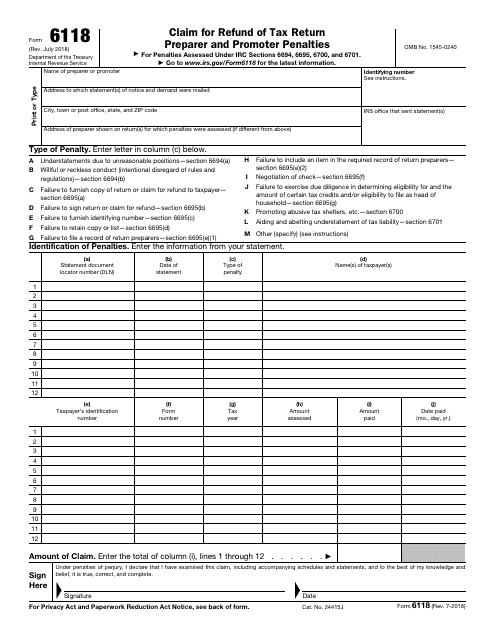

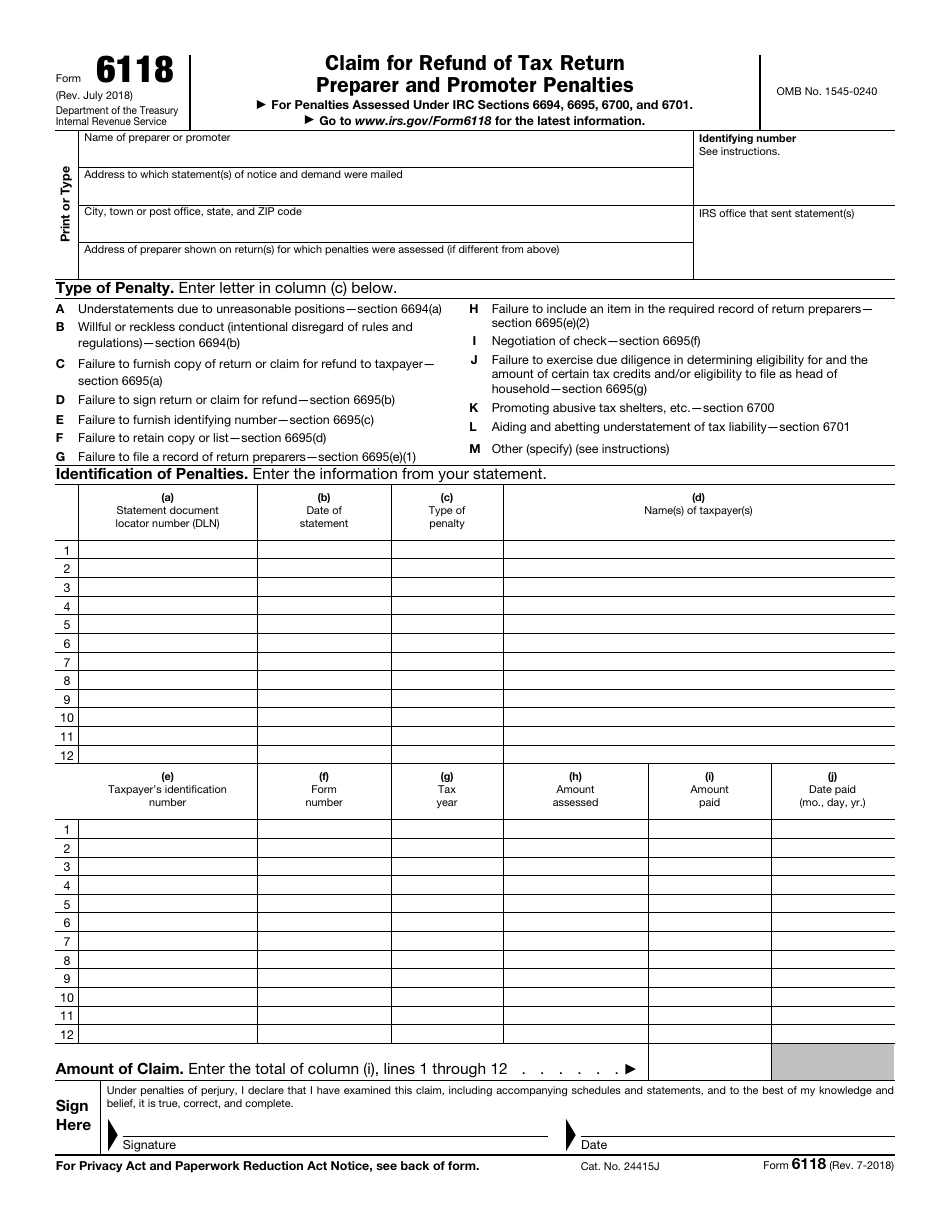

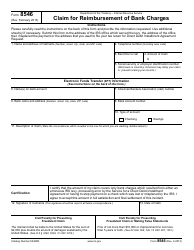

IRS Form 6118 Claim for Refund of Tax Return Preparer and Promoter Penalties

What Is IRS Form 6118?

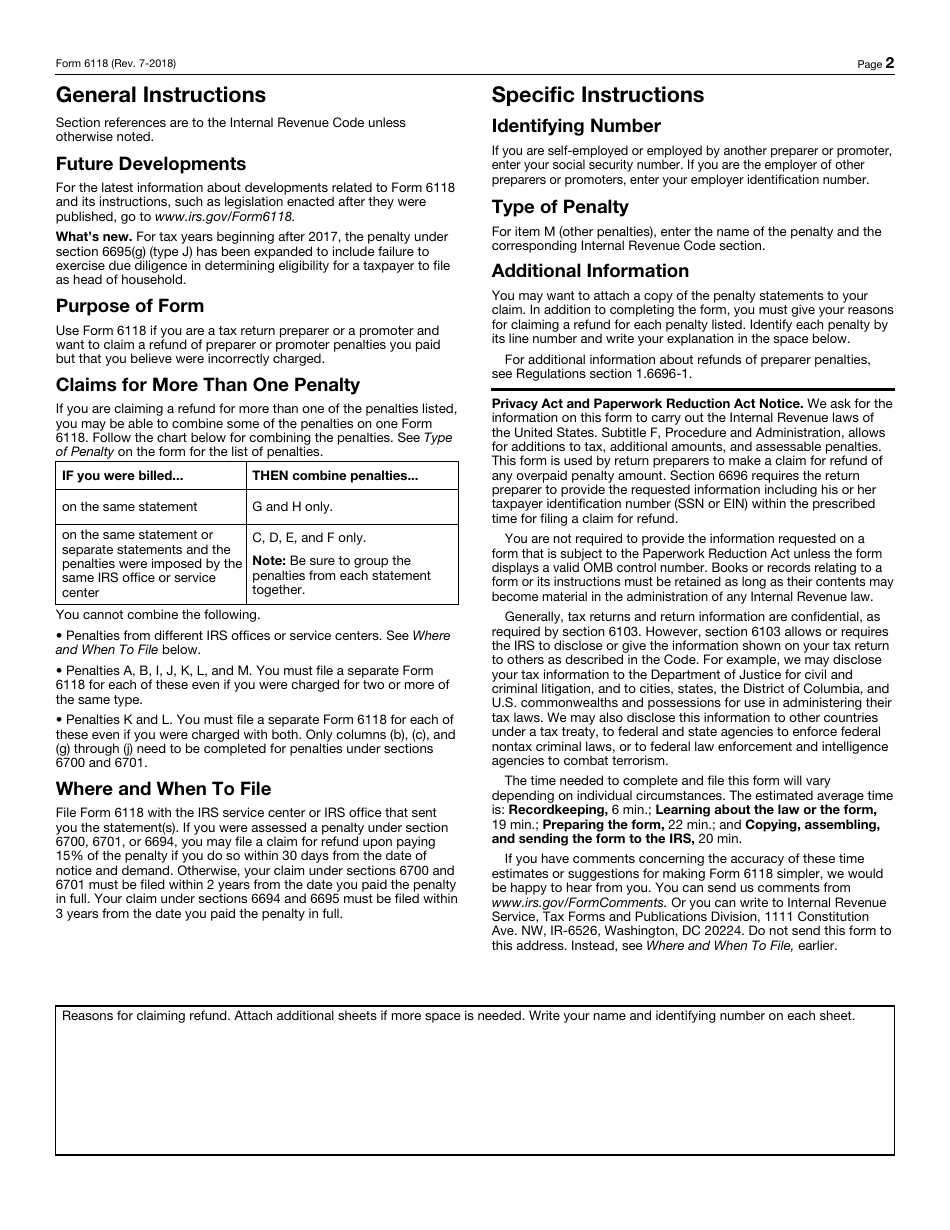

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on July 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 6118?

A: Form 6118 is the IRS form used to claim a refund of tax return preparer and promoter penalties.

Q: What can I use Form 6118 for?

A: You can use Form 6118 to claim a refund of penalties you paid as a tax return preparer or promoter.

Q: Who can use Form 6118?

A: Tax return preparers and promoters who have paid penalties can use Form 6118.

Q: When should I file Form 6118?

A: You should file Form 6118 within the applicable time period specified by the IRS.

Q: What documentation do I need to include with Form 6118?

A: You may need to include supporting documentation, such as copies of penalty assessment notices, with Form 6118.

Q: Can I e-file Form 6118?

A: No, you cannot e-file Form 6118. It must be filed by mail.

Q: Is there a fee to file Form 6118?

A: No, there is no fee to file Form 6118.

Q: What happens after I file Form 6118?

A: The IRS will review your claim and notify you of their decision regarding your refund request.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 6118 through the link below or browse more documents in our library of IRS Forms.