This version of the form is not currently in use and is provided for reference only. Download this version of

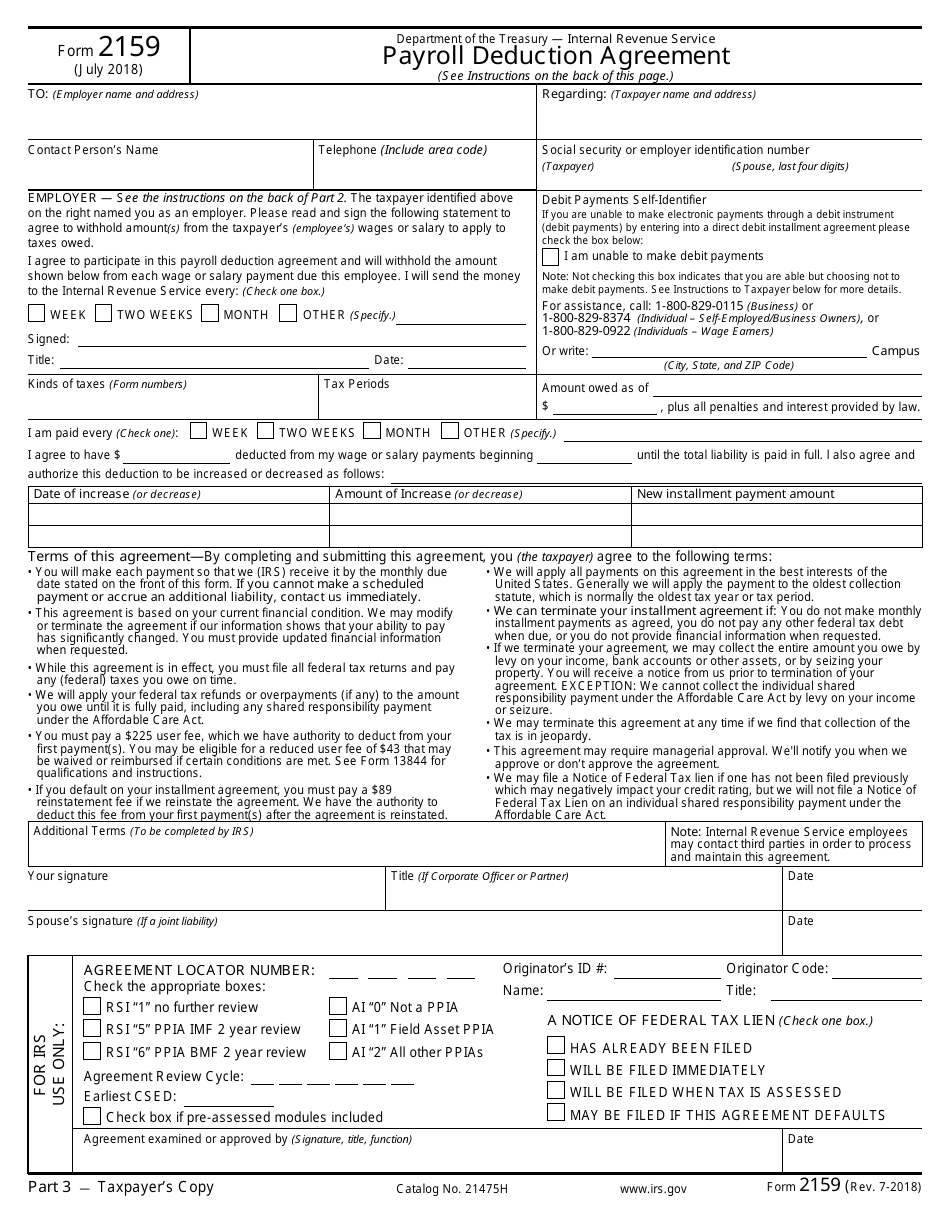

IRS Form 2159

for the current year.

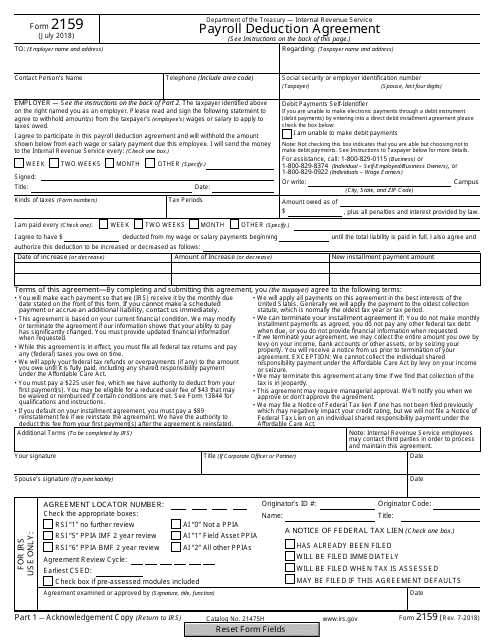

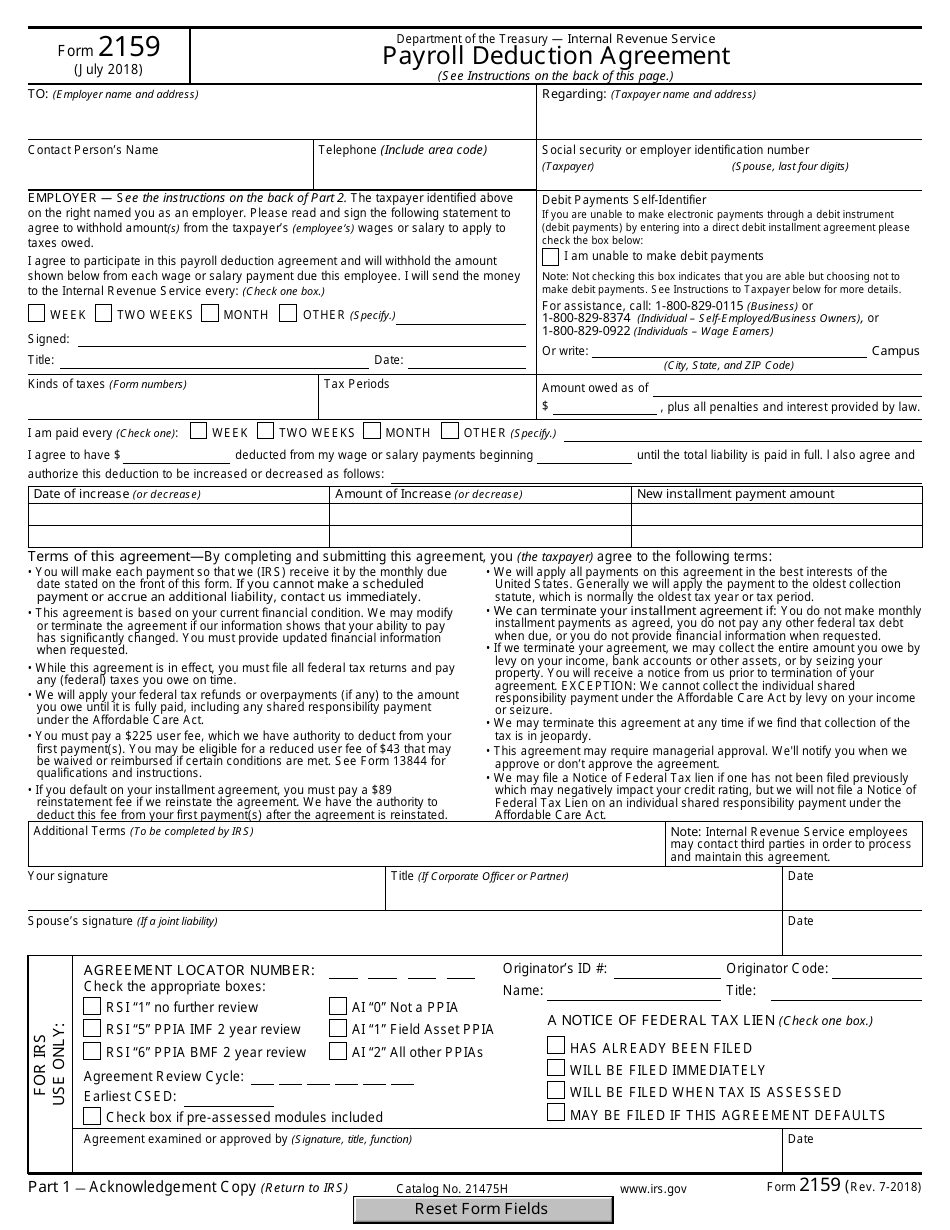

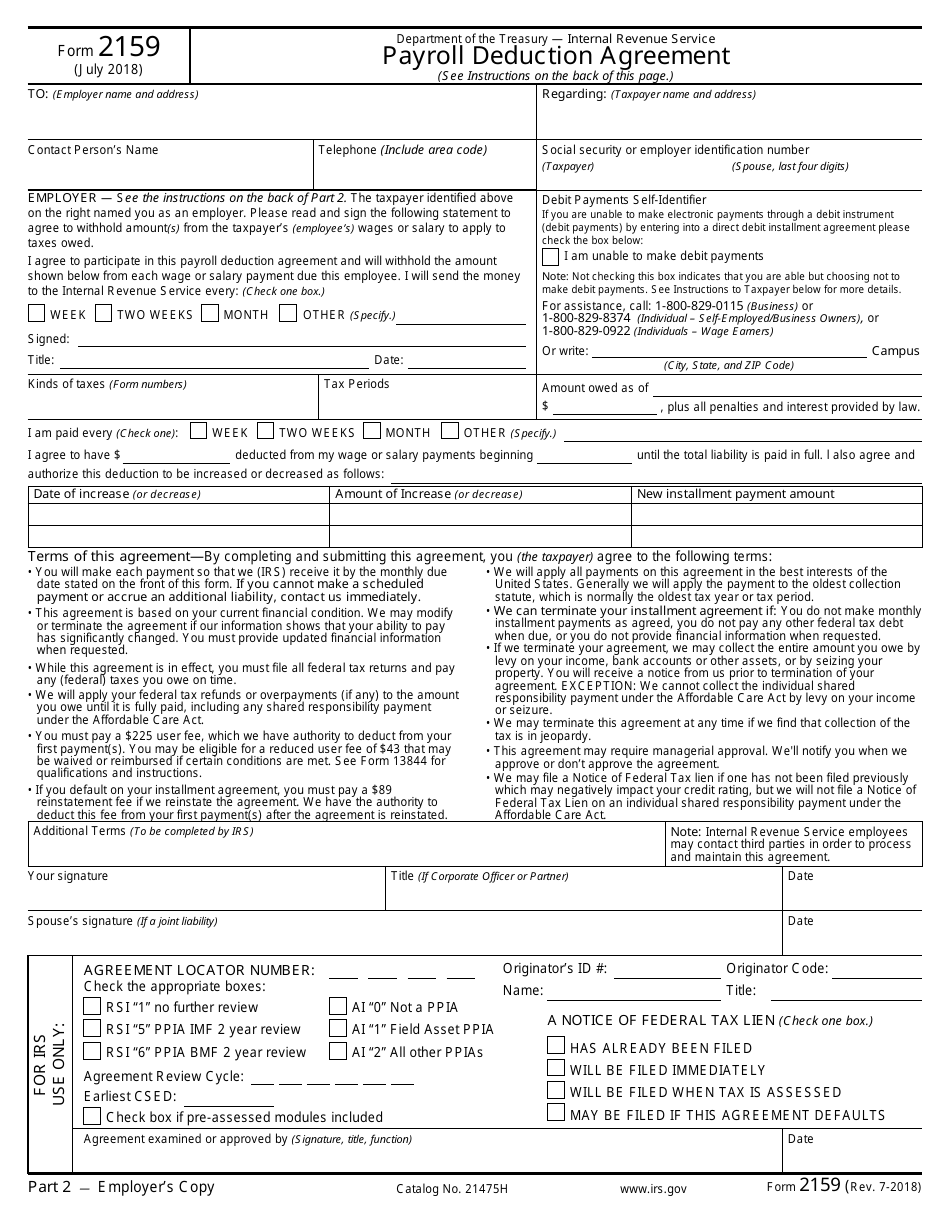

IRS Form 2159 Payroll Deduction Agreement

What Is IRS Form 2159?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on July 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 2159?

A: IRS Form 2159 is the Payroll Deduction Agreement form.

Q: What is the purpose of IRS Form 2159?

A: The purpose of IRS Form 2159 is to authorize the payroll deduction of unpaid tax debts.

Q: Who needs to fill out IRS Form 2159?

A: Individuals who owe unpaid taxes to the IRS and want to arrange for automatic payroll deductions can fill out IRS Form 2159.

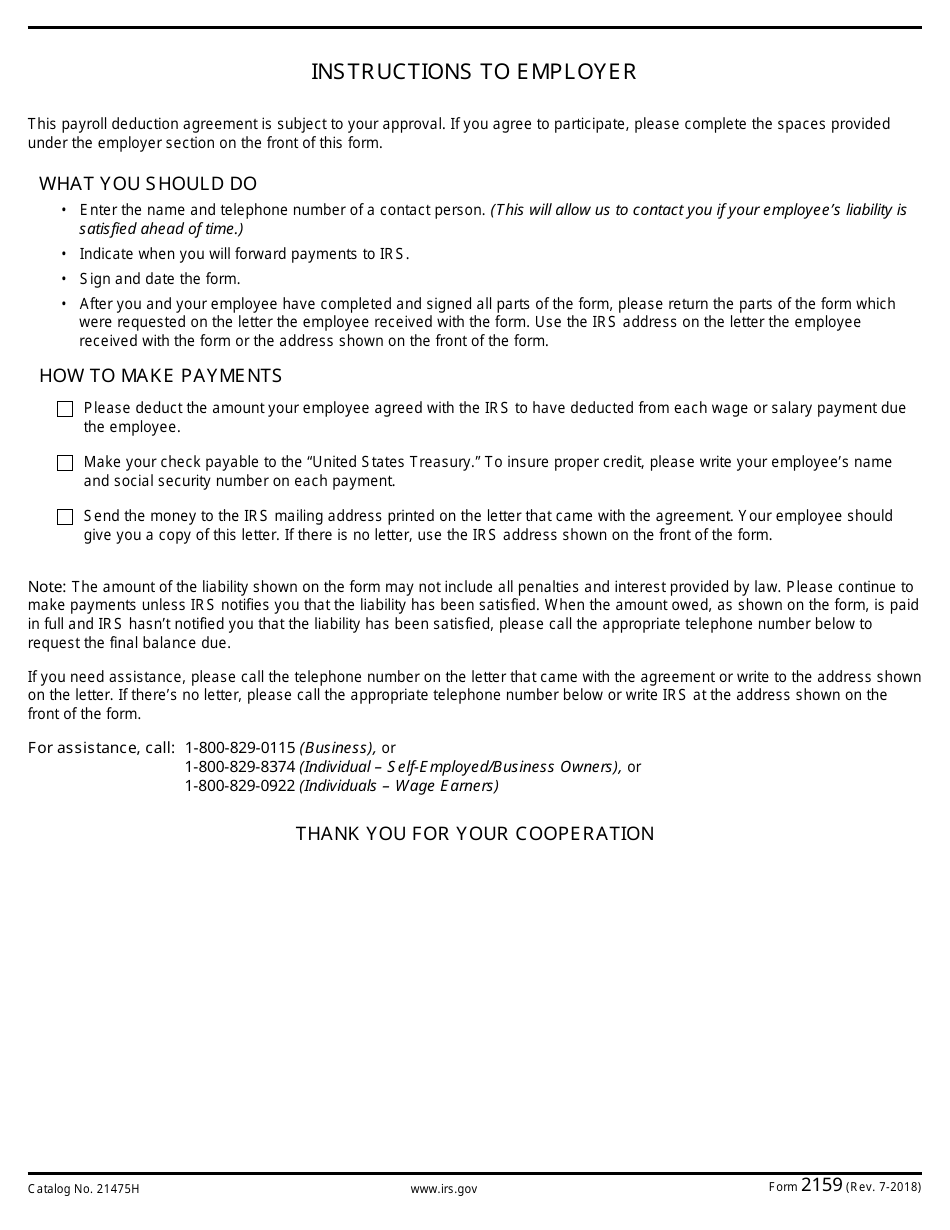

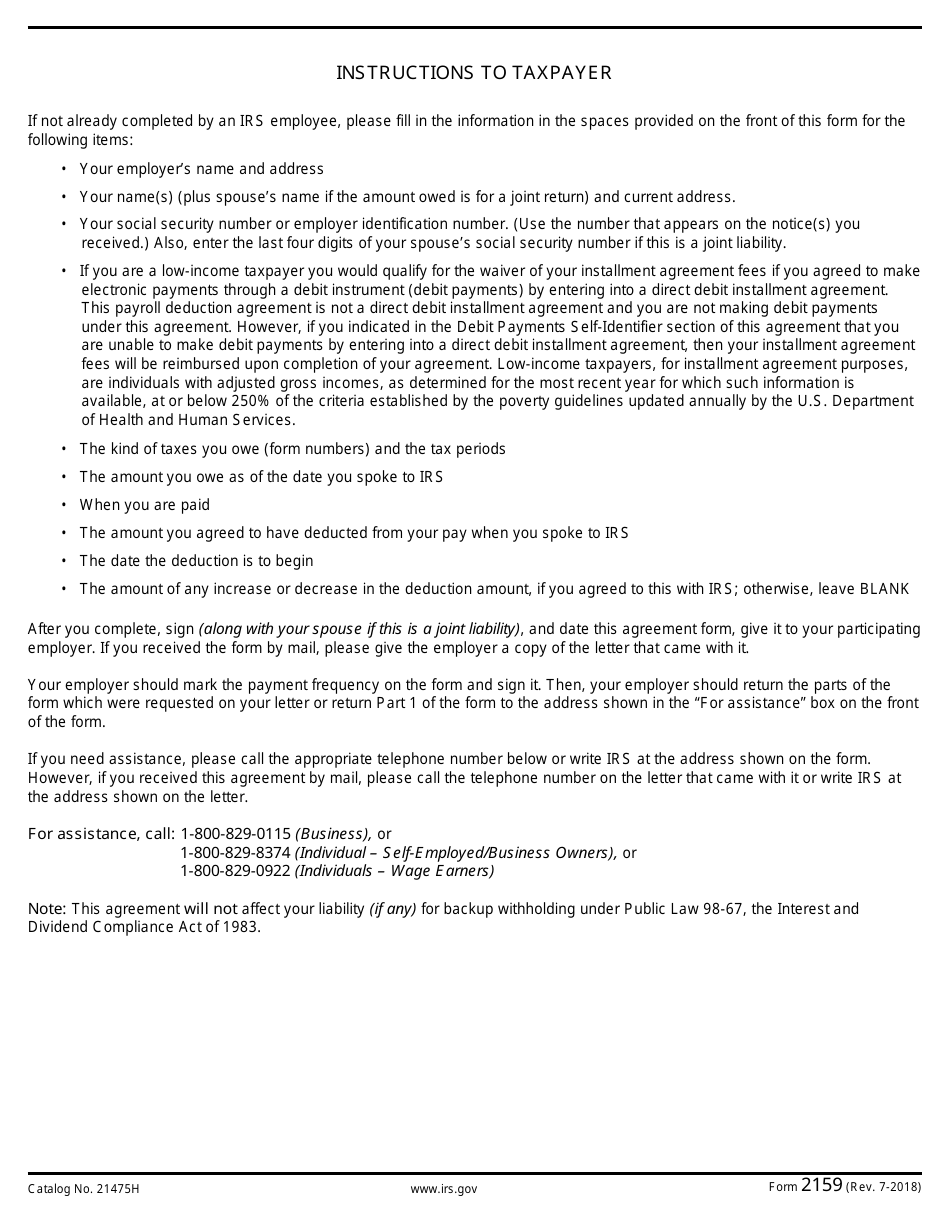

Q: How do I fill out IRS Form 2159?

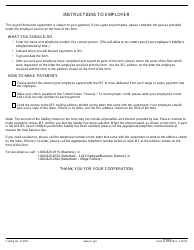

A: You will need to provide your personal information, including your name, Social Security number, employer information, and details about your tax debt. You will also need to indicate the amount you can afford to have deducted from your paycheck each pay period.

Q: Are there any fees for using payroll deduction through IRS Form 2159?

A: No, there is no fee for using payroll deduction through IRS Form 2159.

Q: What are the benefits of using the payroll deduction agreement?

A: Using the payroll deduction agreement can help individuals with unpaid tax debts by providing them with an easy and automated way to pay off their taxes over time.

Q: Is the payroll deduction agreement a legally binding agreement?

A: Yes, the payroll deduction agreement is a legally binding agreement between the individual and the IRS.

Q: Can I cancel the payroll deduction agreement?

A: Yes, you can cancel the payroll deduction agreement at any time by contacting the IRS.

Q: Will the IRS continue to add interest and penalties while I am making payroll deductions?

A: Yes, interest and penalties will continue to accrue on your unpaid tax debts even while you are making payroll deductions.

Form Details:

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2159 through the link below or browse more documents in our library of IRS Forms.