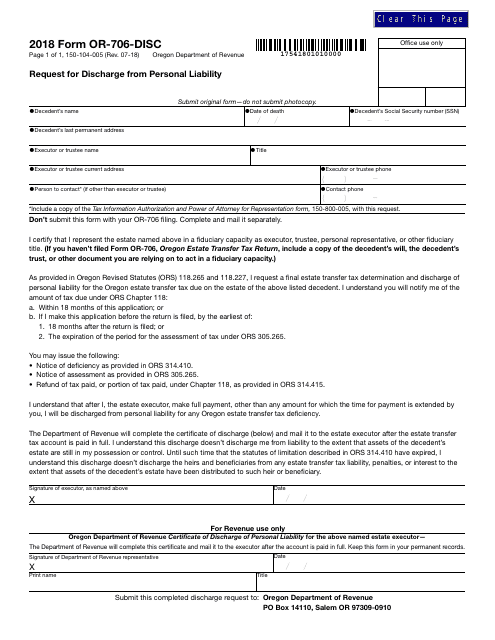

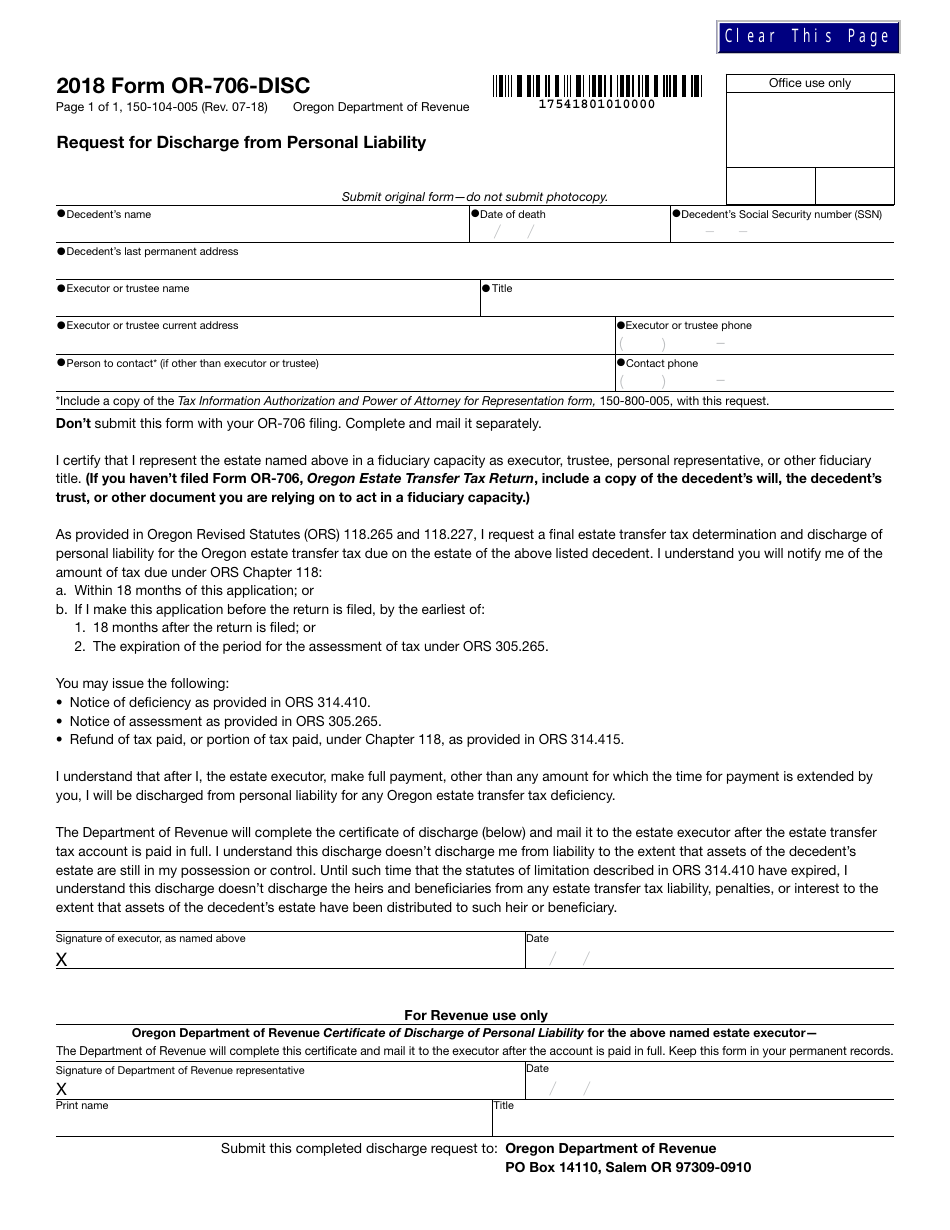

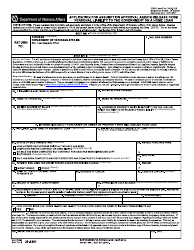

Form 150-104-005 (OR-706-DISC) Request for Discharge From Personal Liability - Oregon

What Is Form 150-104-005 (OR-706-DISC)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-104-005 (OR-706-DISC)?

A: Form 150-104-005 (OR-706-DISC) is a request for discharge from personal liability in the state of Oregon.

Q: Who can use Form 150-104-005 (OR-706-DISC)?

A: Form 150-104-005 (OR-706-DISC) can be used by those who want to be discharged from personal liability for taxes owed by a deceased person.

Q: What is the purpose of Form 150-104-005 (OR-706-DISC)?

A: Form 150-104-005 (OR-706-DISC) is used to request the Oregon Department of Revenue to grant a discharge from personal liability for taxes owed by a deceased person.

Q: Is Form 150-104-005 (OR-706-DISC) free to use?

A: Yes, Form 150-104-005 (OR-706-DISC) is provided free of charge by the Oregon Department of Revenue.

Q: What information is required on Form 150-104-005 (OR-706-DISC)?

A: Form 150-104-005 (OR-706-DISC) requires information such as the deceased person's name, date of death, tax identification number, and a description of the taxes owed.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-104-005 (OR-706-DISC) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.