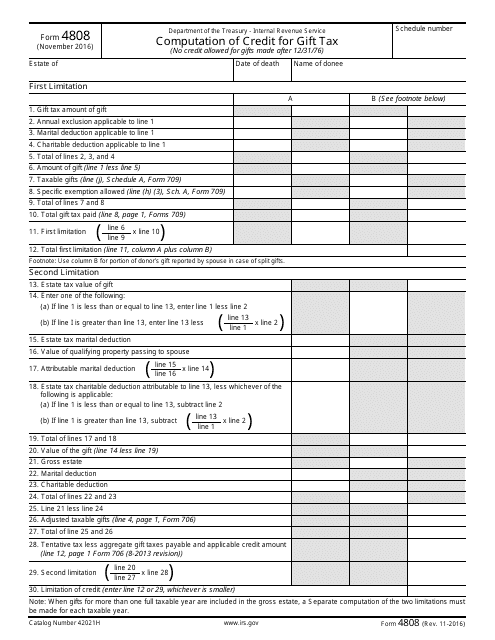

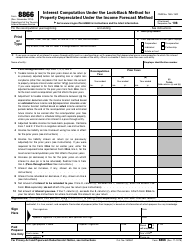

IRS Form 4808 Computation of Credit for Gift Tax

What Is IRS Form 4808?

IRS Form 4808, Computation of Credit for Gift Tax , is a supplementary form designed by the tax authorities to help a taxpayer figure out the credit they are allowed to claim while executing the estate of a deceased individual. In order to fill outIRS Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, correctly, it is necessary to fill out this tool first so that you know the total credit applicable in your situation.

This worksheet was released by the Internal Revenue Service (IRS) on November 1, 2016 , making older editions of the form obsolete. You can download an IRS Form 4808 fillable version through the link below.

Specify whose estate you are describing and when the person in question passed, indicate the name of the gift recipient, and record the limitations that refer to the amount of credit. You have to state the tax amount of the gift, mention possible deductions and exemptions, and use formulas provided in the form to enter the credit you are entitled to claim upon receiving the gift from the person that recently died as long as the gift itself is taxable. Remember to enclose Form 4808 with the tax return you made all the calculations for or attach a separate sheet that demonstrates how you calculated the credit - you are obliged to file the documentation within nine months after you have learned the individual has died unless you submit a request for an extension.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4808 through the link below or browse more documents in our library of IRS Forms.