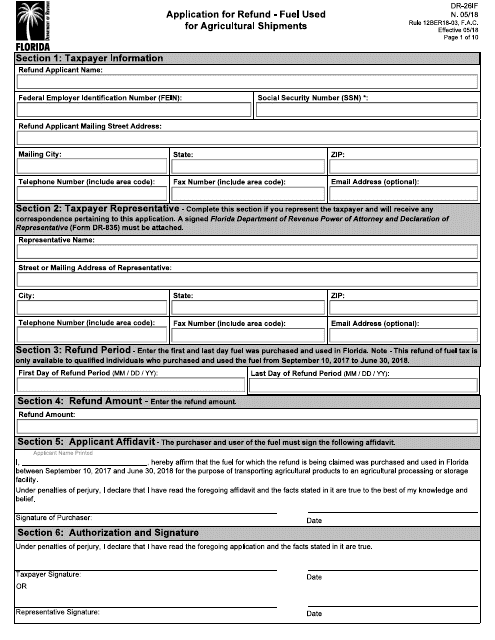

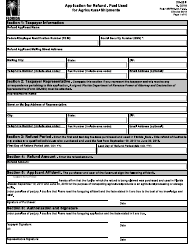

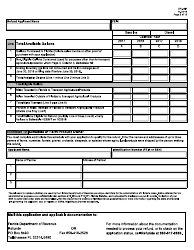

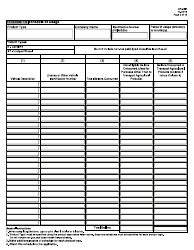

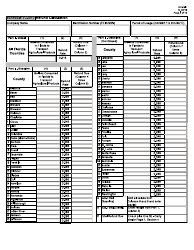

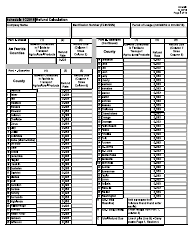

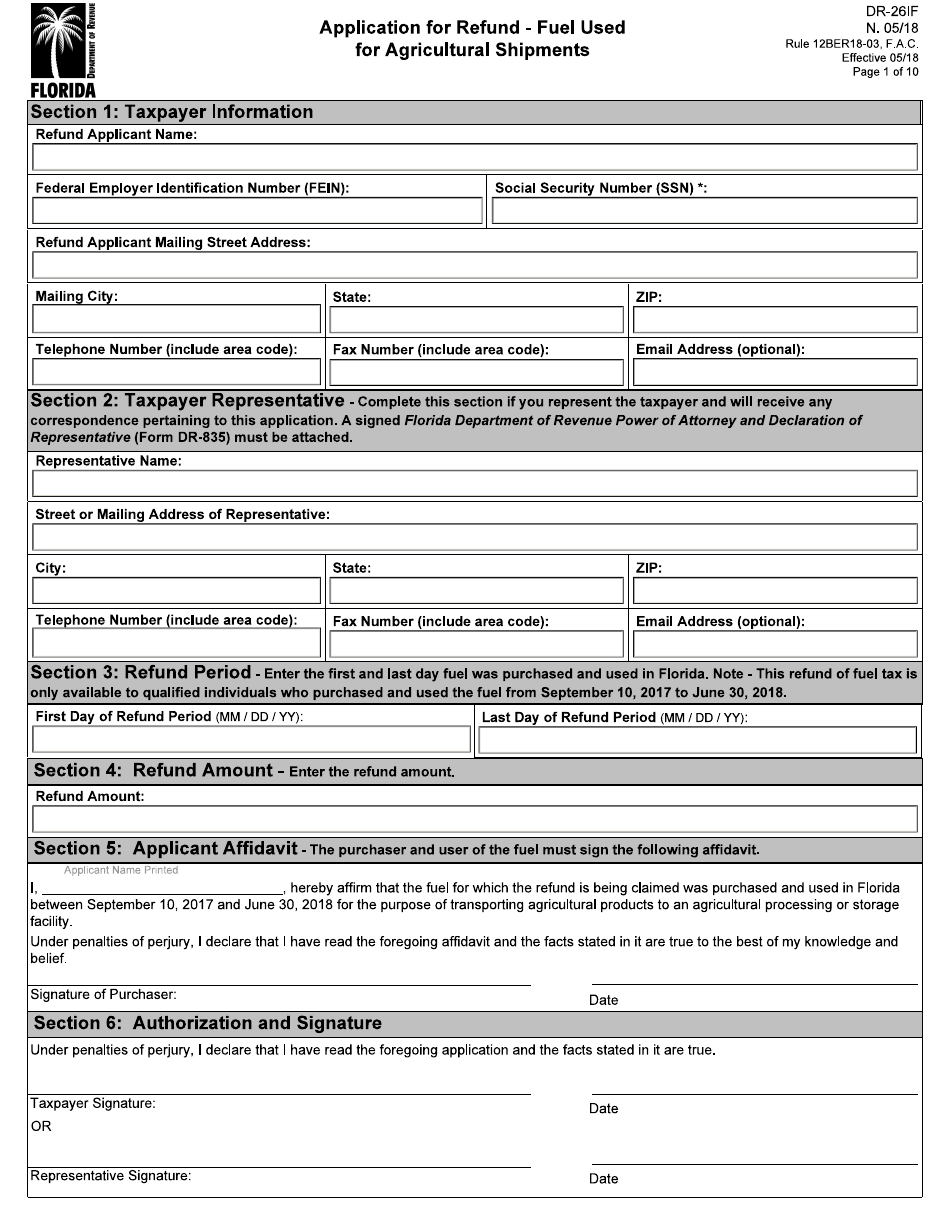

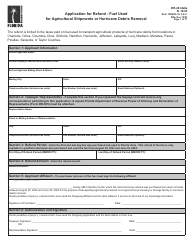

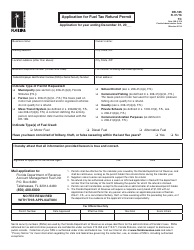

Form DR-26IF Application for Refund - Fuel Used for Agricultural Shipments - Florida

What Is Form DR-26IF?

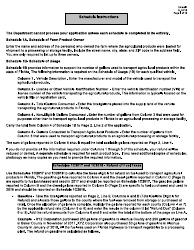

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-26IF?

A: Form DR-26IF is an application for refund specifically for fuel used for agricultural shipments in the state of Florida.

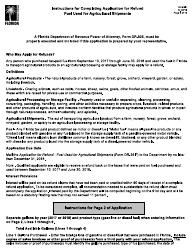

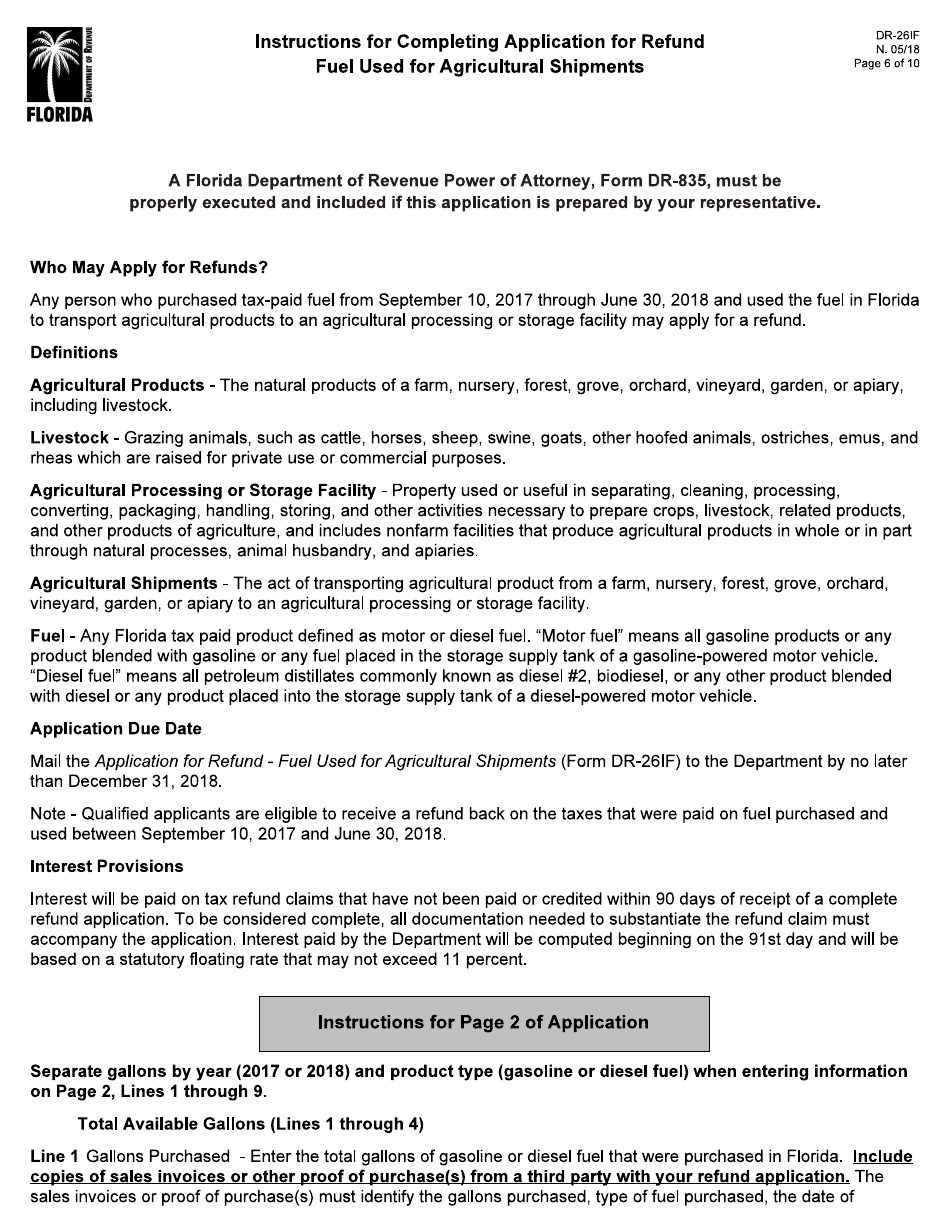

Q: Who can use Form DR-26IF?

A: Form DR-26IF can be used by individuals, corporations, partnerships, and other entities engaged in agricultural activities in Florida.

Q: What is the purpose of Form DR-26IF?

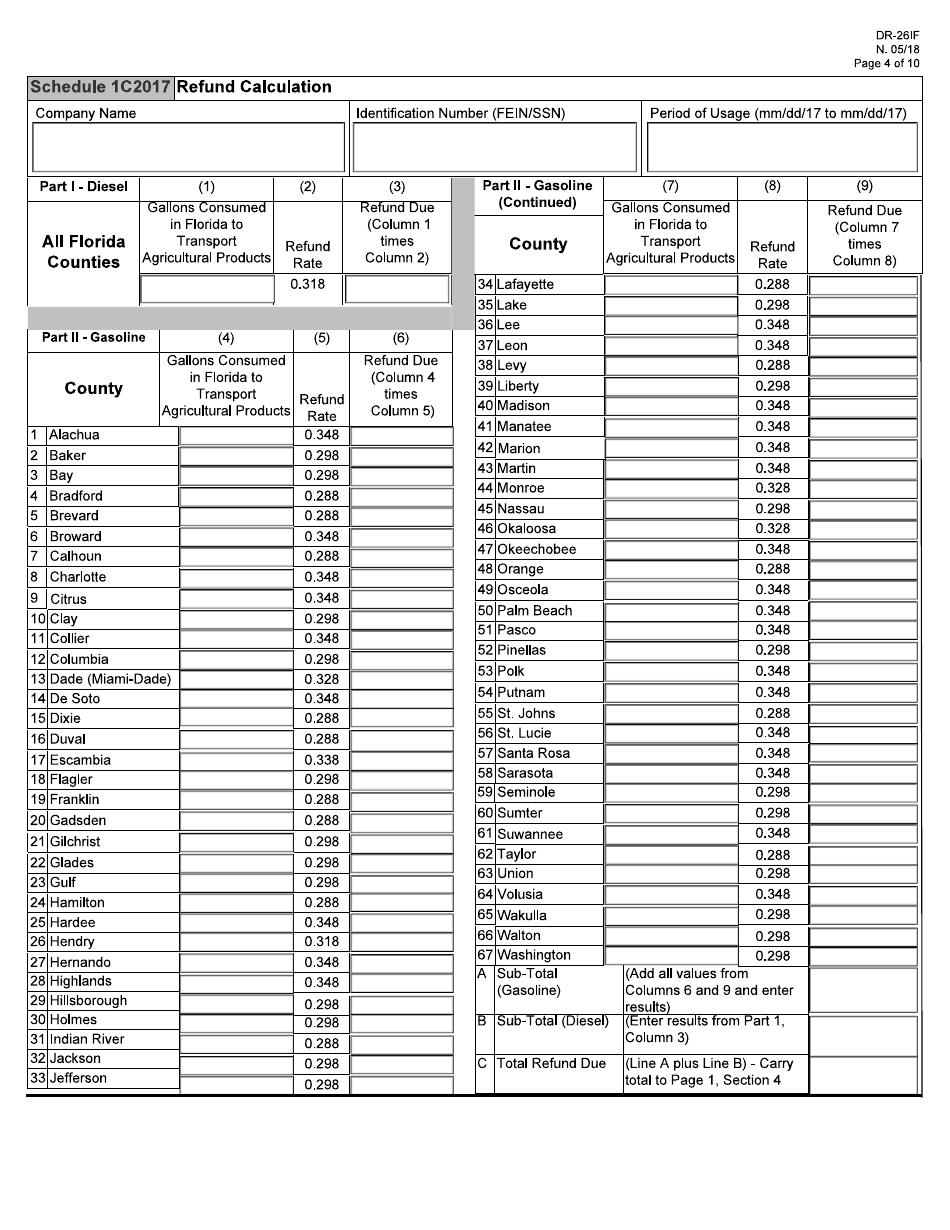

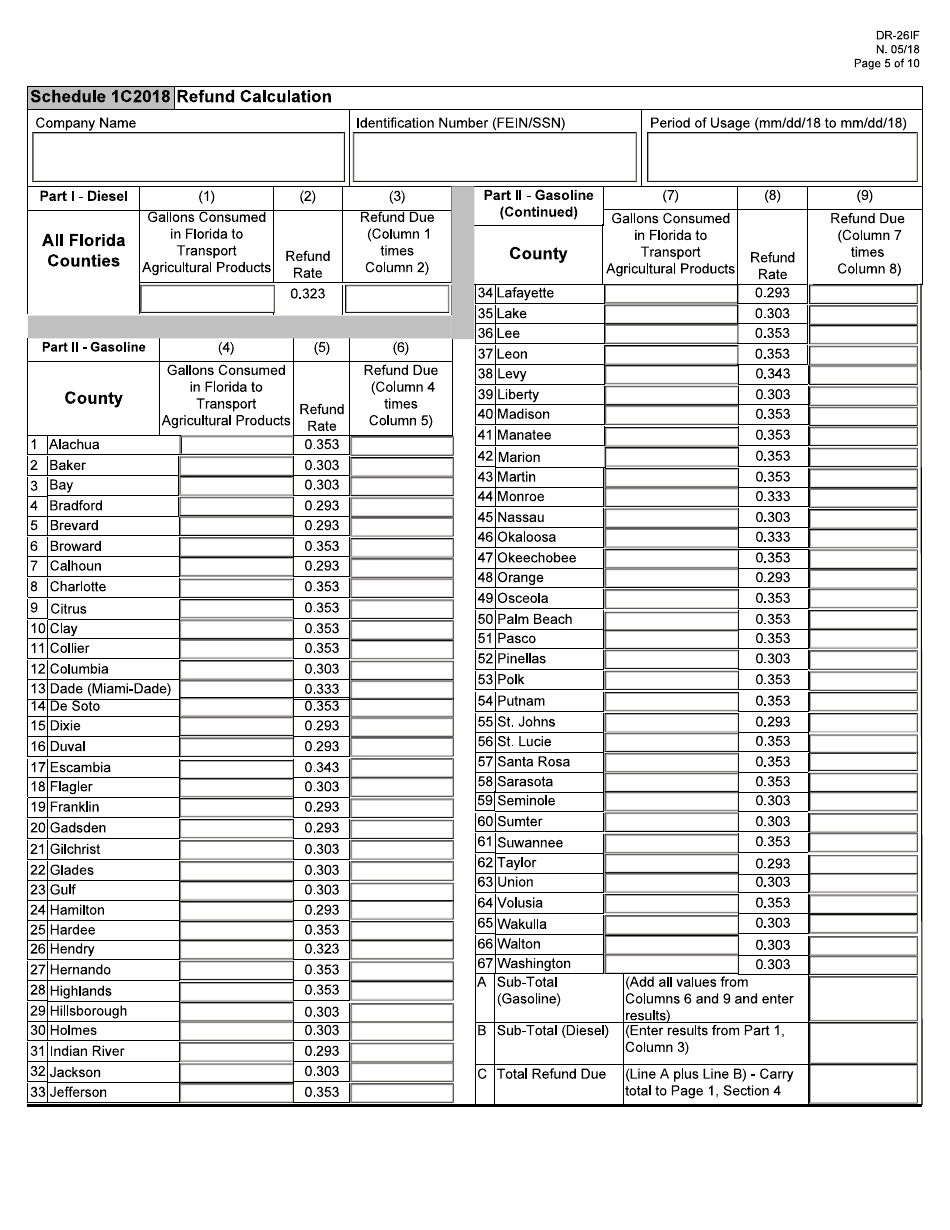

A: The purpose of Form DR-26IF is to apply for a refund of fuel taxes paid when using fuel for agricultural shipments.

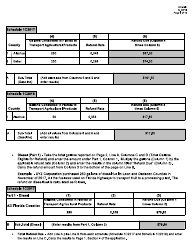

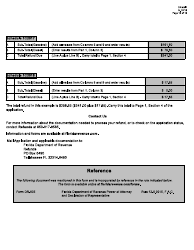

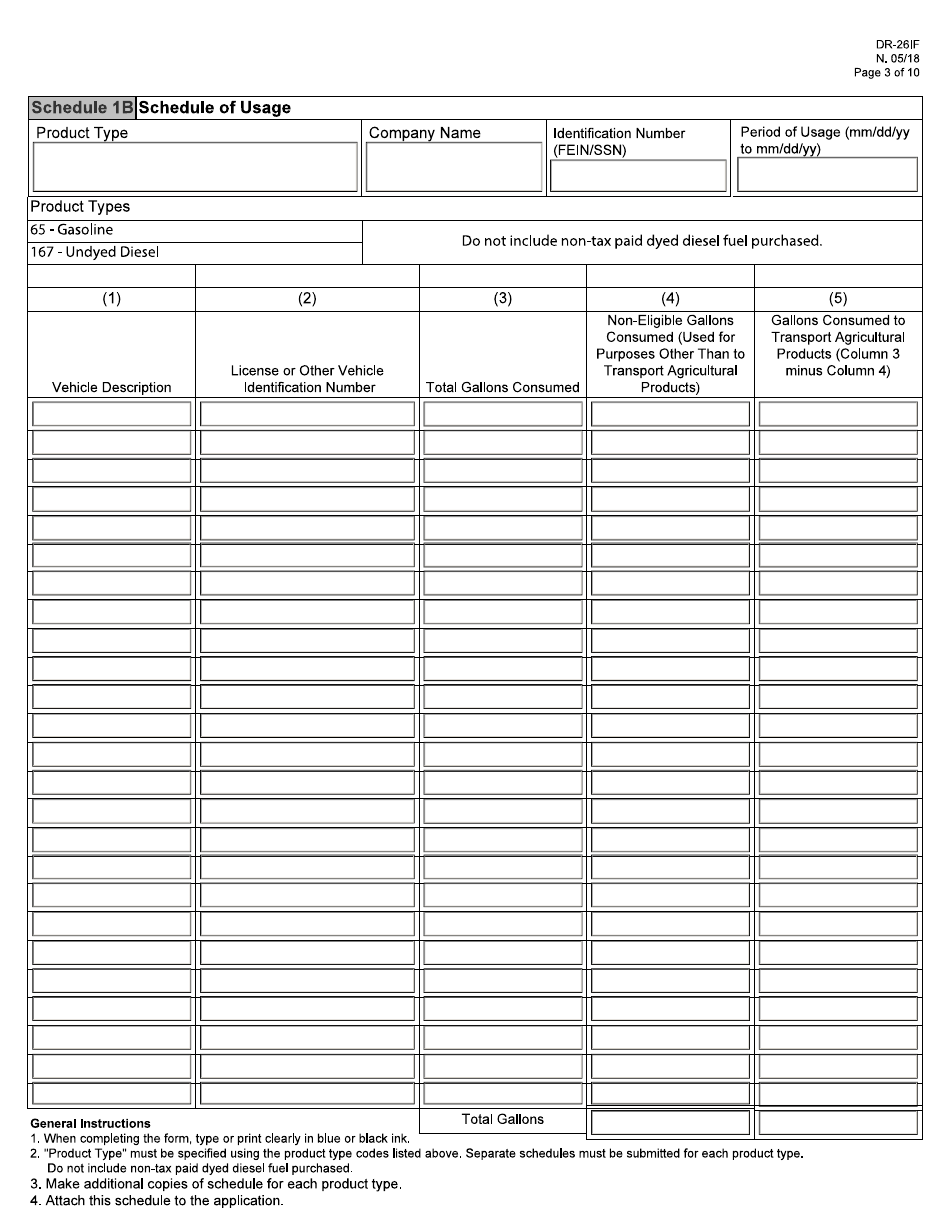

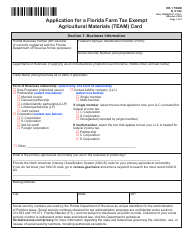

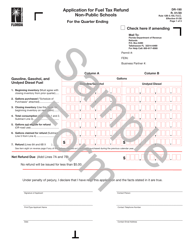

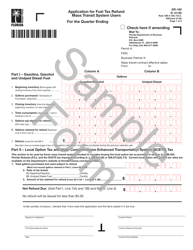

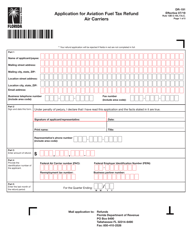

Q: What information is required on Form DR-26IF?

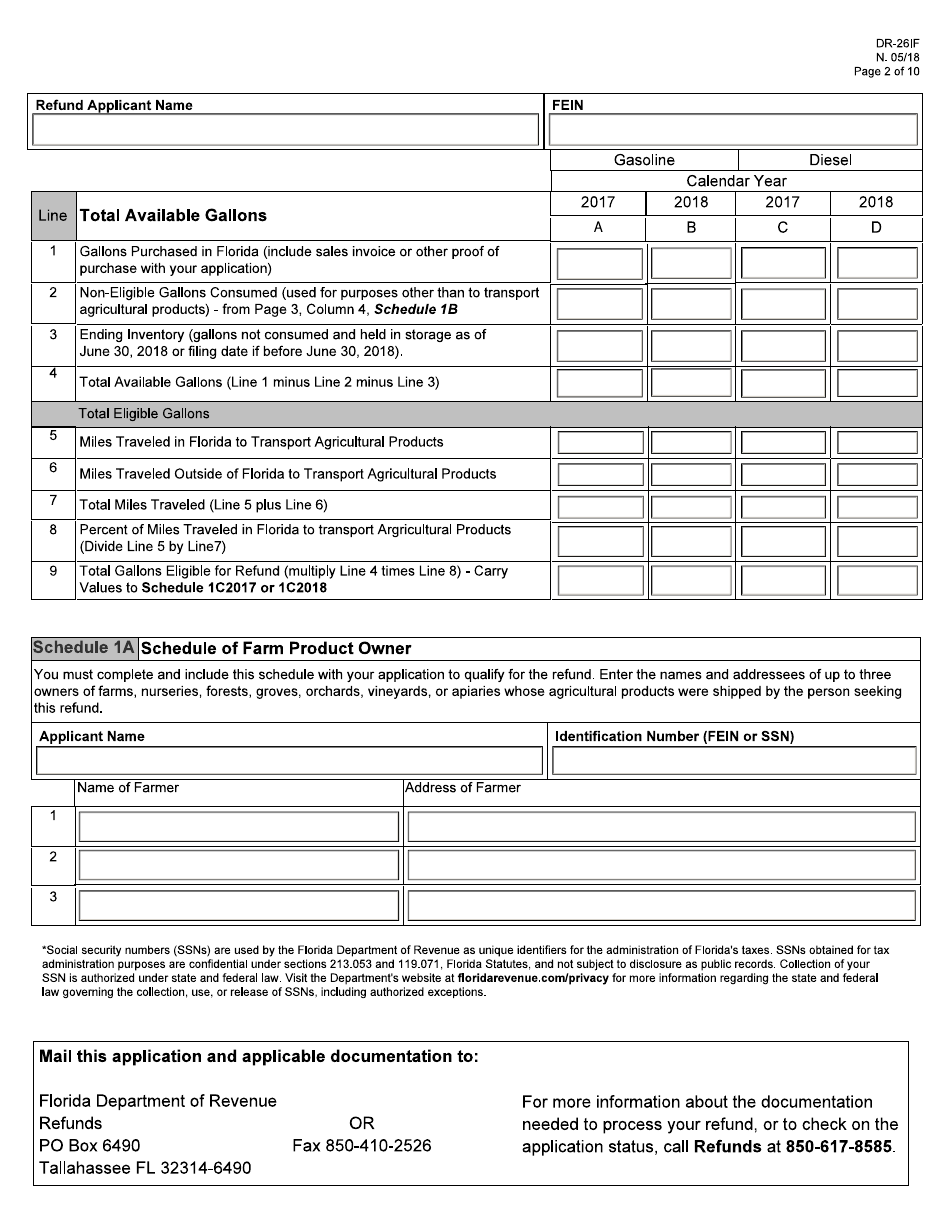

A: Form DR-26IF requires you to provide information such as your name, address, the type of agricultural activity, and detailed usage information for the fuel.

Q: Are there any deadlines for submitting Form DR-26IF?

A: Yes, Form DR-26IF must be submitted within 6 months from the date of purchase of the fuel.

Q: What supporting documents are required for Form DR-26IF?

A: You must include copies of invoices, receipts, or other documentation that show the fuel purchases and its usage for agricultural shipments.

Q: How long does it take to receive a refund after submitting Form DR-26IF?

A: The processing time for Form DR-26IF varies, but it typically takes around 30 to 60 days to receive a refund.

Q: Are there any fees associated with filing Form DR-26IF?

A: No, there are no fees associated with filing Form DR-26IF.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-26IF by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.