This version of the form is not currently in use and is provided for reference only. Download this version of

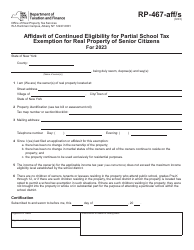

Form RP-467-AFF/CTV

for the current year.

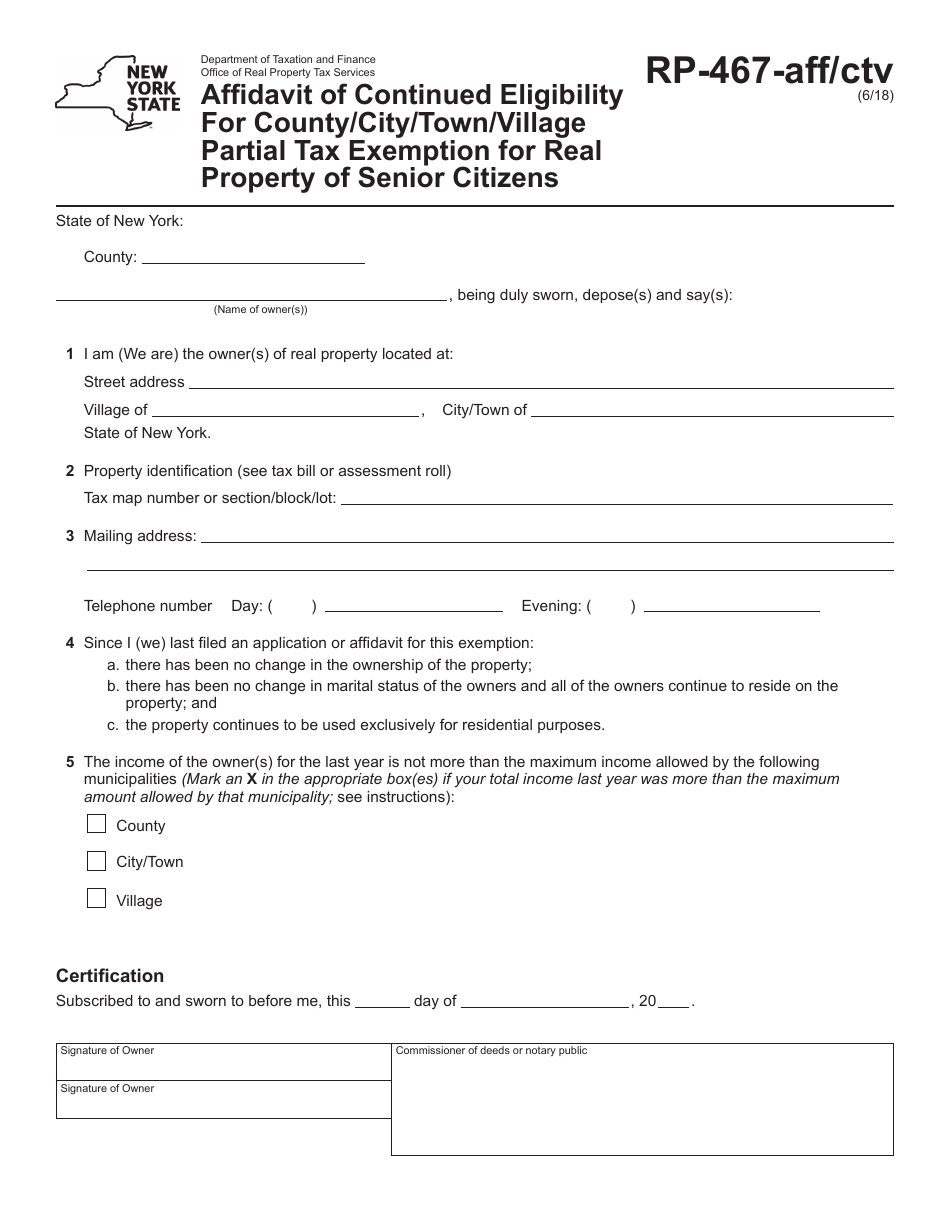

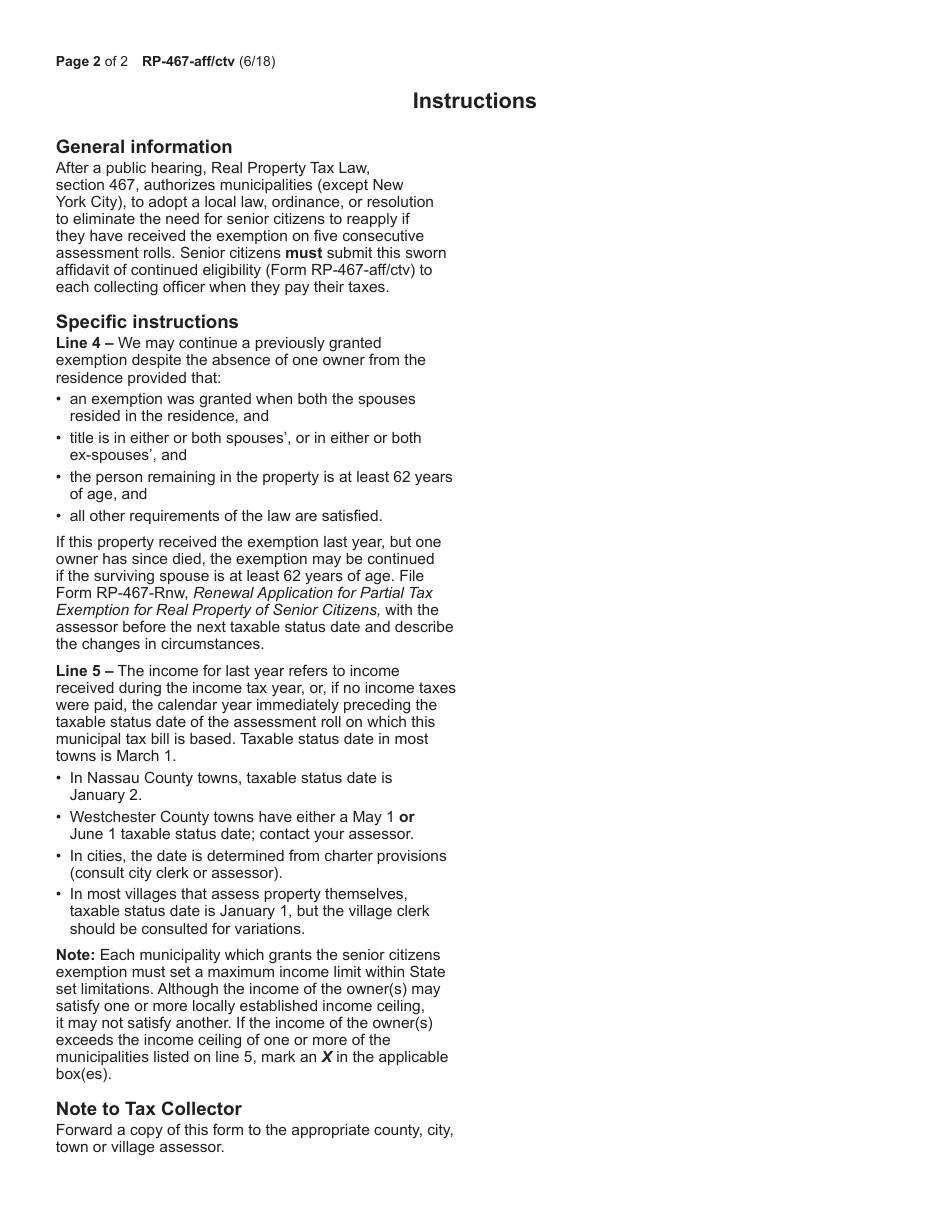

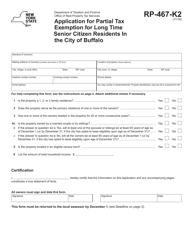

Form RP-467-AFF / CTV Affidavit of Continued Eligibility for County / City / Town / Village Partial Tax Exemption for Real Property of Senior Citizens - New York

What Is Form RP-467-AFF/CTV?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-467-AFF/CTV?

A: Form RP-467-AFF/CTV is an Affidavit of Continued Eligibility for County/City/Town/Village Partial Tax Exemption for Real Property of Senior Citizens in New York.

Q: Who is eligible for this tax exemption?

A: Senior citizens who meet certain criteria are eligible for this tax exemption.

Q: What is the purpose of this form?

A: The purpose of this form is to declare and affirm that the applicant still meets the eligibility requirements for the tax exemption.

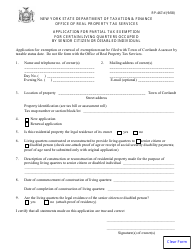

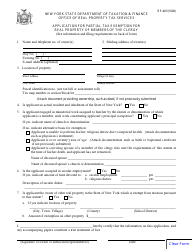

Q: What information do I need to provide on this form?

A: You will need to provide personal information, property details, income information, and any other required documentation.

Q: Do I need to renew this exemption annually?

A: Yes, you must renew this exemption annually by filing a new affidavit of eligibility.

Q: What are the benefits of this tax exemption?

A: The tax exemption can provide partial exemption from property taxes for eligible senior citizens.

Q: Are there any income limits for this exemption?

A: Yes, there are income limits to qualify for this exemption. The limits vary depending on the location and other factors.

Q: Can I claim this exemption if I don't own the property?

A: No, this exemption is only available to senior citizens who own the property as their primary residence.

Q: What is the deadline to file this form?

A: The deadline to file this form may vary depending on the local requirements. Contact your local assessor's office for specific deadlines.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-467-AFF/CTV by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.