notify?

A: The form notifies the Disabled American Veterans about the denial of exemption.

Q: What is the purpose of the exemption?

A: The purpose of the exemption is to provide tax benefits to Disabled American Veterans.

Form Details:

- Released on February 1, 2008;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 13-37 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.