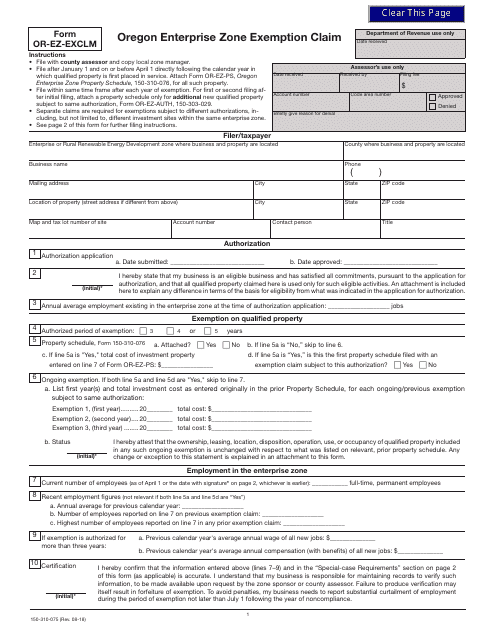

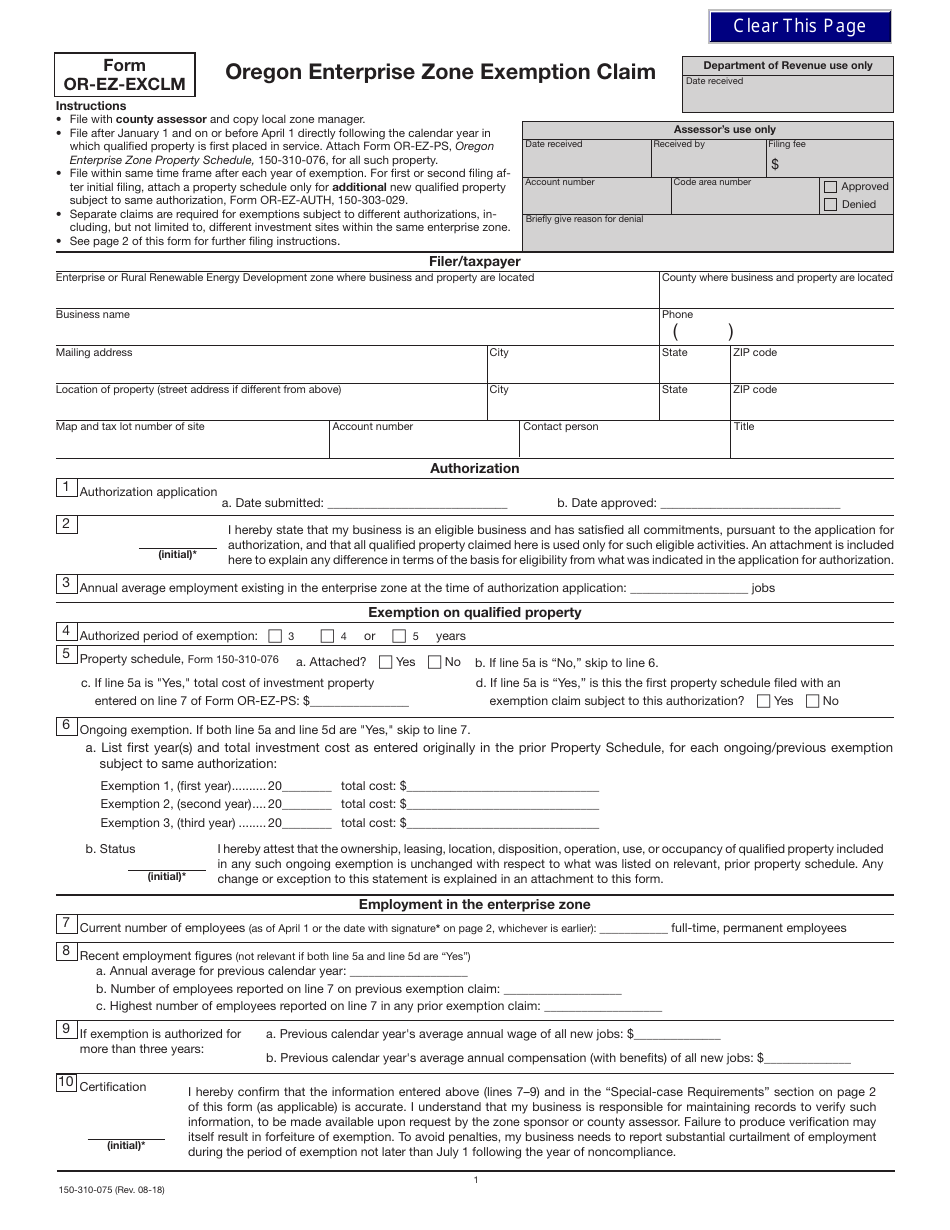

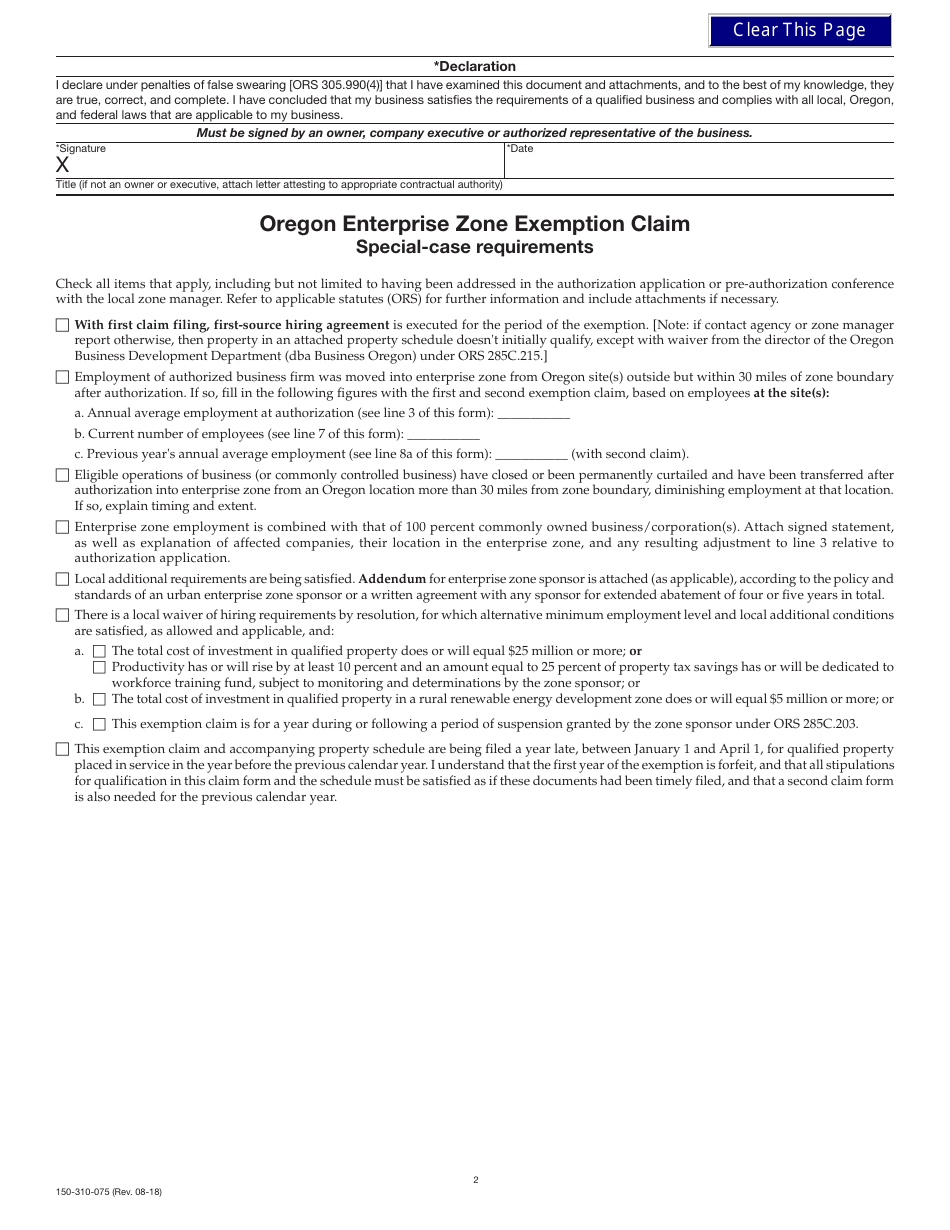

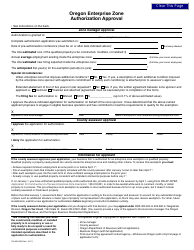

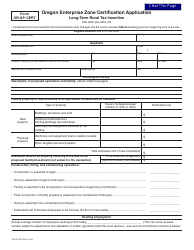

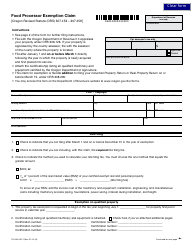

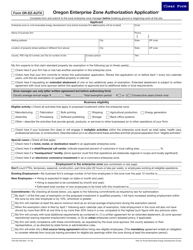

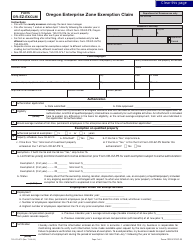

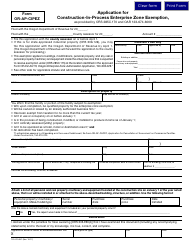

Form 150-310-075 (OR-EZ-EXCLM) Enterprise Zone Exemption Claim - Oregon

What Is Form 150-310-075 (OR-EZ-EXCLM)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-310-075?

A: Form 150-310-075 is the Enterprise Zone Exemption Claim form for Oregon.

Q: What is the purpose of Form 150-310-075?

A: The purpose of Form 150-310-075 is to claim the Enterprise Zone Exemption in Oregon.

Q: Who is eligible to file Form 150-310-075?

A: Businesses located in designated Enterprise Zones in Oregon may be eligible to file Form 150-310-075.

Q: What is the Enterprise Zone Exemption?

A: The Enterprise Zone Exemption provides qualifying businesses with property tax exemptions in Oregon.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-310-075 (OR-EZ-EXCLM) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.