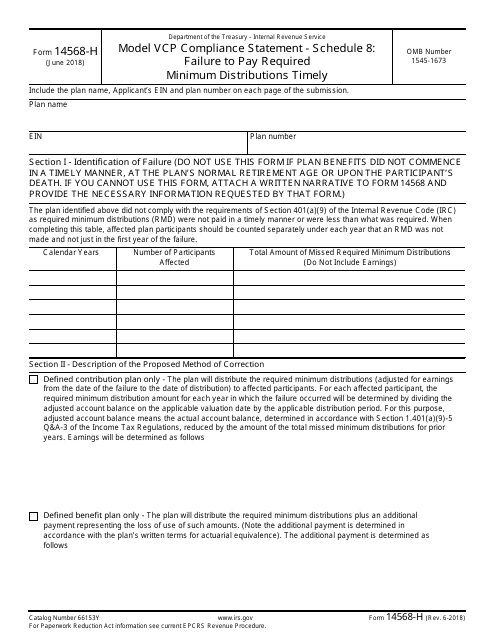

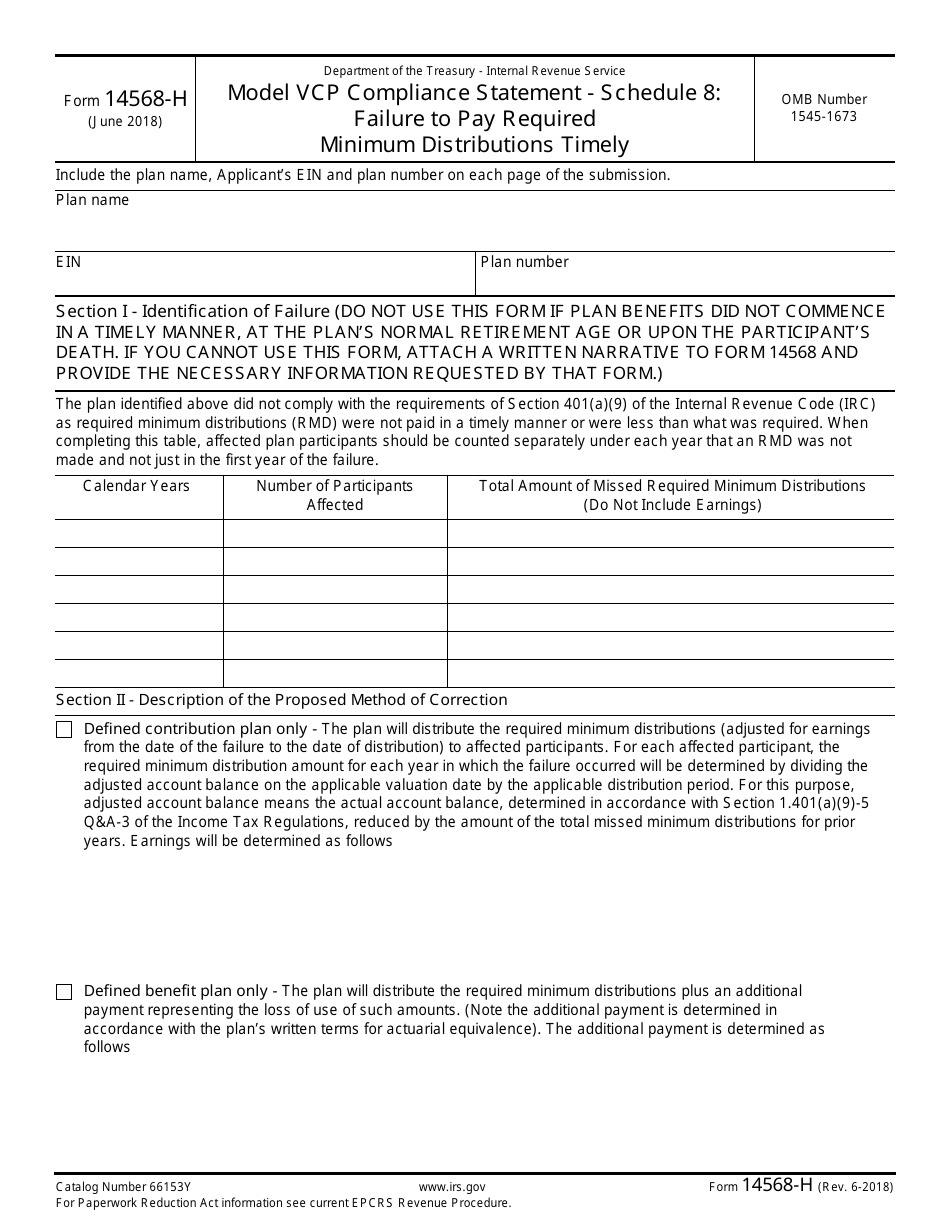

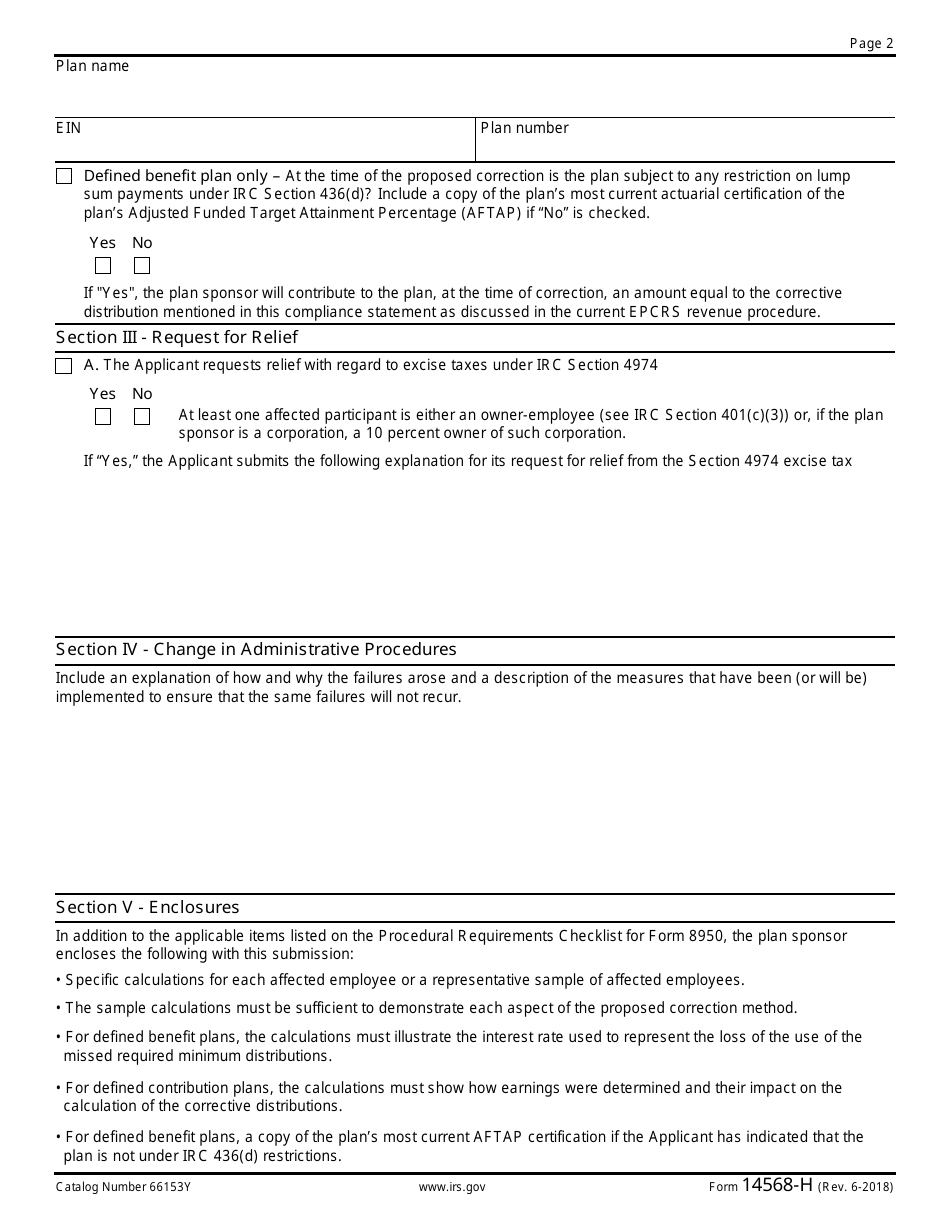

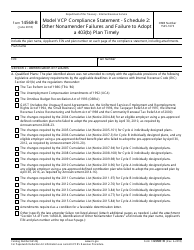

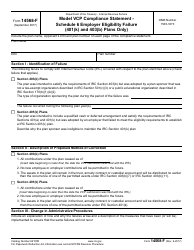

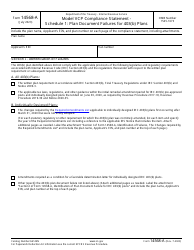

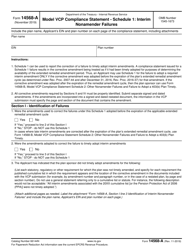

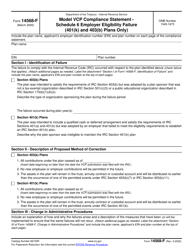

IRS Form 14568-H Model Vcp Compliance Statement - Schedule 8: Failure to Pay Required Minimum Distributions Timely

What Is IRS Form 14568-H?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 14568-H?

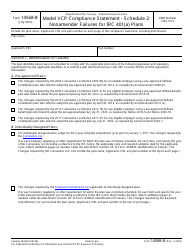

A: Form 14568-H is a model Voluntary Correction Program (VCP) Compliance Statement.

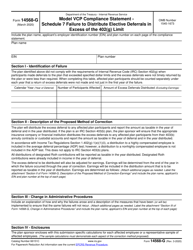

Q: What is Schedule 8?

A: Schedule 8 is a part of Form 14568-H that deals with failures to pay required minimum distributions (RMDs) timely.

Q: What is the purpose of Form 14568-H?

A: The purpose of Form 14568-H is to correct failures to comply with the IRS rules regarding RMDs.

Q: What is a failure to pay required minimum distributions timely?

A: A failure to pay required minimum distributions timely refers to not distributing the minimum amount from certain retirement plans by the required deadline.

Q: What is the Voluntary Correction Program (VCP)?

A: The Voluntary Correction Program (VCP) is a way for plan sponsors to correct retirement plan errors that qualify under the Employee Plans Compliance Resolution System (EPCRS).

Q: What is the Employee Plans Compliance Resolution System (EPCRS)?

A: The Employee Plans Compliance Resolution System (EPCRS) is a program that allows eligible retirement plan sponsors to correct certain plan document and operational failures.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14568-H through the link below or browse more documents in our library of IRS Forms.