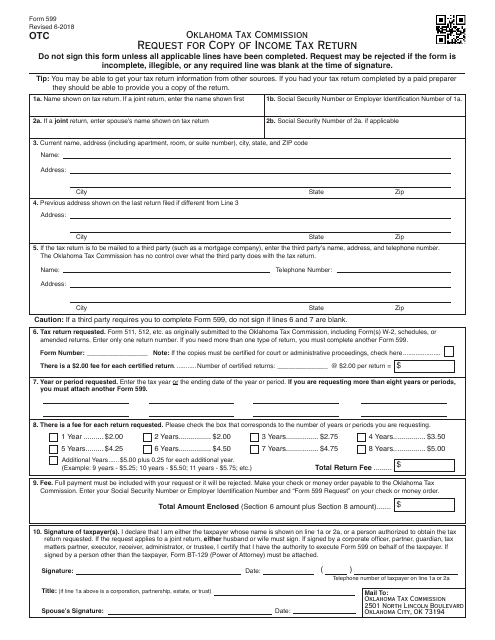

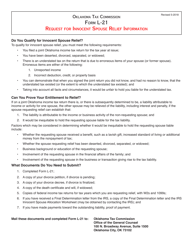

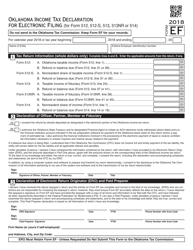

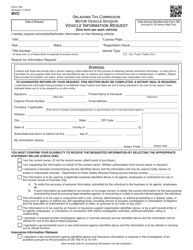

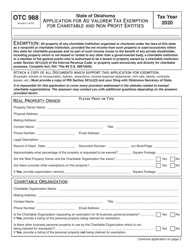

OTC Form 599 Request for Copy of Income Tax Return - Oklahoma

What Is OTC Form 599?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 599?

A: OTC Form 599 is a request form used in Oklahoma to obtain a copy of an income tax return.

Q: Who can use OTC Form 599?

A: Any individual or business in Oklahoma who wishes to obtain a copy of their income tax return can use OTC Form 599.

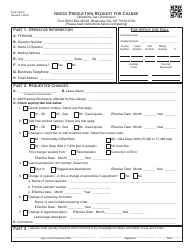

Q: What information is required on OTC Form 599?

A: You will need to provide your name, social security number or employer identification number, tax year, and your signature.

Q: Is there a fee for requesting a copy of the income tax return?

A: Yes, there is a $5 fee for each copy of the income tax return requested.

Q: How long does it take to process the request?

A: The Oklahoma Tax Commission typically processes requests for copies of income tax returns within 10 business days.

Q: Can I request copies of income tax returns for previous years?

A: Yes, you can request copies of income tax returns for the current year and up to three prior years.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 599 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.