This version of the form is not currently in use and is provided for reference only. Download this version of

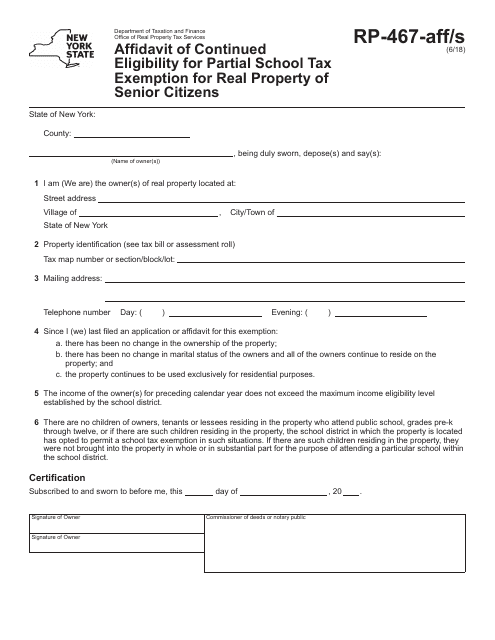

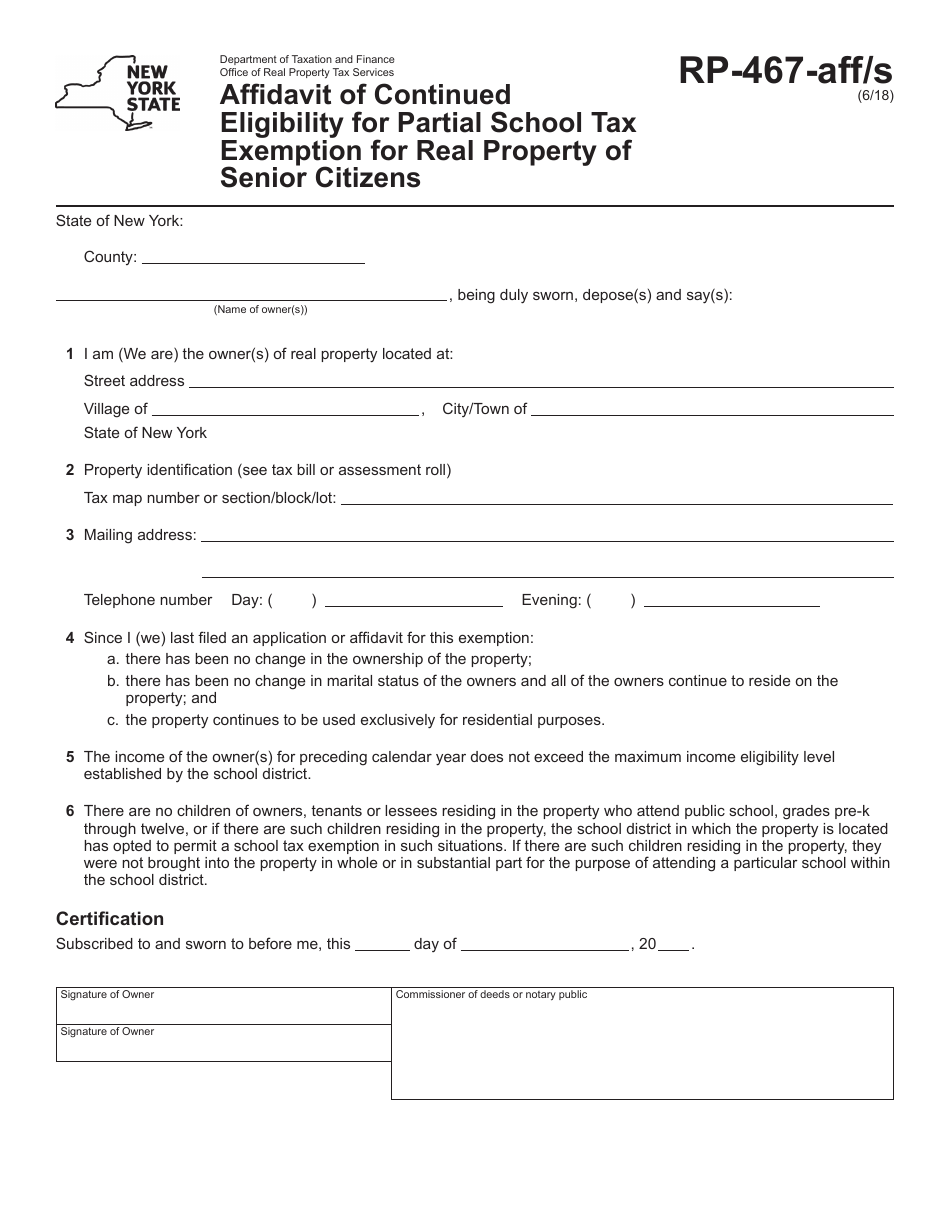

Form RP-467-AFF/S

for the current year.

Form RP-467-AFF / S Affidavit of Continued Eligibility for Partial School Tax Exemption for Real Property of Senior Citizens - New York

What Is Form RP-467-AFF/S?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-467-AFF/S?

A: Form RP-467-AFF/S is the Affidavit of Continued Eligibility for Partial School Tax Exemption for Real Property of Senior Citizens in New York.

Q: Who needs to fill out Form RP-467-AFF/S?

A: Senior citizens in New York who wish to continue receiving the partial school tax exemption for their real property.

Q: What is the purpose of Form RP-467-AFF/S?

A: The purpose of this form is to verify the continued eligibility of senior citizens for the partial school tax exemption on their real property.

Q: What information is required on Form RP-467-AFF/S?

A: The form requires the property owner's name, address, Social Security number, and other relevant information to determine eligibility.

Q: When is the deadline for submitting Form RP-467-AFF/S?

A: The deadline for submitting this form may vary, so it is best to check with your local assessor's office for the specific deadline in your area.

Q: Is there a fee to submit Form RP-467-AFF/S?

A: No, there is no fee required to submit this form.

Q: What should I do if I have questions about Form RP-467-AFF/S?

A: If you have questions or need assistance with this form, you should contact your local assessor's office or the New York State Department of Taxation and Finance.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-467-AFF/S by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.