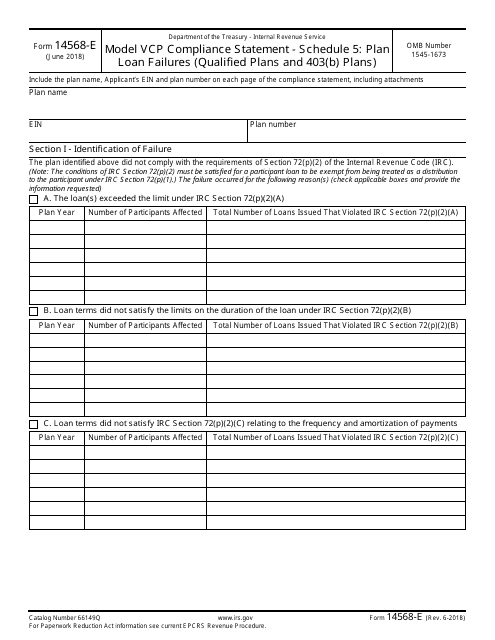

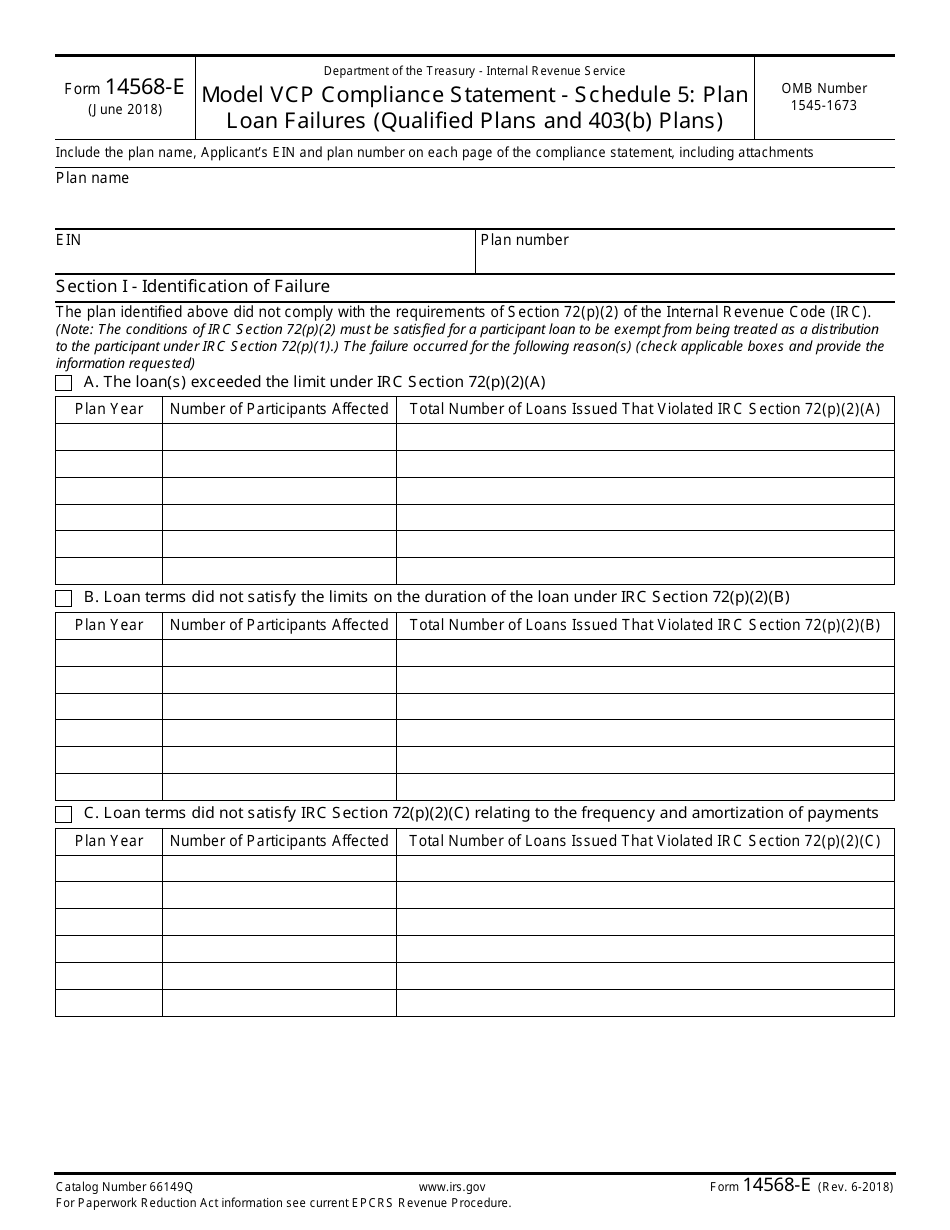

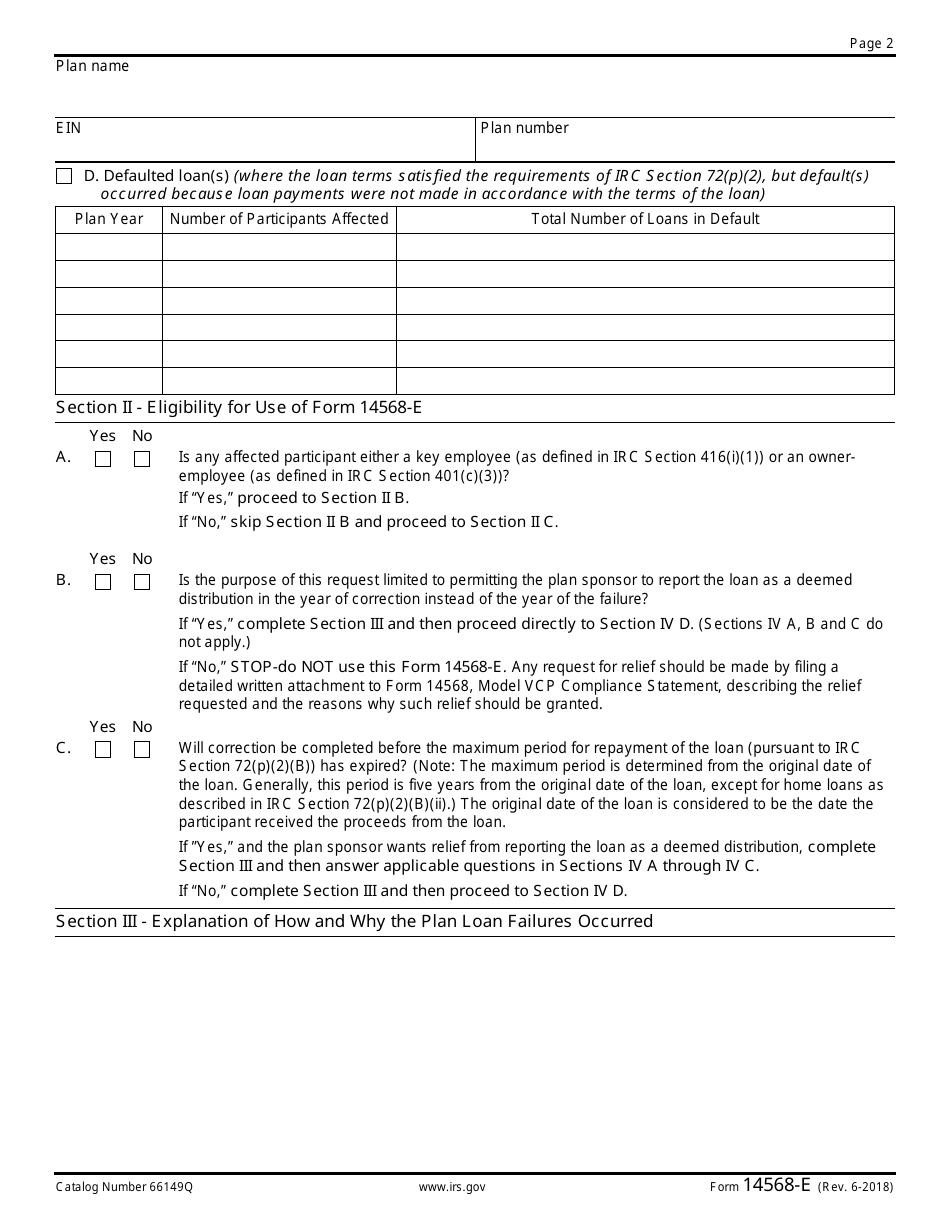

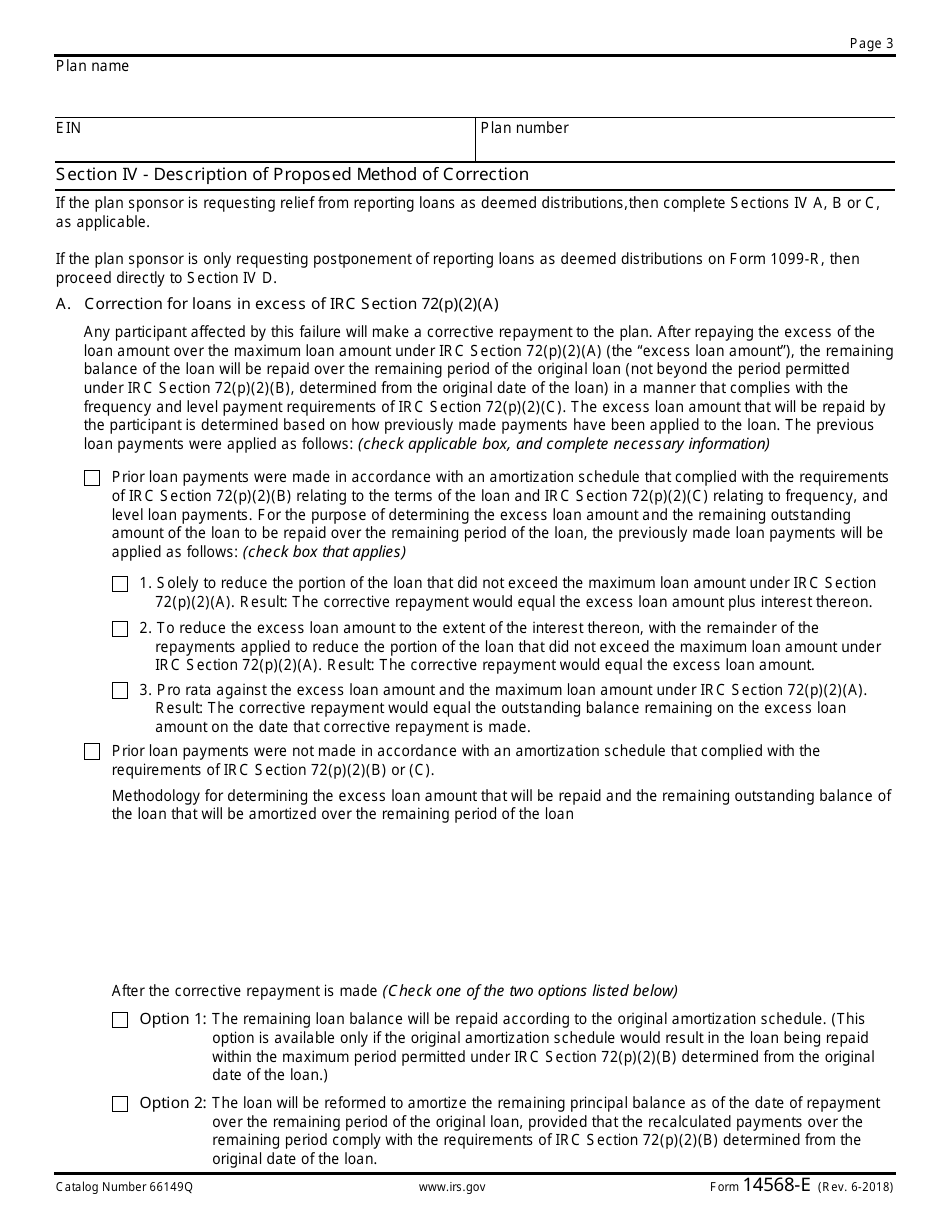

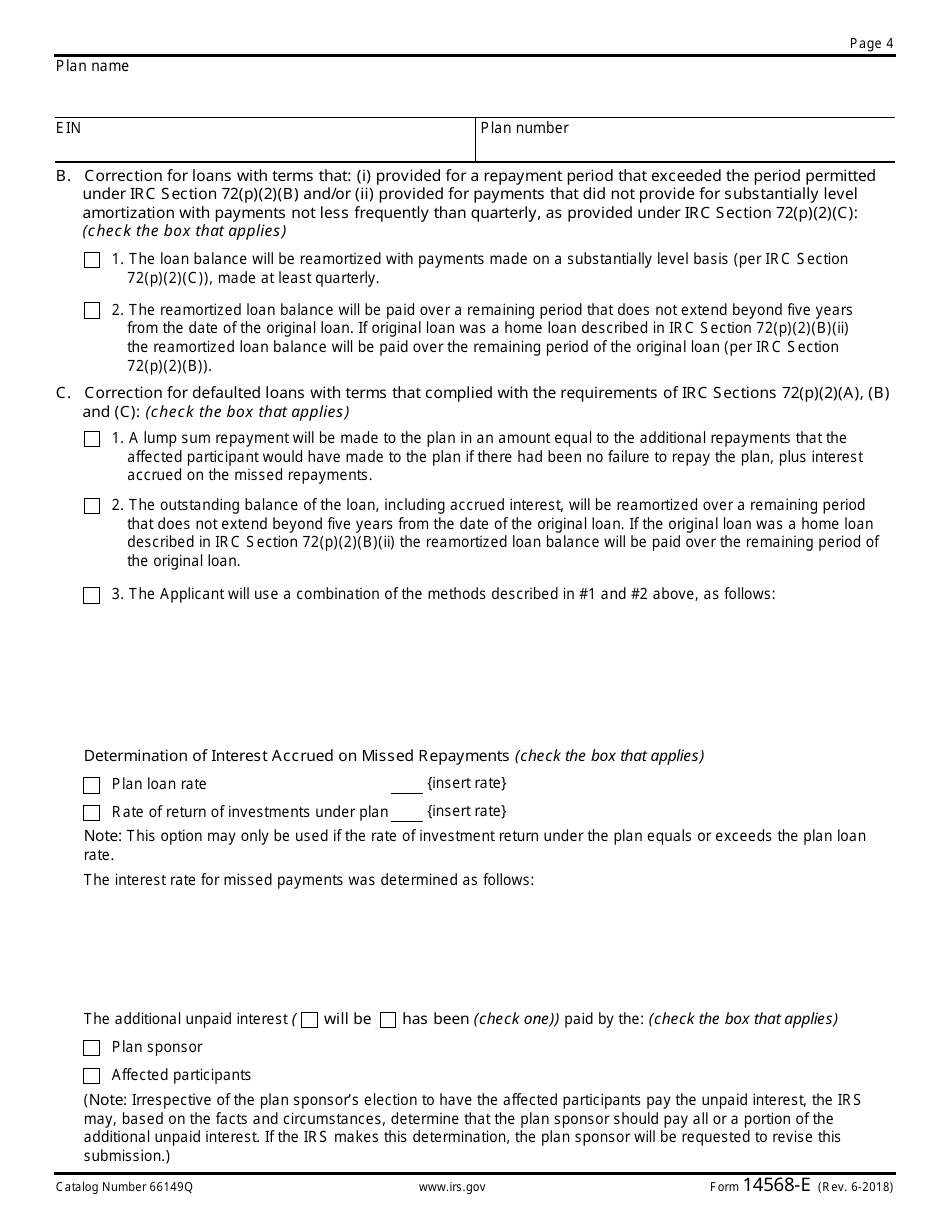

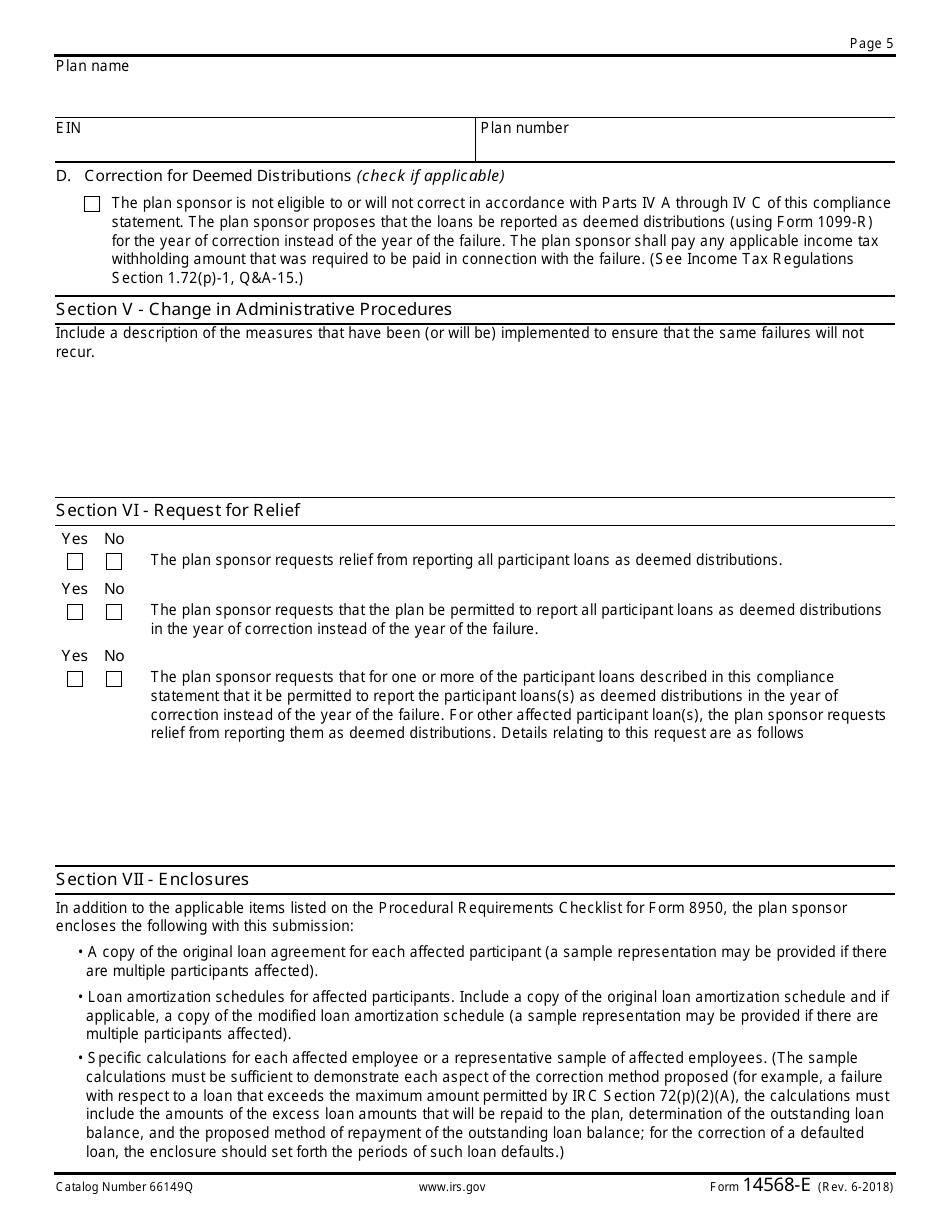

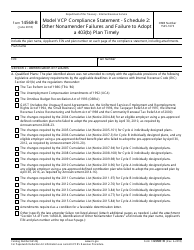

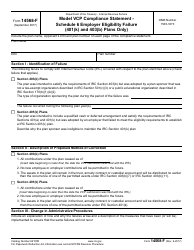

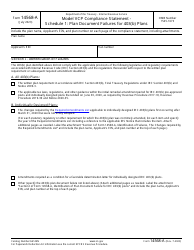

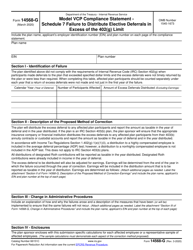

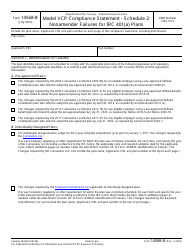

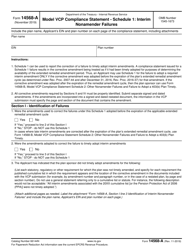

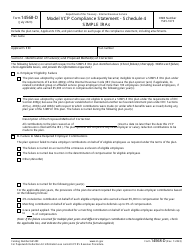

IRS Form 14568-E Model Vcp Compliance Statement - Schedule 5: Plan Loan Failures (Qualified Plans and 403(B) Plans)

What Is IRS Form 14568-E?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14568-E?

A: IRS Form 14568-E is a Model Vcp Compliance Statement.

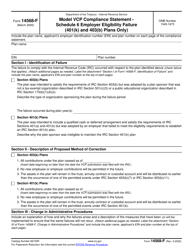

Q: What is the purpose of Schedule 5: Plan Loan Failures (Qualified Plans and 403(B) Plans)?

A: The purpose of Schedule 5 is to report plan loan failures for qualified plans and 403(B) plans.

Q: Who is required to file IRS Form 14568-E?

A: Employers who have identified plan loan failures in their qualified plans or 403(B) plans are required to file IRS Form 14568-E.

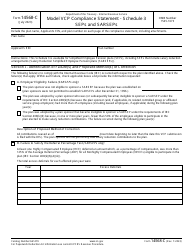

Q: What does Vcp stand for?

A: Vcp stands for Voluntary Correction Program.

Q: What should be reported in Schedule 5?

A: Schedule 5 should include information regarding plan loan failures, such as the participant's name, loan amount, and repayment status.

Q: Is IRS Form 14568-E mandatory?

A: No, IRS Form 14568-E is not mandatory. It is a voluntary form used for self-correction of plan loan failures.

Q: Are there any penalties for not filing IRS Form 14568-E?

A: There are no specific penalties for not filing IRS Form 14568-E, but it is recommended to correct plan loan failures to avoid potential penalties or disqualification of the plan.

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14568-E through the link below or browse more documents in our library of IRS Forms.