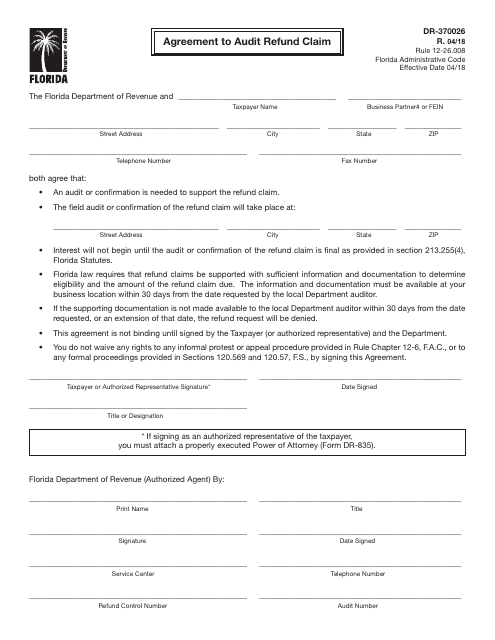

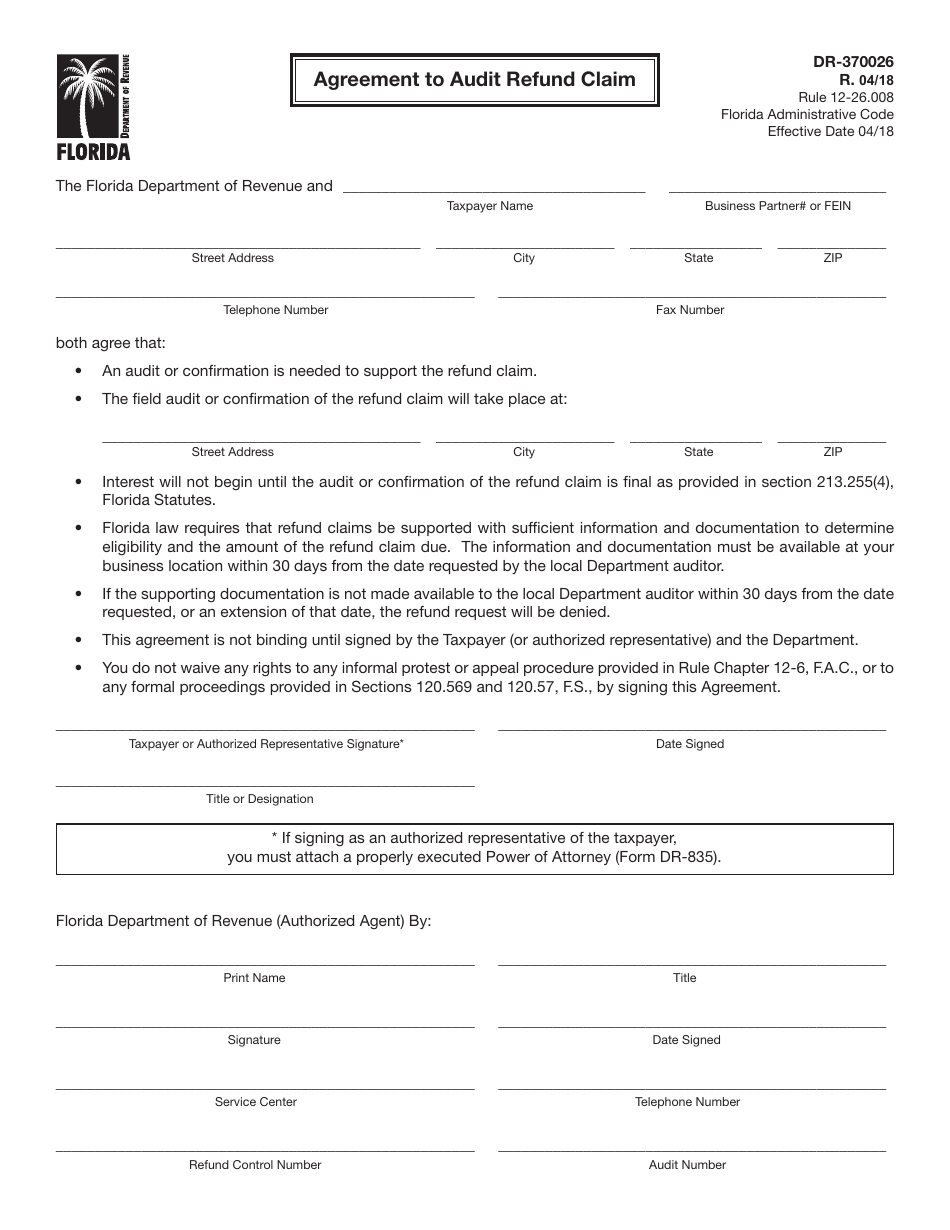

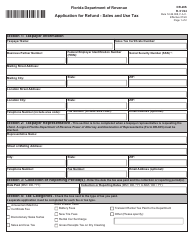

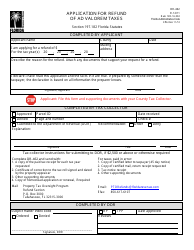

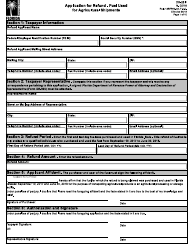

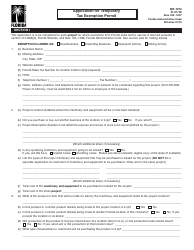

Form DR-370026 Agreement to Audit Refund Claim - Florida

What Is Form DR-370026?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-370026?

A: Form DR-370026 is an Agreement to Audit Refund Claim in Florida.

Q: What is the purpose of Form DR-370026?

A: The purpose of Form DR-370026 is to establish an agreement for the audit of a refund claim in Florida.

Q: Who needs to fill out Form DR-370026?

A: Form DR-370026 should be completed by the taxpayer or their authorized representative who wants to request an audit of a refund claim.

Q: Is Form DR-370026 mandatory?

A: No, Form DR-370026 is not mandatory. It is optional for taxpayers who want to request an audit of their refund claim.

Q: Are there any fees associated with Form DR-370026?

A: There are no fees associated with Form DR-370026. However, additional costs may apply if the audit leads to a change in the taxpayer's refund amount.

Q: How long does the audit process take?

A: The duration of the audit process varies depending on the complexity of the refund claim. The taxpayer will be notified by the Florida Department of Revenue regarding the timeline for completion.

Q: What happens after the audit is completed?

A: After the audit is completed, the Florida Department of Revenue will notify the taxpayer of the final refund claim determination. If necessary, adjustments will be made to the refund amount.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

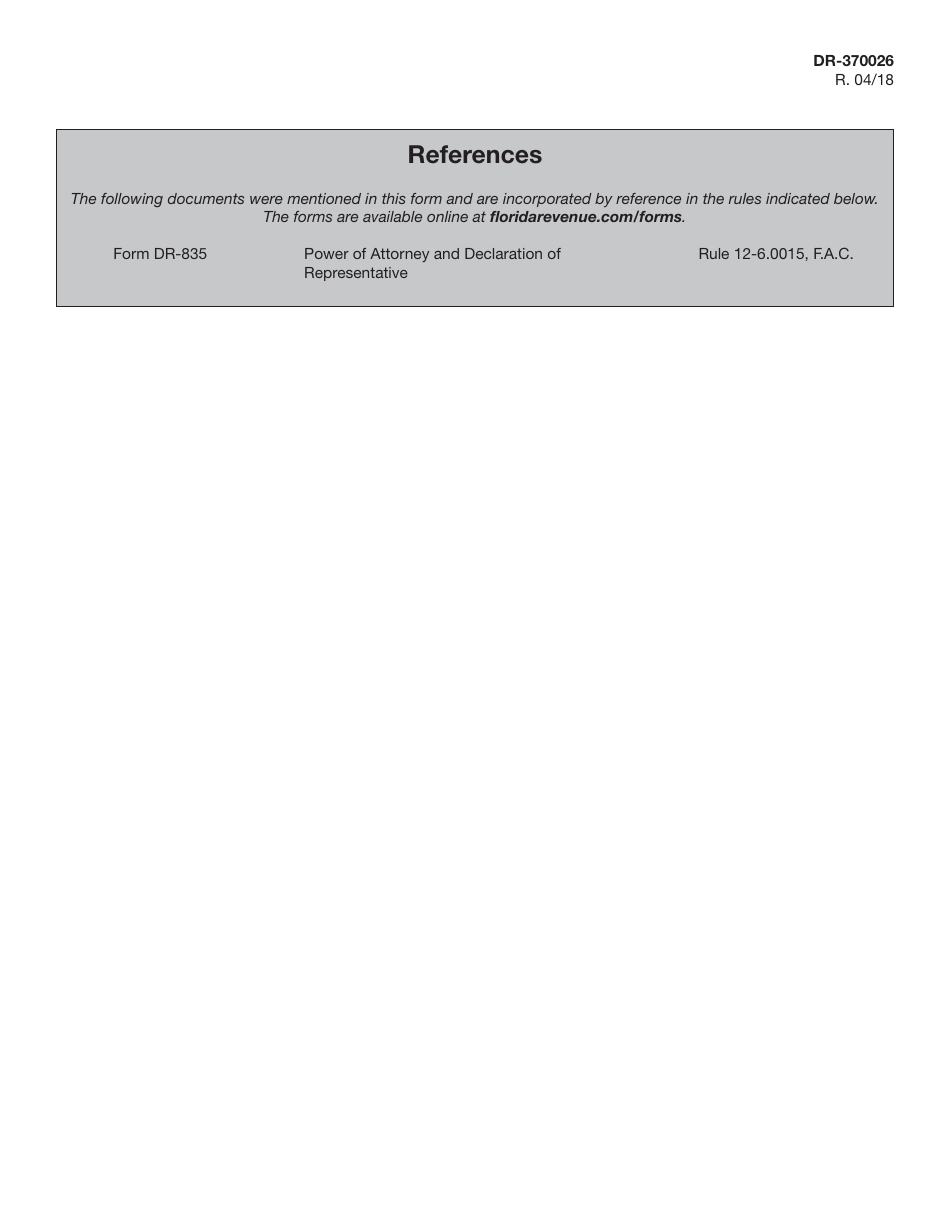

Download a printable version of Form DR-370026 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.