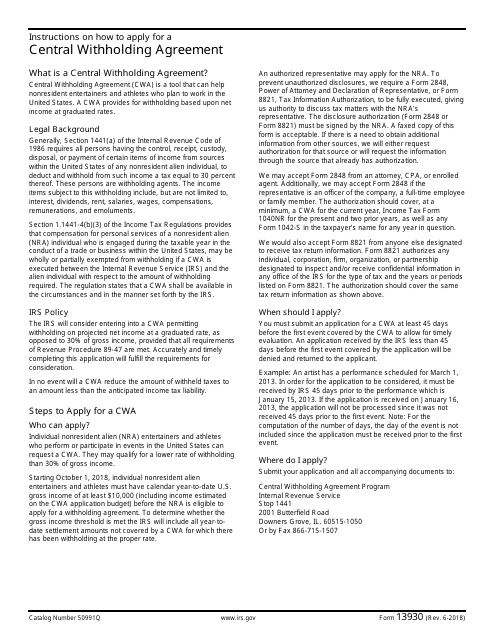

This version of the form is not currently in use and is provided for reference only. Download this version of

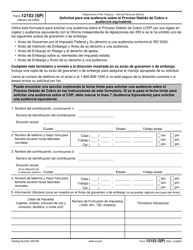

IRS Form 13930

for the current year.

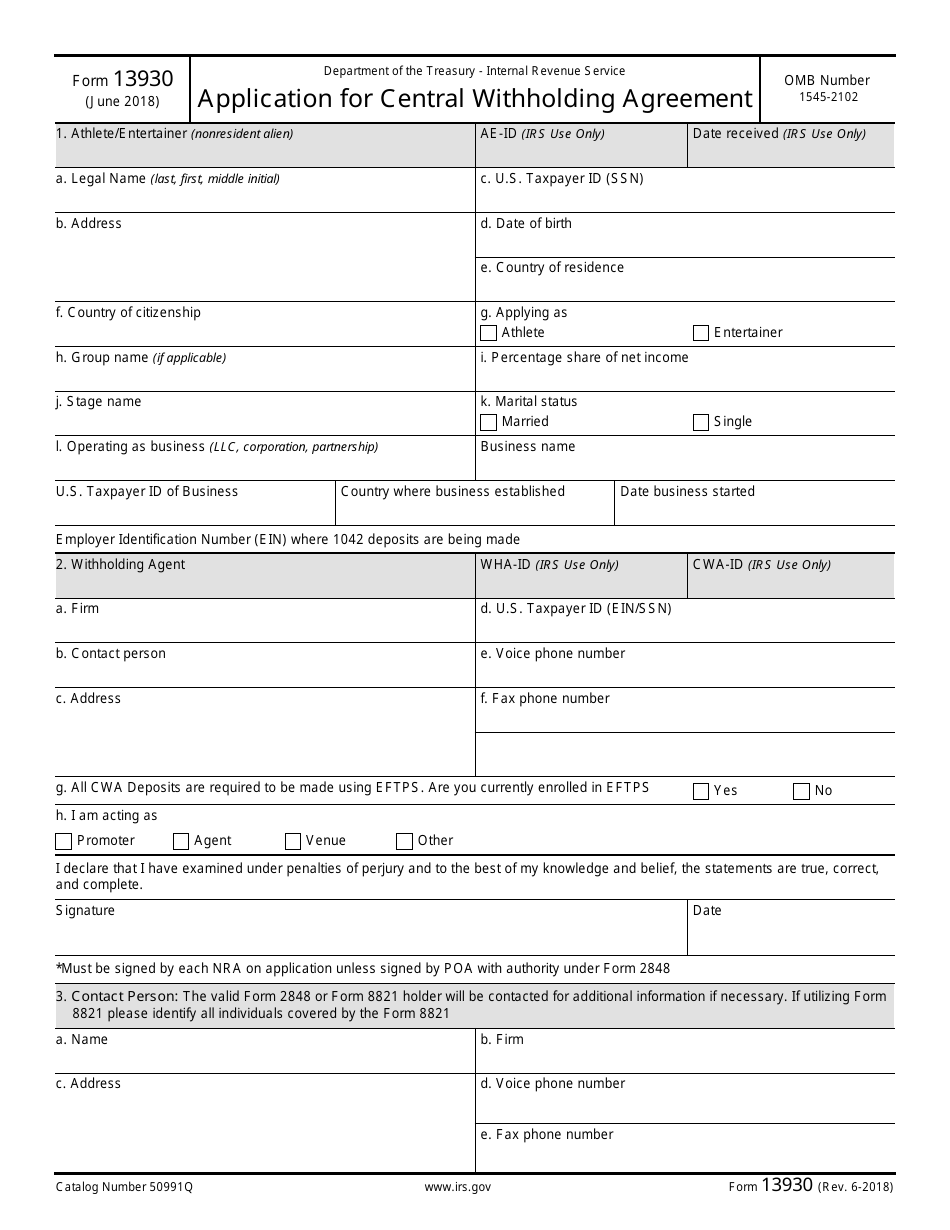

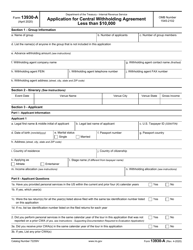

IRS Form 13930 Application for Central Withholding Agreement

What Is IRS Form 13930?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 13930?

A: IRS Form 13930 is an Application for Central Withholding Agreement.

Q: Who needs to file IRS Form 13930?

A: Entities or individuals who make income payments subject to withholding taxes and want to enter into an agreement with the IRS to have a reduced withholding rate.

Q: What is a Central Withholding Agreement?

A: A Central Withholding Agreement is an agreement between the IRS and a withholding agent to establish a reduced rate of withholding on specific types of payments.

Q: What types of payments are eligible for a Central Withholding Agreement?

A: Certain types of income payments, such as royalties, rents, and certain periodic payments, may be eligible for a Central Withholding Agreement.

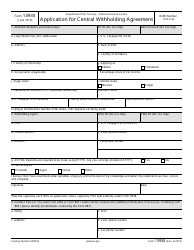

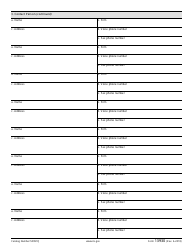

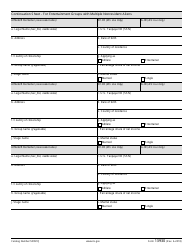

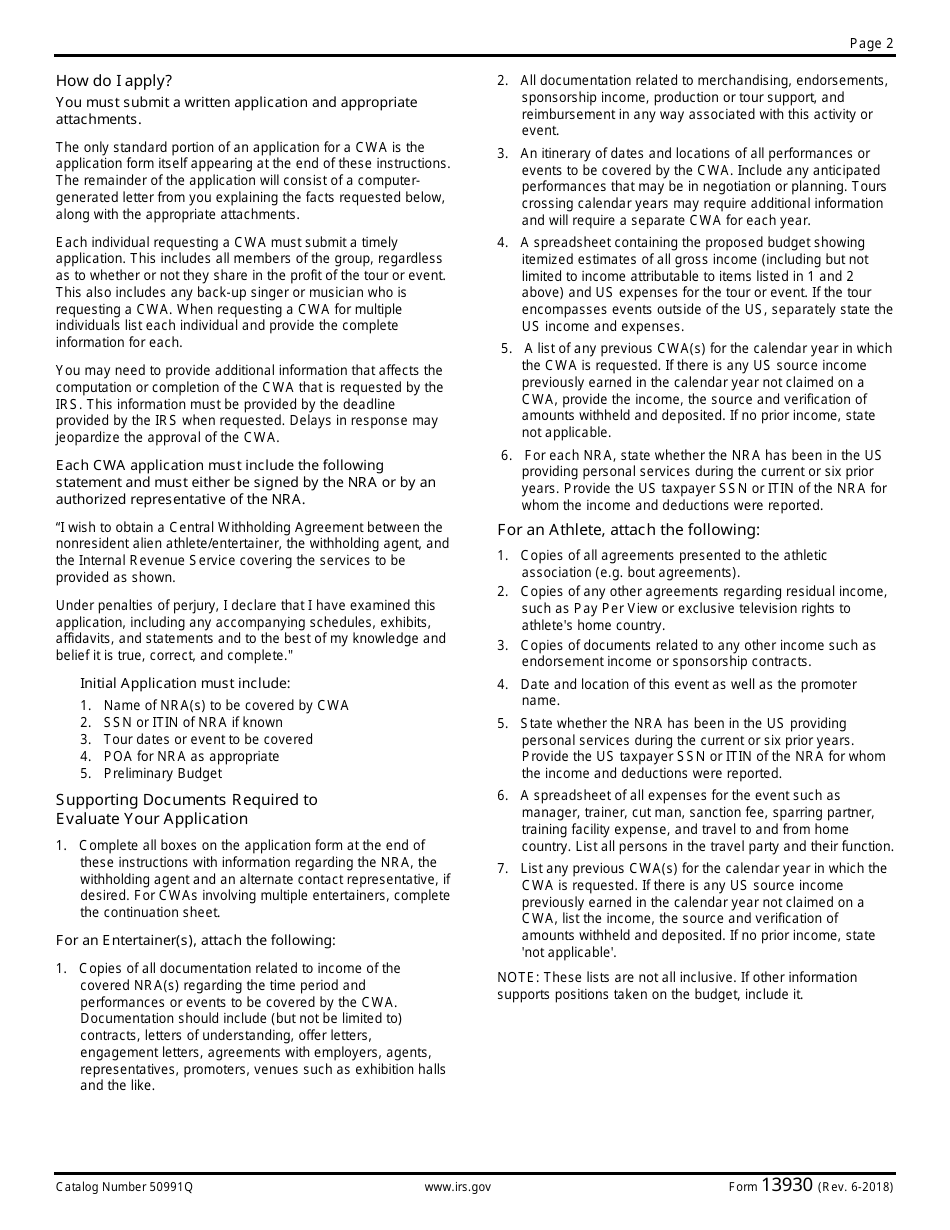

Q: How do I complete IRS Form 13930?

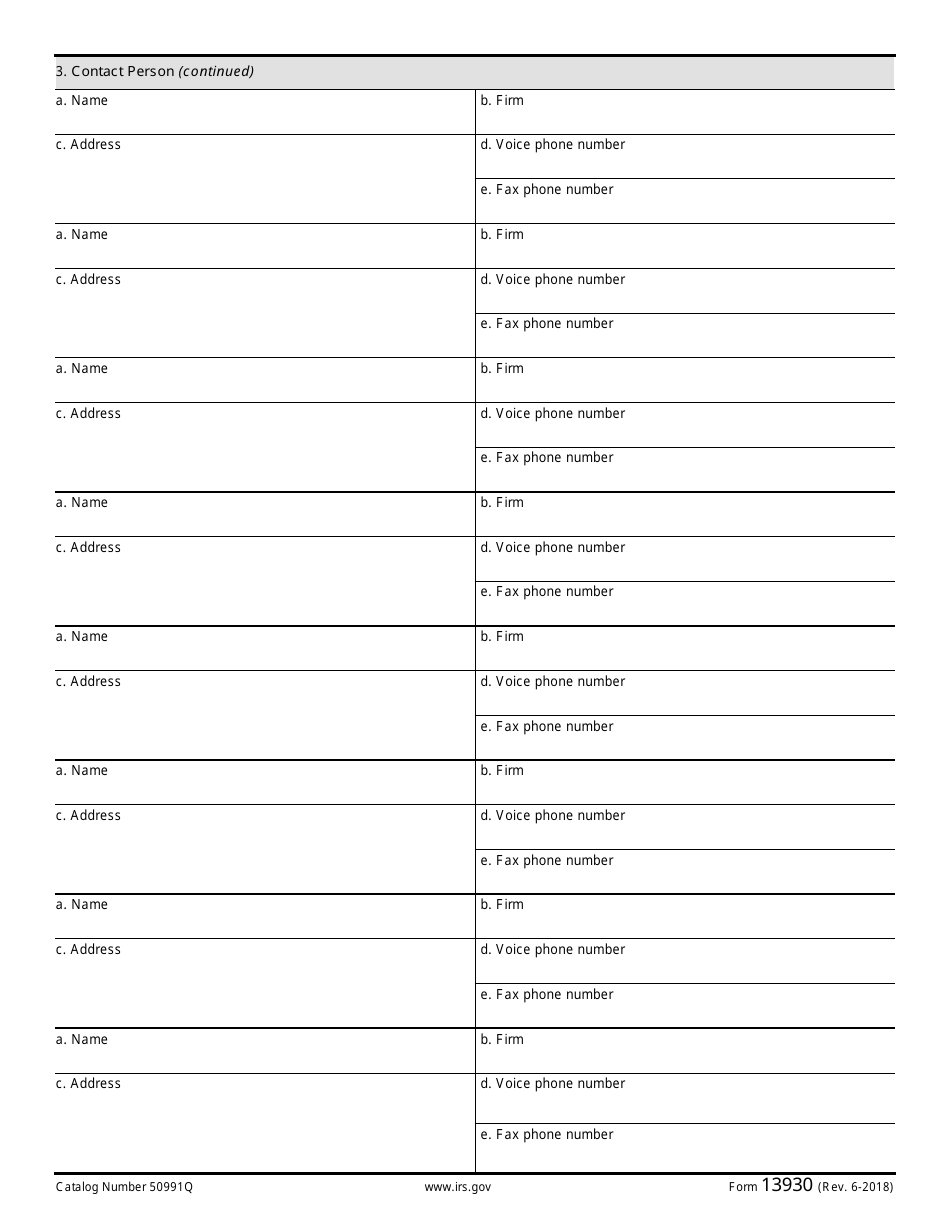

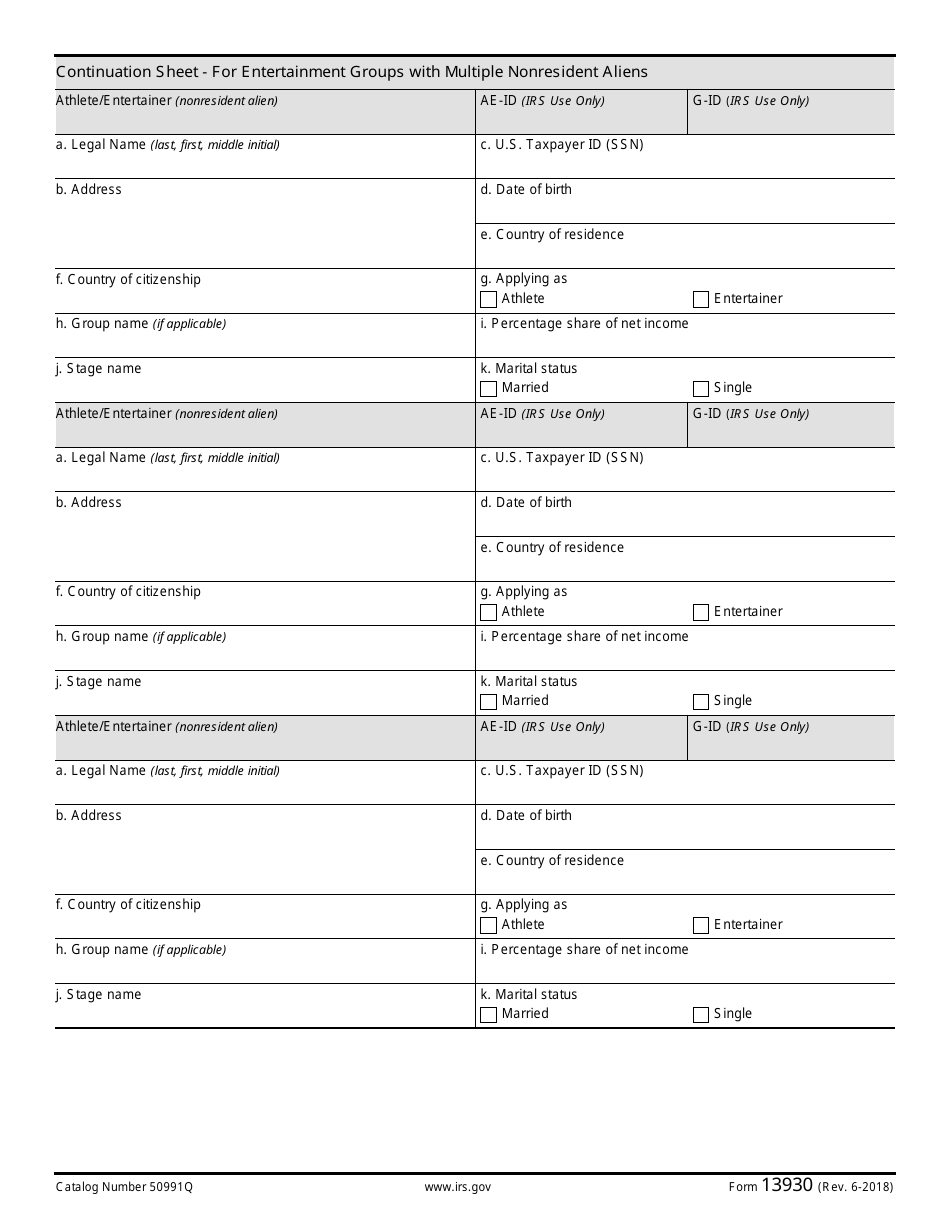

A: You will need to provide your identifying information, details of the payment(s) you are seeking a reduced withholding rate for, and other supporting documentation as required.

Q: Are there any fees associated with filing IRS Form 13930?

A: Yes, there may be a user fee associated with filing IRS Form 13930. The exact fee amount can be found in the instructions for the form.

Q: Can I electronically file IRS Form 13930?

A: As of now, electronic filing is not available for IRS Form 13930. The form must be filed by mail or fax.

Q: How long does it take to process IRS Form 13930?

A: The processing time for IRS Form 13930 varies. It is recommended to submit the form well in advance of the anticipated payment date to allow for processing time.

Q: Can I make changes or cancel a Central Withholding Agreement after it is approved?

A: Yes, you can make changes or cancel a Central Withholding Agreement by submitting a revised Form 13930 or by contacting the IRS.

Form Details:

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13930 through the link below or browse more documents in our library of IRS Forms.