This version of the form is not currently in use and is provided for reference only. Download this version of

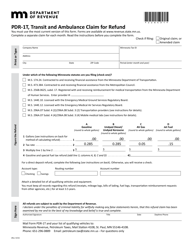

Form PDR-1AV

for the current year.

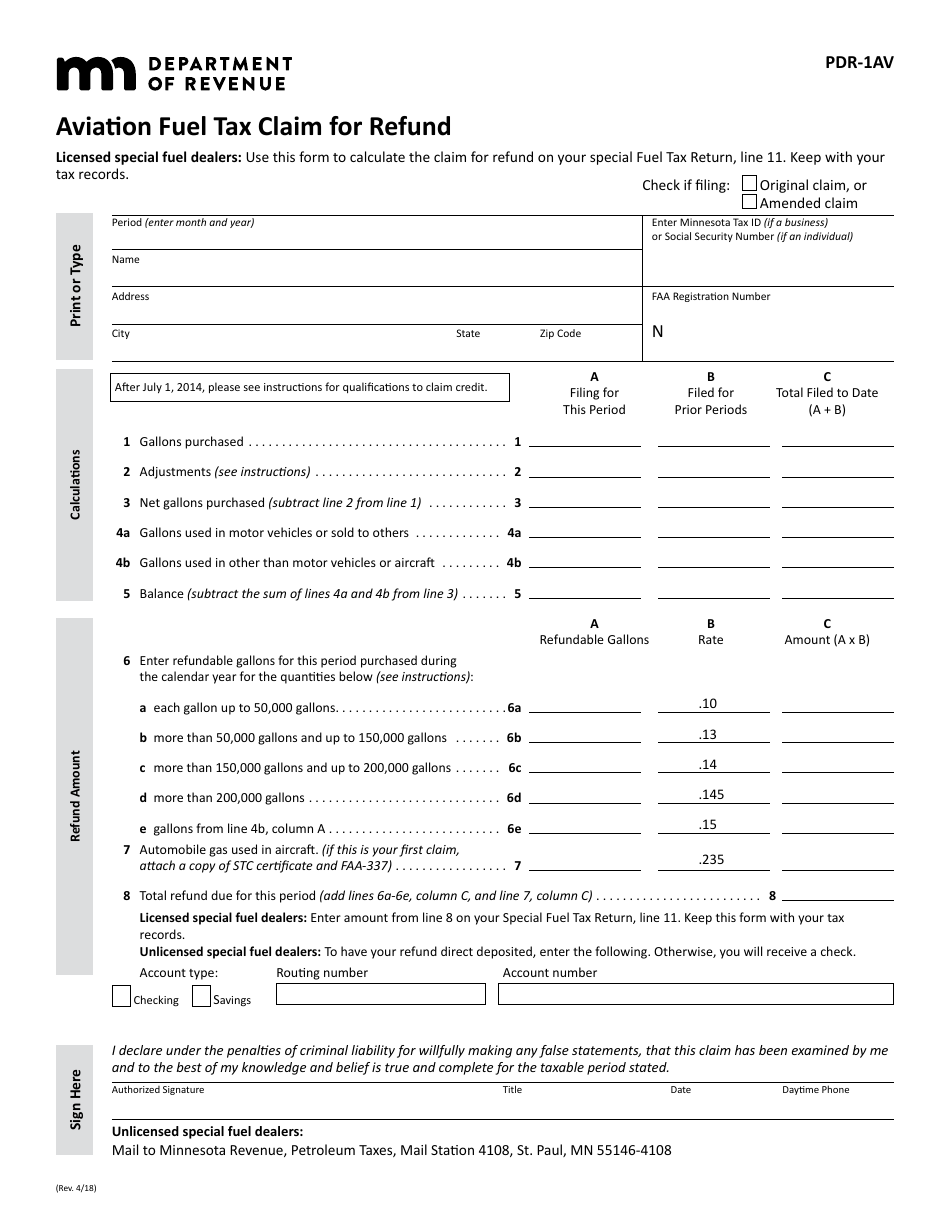

Form PDR-1AV Aviation Fuel Tax Claim for Refund - Minnesota

What Is Form PDR-1AV?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PDR-1AV?

A: Form PDR-1AV is the Aviation FuelTax Claim for Refund form for the state of Minnesota.

Q: Who can use Form PDR-1AV?

A: This form can be used by individuals or businesses that have paid aviation fuel tax in Minnesota and are seeking a refund.

Q: What is the purpose of Form PDR-1AV?

A: The purpose of this form is to claim a refund for aviation fuel tax paid in Minnesota.

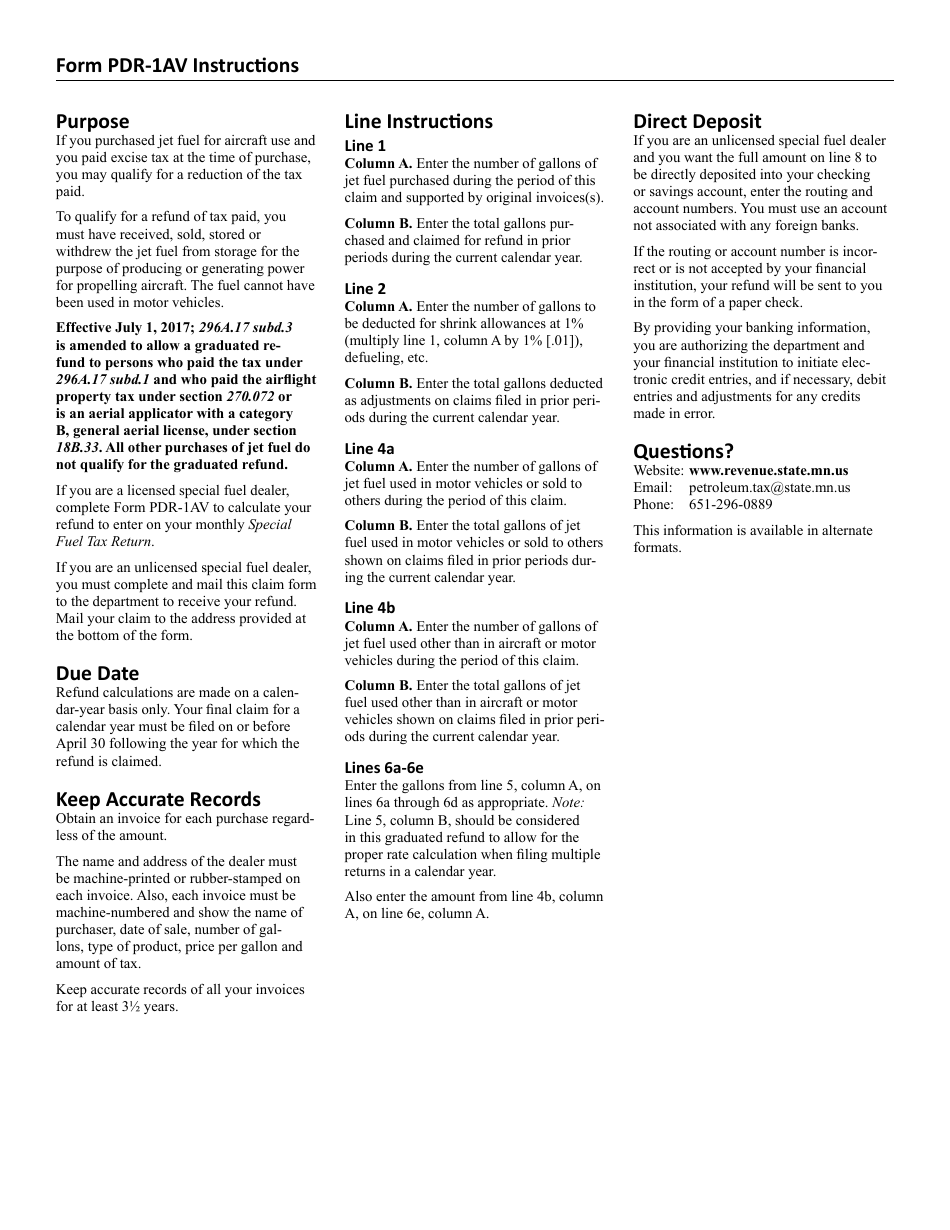

Q: What information is required on Form PDR-1AV?

A: The form requires information such as the name and address of the claimant, the amount of aviation fuel tax paid, and supporting documentation.

Q: Is there a deadline for filing Form PDR-1AV?

A: Yes, this form must be filed within three years from the date the aviation fuel tax was paid.

Q: Can I file Form PDR-1AV electronically?

A: No, this form cannot be filed electronically and must be submitted by mail.

Q: How long does it take to receive a refund after filing Form PDR-1AV?

A: The processing time for refunds varies, but the Minnesota Department of Revenue aims to issue refunds within 60 days of receiving a complete and accurate claim.

Q: Are there any other requirements or considerations when filing Form PDR-1AV?

A: It is important to review the instructions provided with the form to ensure compliance with all requirements and to include all necessary supporting documentation.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PDR-1AV by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.