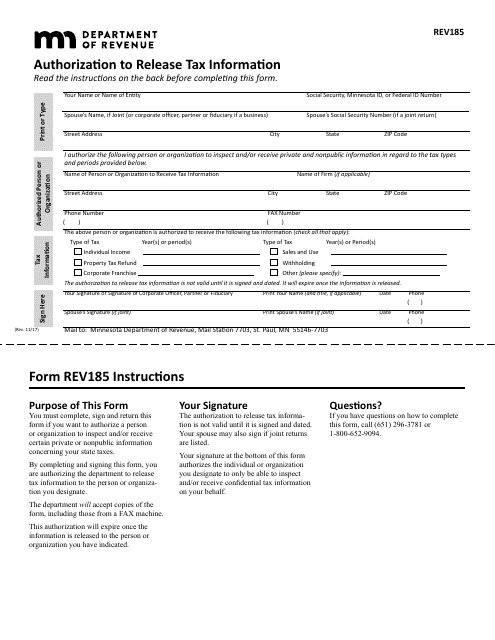

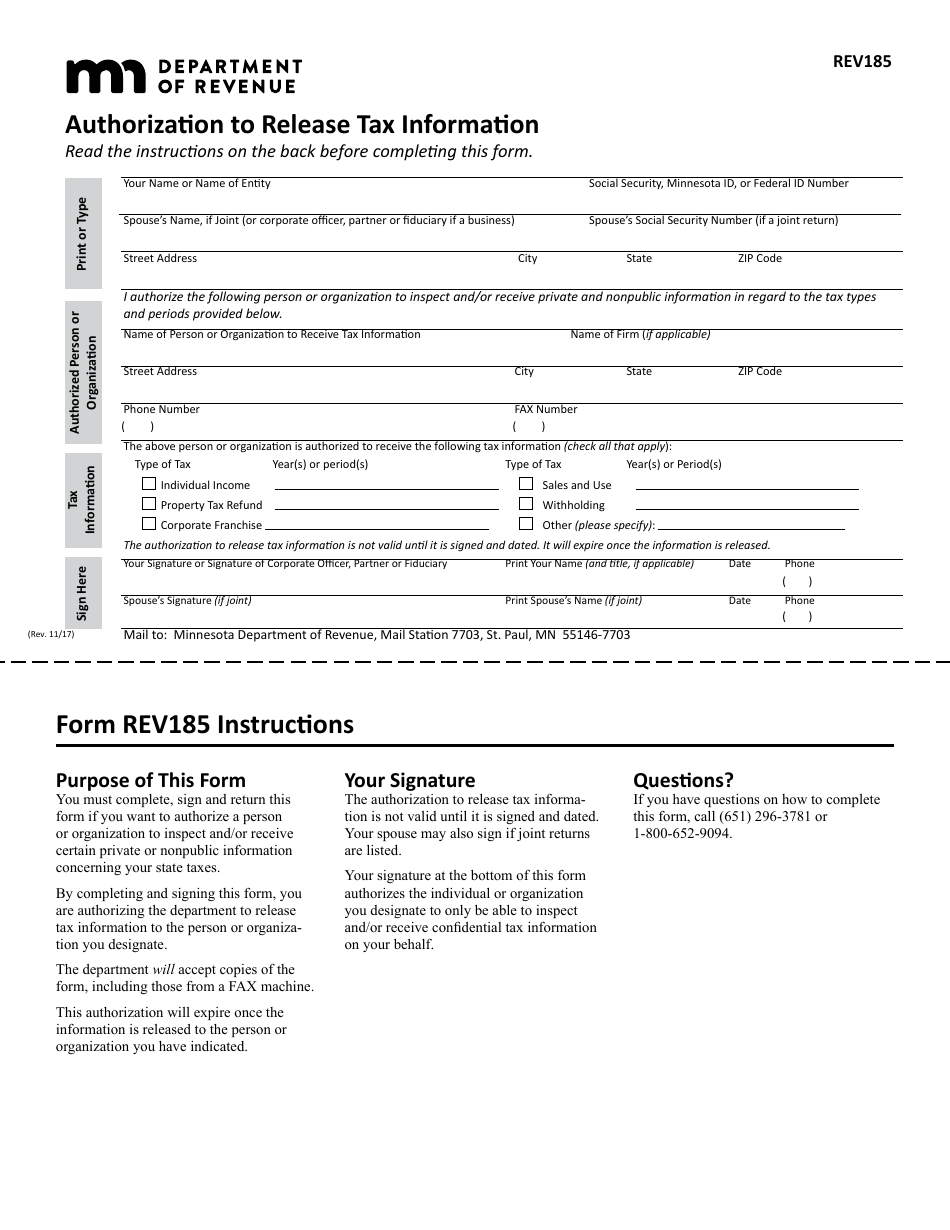

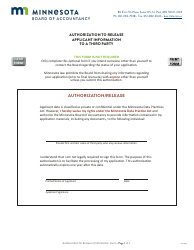

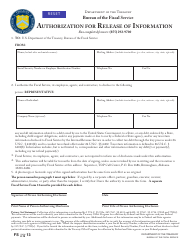

Form REV185 Authorization to Release Tax Information - Minnesota

What Is Form REV185?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

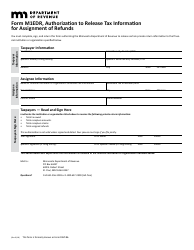

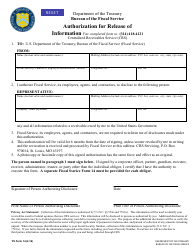

Q: What is Form REV185?

A: Form REV185 is an Authorization to Release Tax Information form.

Q: Why would I need to fill out Form REV185?

A: You would need to fill out Form REV185 if you want to authorize someone to access your tax information in Minnesota.

Q: Who can I authorize to access my tax information using Form REV185?

A: You can authorize any individual, organization, or firm to access your tax information using Form REV185.

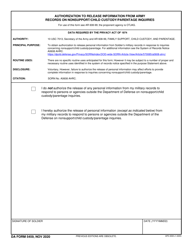

Q: Is Form REV185 specific to Minnesota?

A: Yes, Form REV185 is specific to Minnesota.

Q: Is there a fee to file Form REV185?

A: No, there is no fee to file Form REV185.

Q: Can I submit Form REV185 electronically?

A: Yes, you can submit Form REV185 electronically.

Q: What information do I need to provide on Form REV185?

A: You need to provide your name, social security number, and the name of the person or organization you are authorizing to access your tax information.

Q: How long does it take to process Form REV185?

A: The processing time for Form REV185 varies, but it usually takes a few weeks.

Q: Can I revoke the authorization provided on Form REV185?

A: Yes, you can revoke the authorization provided on Form REV185 at any time.

Q: Are there any restrictions on who I can authorize using Form REV185?

A: There are no specific restrictions on who you can authorize using Form REV185, as long as they have a legitimate reason to access your tax information.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV185 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.