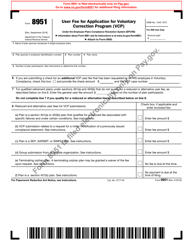

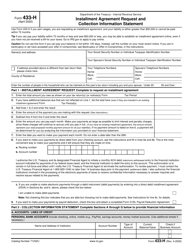

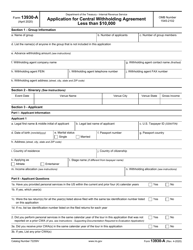

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 13844

for the current year.

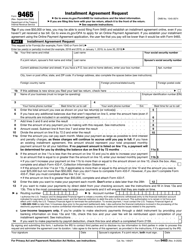

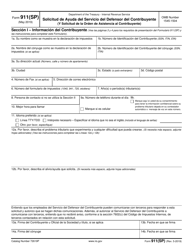

IRS Form 13844 Application for Reduced User Fee for Installment Agreements

What Is IRS Form 13844?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on July 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

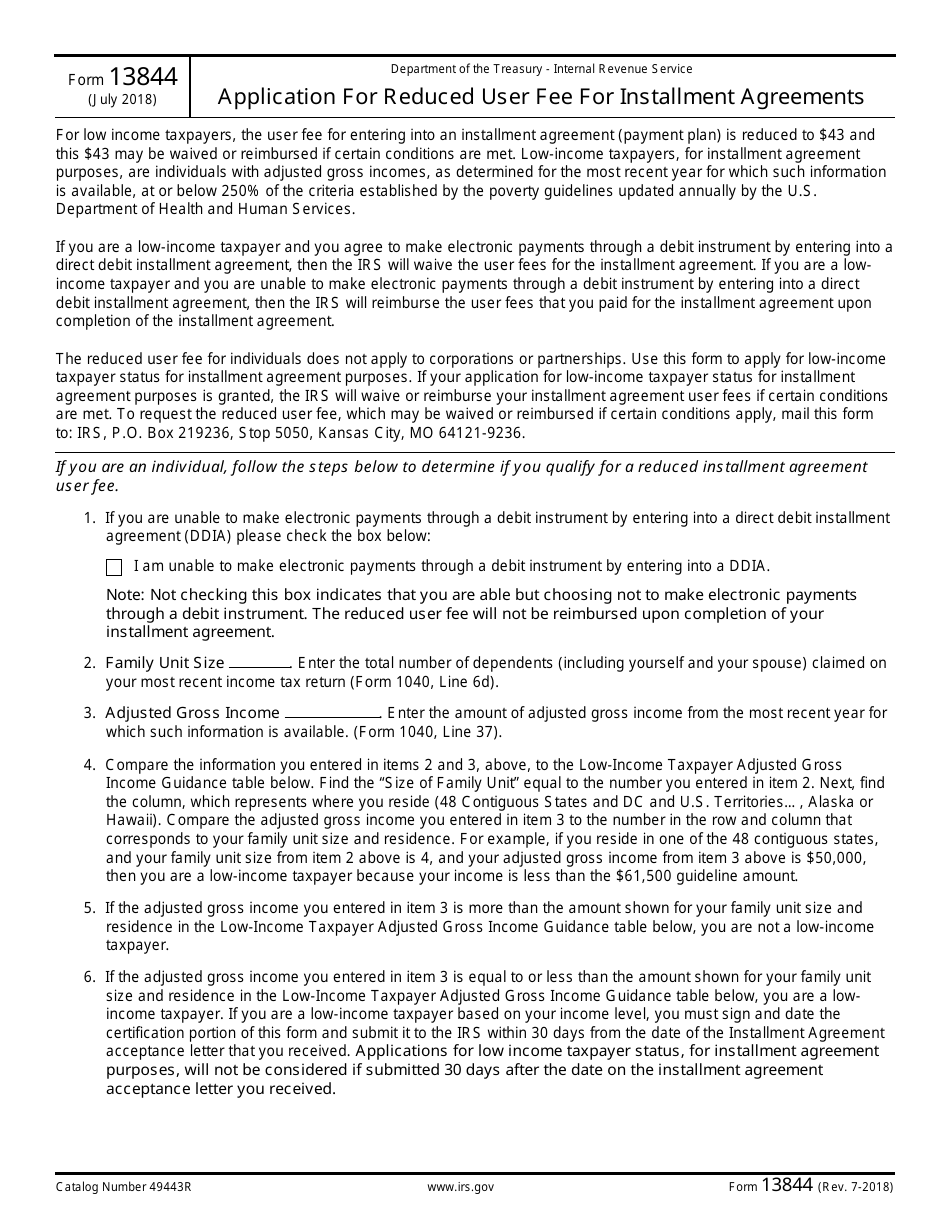

Q: What is IRS Form 13844?

A: IRS Form 13844 is the Application for Reduced User Fee for Installment Agreements.

Q: Who needs to fill out IRS Form 13844?

A: Taxpayers who are seeking a reduced fee for installment agreements with the IRS need to fill out IRS Form 13844.

Q: What is the purpose of IRS Form 13844?

A: The purpose of IRS Form 13844 is to request a reduced user fee for taxpayers applying for installment agreements.

Q: What is a reduced user fee for installment agreements?

A: A reduced user fee is a lower fee that taxpayers may be eligible for when applying for installment agreements with the IRS.

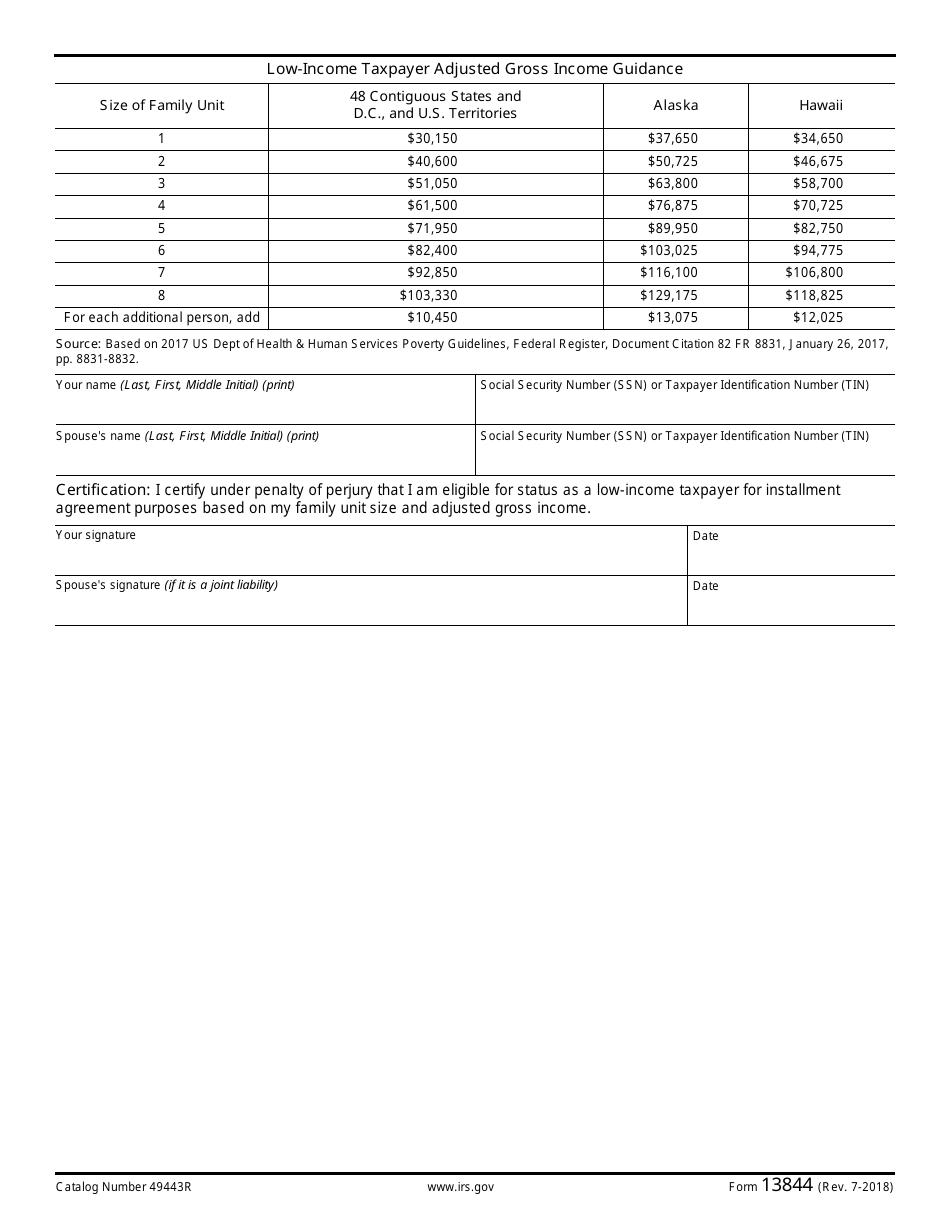

Q: Are there any eligibility requirements for the reduced user fee?

A: Yes, taxpayers must meet certain income criteria to be eligible for a reduced user fee. The details are provided on IRS Form 13844.

Q: Can the reduced user fee be waived?

A: In certain circumstances, the IRS may waive the reduced user fee. More information can be found on IRS Form 13844 or by contacting the IRS.

Q: What happens after I submit IRS Form 13844?

A: After you submit IRS Form 13844, the IRS will review your application and determine if you qualify for a reduced user fee for your installment agreement.

Q: Are there any fees associated with IRS Form 13844?

A: There is no fee to submit IRS Form 13844. However, there may be fees associated with the installment agreement itself. These fees are separate from the reduced user fee.

Form Details:

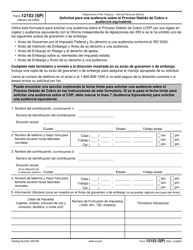

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

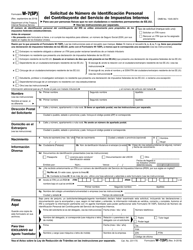

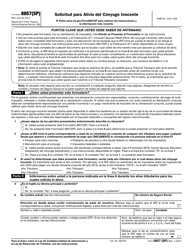

- A Spanish version of IRS Form 13844 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13844 through the link below or browse more documents in our library of IRS Forms.