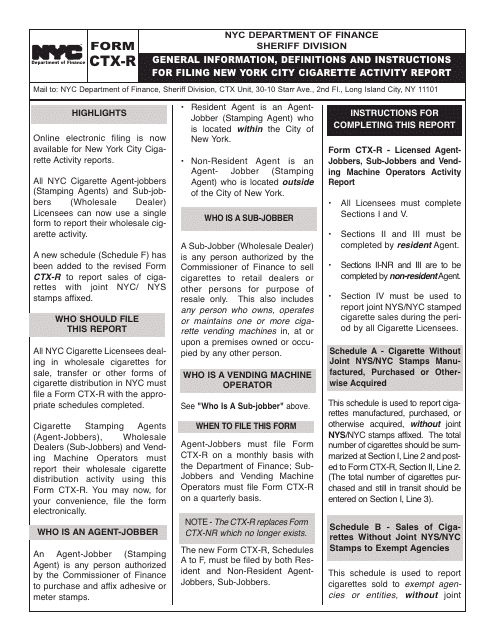

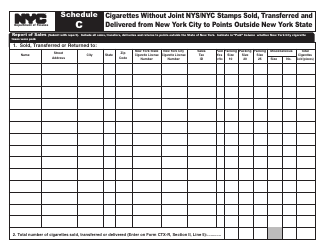

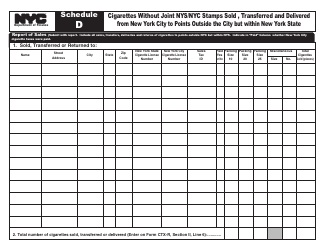

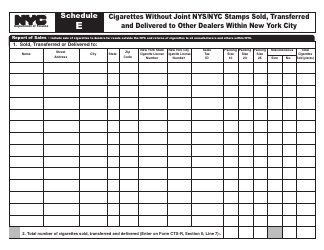

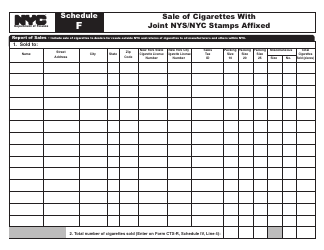

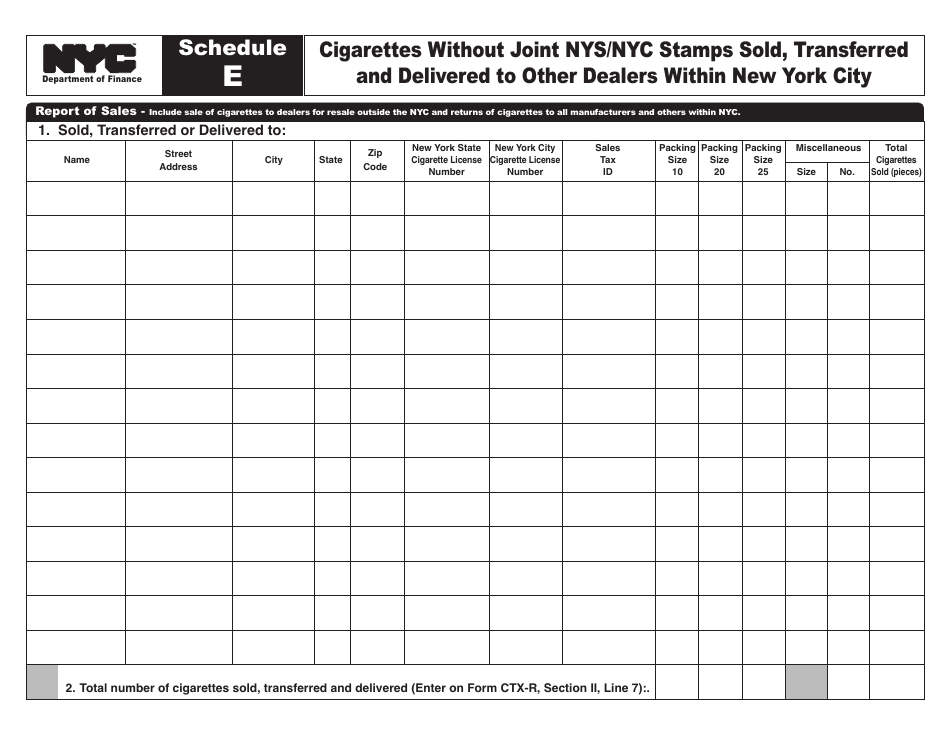

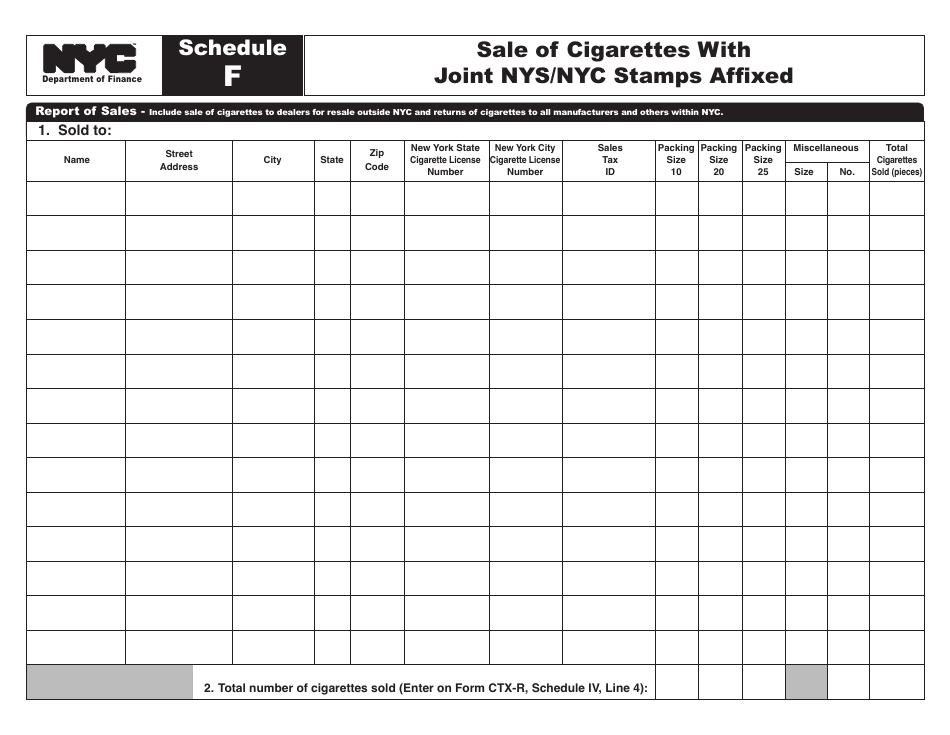

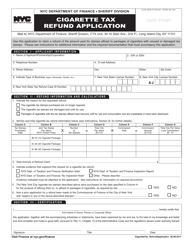

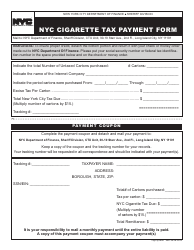

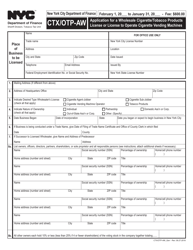

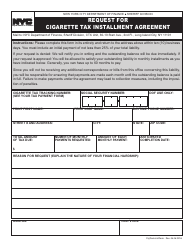

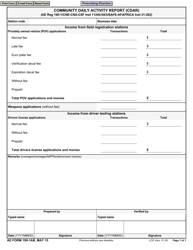

Form CTX-R Cigarette Tax Activity Report - New York City

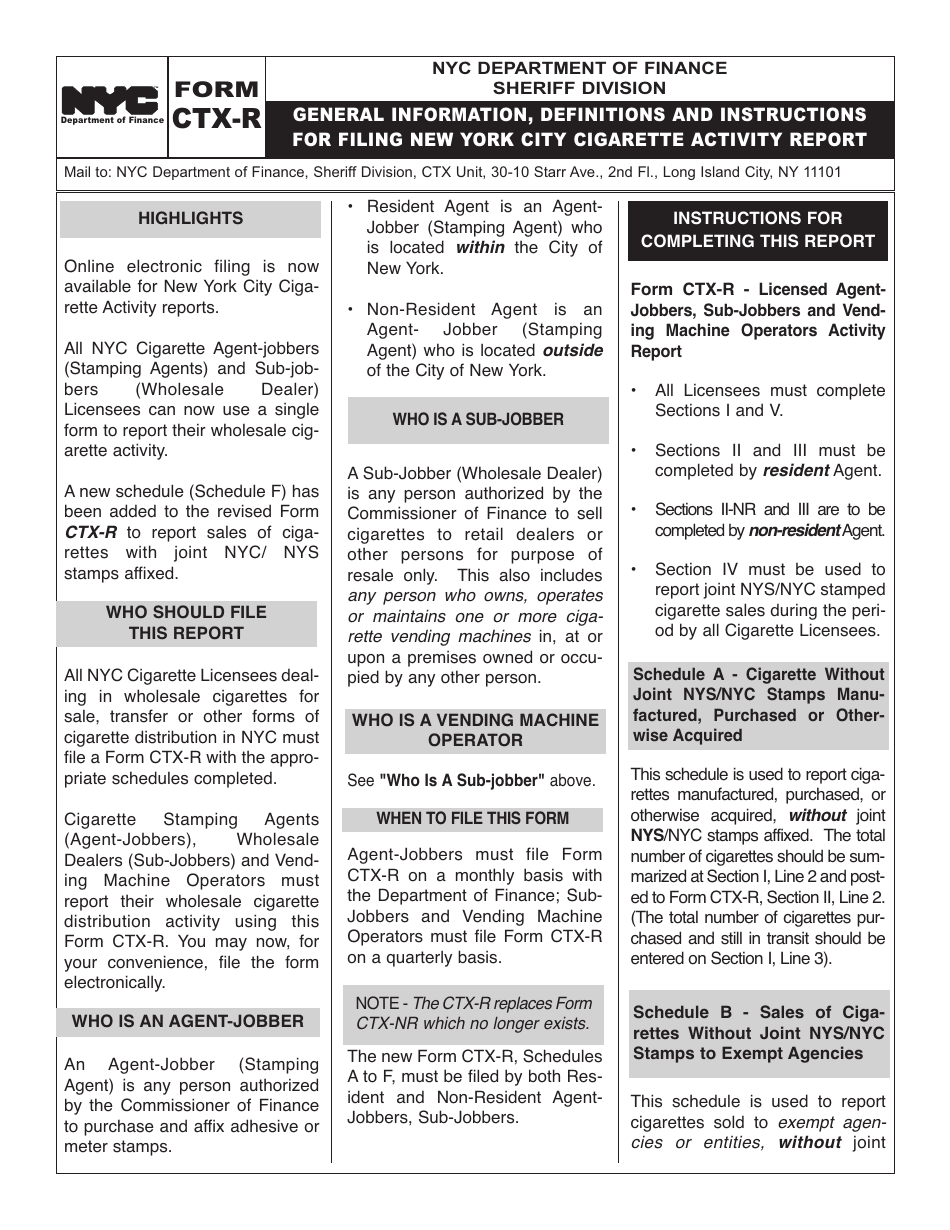

What Is Form CTX-R?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CTX-R?

A: The Form CTX-R is a Cigarette TaxActivity Report.

Q: Who uses the Form CTX-R?

A: The Form CTX-R is used by businesses in New York City that sell cigarettes.

Q: What is the purpose of the Form CTX-R?

A: The purpose of the Form CTX-R is to report cigarette tax activity in New York City.

Q: When is the Form CTX-R due?

A: The Form CTX-R is due on a monthly basis by the 20th day of the following month.

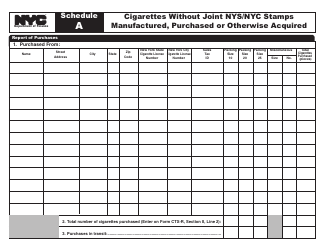

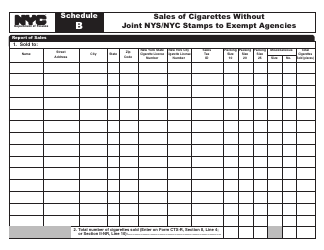

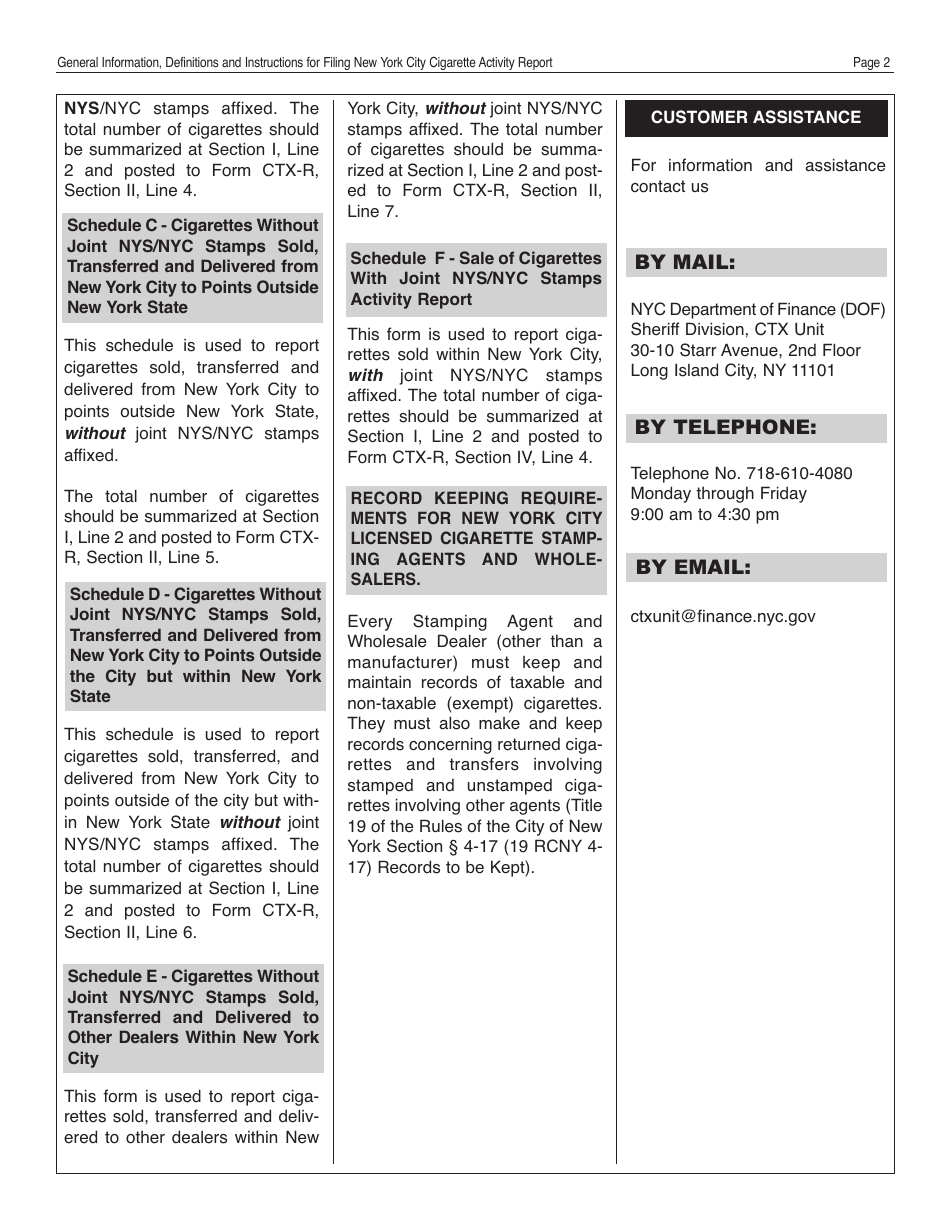

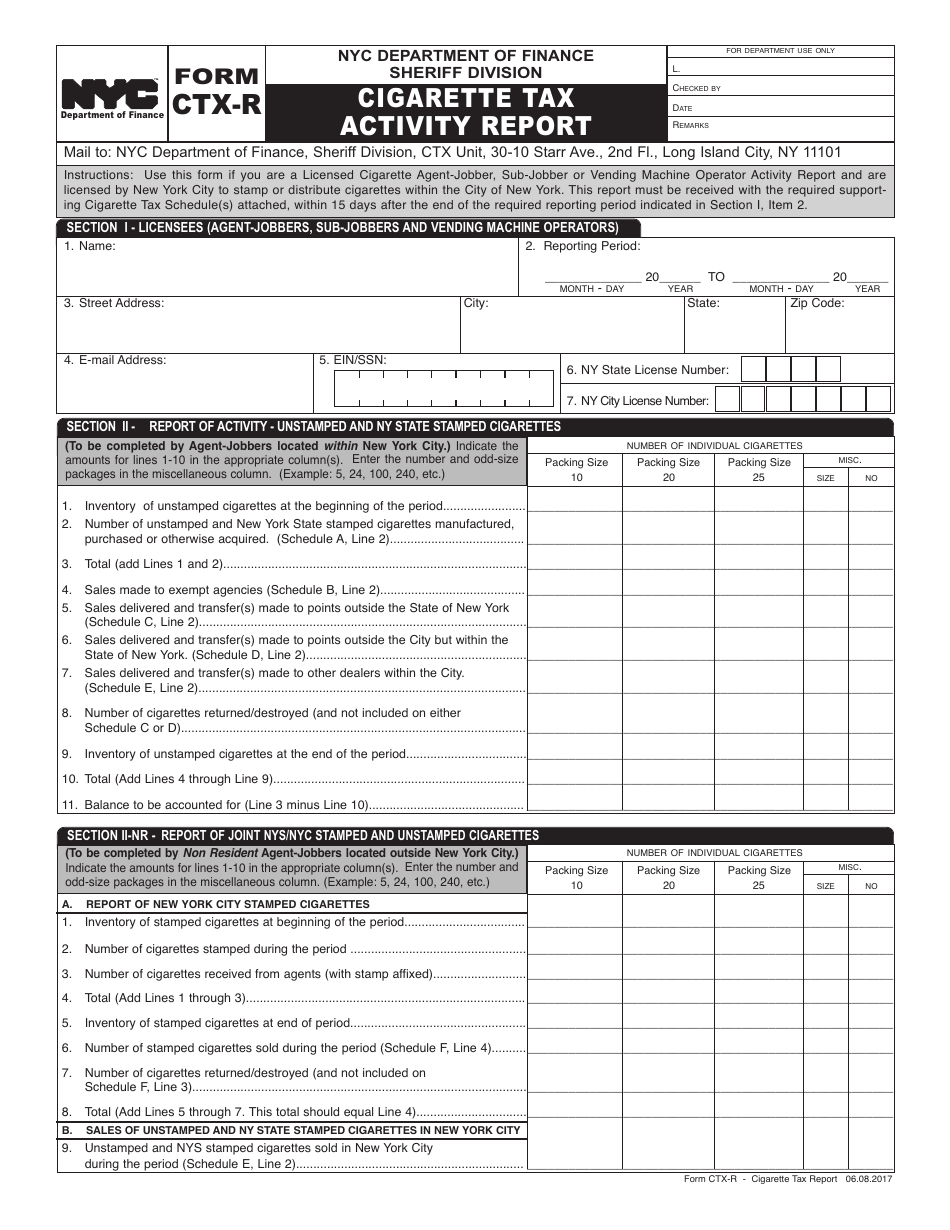

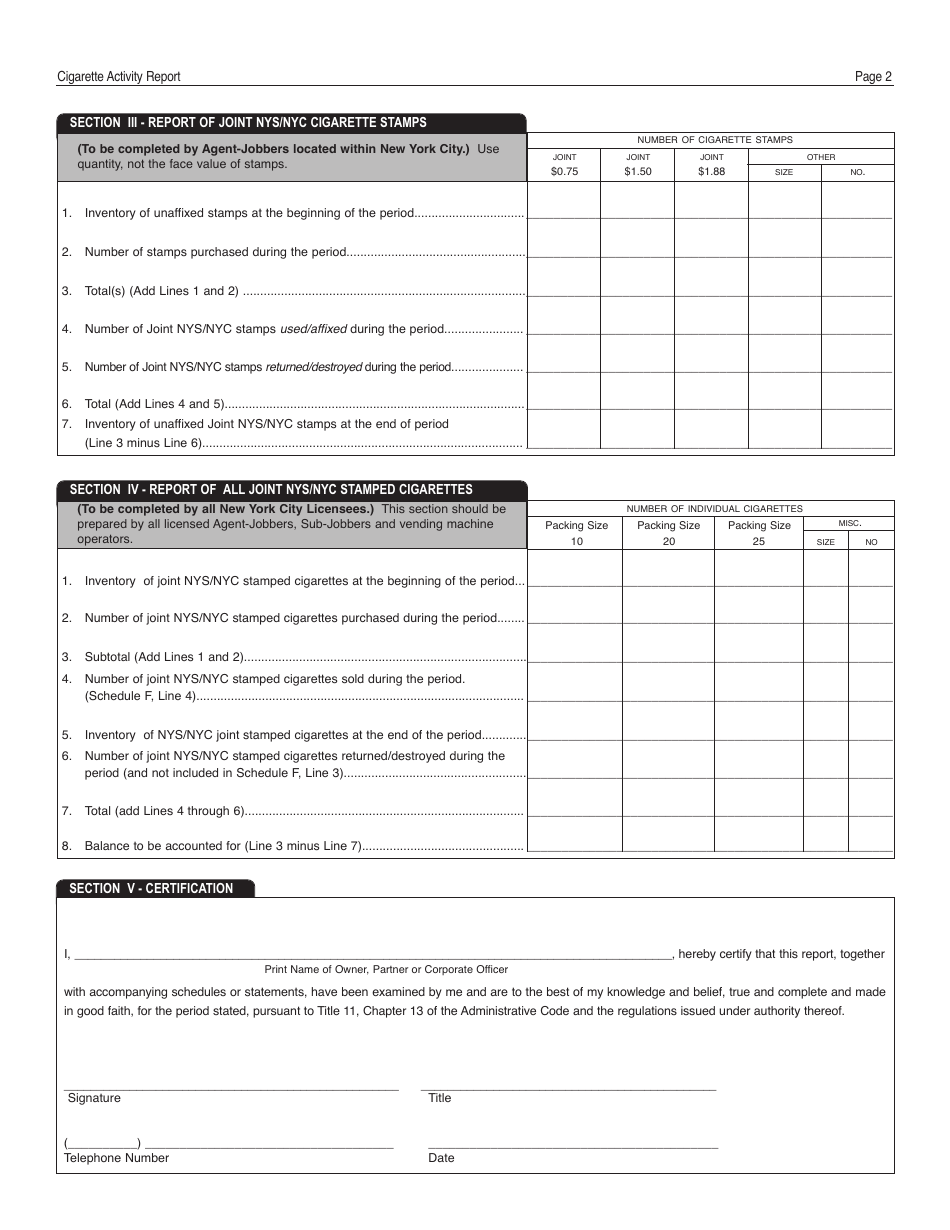

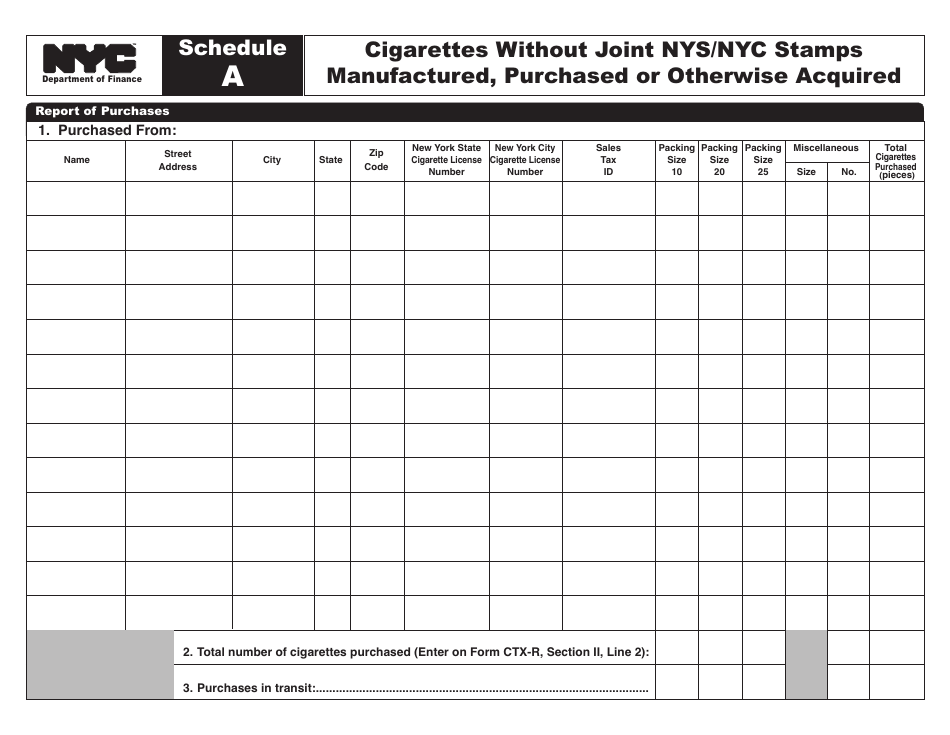

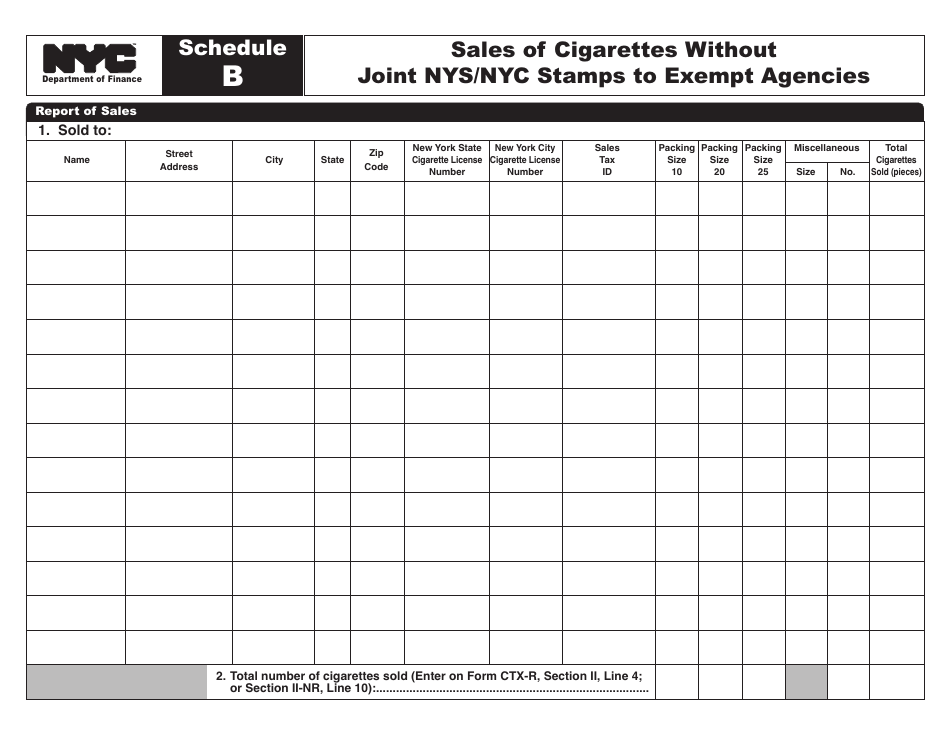

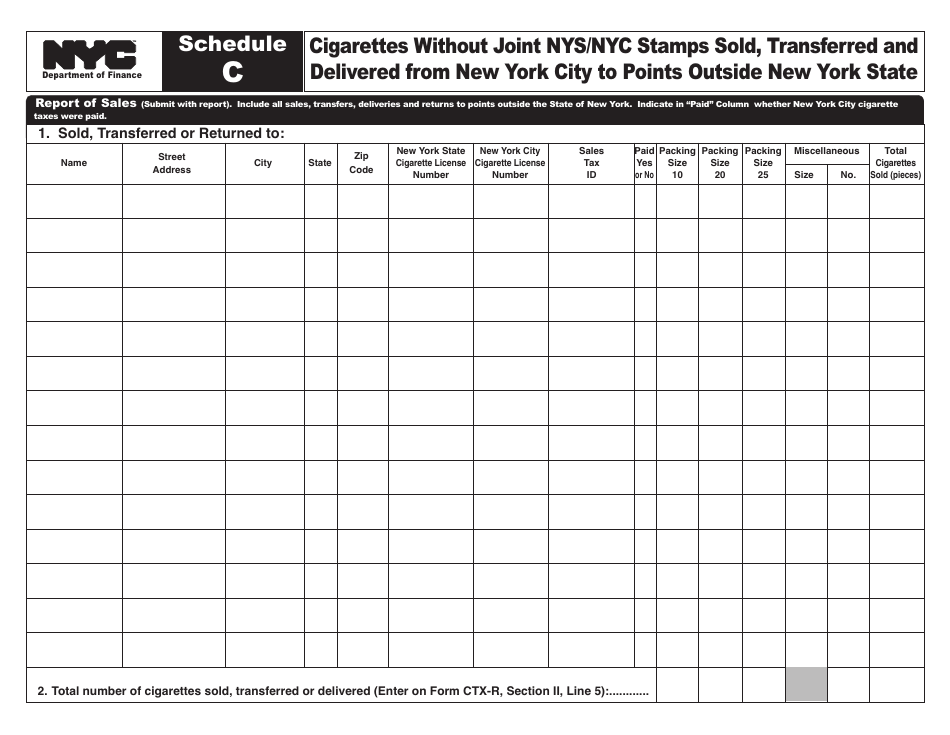

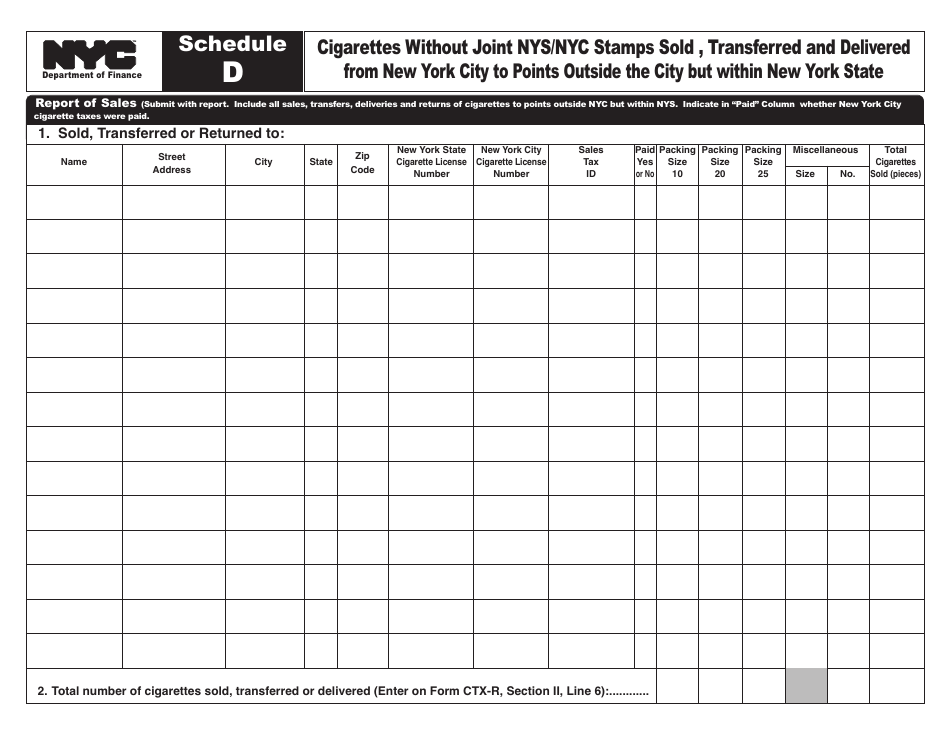

Q: What information is required on the Form CTX-R?

A: The Form CTX-R requires information such as the quantity of cigarettes sold, purchases, and inventory.

Q: Is the Form CTX-R only for businesses in New York City?

A: Yes, the Form CTX-R is specifically for businesses in New York City that sell cigarettes.

Q: Are there any penalties for not filing the Form CTX-R?

A: Yes, there are penalties for not filing the Form CTX-R, including monetary fines and other enforcement actions.

Form Details:

- Released on June 8, 2017;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CTX-R by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.