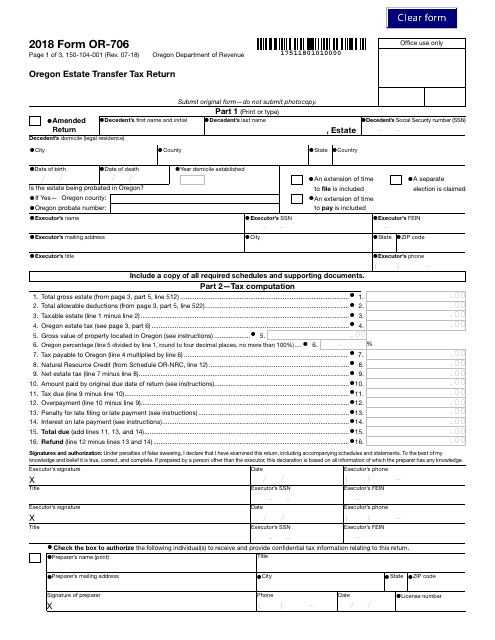

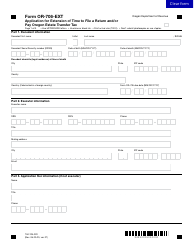

This version of the form is not currently in use and is provided for reference only. Download this version of

Form OR-706 (150-104-001)

for the current year.

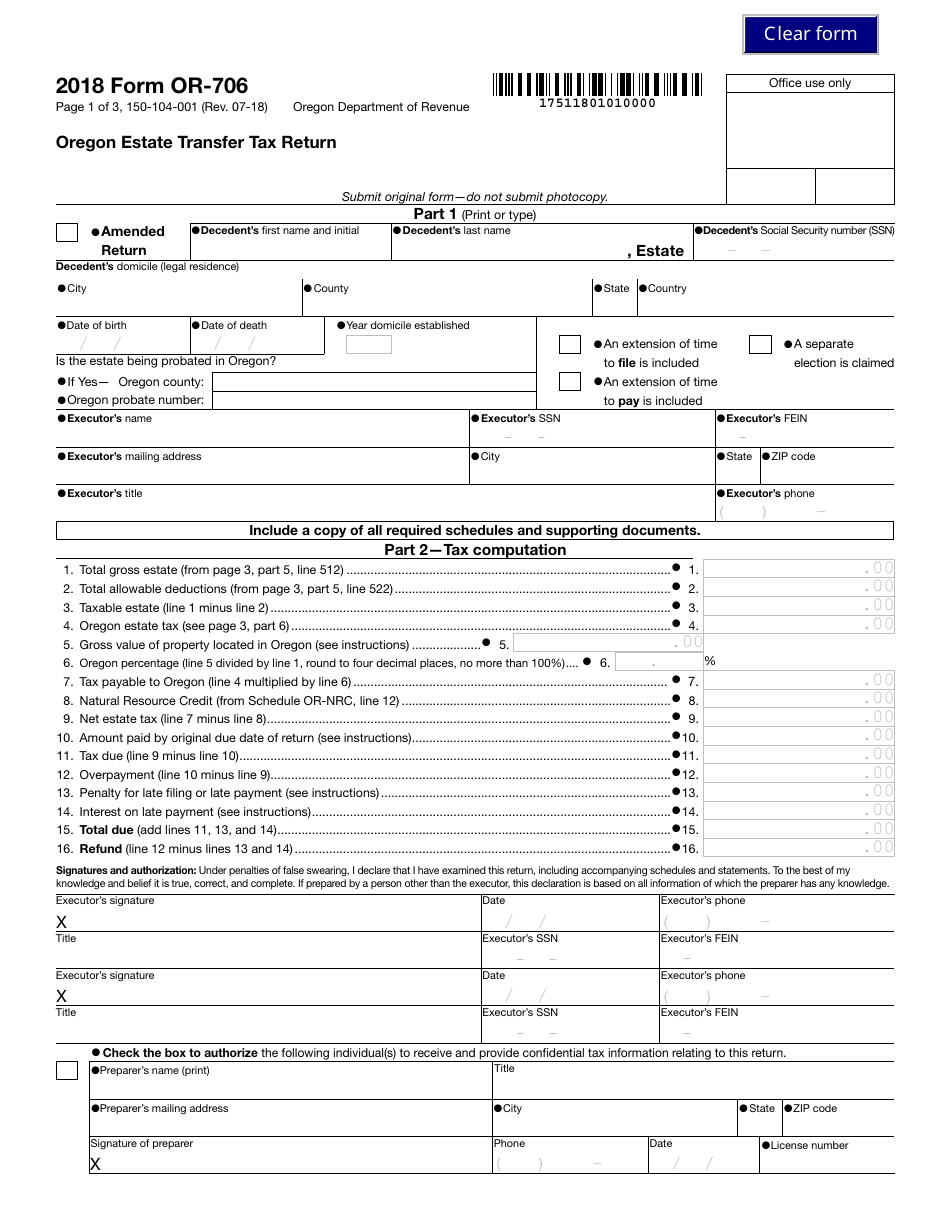

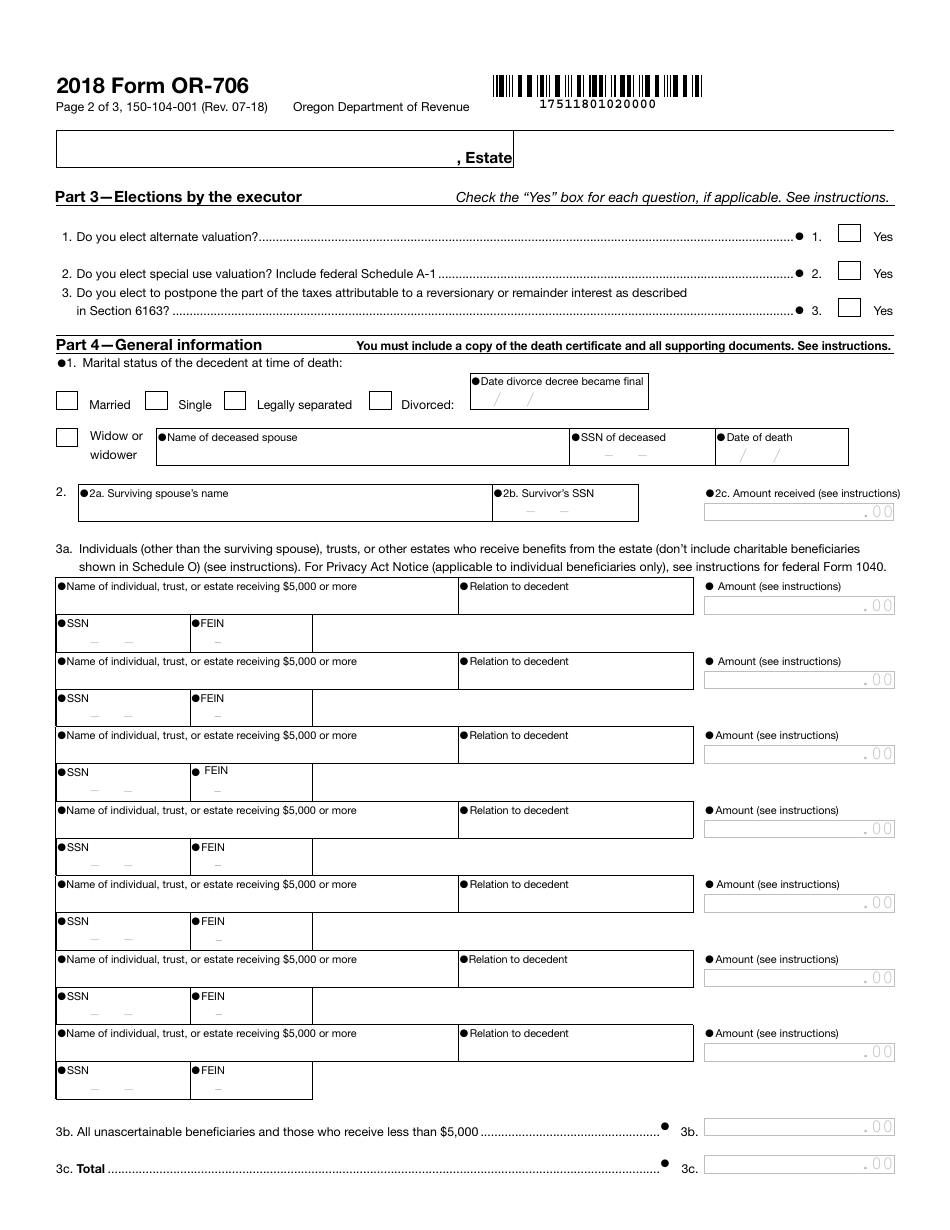

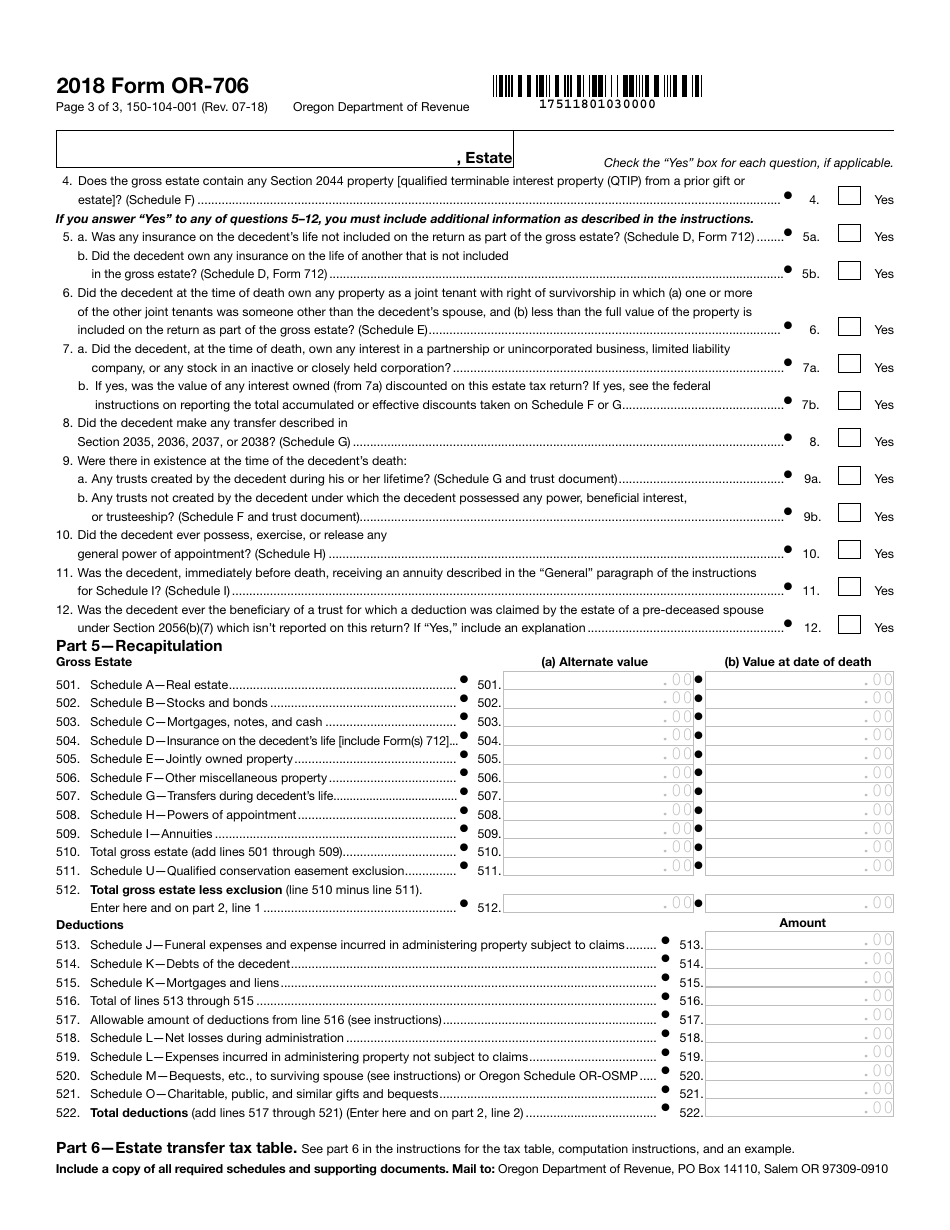

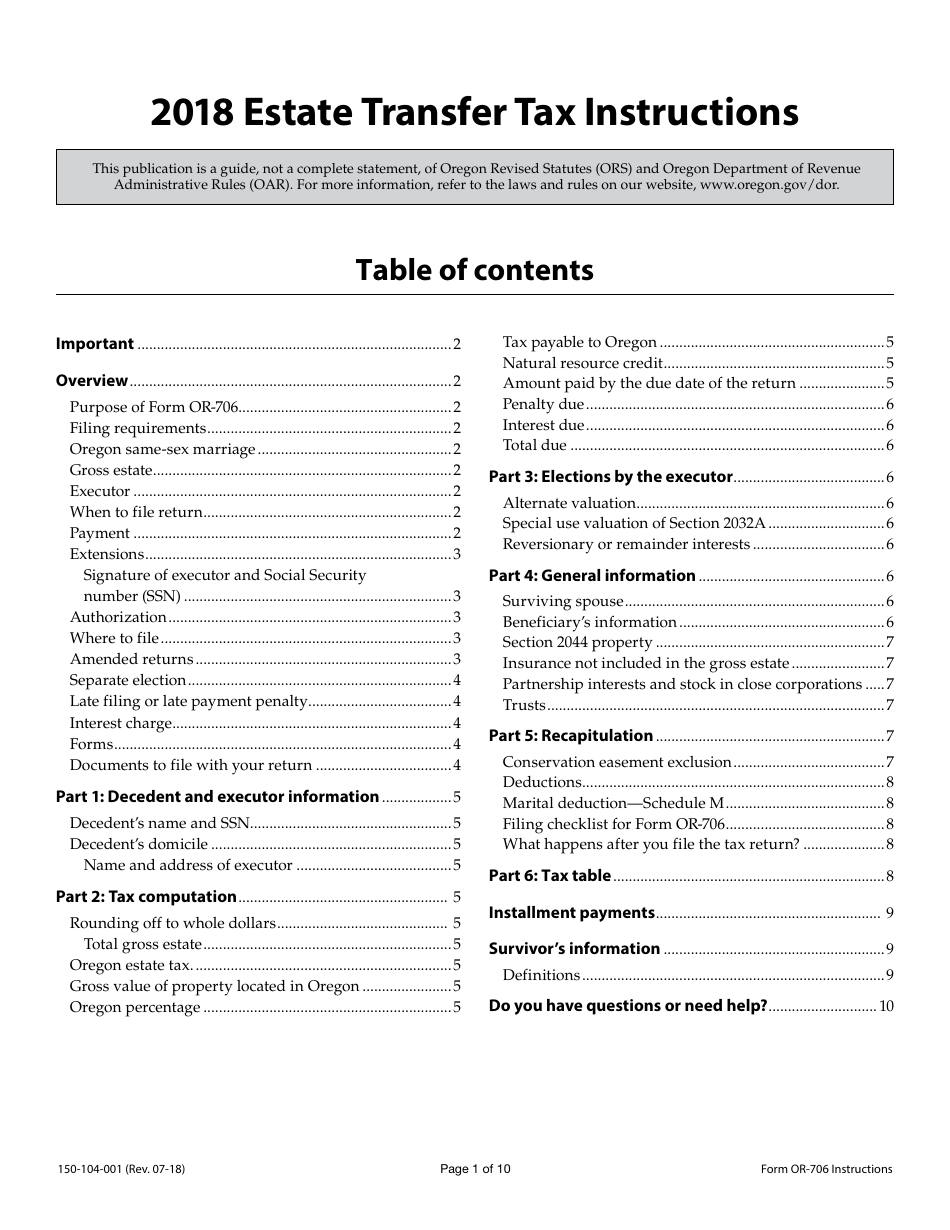

Form OR-706 (150-104-001) Oregon Estate Transfer Tax Return - Oregon

What Is Form OR-706 (150-104-001)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-706?

A: Form OR-706 is the Oregon Estate Transfer Tax Return.

Q: Who needs to file Form OR-706?

A: Form OR-706 needs to be filed by the executor or personal representative of the estate of a resident of Oregon or a nonresident who owned real or tangible personal property in Oregon.

Q: What is the purpose of Form OR-706?

A: The purpose of Form OR-706 is to report and pay the Oregon Estate Transfer Tax.

Q: What is the Oregon Estate Transfer Tax?

A: The Oregon Estate Transfer Tax is a tax imposed on the transfer of the estate of a deceased person.

Q: Are there any filing deadlines for Form OR-706?

A: Form OR-706 must be filed and the tax must be paid within nine months after the decedent's death.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-706 (150-104-001) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.