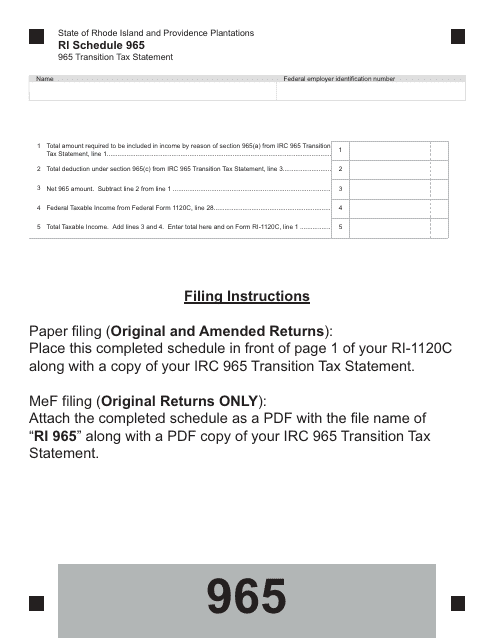

Schedule 965 Transition Tax Statement - Rhode Island

What Is Schedule 965?

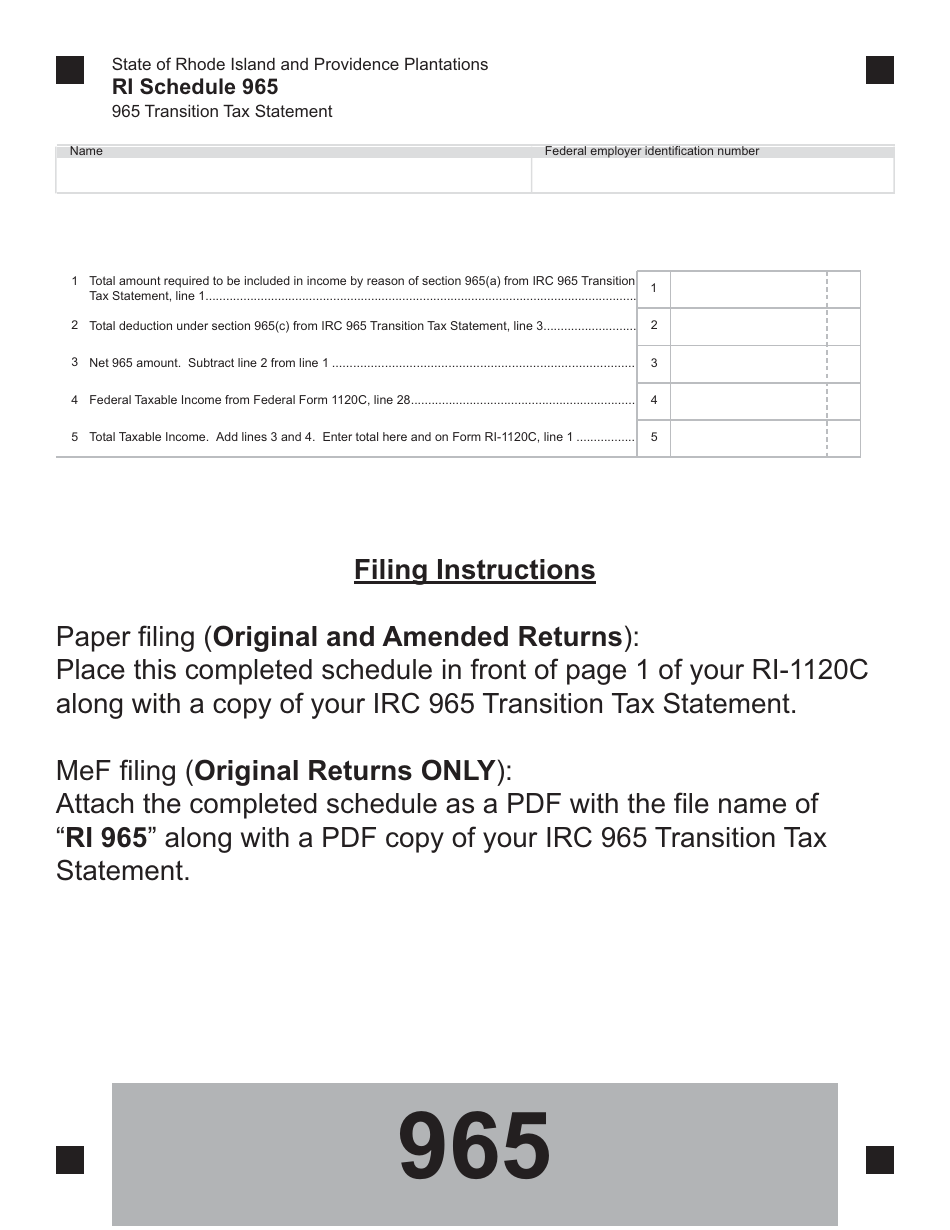

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 965 Transition Tax Statement?

A: Schedule 965 Transition Tax Statement is a tax form used to report the transition tax under section 965 of the Internal Revenue Code.

Q: Who needs to file Schedule 965 Transition Tax Statement?

A: US persons (including corporations, partnerships, and individuals) who own certain specified foreign corporations may need to file Schedule 965 Transition Tax Statement.

Q: What is the purpose of Schedule 965 Transition Tax Statement?

A: The purpose of Schedule 965 Transition Tax Statement is to calculate and report the transition tax on previously untaxed foreign earnings of specified foreign corporations.

Q: Are there any penalties for not filing Schedule 965 Transition Tax Statement?

A: Yes, there are penalties for not filing Schedule 965 Transition Tax Statement. It is important to comply with the tax filing requirements and deadlines set by the IRS.

Q: What if I have questions about filling out Schedule 965 Transition Tax Statement?

A: If you have questions about filling out Schedule 965 Transition Tax Statement, it is recommended to seek guidance from a tax professional or consult the instructions provided by the IRS.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule 965 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.