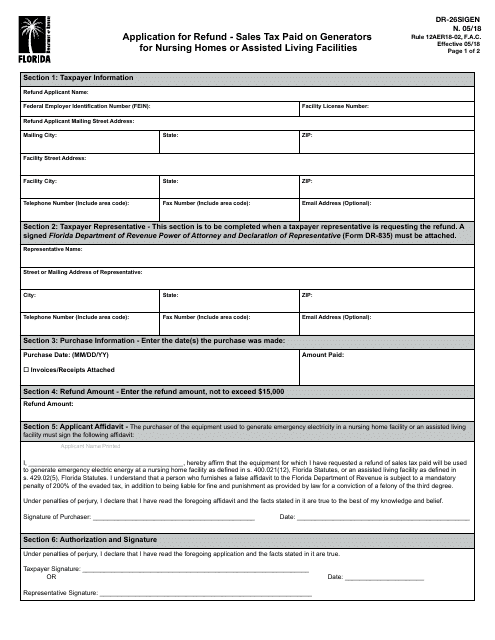

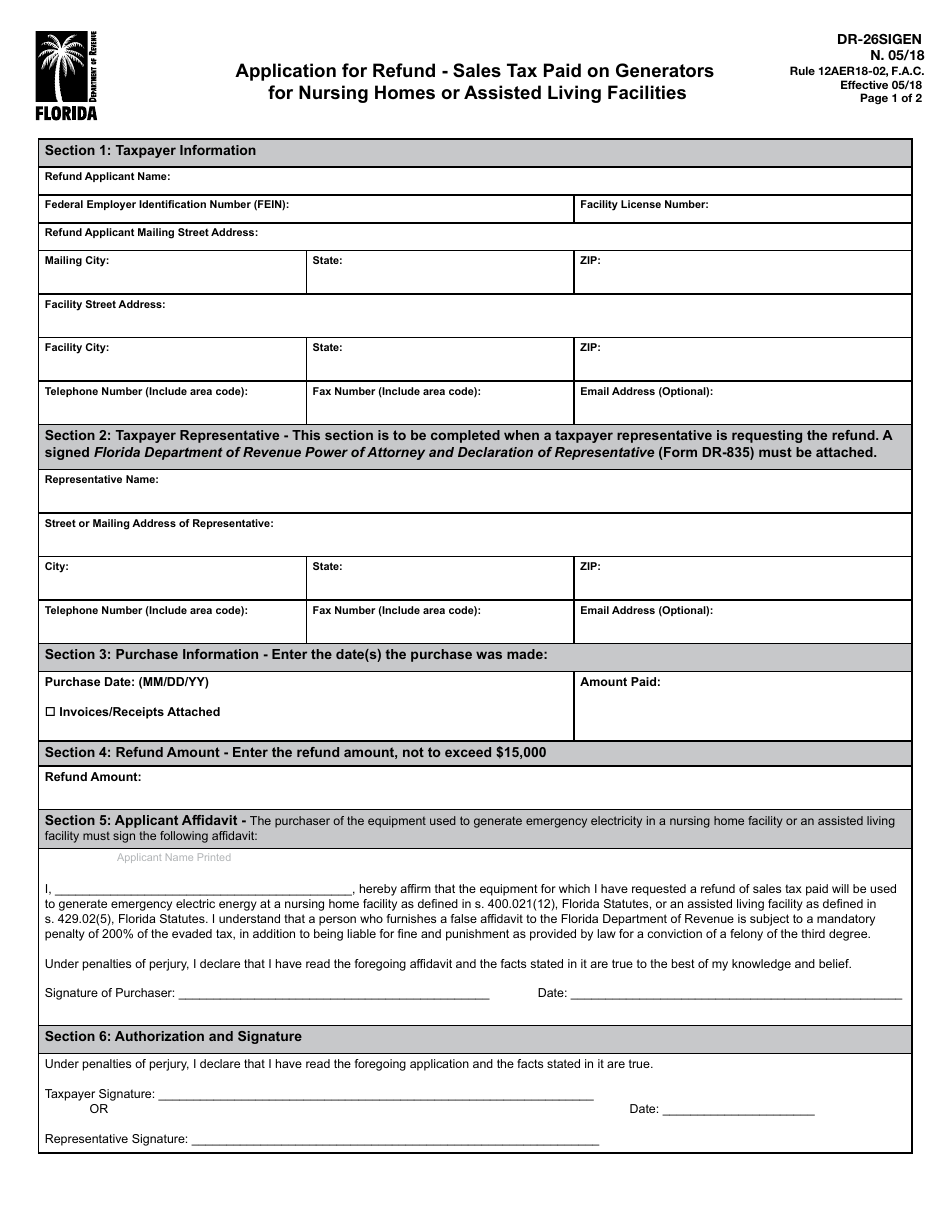

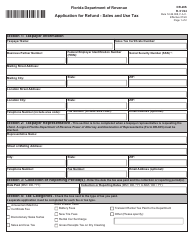

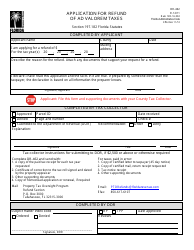

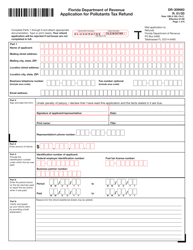

Form DR-26SIGEN Application for Refund - Sales Tax Paid on Generators for Nursing Homes or Assisted Living Facilities - Florida

What Is Form DR-26SIGEN?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

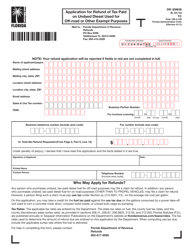

Q: What is Form DR-26SIGEN?

A: Form DR-26SIGEN is an application for refund in Florida for sales tax paid on generators for nursing homes or assisted living facilities.

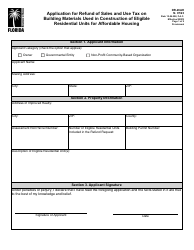

Q: Who is eligible to use Form DR-26SIGEN?

A: Nursing homes or assisted living facilities in Florida that have purchased generators and paid sales tax on them are eligible to use this form.

Q: What is the purpose of Form DR-26SIGEN?

A: The purpose of Form DR-26SIGEN is to request a refund of sales tax paid on generators by nursing homes or assisted living facilities in Florida.

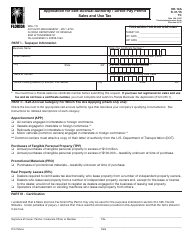

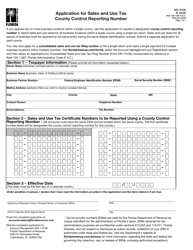

Q: What information is required on Form DR-26SIGEN?

A: Form DR-26SIGEN requires information such as the facility's name and address, purchase information for the generator, and proof of payment of sales tax.

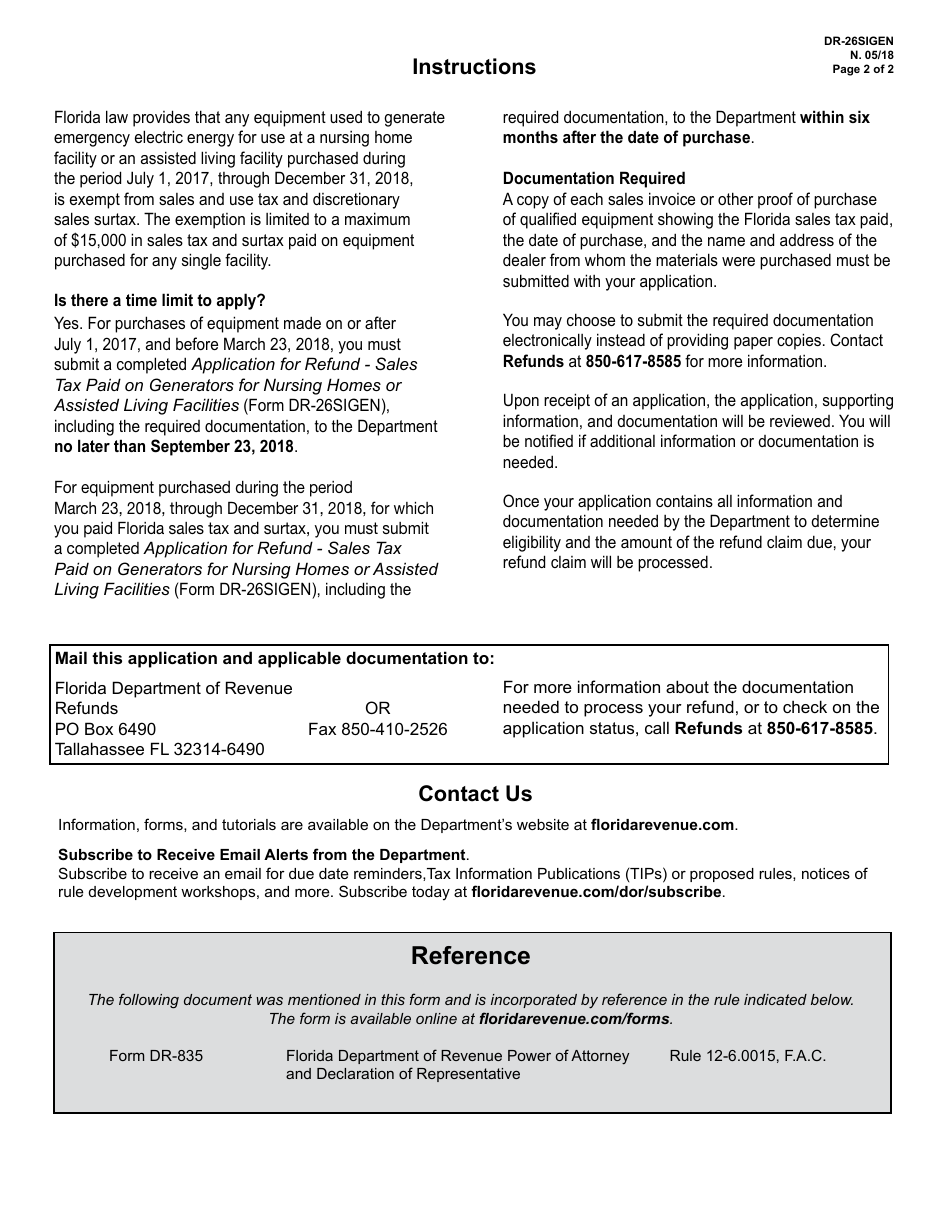

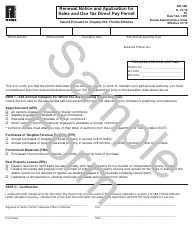

Q: Are there any deadlines for submitting Form DR-26SIGEN?

A: Yes, Form DR-26SIGEN must be submitted within one year from the date of purchase of the generator.

Q: What supporting documentation should be included with Form DR-26SIGEN?

A: Supporting documentation such as the purchase invoice, proof of payment of sales tax, and any other relevant documentation should be included with Form DR-26SIGEN.

Q: How long does it take to receive a refund after submitting Form DR-26SIGEN?

A: The processing time for refunds can vary, but it generally takes around 90 days to receive a refund after submitting Form DR-26SIGEN.

Q: Can I file Form DR-26SIGEN electronically?

A: No, Form DR-26SIGEN cannot be filed electronically. It must be submitted in paper form.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-26SIGEN by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.