This version of the form is not currently in use and is provided for reference only. Download this version of

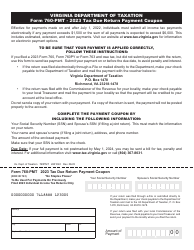

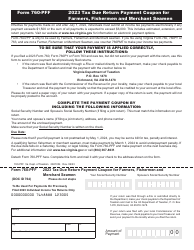

Form 770-pmt

for the current year.

Form 770-pmt Payment Coupon for Previously Filed Fiduciary Income Tax Returns - Virginia

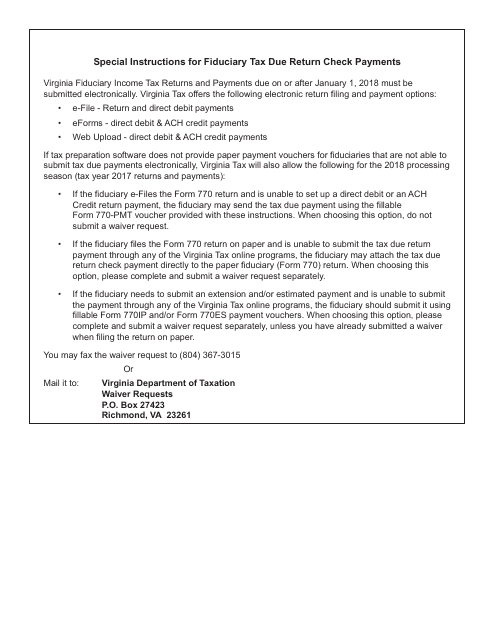

What Is Form 770-pmt?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 770-pmt?

A: Form 770-pmt is a Payment Coupon for Previously Filed Fiduciary Income Tax Returns in Virginia.

Q: Who needs to use Form 770-pmt?

A: Form 770-pmt is used by individuals or entities who have previously filed fiduciary income tax returns in Virginia and need to make a payment.

Q: What is the purpose of Form 770-pmt?

A: The purpose of Form 770-pmt is to provide a payment coupon for individuals or entities who owe additional taxes after filing their fiduciary income tax returns in Virginia.

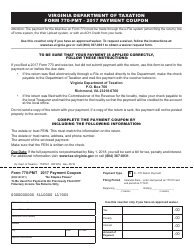

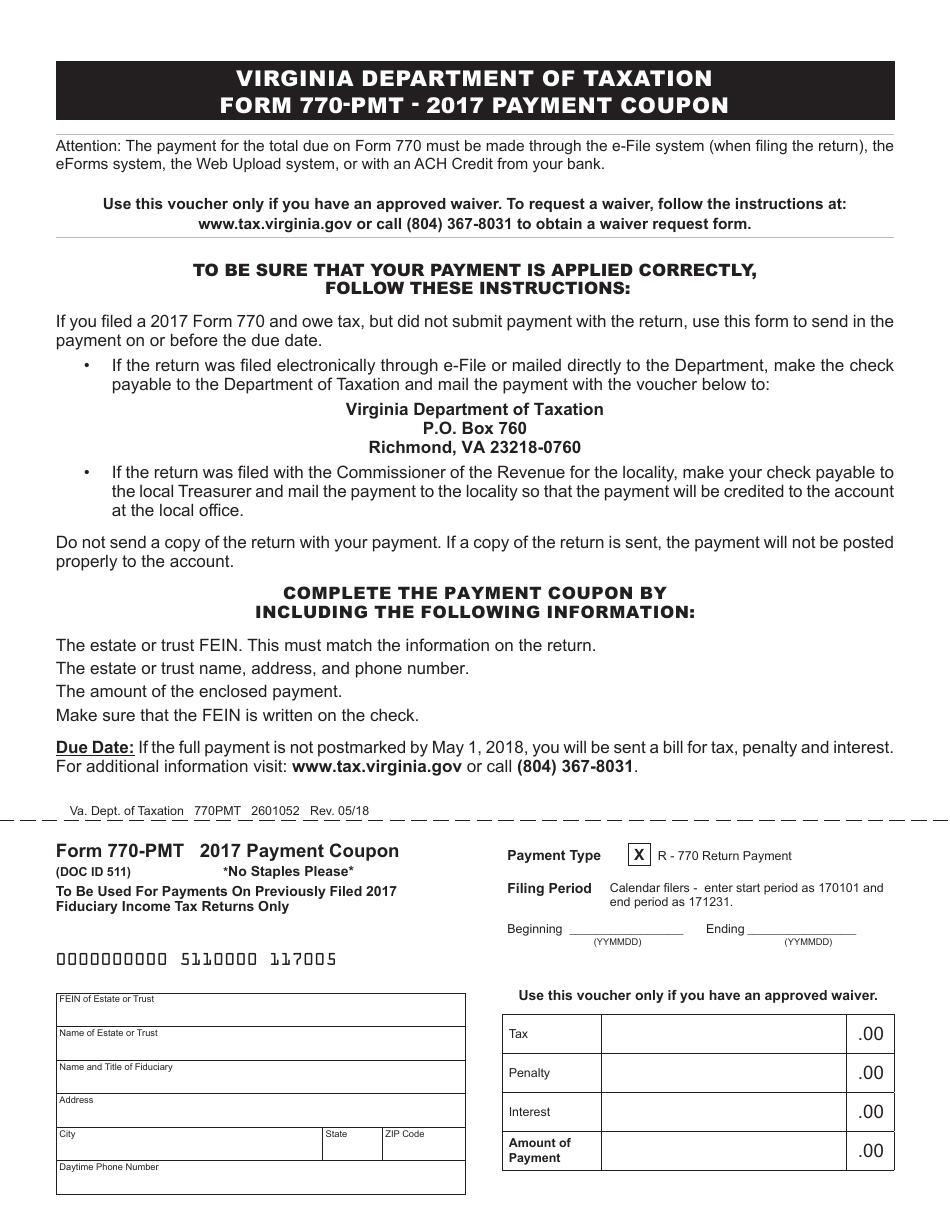

Q: How do I fill out Form 770-pmt?

A: You will need to enter the payment amount, your name, Social Security number or taxpayer identification number, and other required information on Form 770-pmt.

Q: Are there any deadlines for filing Form 770-pmt?

A: Yes, the deadline for filing Form 770-pmt and making the payment is usually the same as the deadline for filing your fiduciary income tax return in Virginia.

Q: What happens if I don't file Form 770-pmt?

A: If you owe additional taxes and fail to file Form 770-pmt and make the payment, you may be subject to penalties and interest charges.

Q: Is there a fee for using Form 770-pmt?

A: There is no fee for using Form 770-pmt, but you will be responsible for any payment processing fees if you choose to make the payment electronically.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 770-pmt by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.