This version of the form is not currently in use and is provided for reference only. Download this version of

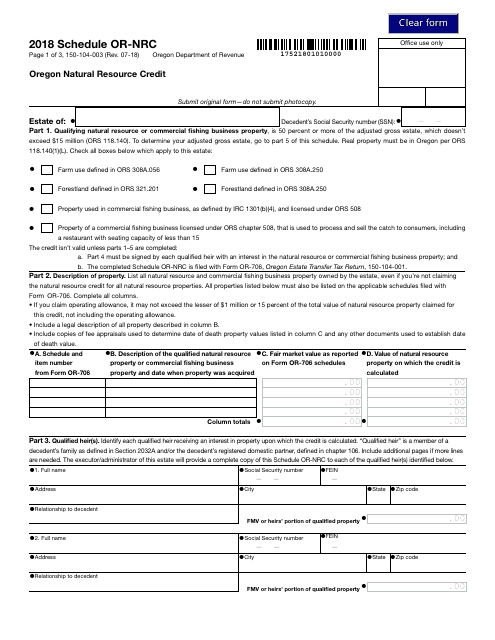

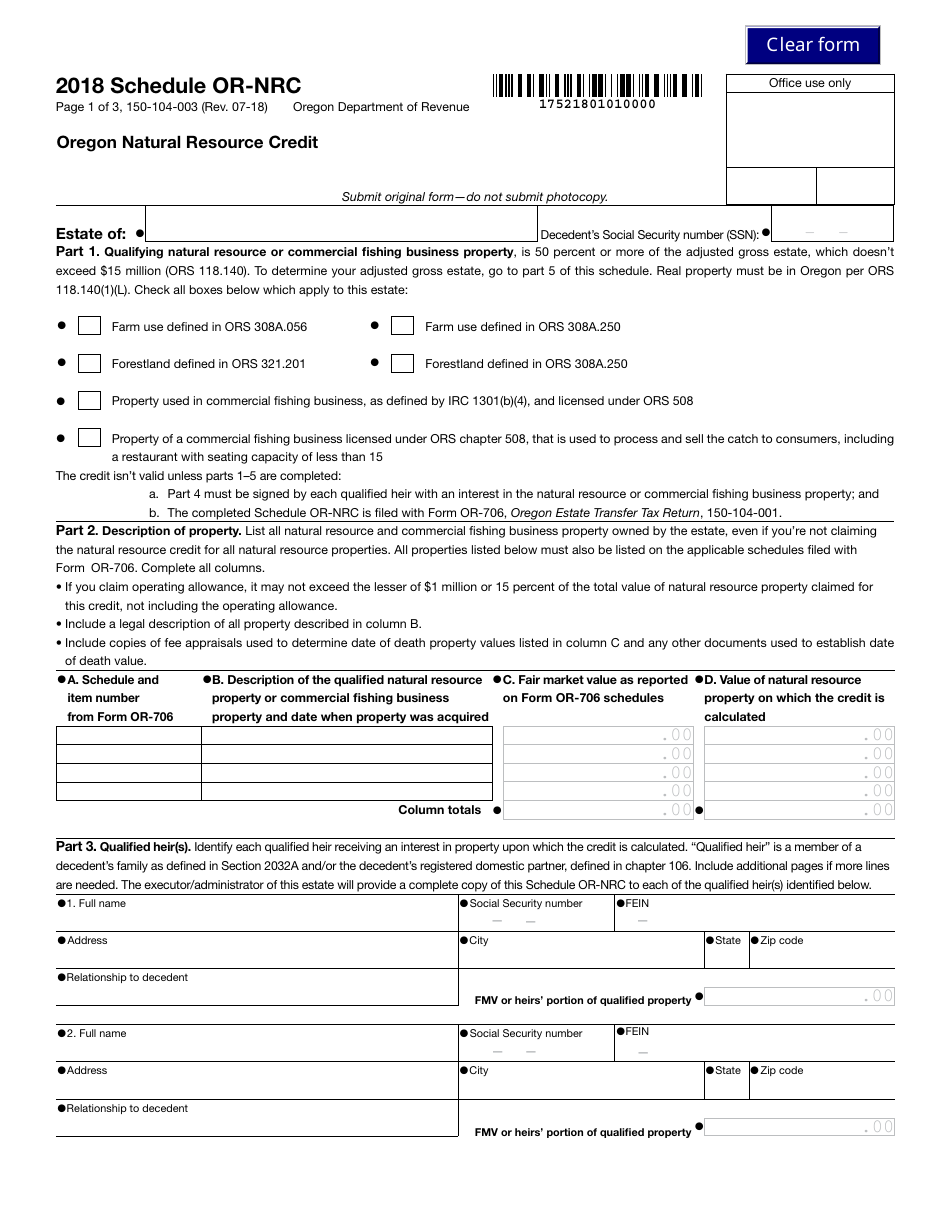

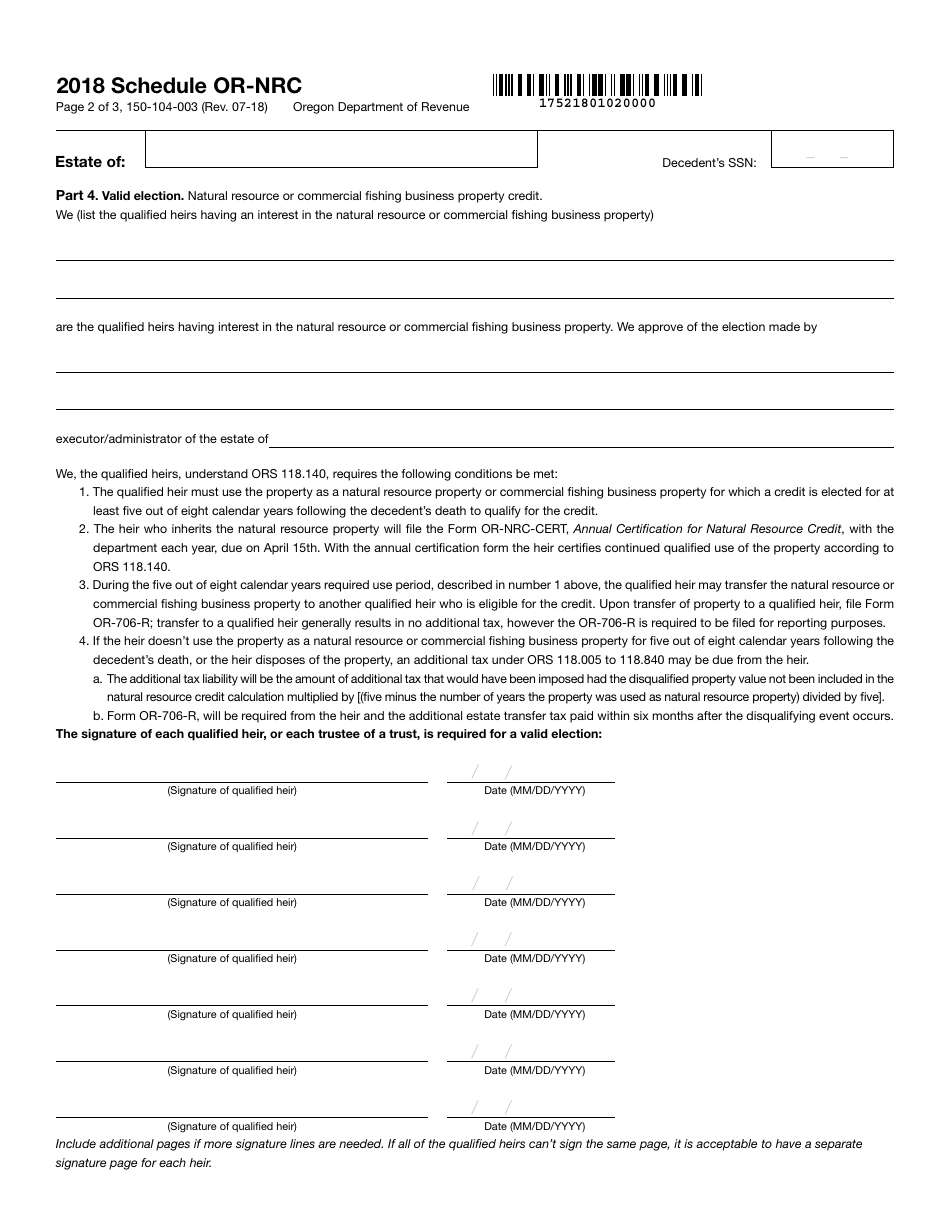

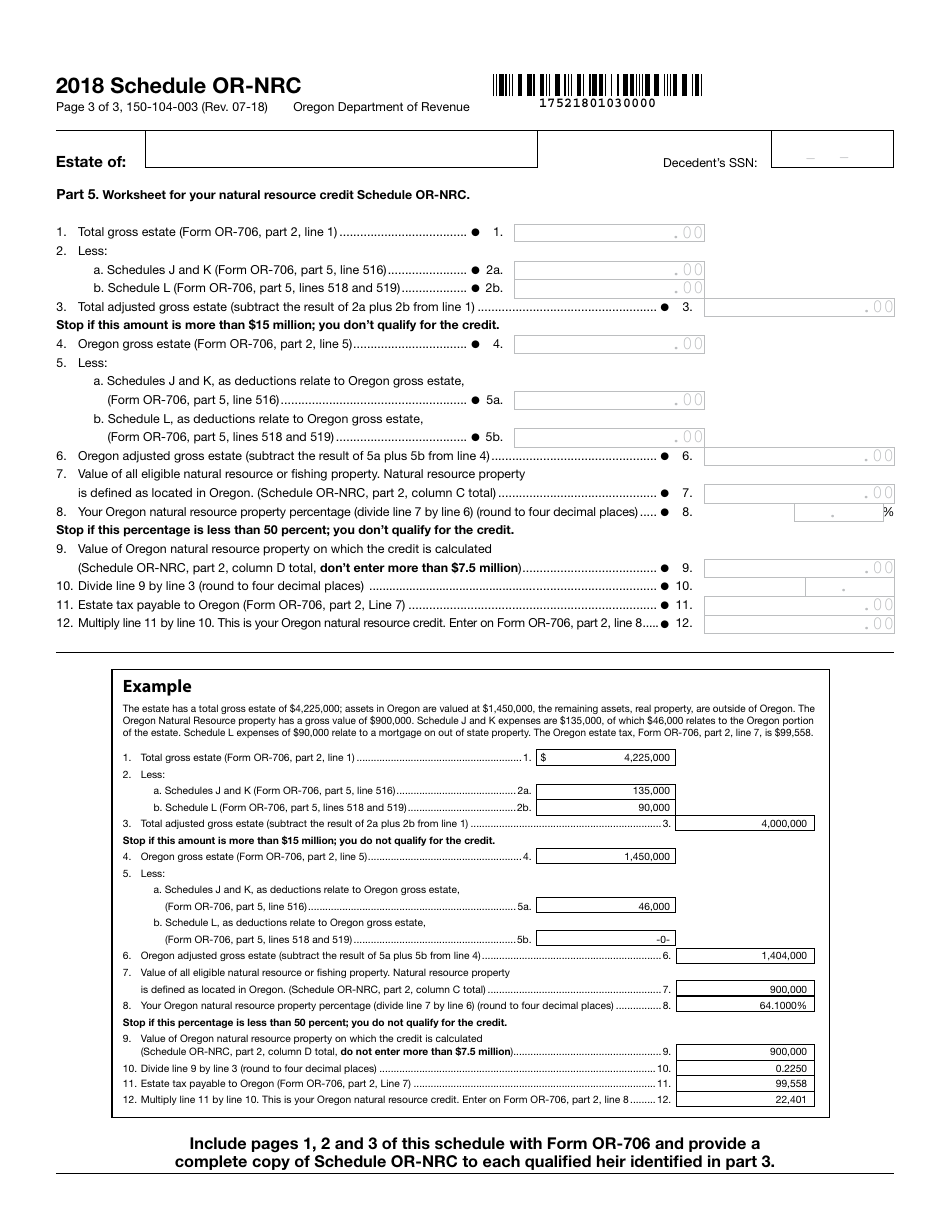

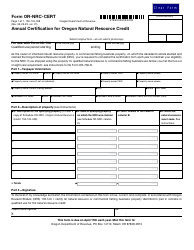

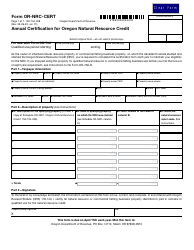

Form 150-104-003 Schedule OR-NRC

for the current year.

Form 150-104-003 Schedule OR-NRC Oregon Natural Resource Credit - Oregon

What Is Form 150-104-003 Schedule OR-NRC?

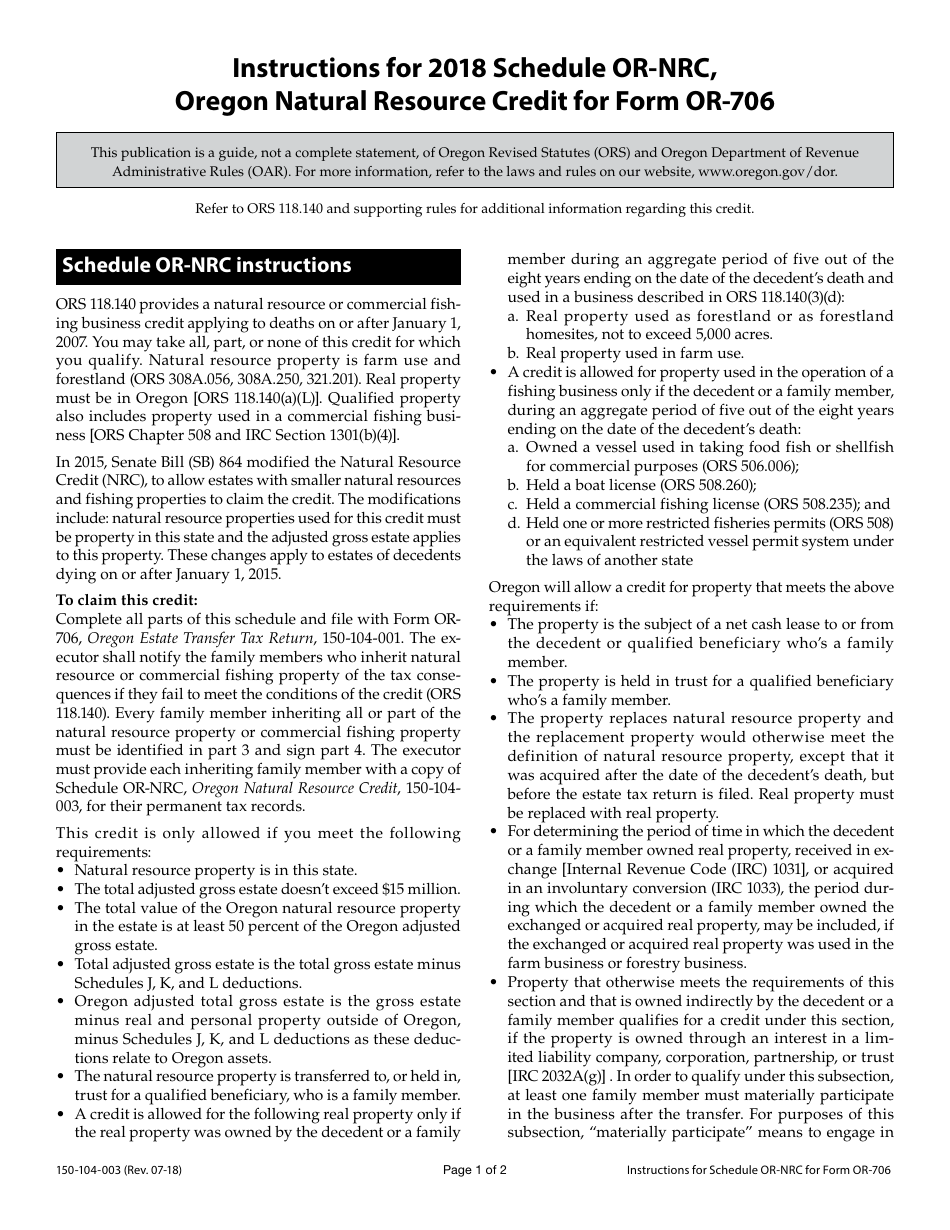

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-104-003?

A: Form 150-104-003 is the official form used by taxpayers in Oregon to claim the Oregon Natural Resource Credit.

Q: What is the Oregon Natural Resource Credit?

A: The Oregon Natural Resource Credit is a tax credit available to individuals and businesses that invest in certain natural resource activities in Oregon.

Q: Who is eligible to claim the Oregon Natural Resource Credit?

A: Individuals and businesses that conduct eligible natural resource activities in Oregon may be eligible to claim the credit.

Q: What activities qualify for the Oregon Natural Resource Credit?

A: Eligible activities can include timber harvesting, forest management, agricultural practices, and fisheries activities, among others. It is best to consult the instructions on Form 150-104-003 for a complete list of qualifying activities.

Q: How do I claim the Oregon Natural Resource Credit?

A: To claim the credit, taxpayers must complete and file Form 150-104-003 with their Oregon state tax return. The form requires detailed information about the qualifying activities and expenses incurred.

Q: Is there a limit to the Oregon Natural Resource Credit?

A: Yes, there is a limit to the credit, which may vary depending on the type of activity and other factors. Taxpayers should refer to the instructions on Form 150-104-003 for specific limitations.

Q: Are there any deadlines for claiming the Oregon Natural Resource Credit?

A: Yes, taxpayers generally must file their Oregon state tax return and claim the credit by the due date of the return, including any extensions.

Q: Can the Oregon Natural Resource Credit be carried forward or transferred?

A: Yes, any unused credit may be carried forward for up to five years or transferred to another eligible taxpayer, subject to certain restrictions. The instructions on Form 150-104-003 provide additional details.

Q: Do I need to include any supporting documentation with Form 150-104-003?

A: Yes, taxpayers are generally required to attach supporting documentation to substantiate the claimed credit. The specific documentation requirements are outlined in the instructions for Form 150-104-003.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-104-003 Schedule OR-NRC by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.