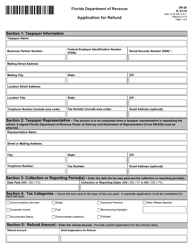

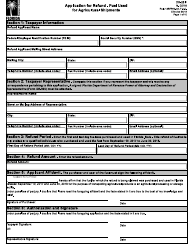

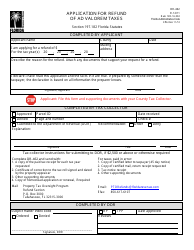

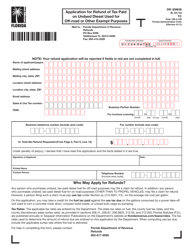

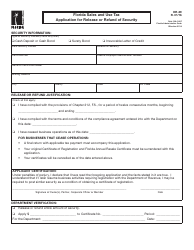

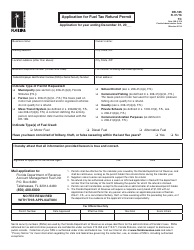

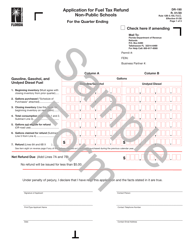

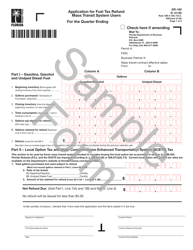

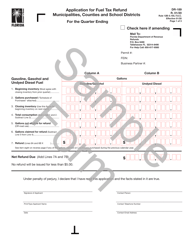

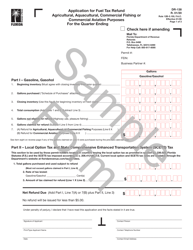

Instructions for Form DR-26N, DR-26 Application for Refund for All Taxes (Except Sales and Use Tax) - Florida

This document contains official instructions for Form DR-26N , and Form DR-26 . Both forms are released and collected by the Florida Department of Revenue. An up-to-date fillable Form DR-26 is available for download through this link.

FAQ

Q: What is Form DR-26N?

A: Form DR-26N is the Application for Refund for All Taxes (Except Sales and Use Tax) in Florida.

Q: What is the purpose of Form DR-26N?

A: The purpose of Form DR-26N is to apply for a refund of taxes in Florida, excluding sales and use tax.

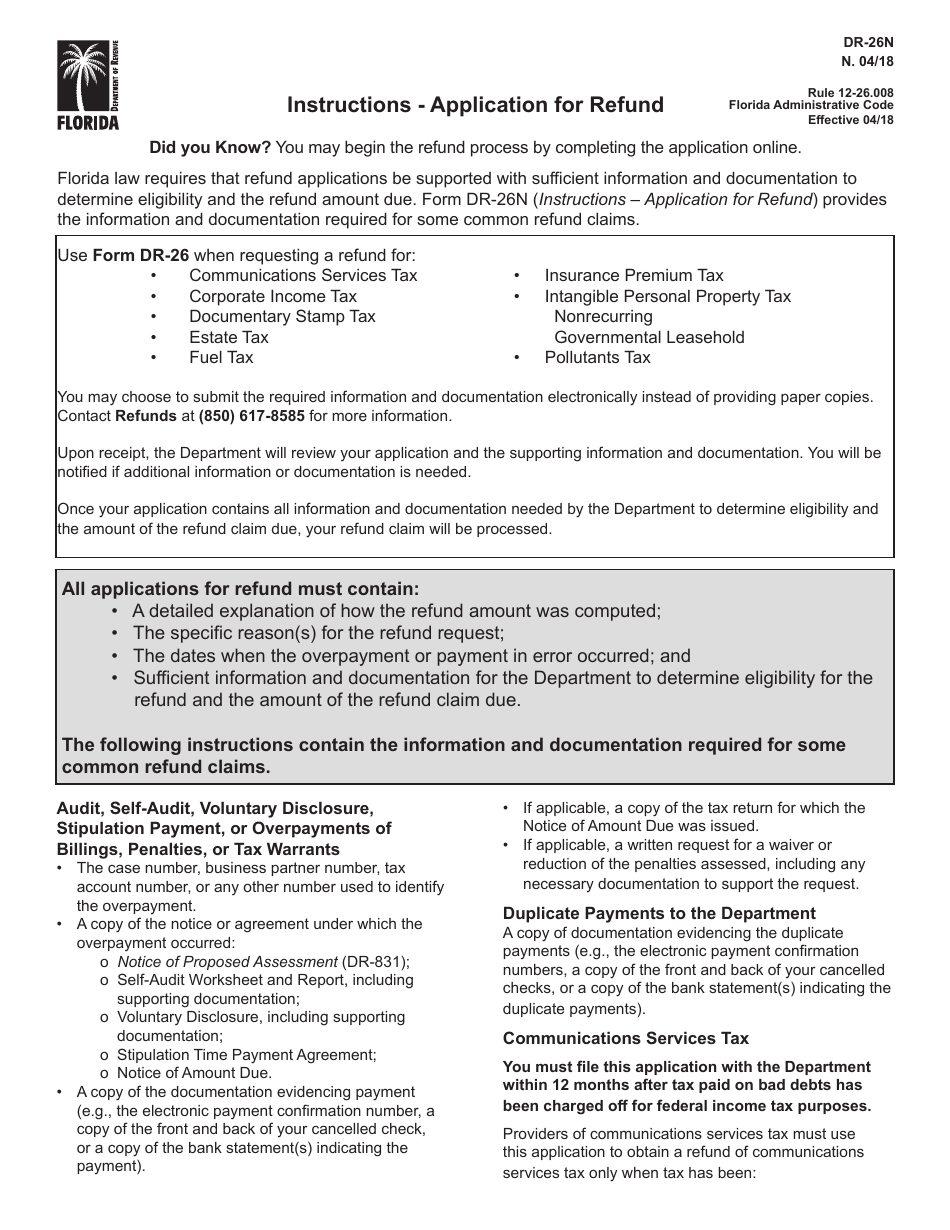

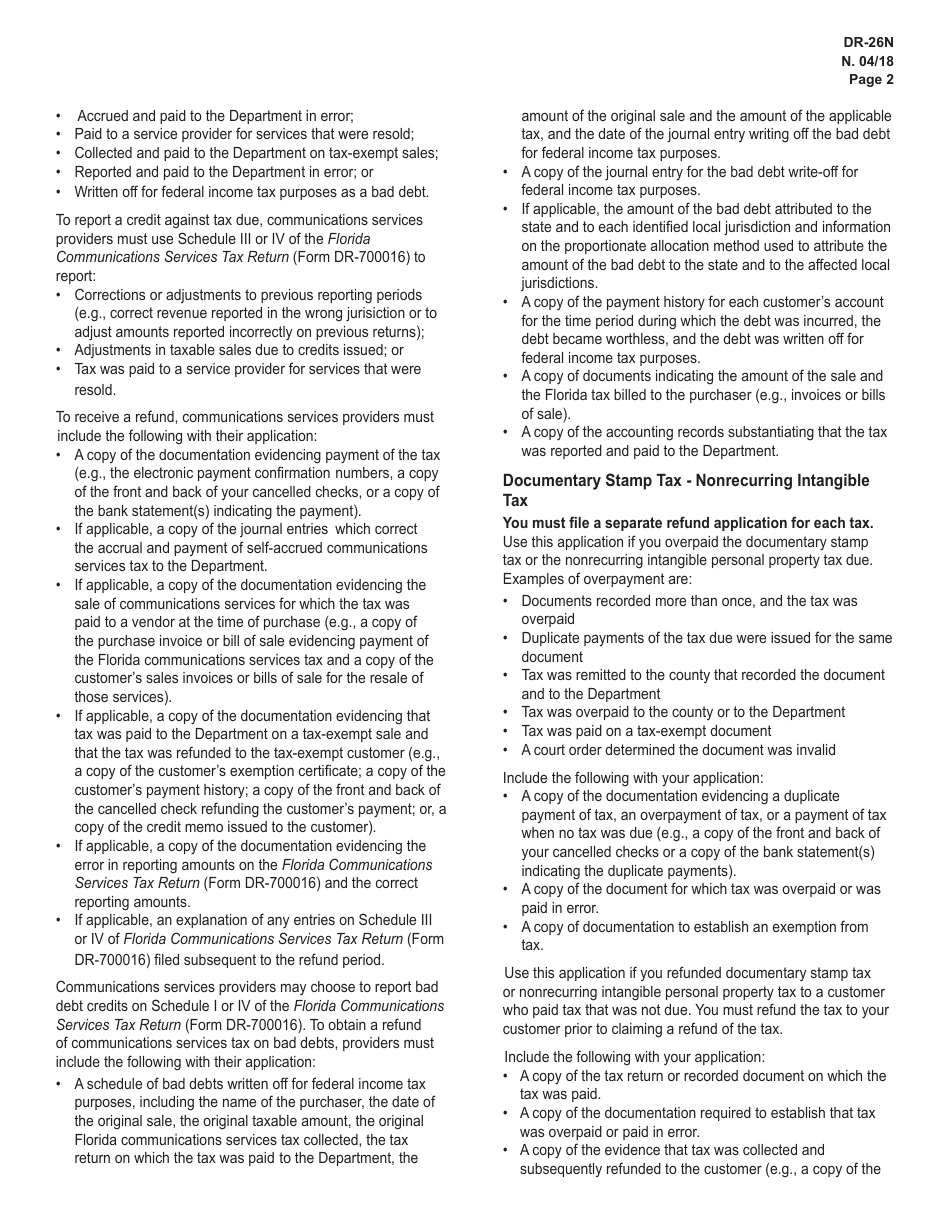

Q: Which taxes can be refunded with Form DR-26N?

A: Form DR-26N can be used to apply for a refund of all taxes in Florida, except sales and use tax.

Q: Who can use Form DR-26N?

A: Any individual or business that wants to request a refund for taxes (excluding sales and use tax) in Florida can use Form DR-26N.

Q: Are there any deadlines for submitting Form DR-26N?

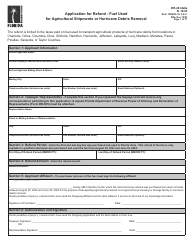

A: Yes, Form DR-26N must be filed within four years from the date the tax was paid or within one year from the date of an overpayment notice from the Department of Revenue, whichever is later.

Q: Is there a fee for filing Form DR-26N?

A: No, there is no fee for filing Form DR-26N.

Q: How long does it take to process a refund application on Form DR-26N?

A: The processing time for a refund application on Form DR-26N varies, but it typically takes 30 to 45 days.

Q: What supporting documentation is required for Form DR-26N?

A: Supporting documentation, such as invoices, receipts, or other evidence of the tax paid, may be required to accompany Form DR-26N.

Instruction Details:

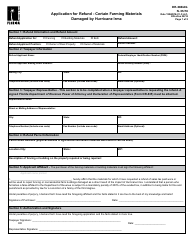

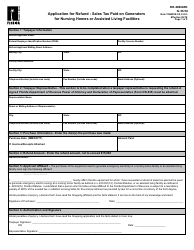

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Florida Department of Revenue.