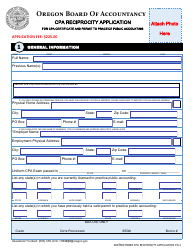

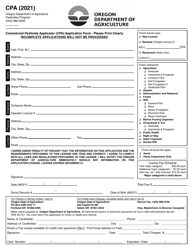

CPA Reciprocity Application Form - Oregon

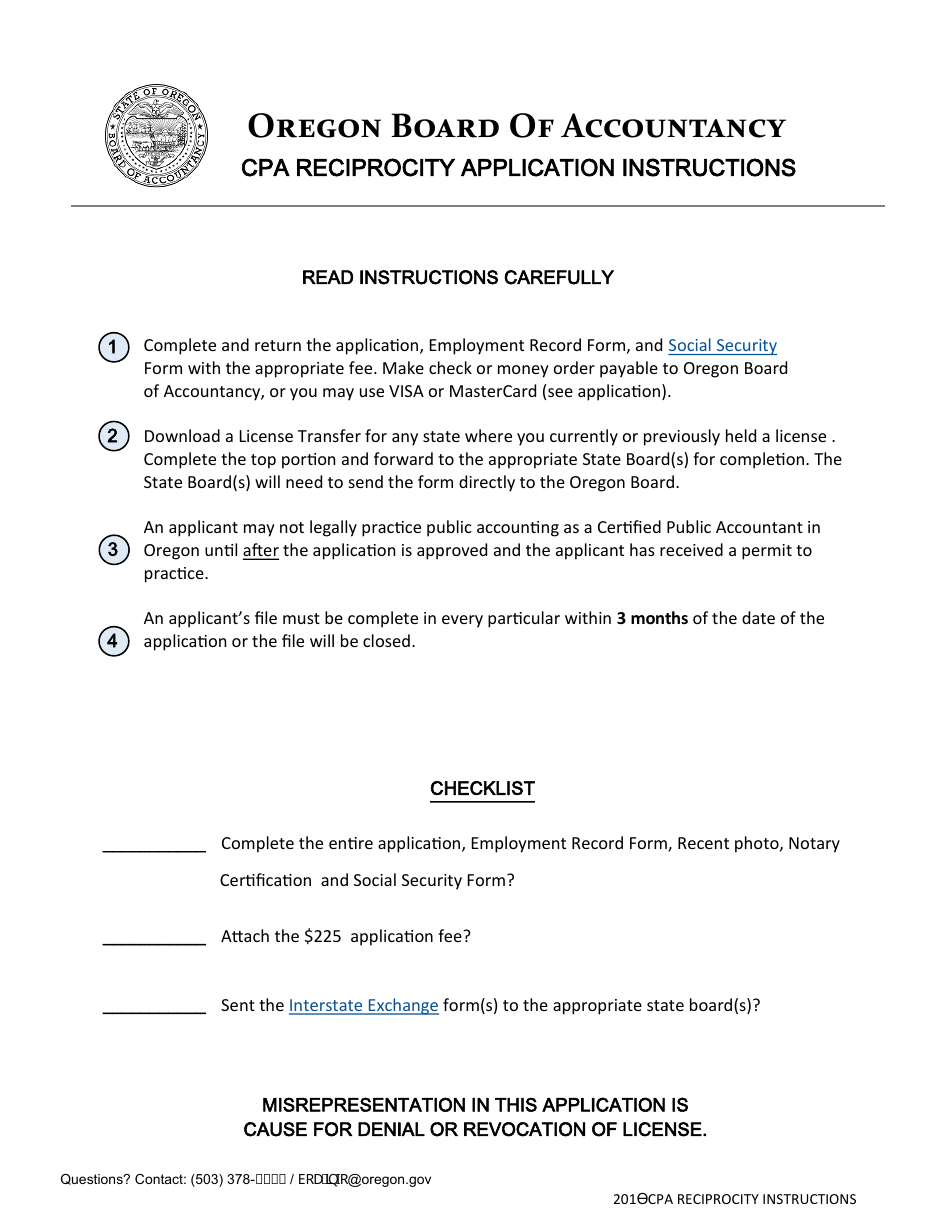

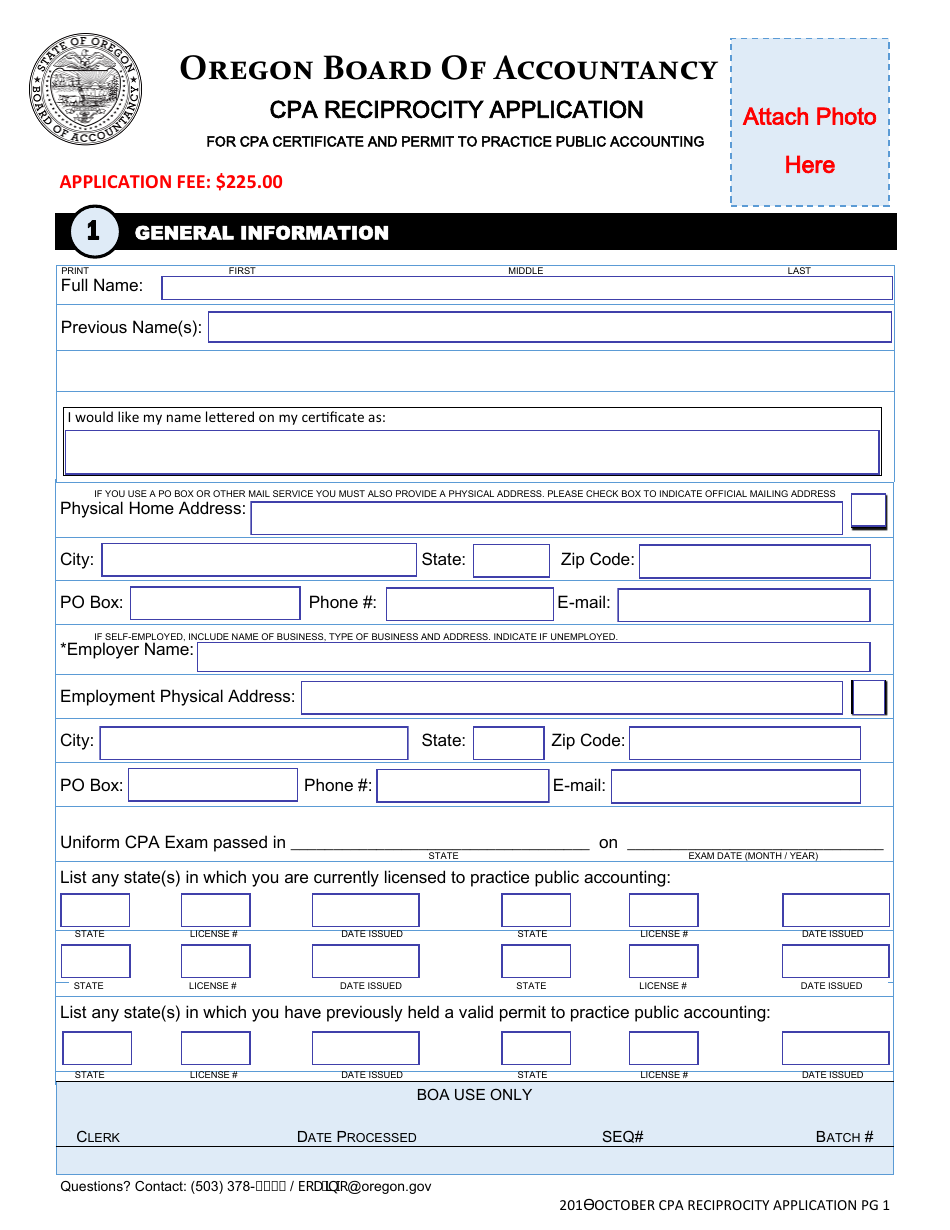

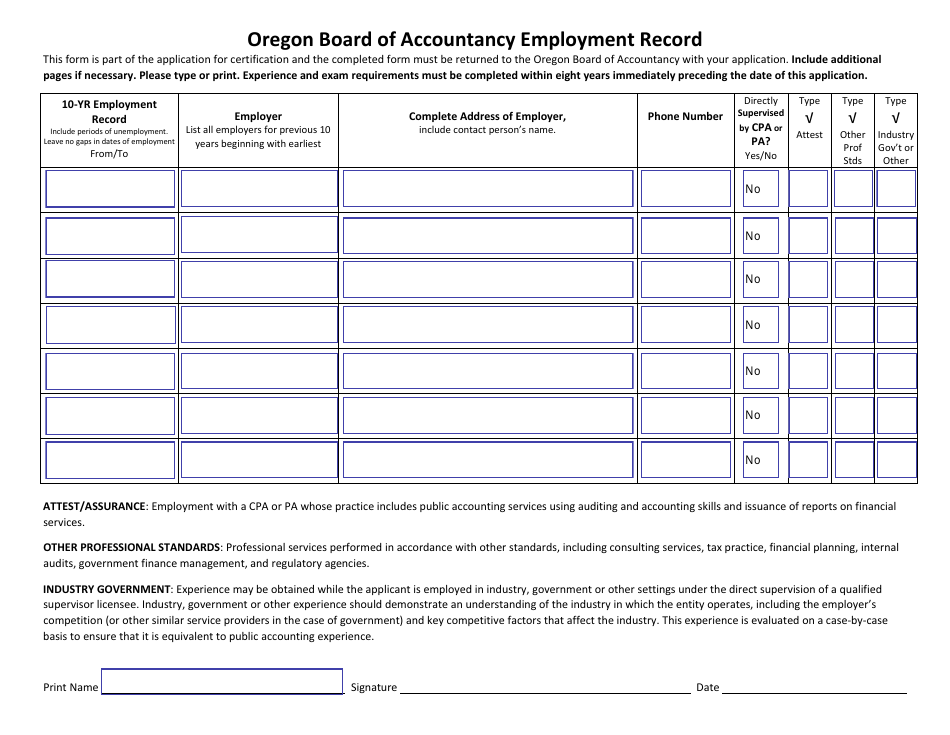

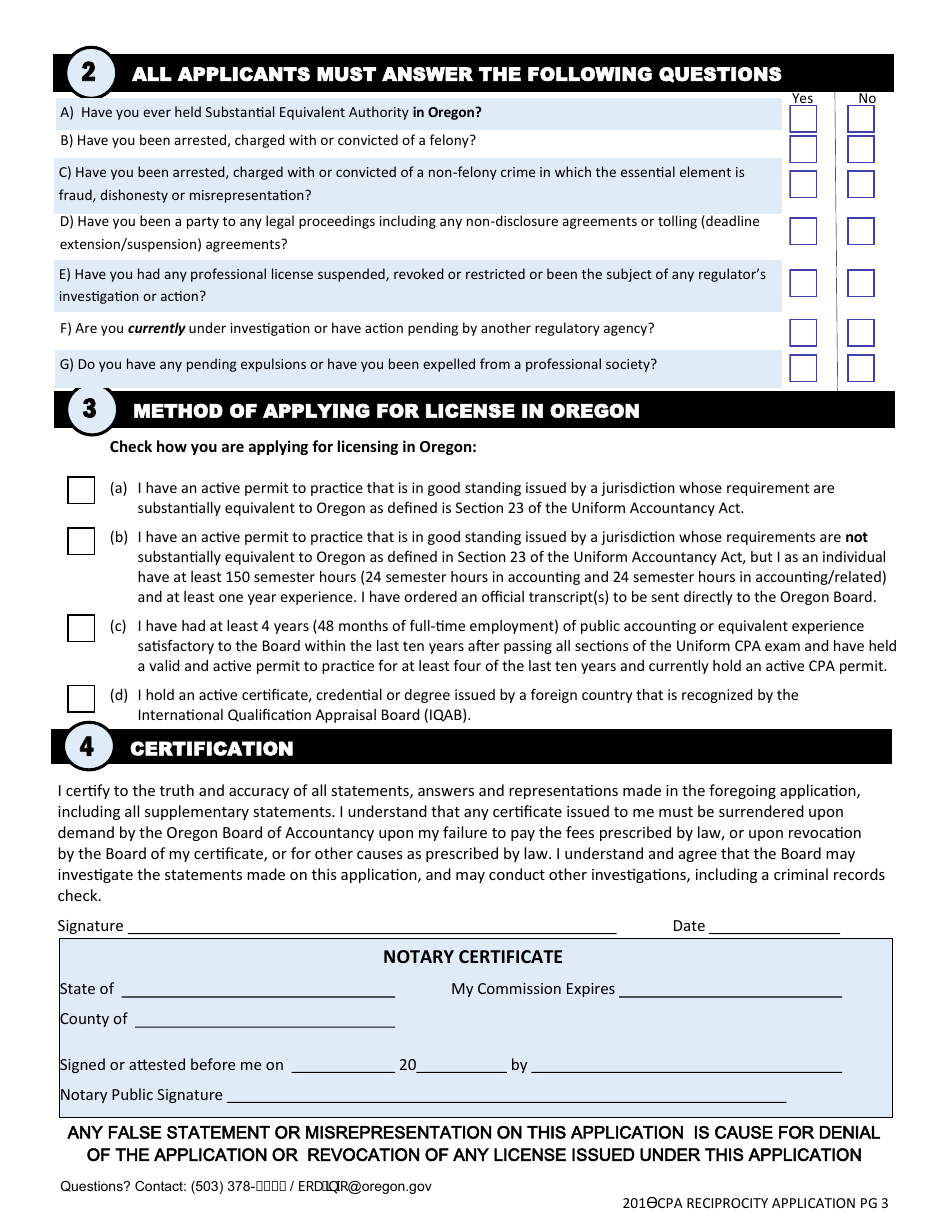

CPA Reciprocity Application Form is a legal document that was released by the Oregon Board of Accountancy - a government authority operating within Oregon.

FAQ

Q: What is a CPA Reciprocity Application Form?

A: It is a form used to apply for reciprocity as a Certified Public Accountant (CPA) in Oregon.

Q: What is reciprocity for CPA?

A: Reciprocity allows CPAs licensed in one state to obtain a license in another state without having to take the full CPA exam again.

Q: Who can use the CPA Reciprocity Application Form in Oregon?

A: CPAs who are licensed in another state and want to obtain a CPA license in Oregon.

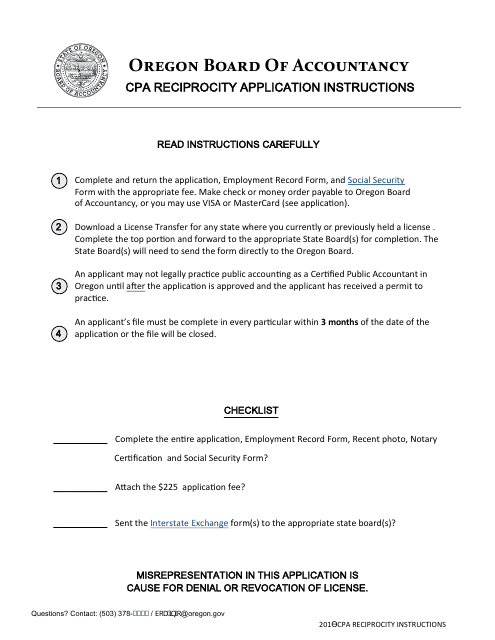

Q: What are the requirements for CPA reciprocity in Oregon?

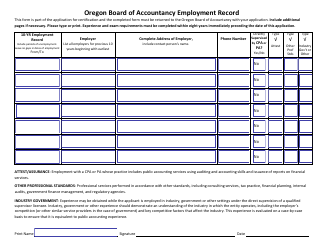

A: The requirements may vary, but typically you need to have a valid CPA license in another state, meet education and experience requirements, and pass an ethics exam.

Q: How long does it take to process the CPA reciprocity application?

A: The processing time can vary, but it usually takes several weeks to a few months for the application to be reviewed and approved.

Q: Can I practice as a CPA in Oregon while my reciprocity application is being processed?

A: Generally, you cannot practice as a CPA in Oregon until your reciprocity application is approved and you receive your license.

Q: What other documents do I need to submit along with the CPA Reciprocity Application Form?

A: Typically, you will need to submit official transcripts, a verification of licensure from the state where you hold a license, and other supporting documents as required by the state board.

Form Details:

- Released on January 1, 2018;

- The latest edition currently provided by the Oregon Board of Accountancy;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Board of Accountancy.