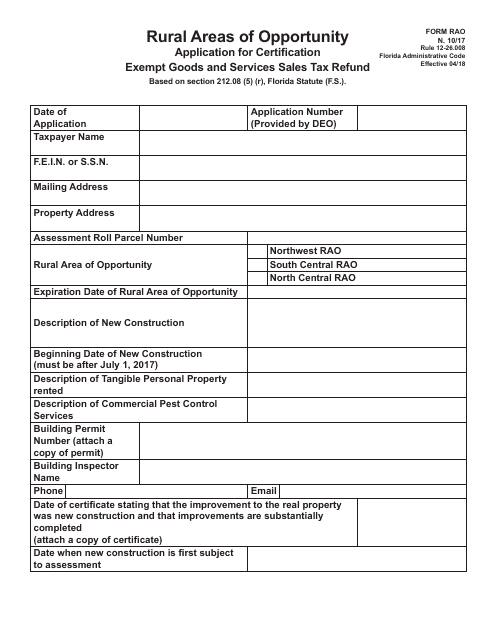

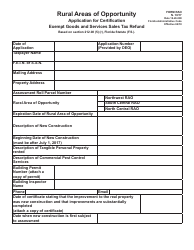

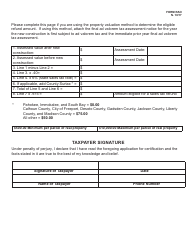

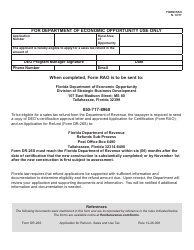

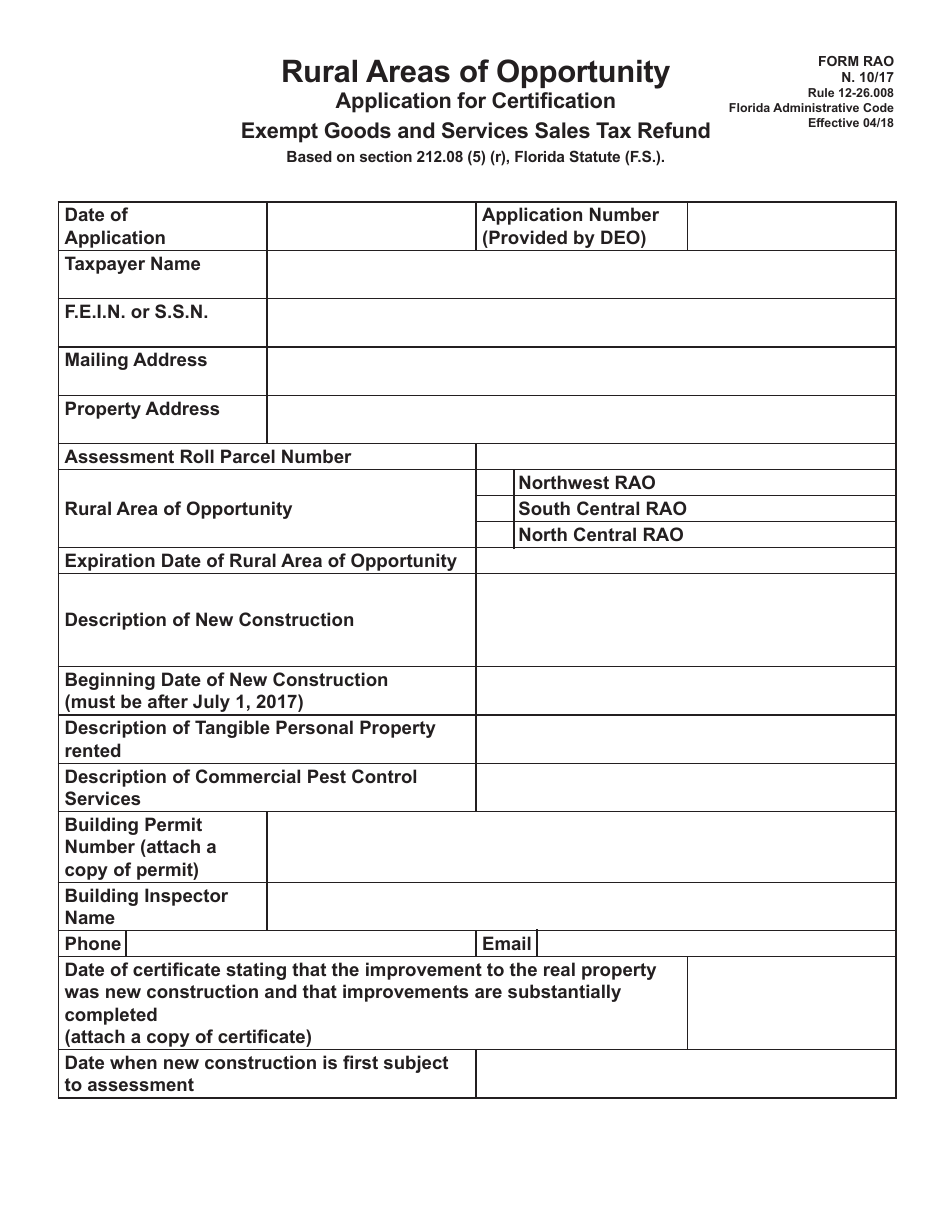

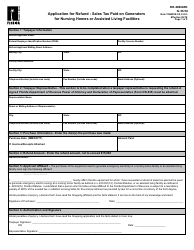

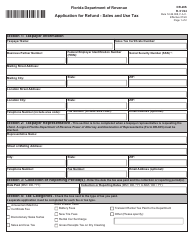

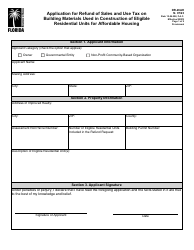

Form RAO Rural Areas of Opportunity Application for Certification Exempt Goods and Services Sales Tax Refund - Florida

What Is Form RAO?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RAO Rural Areas of Opportunity Application?

A: The RAO Rural Areas of Opportunity Application is a form to apply for certification of exempt goods and services sales tax refund in Florida.

Q: What is the purpose of the RAO certification?

A: The purpose of the RAO certification is to provide sales tax refunds for businesses that sell goods and services in rural areas of Florida.

Q: Who can apply for the RAO certification?

A: Any business that sells goods or services in rural areas of Florida can apply for the RAO certification.

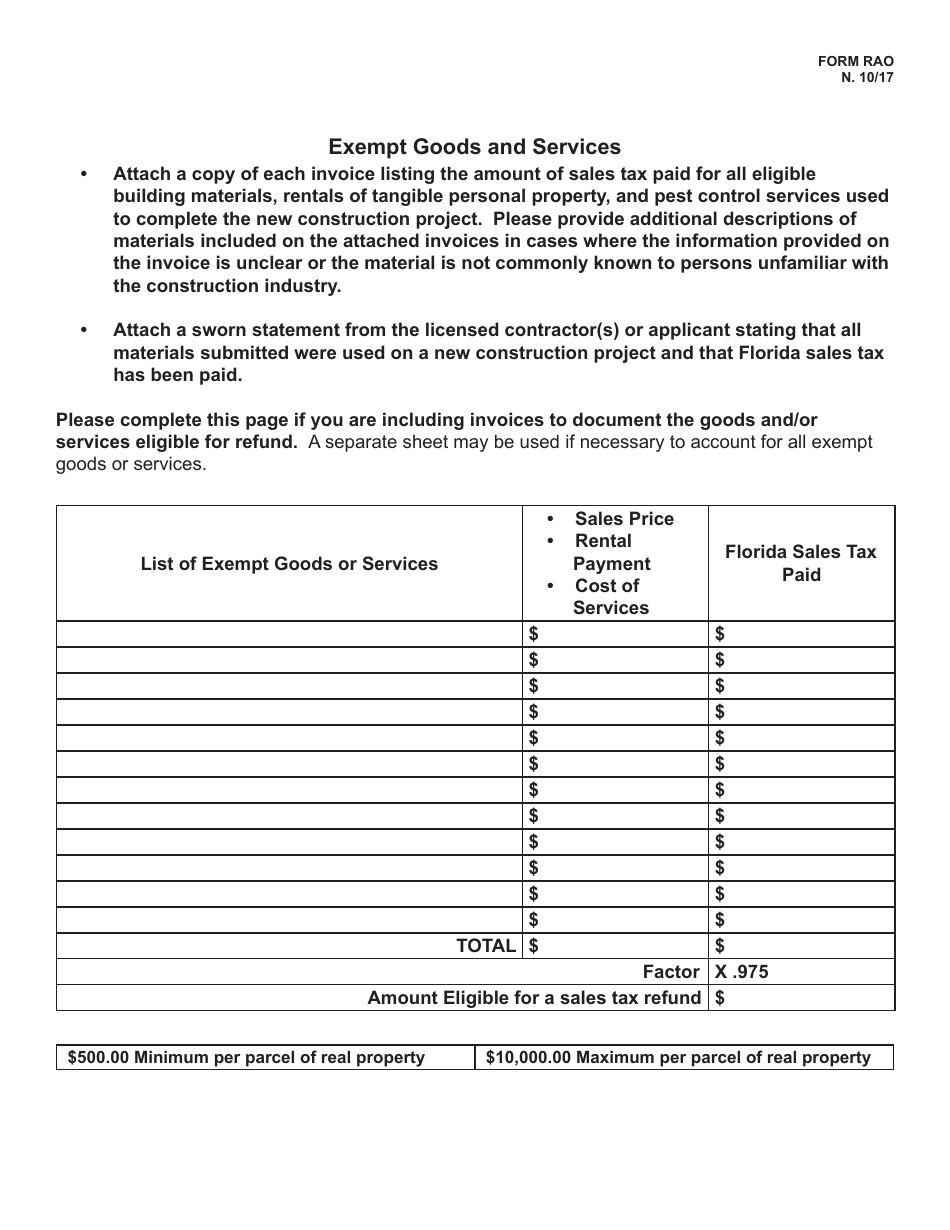

Q: What are exempt goods and services?

A: Exempt goods and services are items that are not subject to sales tax.

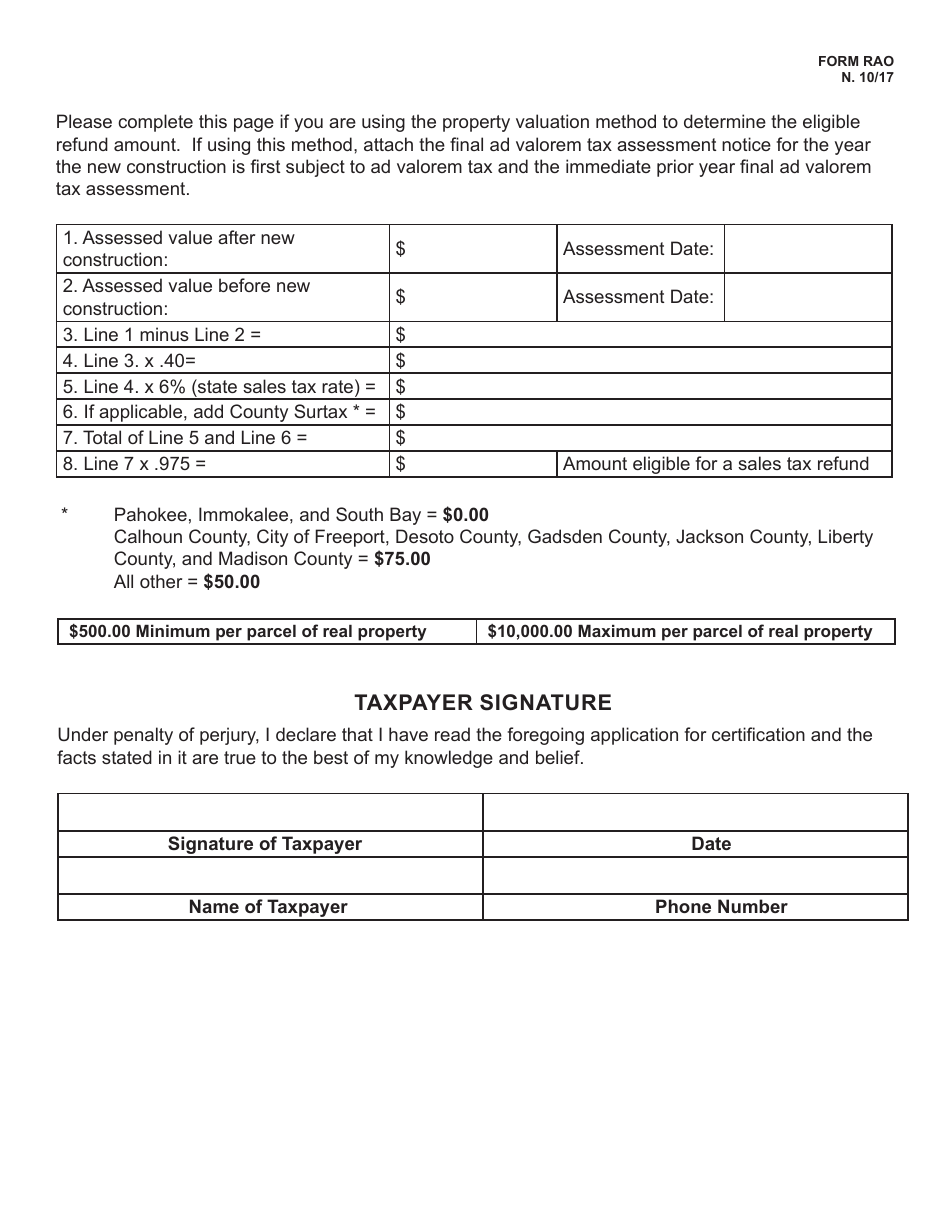

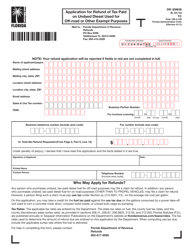

Q: What is the sales tax refund?

A: The sales tax refund is the return of sales taxes paid by a business in rural areas of Florida.

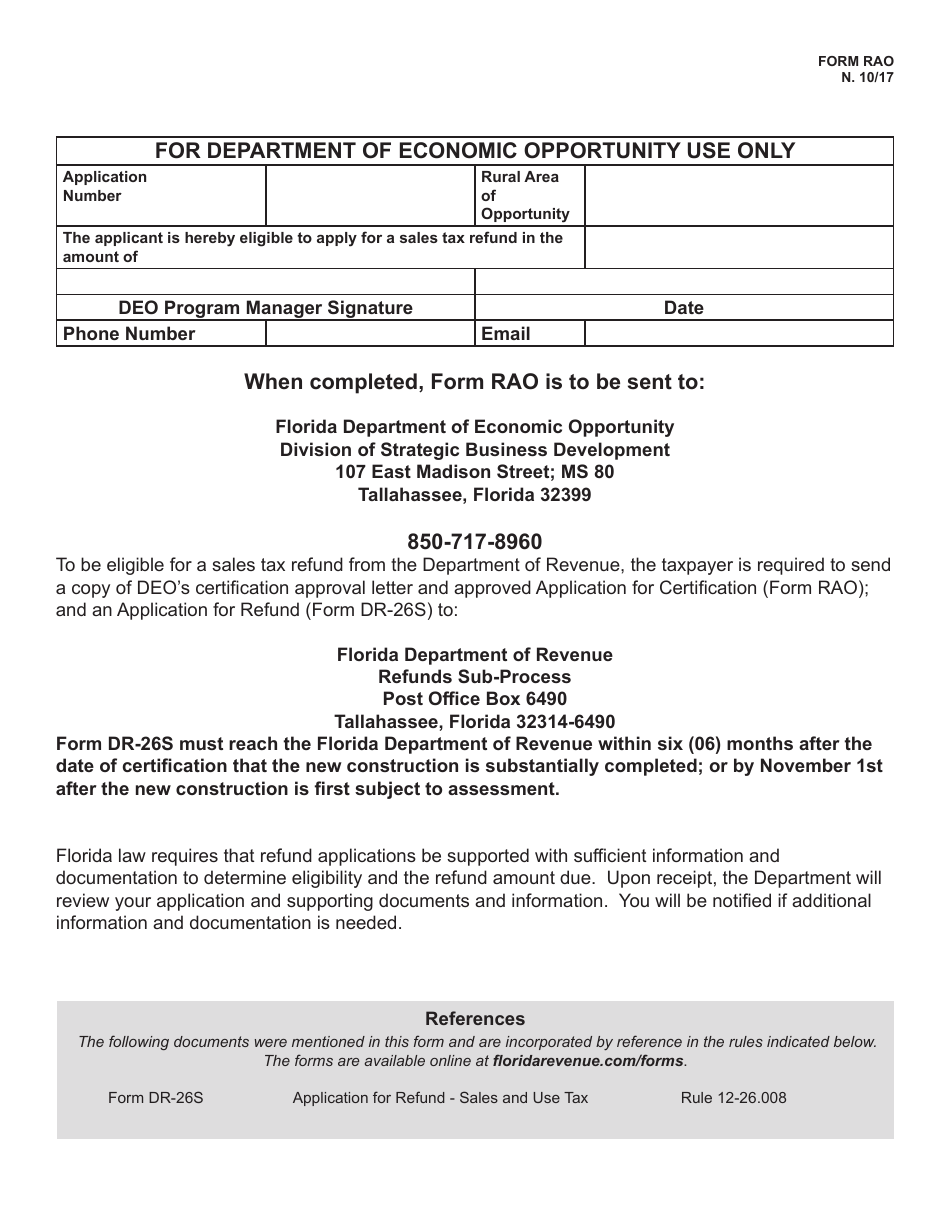

Q: How can I apply for the RAO certification?

A: You can apply for the RAO certification by filling out the RAO Rural Areas of Opportunity Application form.

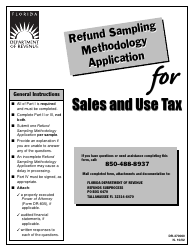

Q: How long does it take to process the RAO certification?

A: The processing time for the RAO certification varies, but it generally takes several weeks to months.

Q: What are the benefits of the RAO certification?

A: The benefits of the RAO certification include sales tax refunds for businesses and economic development in rural areas of Florida.

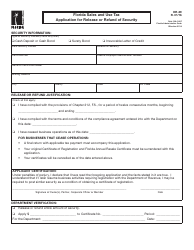

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RAO by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.