This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 13441-A

for the current year.

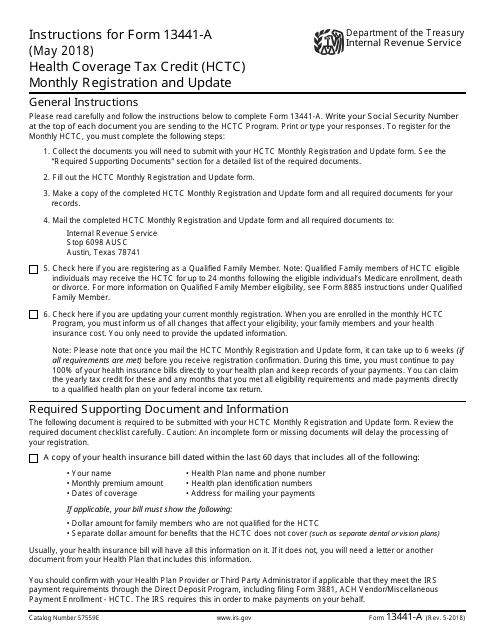

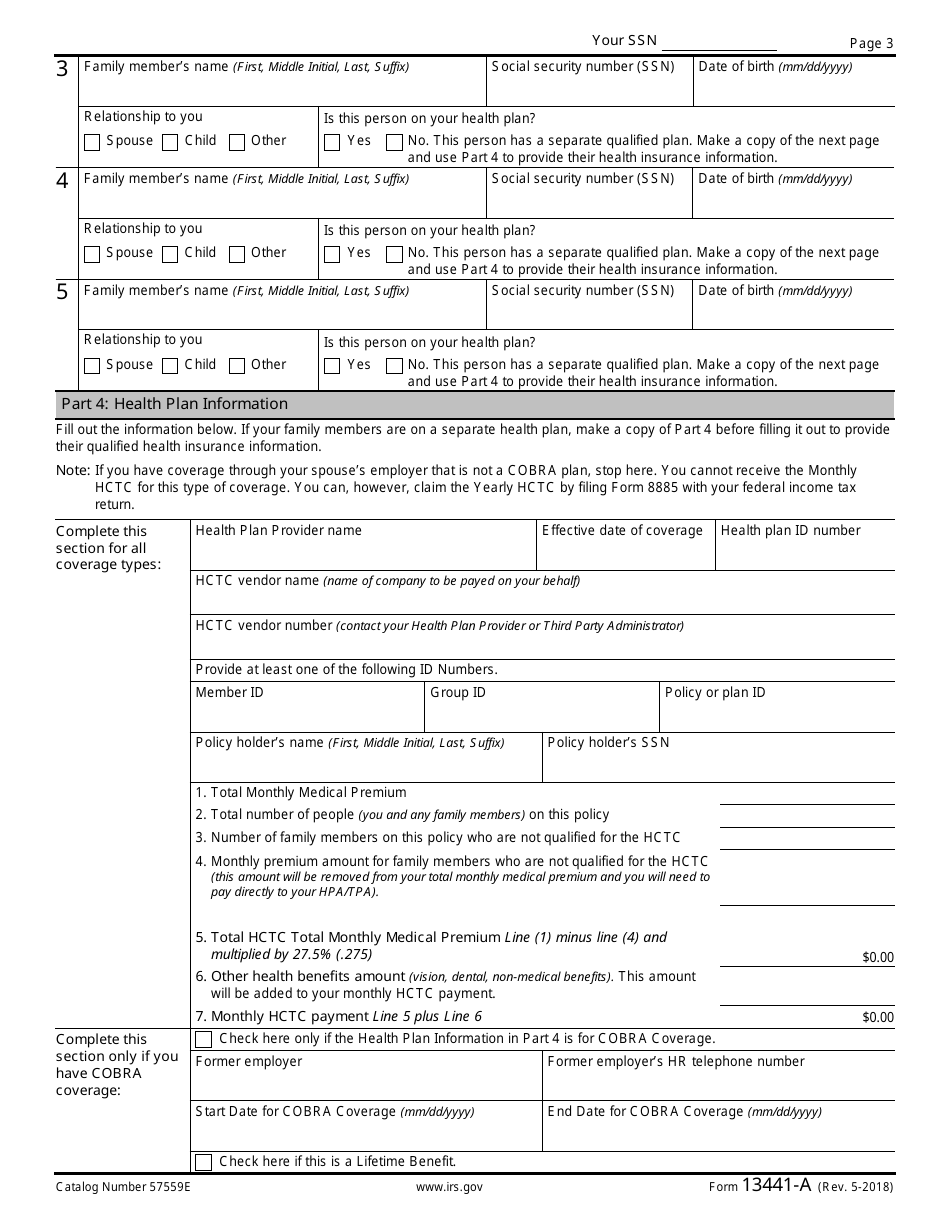

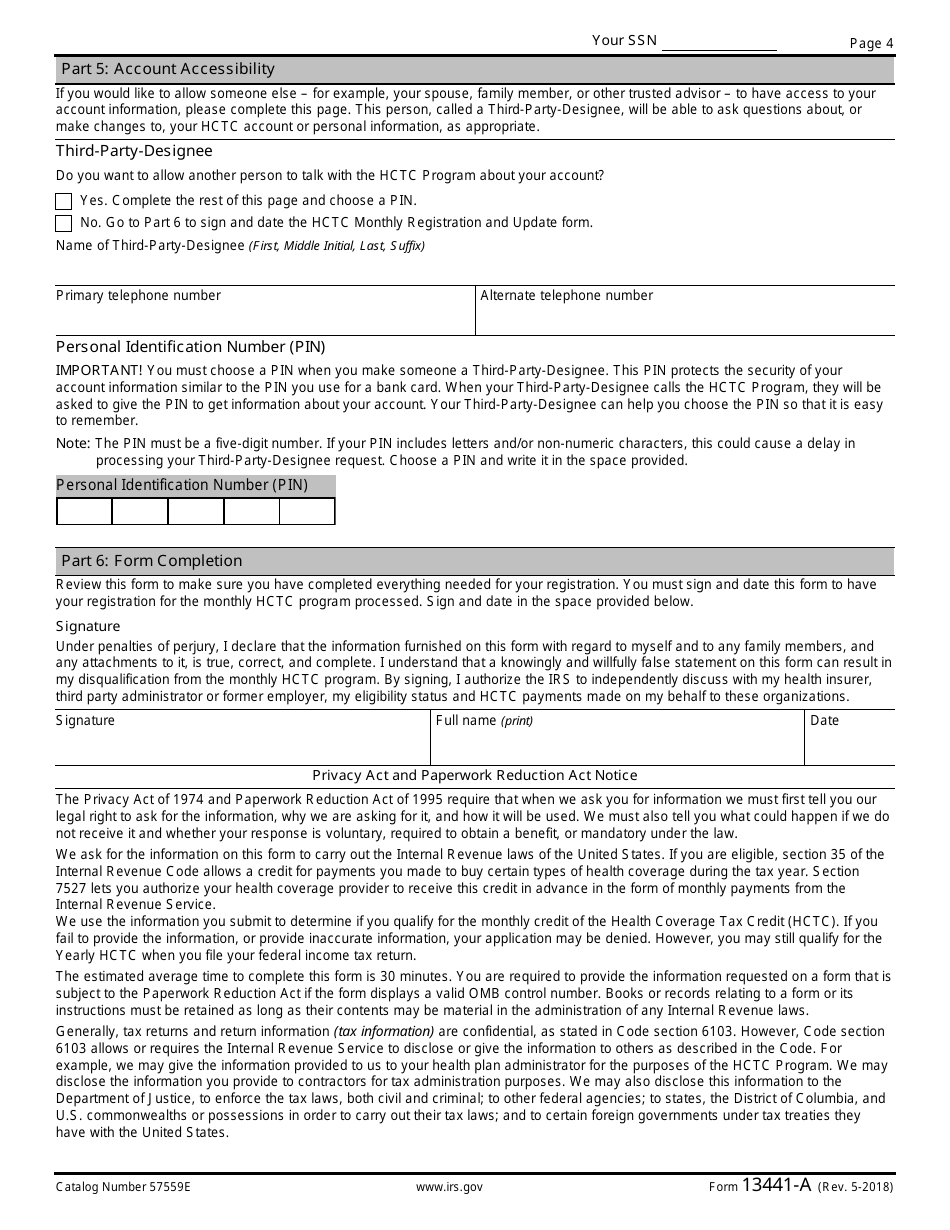

IRS Form 13441-A Health Coverage Tax Credit (Hctc) Monthly Registration and Update

What Is IRS Form 13441-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on May 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 13441-A?

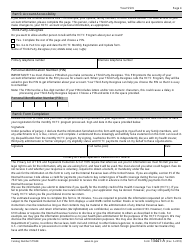

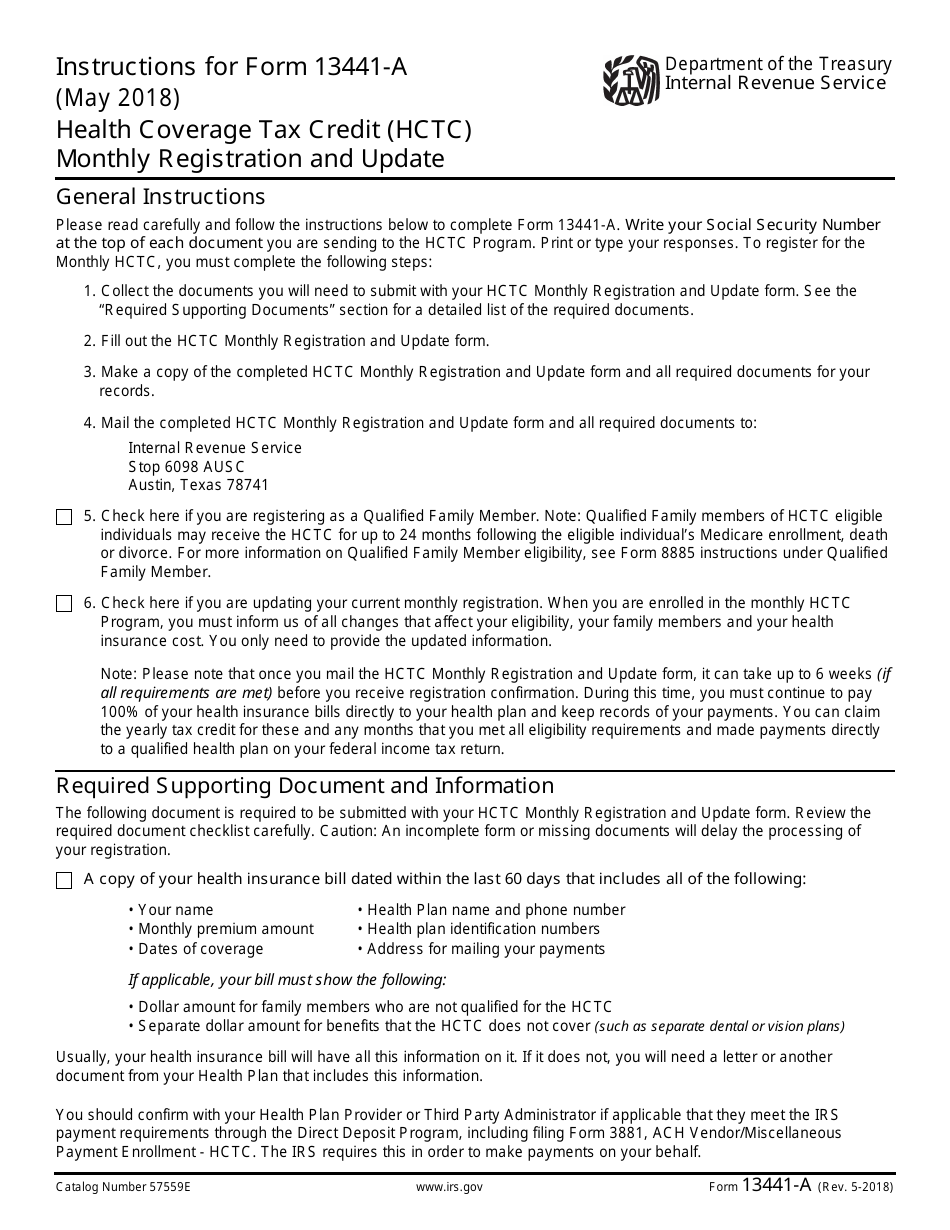

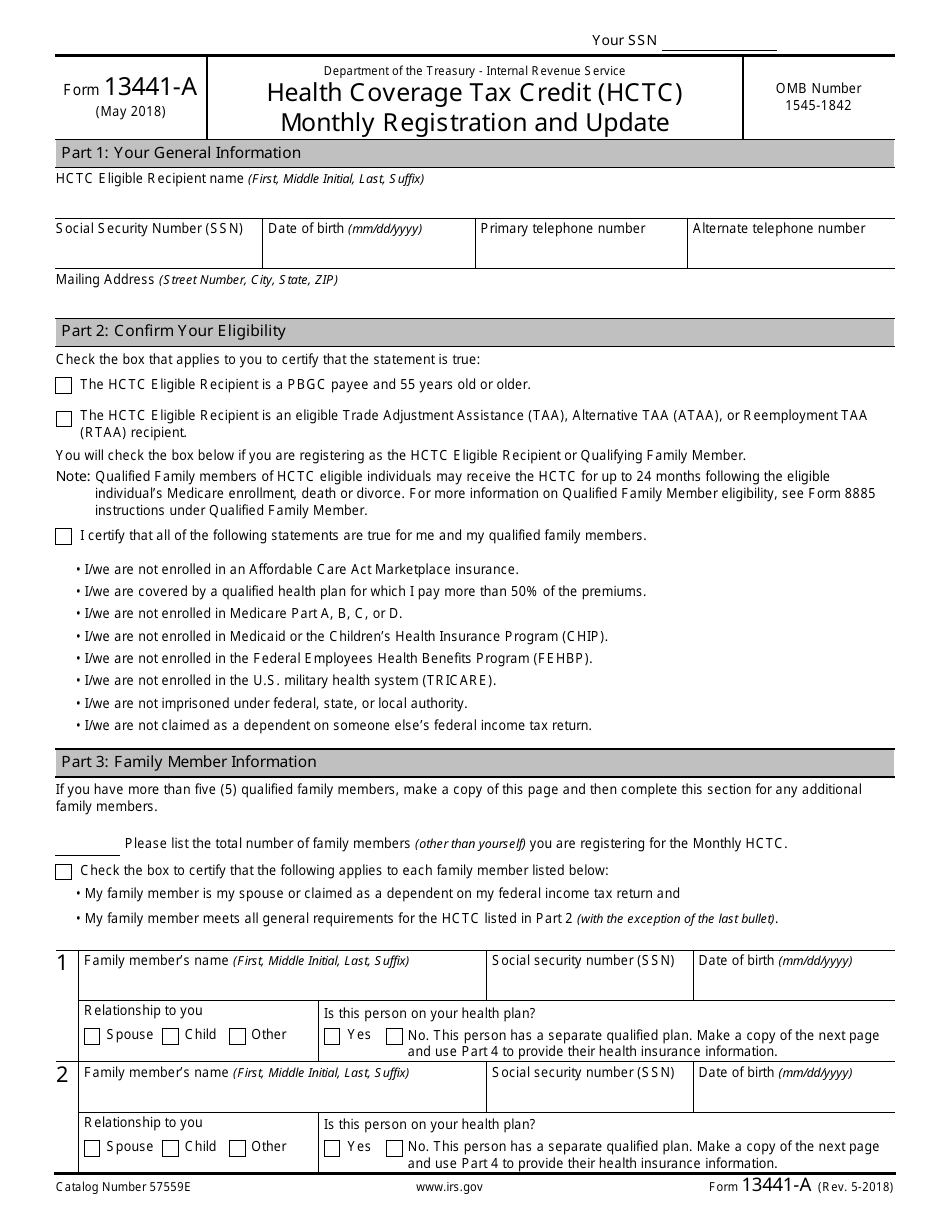

A: IRS Form 13441-A is used for Health Coverage Tax Credit (HCTC) Monthly Registration and Update.

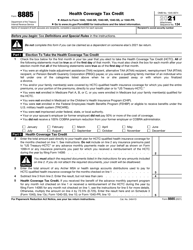

Q: What is the Health Coverage Tax Credit (HCTC)?

A: The Health Coverage Tax Credit (HCTC) is a tax credit that helps eligible individuals and their families maintain health insurance coverage.

Q: Who is eligible for the Health Coverage Tax Credit (HCTC)?

A: To be eligible for the Health Coverage Tax Credit (HCTC), an individual must meet certain criteria, such as being a recipient of Trade Adjustment Assistance or receiving pension payments from the Pension Benefit Guaranty Corporation.

Q: What is the purpose of the IRS Form 13441-A?

A: The purpose of IRS Form 13441-A is to register for the Health Coverage Tax Credit (HCTC) and provide updates on eligibility and enrollment.

Q: How often should I update my information on IRS Form 13441-A?

A: You should update your information on IRS Form 13441-A whenever there are changes to your eligibility or enrollment status.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13441-A through the link below or browse more documents in our library of IRS Forms.