This version of the form is not currently in use and is provided for reference only. Download this version of

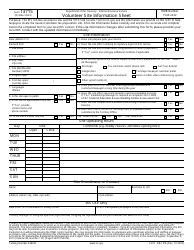

IRS Form 13615

for the current year.

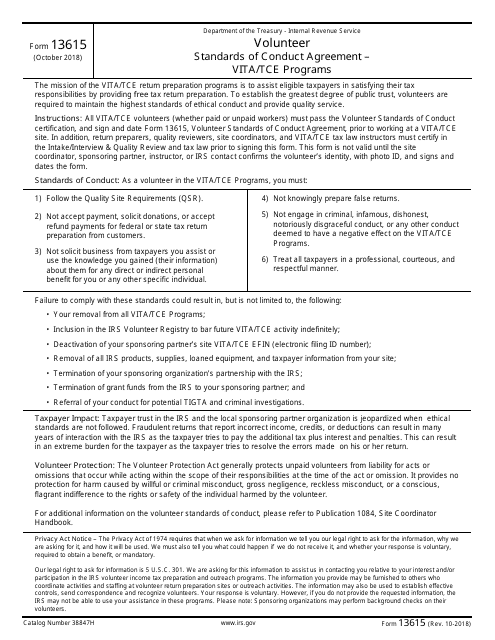

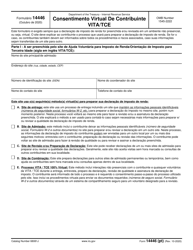

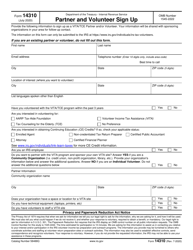

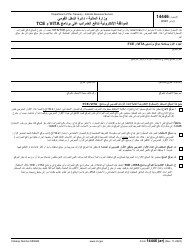

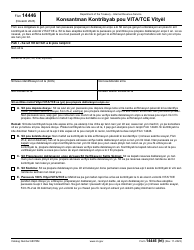

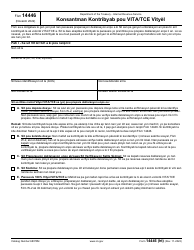

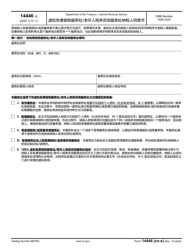

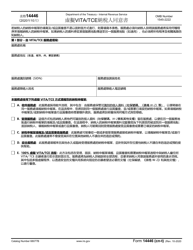

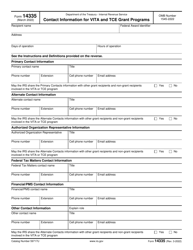

IRS Form 13615 Volunteer Standards of Conduct Agreement - Vita / Tce Programs

What Is IRS Form 13615?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 13615?

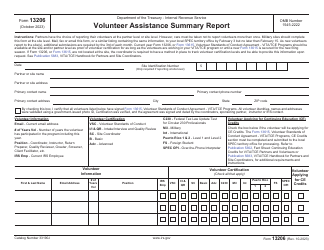

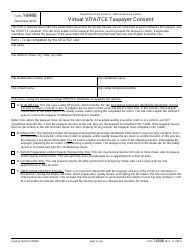

A: IRS Form 13615 is the Volunteer Standards of Conduct Agreement for the VITA/TCE programs.

Q: What is the purpose of IRS Form 13615?

A: The purpose of IRS Form 13615 is to outline the standards of conduct for volunteers participating in the VITA/TCE programs.

Q: Who needs to fill out IRS Form 13615?

A: Volunteers participating in the VITA/TCE programs need to fill out IRS Form 13615.

Q: What are the VITA/TCE programs?

A: The VITA/TCE programs are IRS-sponsored programs that offer free tax assistance to eligible taxpayers.

Q: What happens if I don't fill out IRS Form 13615?

A: If you don't fill out IRS Form 13615, you may not be able to participate as a volunteer in the VITA/TCE programs.

Q: Are there any specific requirements for volunteers in the VITA/TCE programs?

A: Yes, there are specific requirements for volunteers in the VITA/TCE programs, which are outlined in IRS Form 13615.

Q: Can I make changes to IRS Form 13615 after submitting it?

A: Once you submit IRS Form 13615, you typically cannot make changes, so it's important to review the form carefully before submitting it.

Q: Do volunteers in the VITA/TCE programs receive any training?

A: Yes, volunteers in the VITA/TCE programs receive training to ensure they are knowledgeable and capable of providing accurate tax assistance.

Q: Is participation in the VITA/TCE programs voluntary?

A: Yes, participation in the VITA/TCE programs is voluntary for both volunteers and taxpayers seeking assistance.

Form Details:

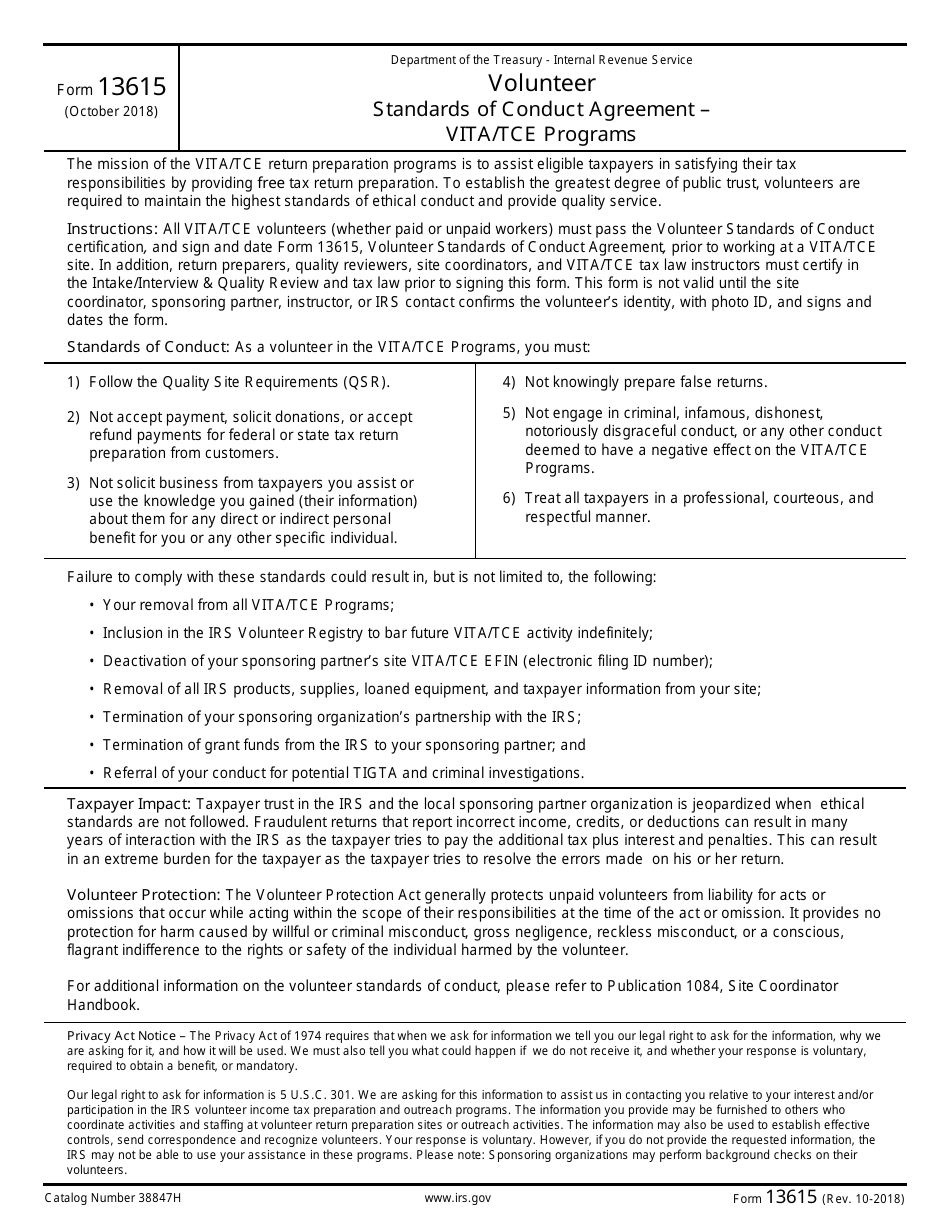

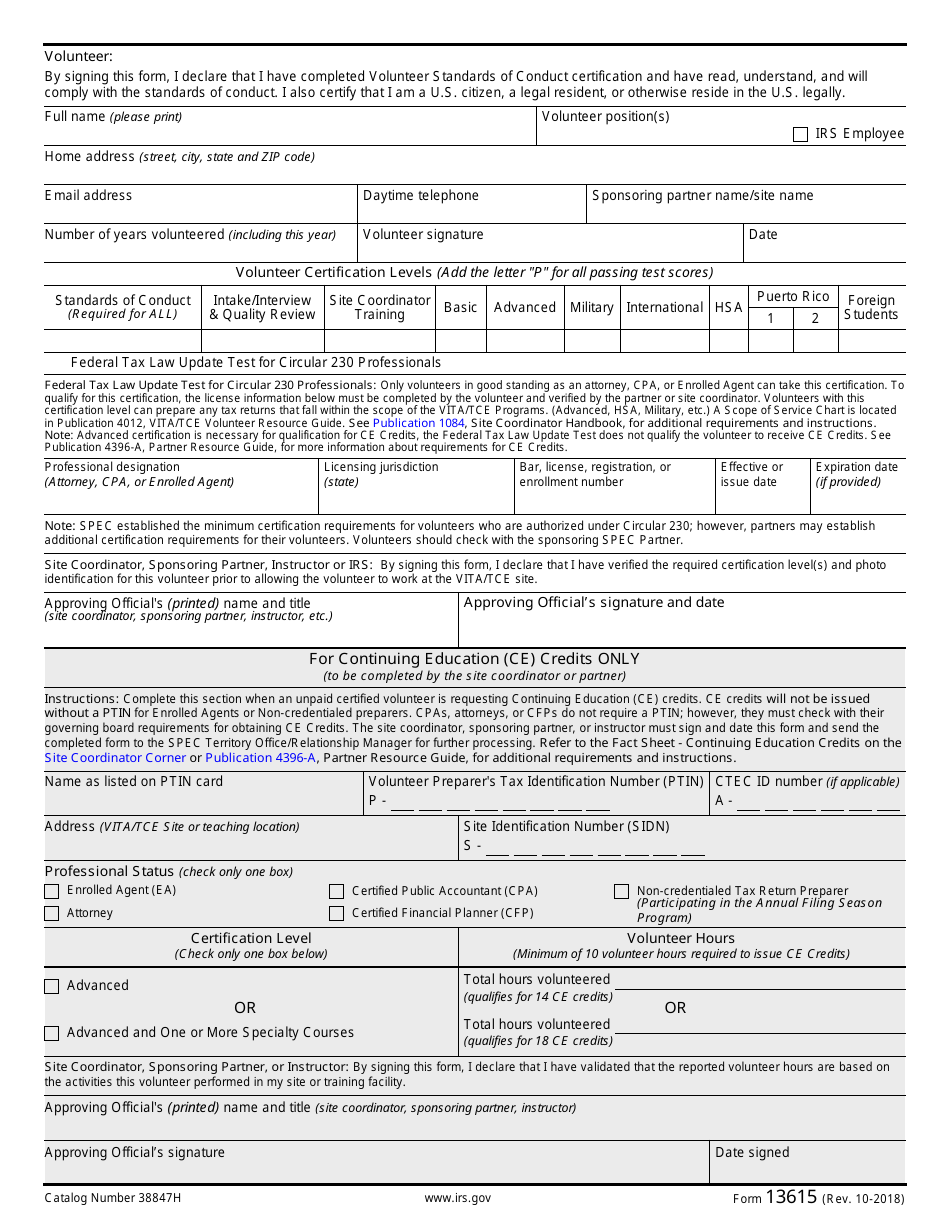

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13615 through the link below or browse more documents in our library of IRS Forms.