This version of the form is not currently in use and is provided for reference only. Download this version of

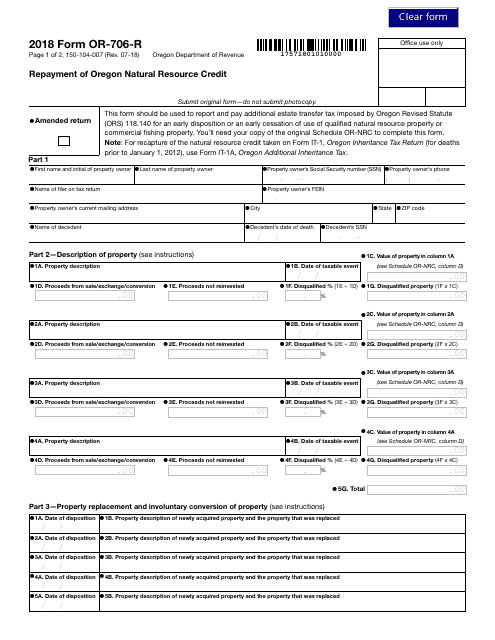

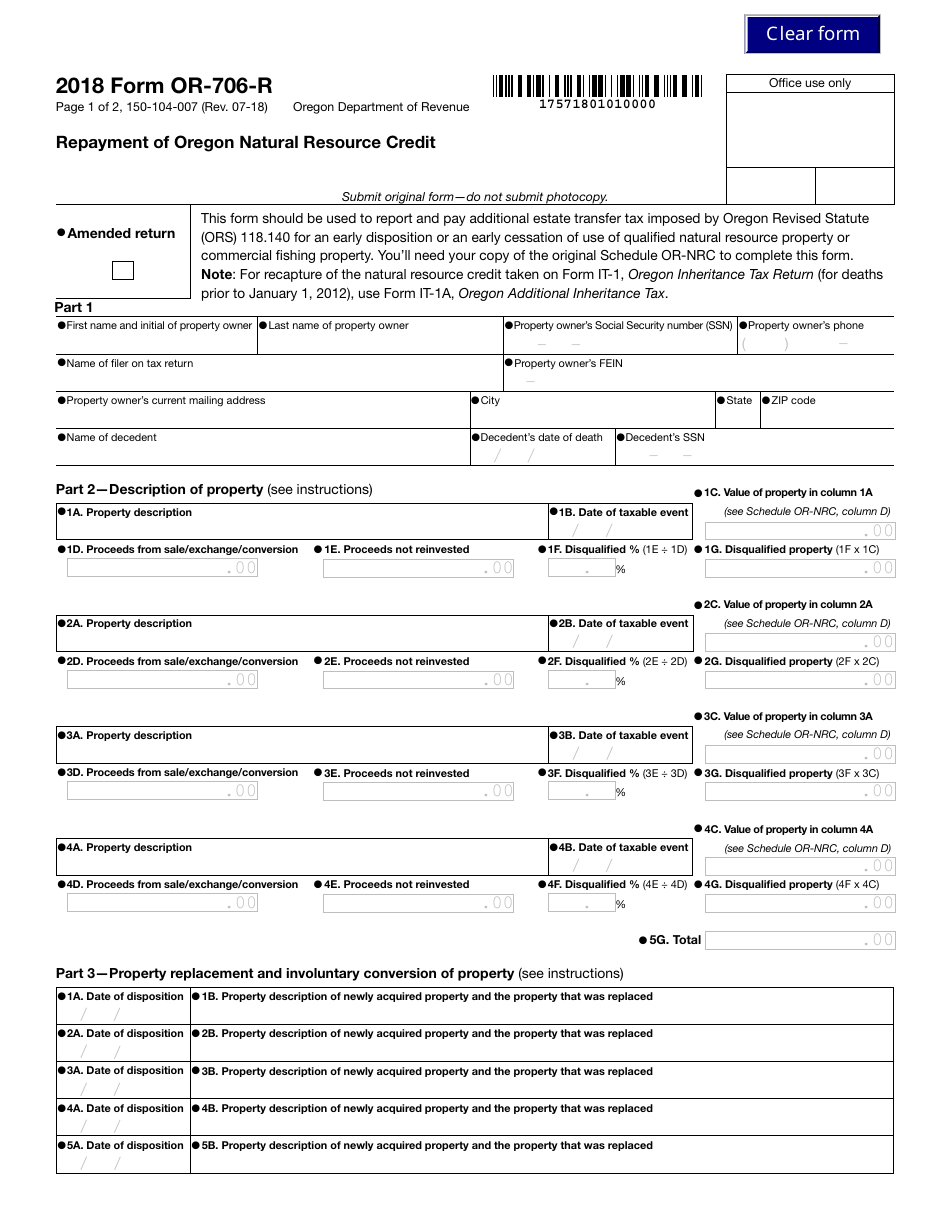

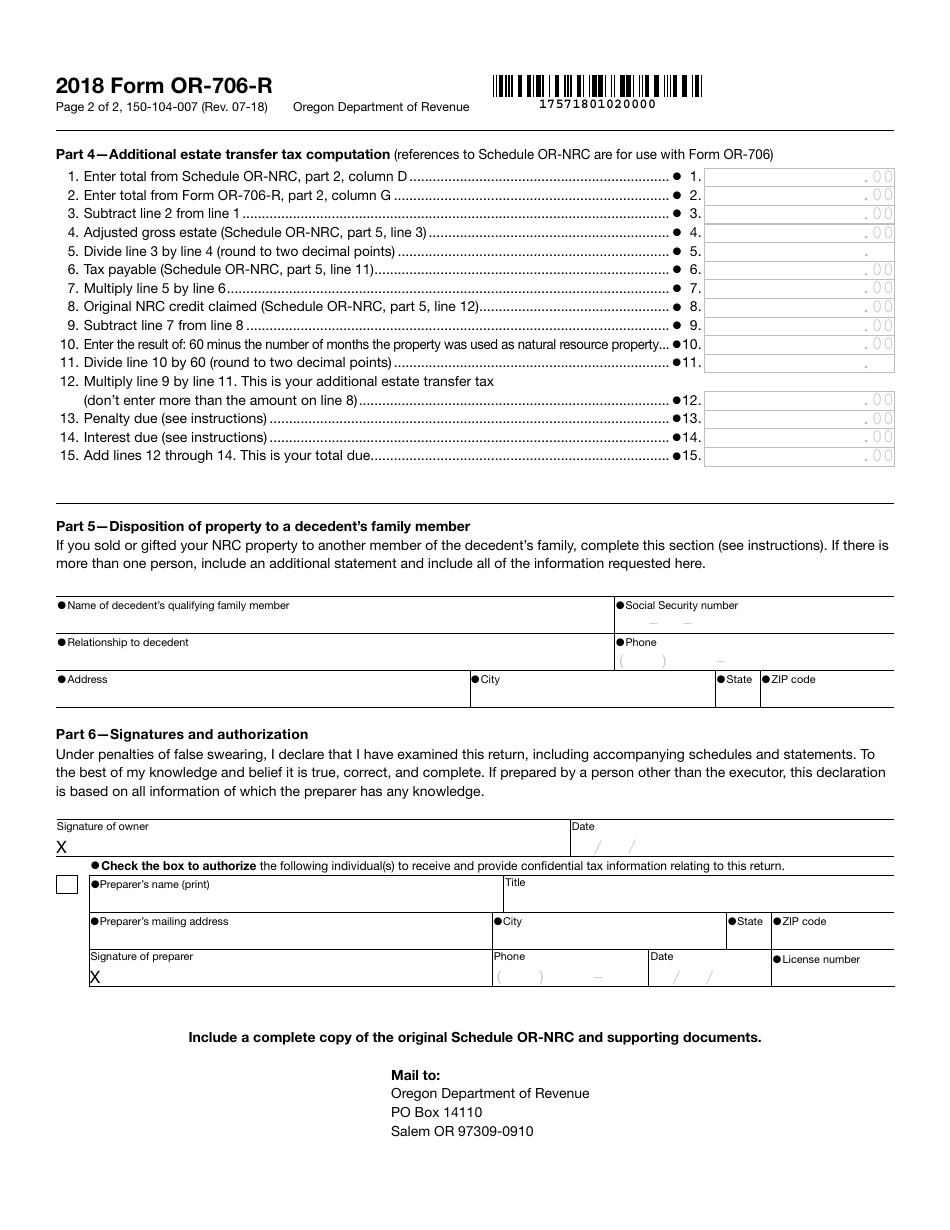

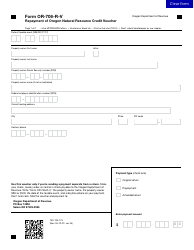

Form OR-706-R (150-104-007)

for the current year.

Form OR-706-R (150-104-007) Repayment of Oregon Natural Resource Credit - Oregon

What Is Form OR-706-R (150-104-007)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-706-R?

A: Form OR-706-R is the form used to repay the Oregon Natural Resource Credit in Oregon.

Q: What is the purpose of Form OR-706-R?

A: The purpose of Form OR-706-R is to repay the Oregon Natural Resource Credit.

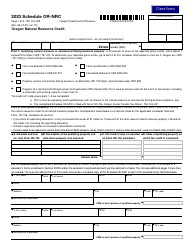

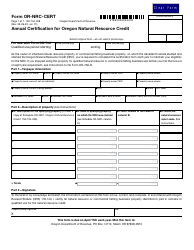

Q: What is the Oregon Natural Resource Credit?

A: The Oregon Natural Resource Credit is a tax credit available to Oregon residents who have owned or leased certain natural resource property.

Q: Who needs to file Form OR-706-R?

A: Individuals who claimed the Oregon Natural Resource Credit and need to repay it must file Form OR-706-R.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-706-R (150-104-007) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.