This version of the form is not currently in use and is provided for reference only. Download this version of

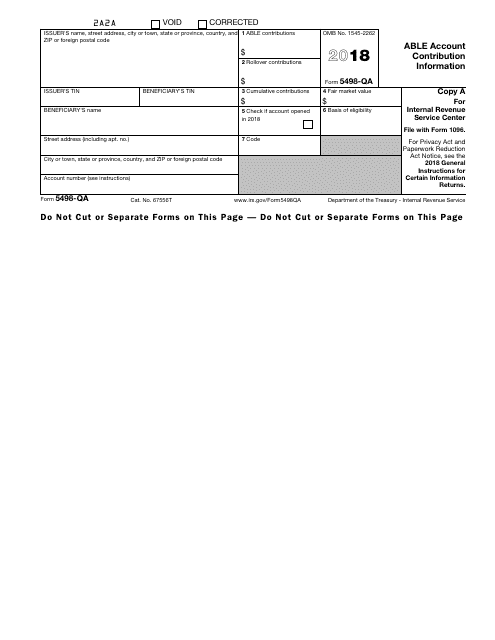

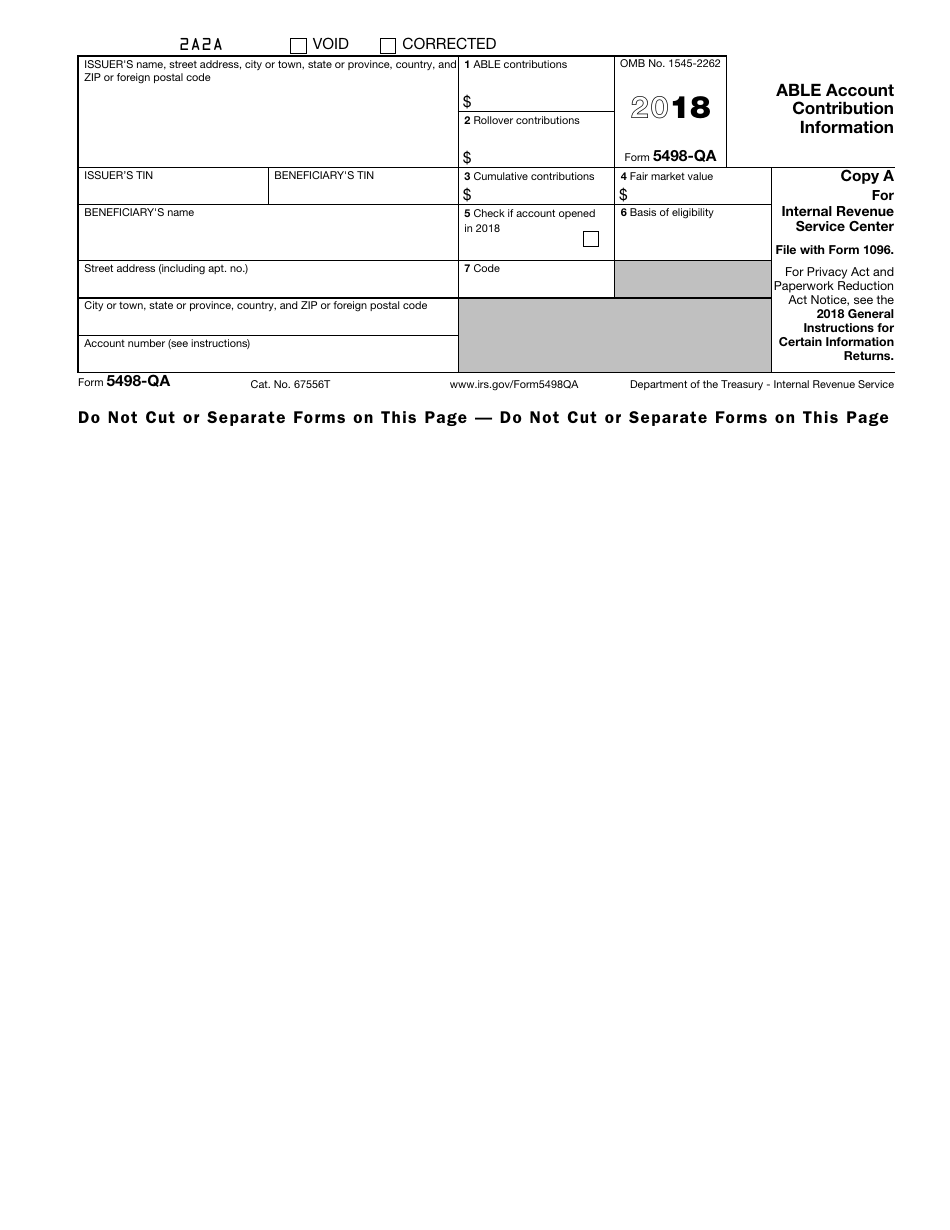

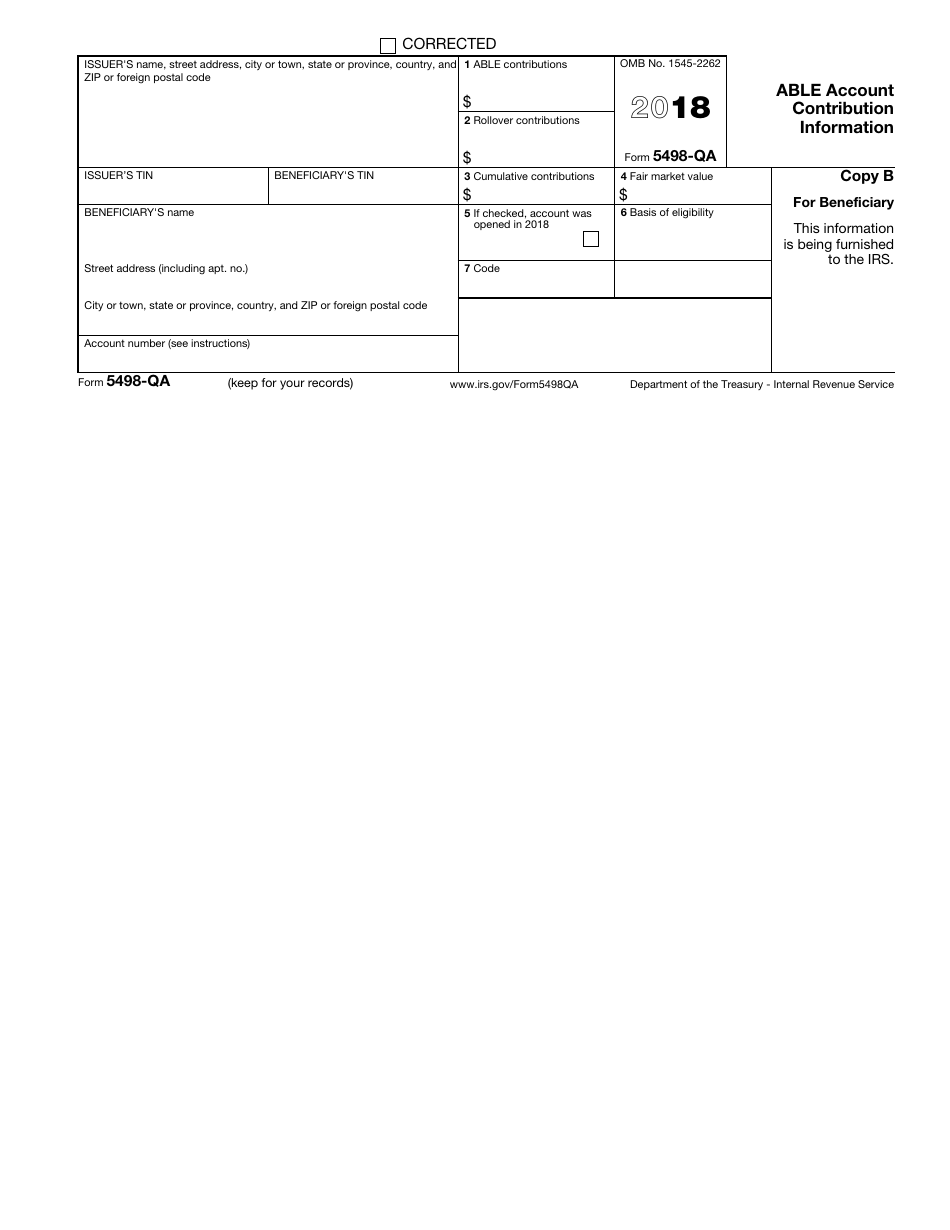

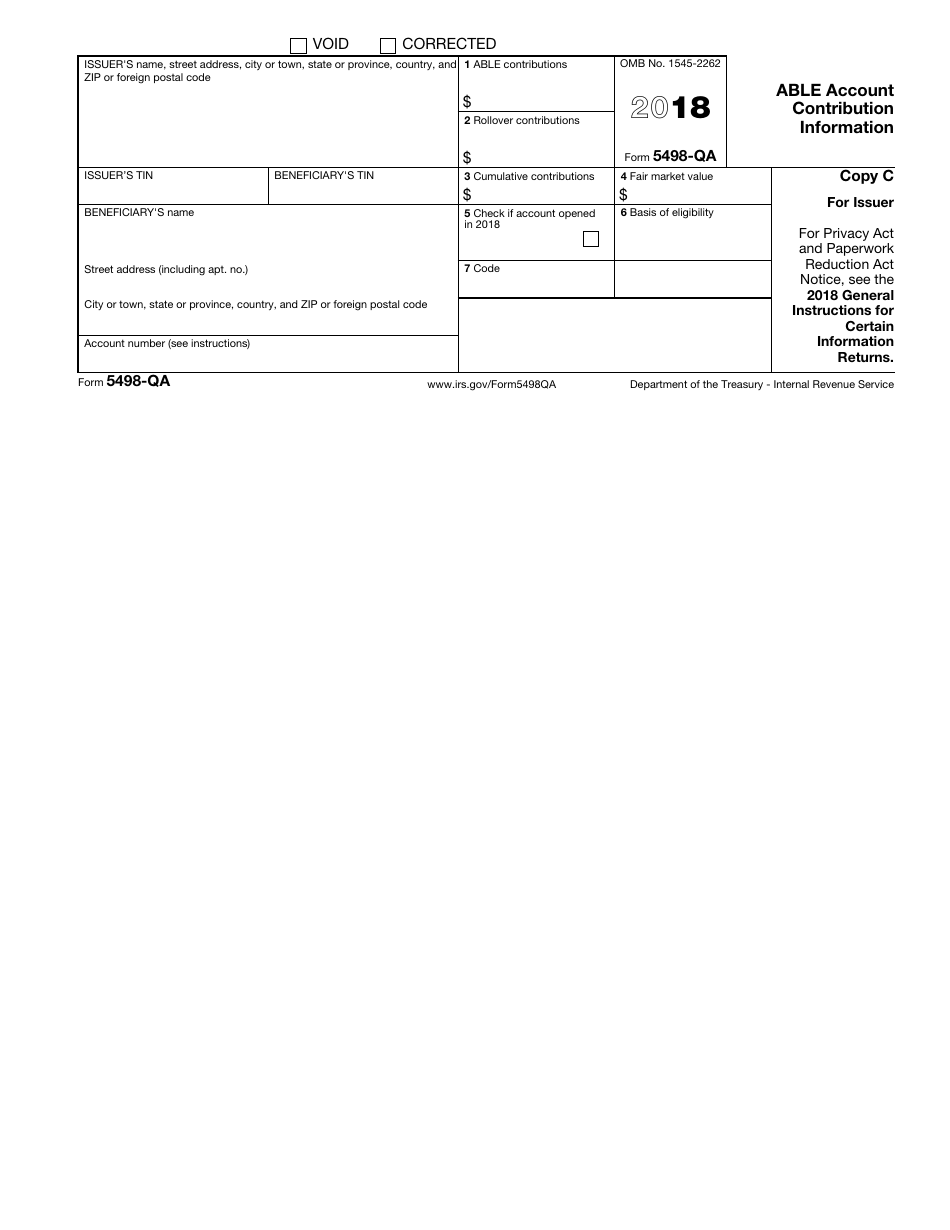

IRS Form 5498-QA

for the current year.

IRS Form 5498-QA Able Account Contribution Information

What Is IRS Form 5498-QA?

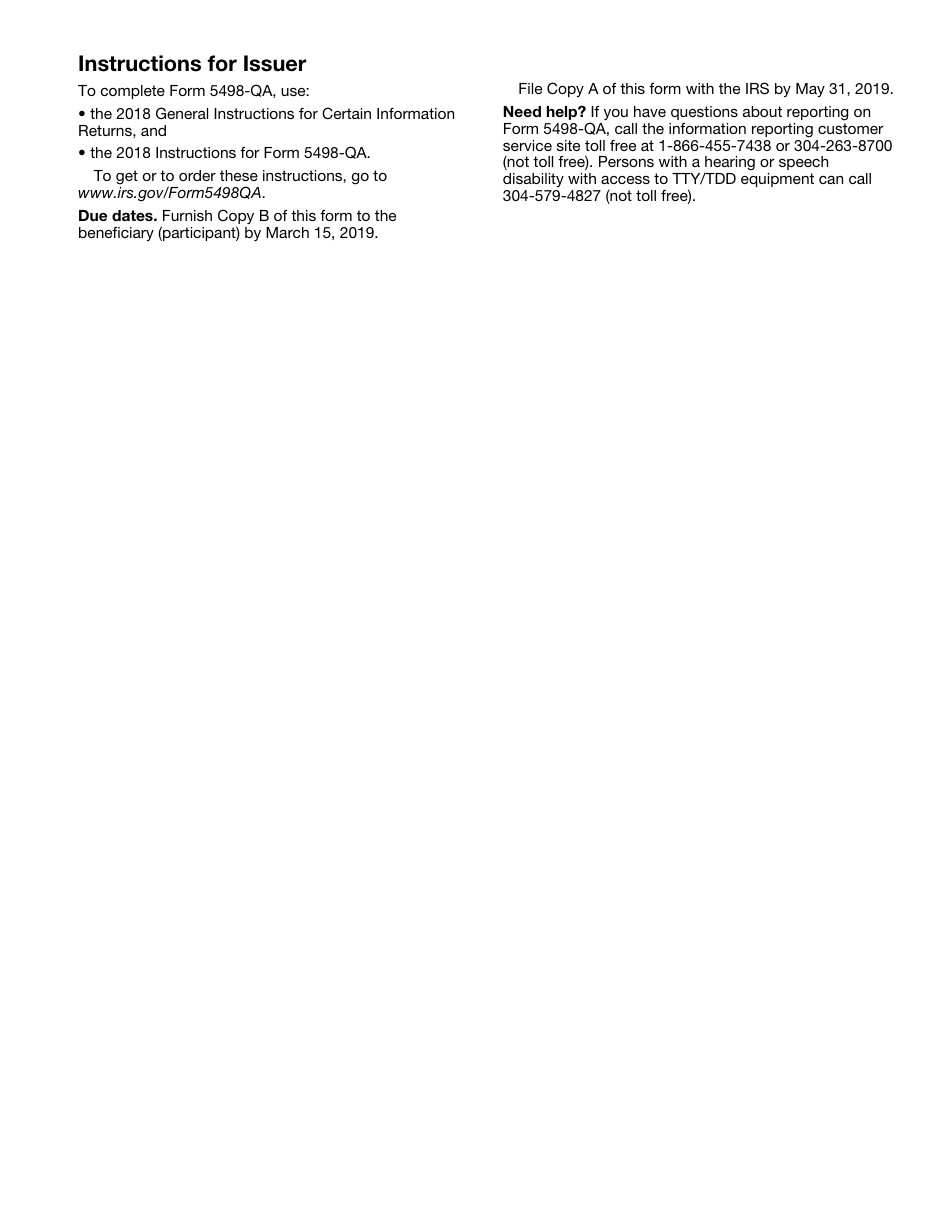

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 5498-QA?

A: IRS Form 5498-QA is a tax form used to report contributions made to an Able account.

Q: What is an Able account?

A: An Able account, also known as an Achieving a Better Life Experience account, is a tax-advantaged savings account for individuals with disabilities.

Q: Who fills out IRS Form 5498-QA?

A: Financial institutions that serve as trustees or custodians of Able accounts are responsible for filling out and submitting IRS Form 5498-QA.

Q: What information is reported on IRS Form 5498-QA?

A: IRS Form 5498-QA reports the contributions made to an Able account during the tax year.

Q: Do I need to include IRS Form 5498-QA with my tax return?

A: No, you do not need to include IRS Form 5498-QA with your tax return. It is for informational purposes only.

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5498-QA through the link below or browse more documents in our library of IRS Forms.