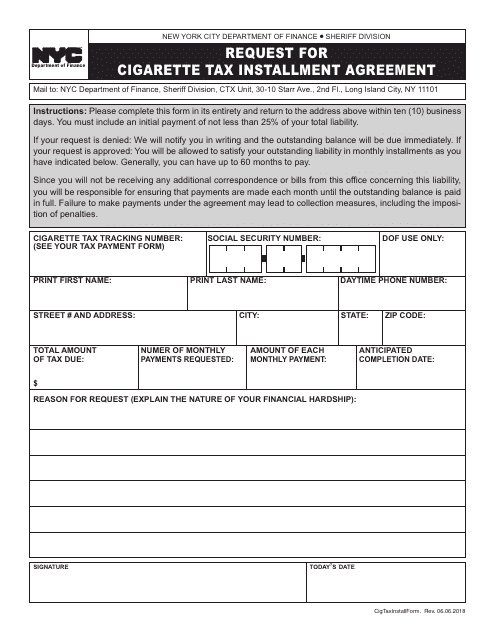

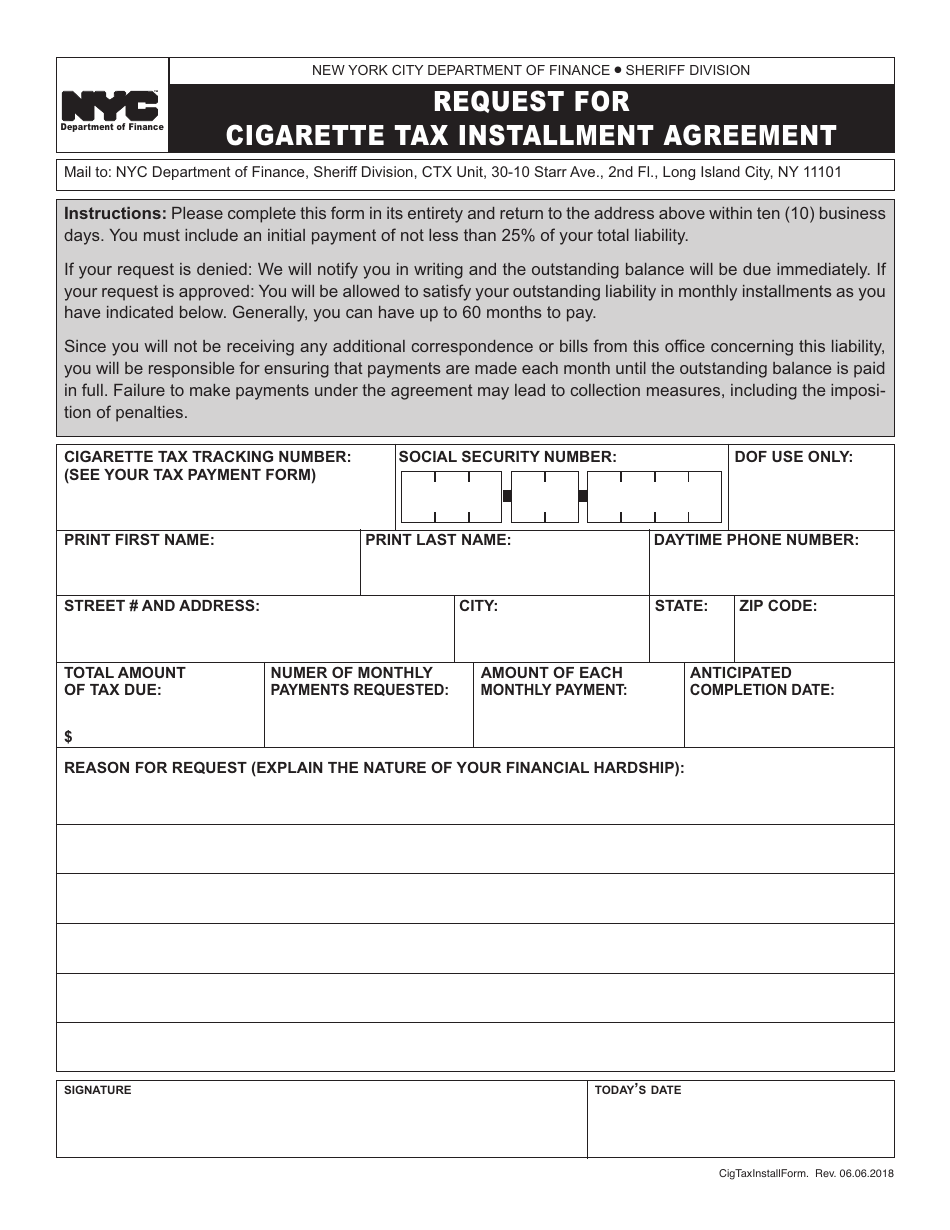

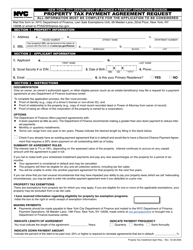

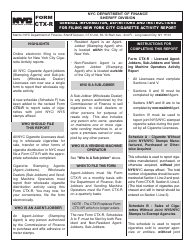

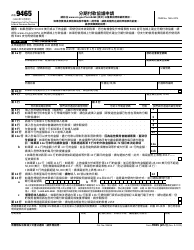

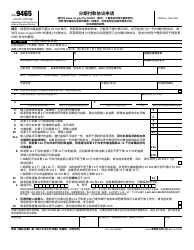

Request for Cigarette Tax Installment Agreement - New York City

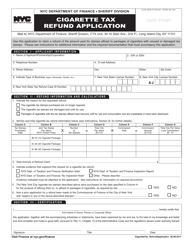

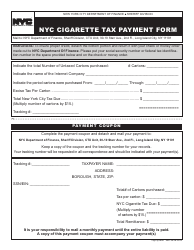

Request for Cigarette Tax Installment Agreement is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

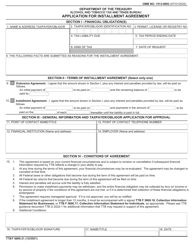

Q: What is a Cigarette Tax Installment Agreement?

A: A Cigarette Tax Installment Agreement is an arrangement with the New York City government where taxpayers can pay their cigarette tax liabilities in installments.

Q: Who can request a Cigarette Tax Installment Agreement?

A: Any taxpayer who owes cigarette tax in New York City can request a Cigarette Tax Installment Agreement.

Q: How can I request a Cigarette Tax Installment Agreement?

A: To request a Cigarette Tax Installment Agreement, you can contact the New York City Department of Finance.

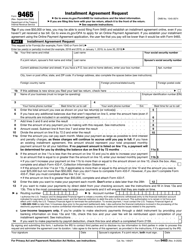

Q: What are the benefits of a Cigarette Tax Installment Agreement?

A: The benefits of a Cigarette Tax Installment Agreement include the ability to pay your tax liabilities over time, avoiding penalties and interest, and maintaining compliance with the law.

Q: Are there any requirements to qualify for a Cigarette Tax Installment Agreement?

A: To qualify for a Cigarette Tax Installment Agreement, you must be current with your filing and reporting requirements, have a valid New York City cigarette tax registration, and meet certain financial criteria.

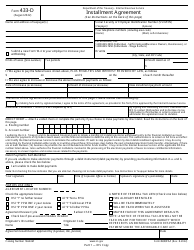

Q: Can I negotiate the terms of a Cigarette Tax Installment Agreement?

A: The terms of a Cigarette Tax Installment Agreement are determined by the New York City Department of Finance, and negotiation is not available.

Q: What happens if I default on a Cigarette Tax Installment Agreement?

A: If you default on a Cigarette Tax Installment Agreement, the New York City government can take enforcement actions, such as seizing your assets or taking legal action.

Form Details:

- Released on June 6, 2018;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.