Worksheet E - Lawful Gambling Combined Net Receipts Tax - Minnesota

Worksheet E - Lawful Gambling Combined Net Receipts Tax is a legal document that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota.

FAQ

Q: What is the Lawful Gambling Combined Net Receipts Tax?

A: The Lawful Gambling Combined Net Receipts Tax is a tax imposed by the state of Minnesota on organizations that conduct lawful gambling activities.

Q: Who is required to pay the Lawful Gambling Combined Net Receipts Tax?

A: Any organization in Minnesota that conducts lawful gambling activities, such as bingo, pull-tabs, and raffles, is required to pay the tax.

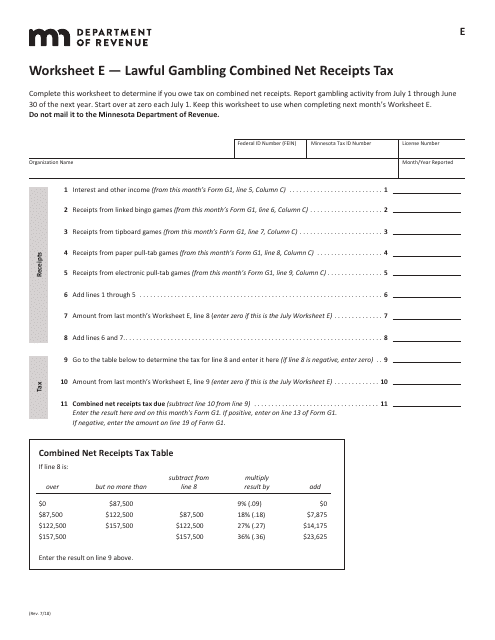

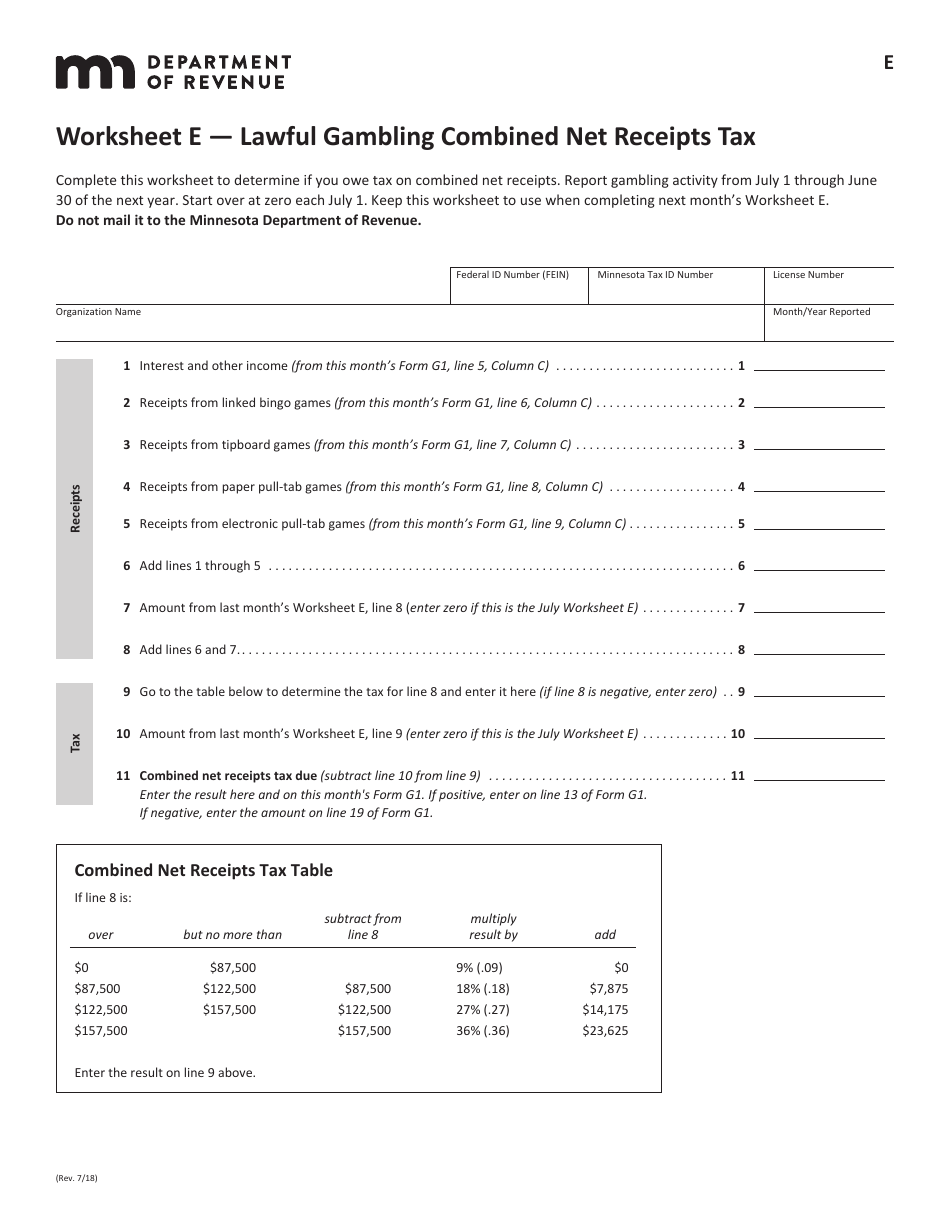

Q: How is the Lawful Gambling Combined Net Receipts Tax calculated?

A: The tax is calculated as a percentage of the combined net receipts from lawful gambling activities.

Q: What is considered as combined net receipts?

A: Combined net receipts refer to the total amount of money received from lawful gambling activities, minus allowable expenses.

Q: What is the current tax rate for the Lawful Gambling Combined Net Receipts Tax?

A: As of 2021, the tax rate is 8.5% for organizations with annual gross receipts of $1.5 million or less, and 9% for organizations with annual gross receipts over $1.5 million.

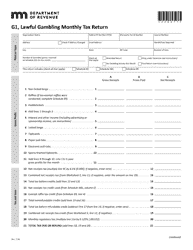

Q: How often is the Lawful Gambling Combined Net Receipts Tax paid?

A: The tax is typically paid on a quarterly basis.

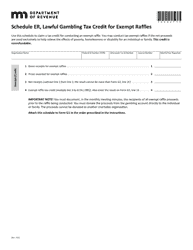

Q: Are there any exemptions or deductions available for the Lawful Gambling Combined Net Receipts Tax?

A: There are certain exemptions and deductions available, such as for veteran's organizations and charitable organizations. It is advised to consult with a tax professional for specific details.

Q: What happens if an organization fails to pay the Lawful Gambling Combined Net Receipts Tax?

A: Failure to pay the tax can result in penalties and interest being assessed by the state.

Form Details:

- Released on July 1, 2018;

- The latest edition currently provided by the Minnesota Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.