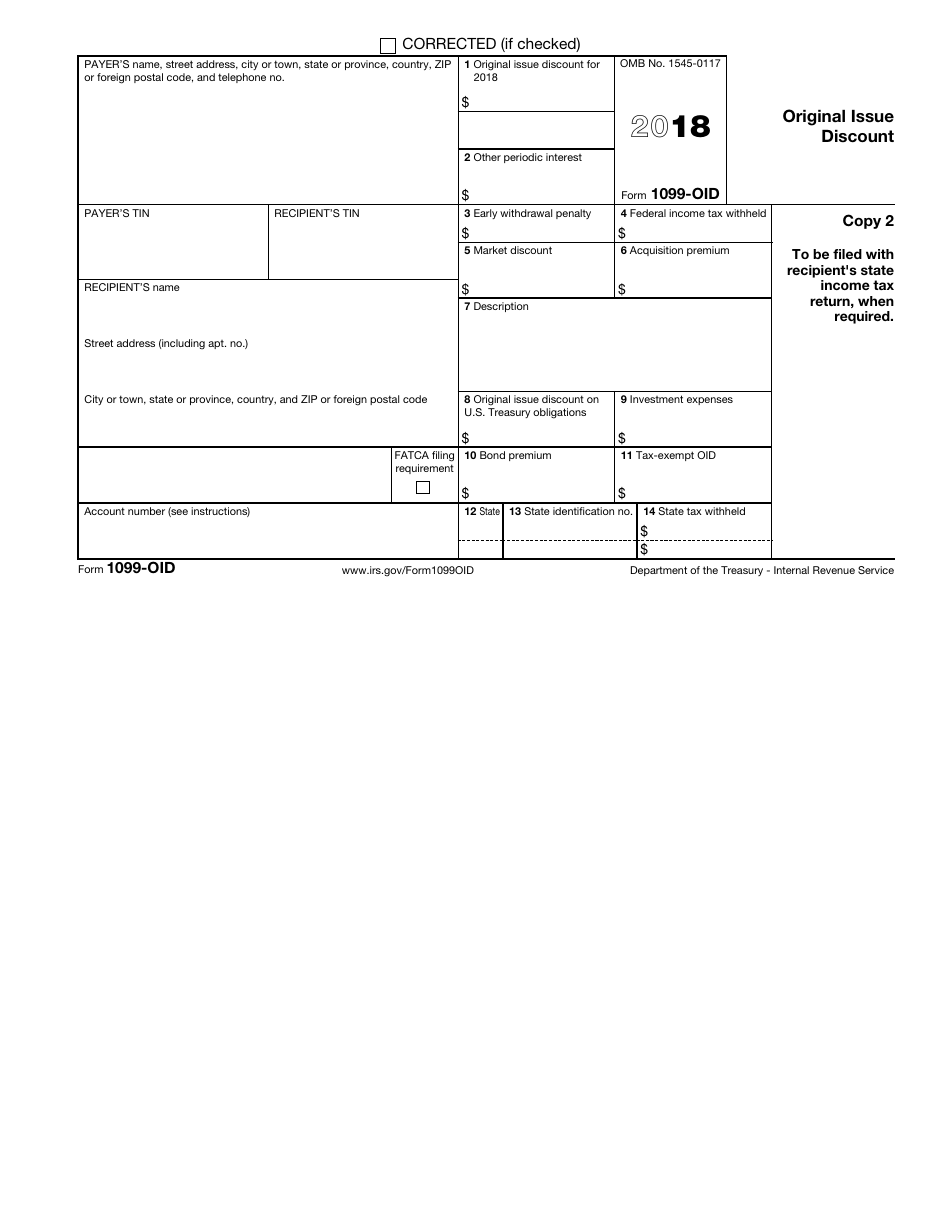

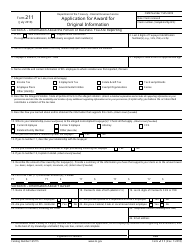

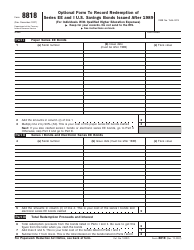

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1099-OID

for the current year.

IRS Form 1099-OID Original Issue Discount

What Is IRS Form 1099-OID?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

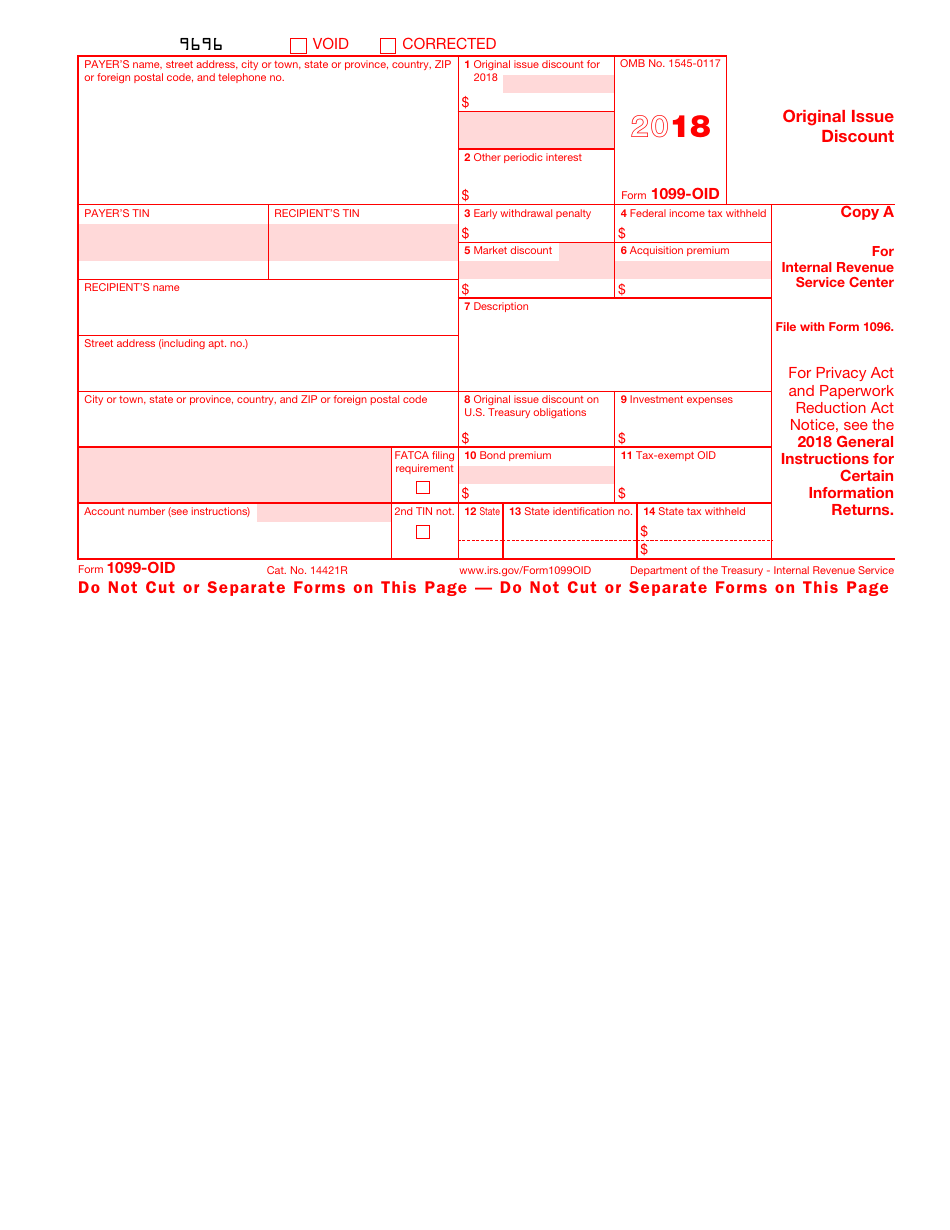

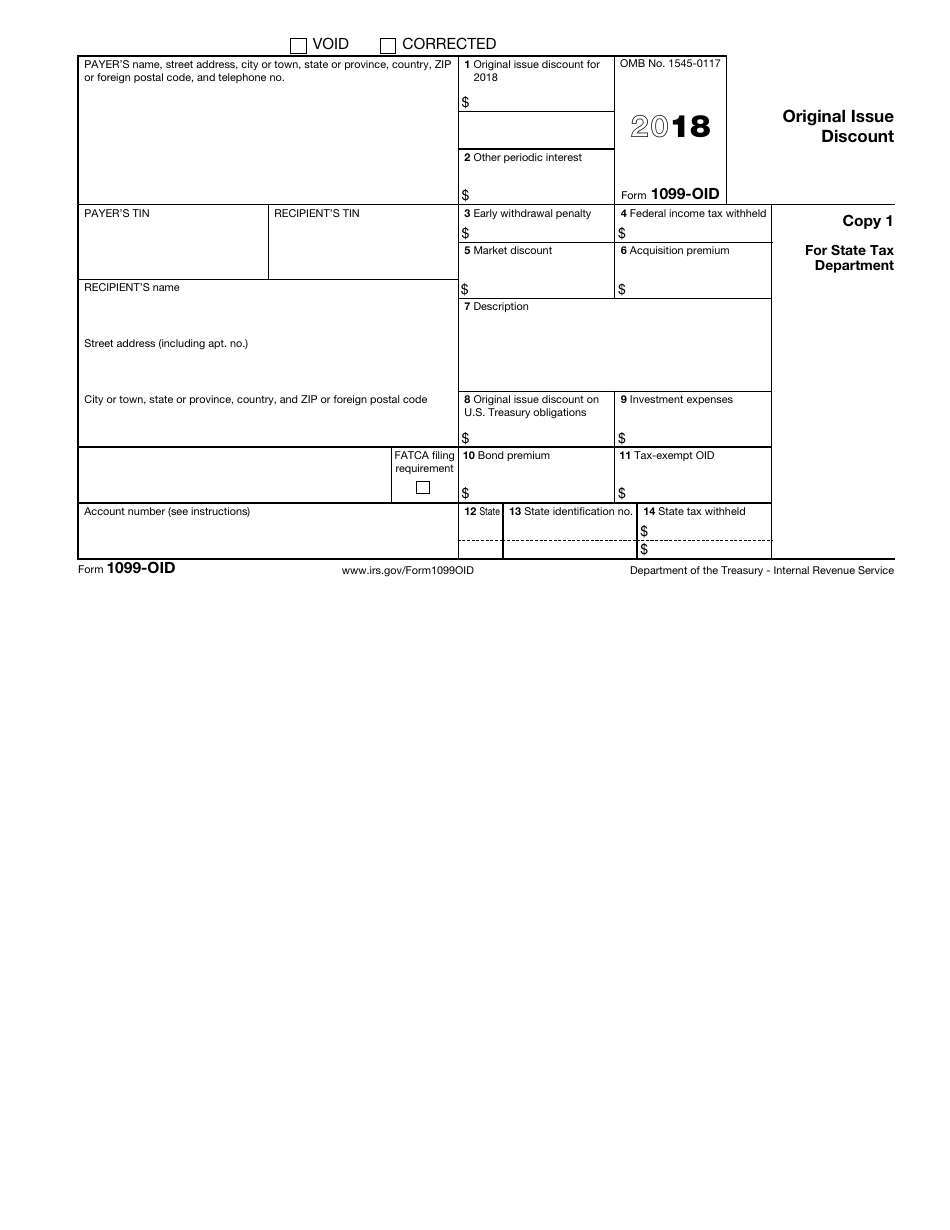

Q: What is IRS Form 1099-OID?

A: IRS Form 1099-OID is a tax form used to report original issue discount (OID) income.

Q: What is original issue discount (OID) income?

A: Original issue discount (OID) income is the difference between the face value of a debt instrument and its stated redemption price at maturity.

Q: Who must file IRS Form 1099-OID?

A: Banks, financial institutions, and other issuers of debt instruments must file IRS Form 1099-OID if they paid OID income of $10 or more to the recipient.

Q: Who receives IRS Form 1099-OID?

A: Recipients of OID income, such as bondholders or investors, receive IRS Form 1099-OID from the issuer or payer.

Q: What information is reported on IRS Form 1099-OID?

A: IRS Form 1099-OID reports information about the OID income received, including the recipient's name, address, and taxpayer identification number.

Q: When is IRS Form 1099-OID due?

A: IRS Form 1099-OID must be filed with the IRS by January 31st of the year following the calendar year in which the OID income was paid.

Q: Do I need to attach IRS Form 1099-OID to my tax return?

A: No, you don't need to attach IRS Form 1099-OID to your tax return. However, you should keep a copy of the form for your records.

Q: What happens if I don't receive IRS Form 1099-OID?

A: If you believe you should have received IRS Form 1099-OID but haven't, you should contact the issuer or payer to request a copy.

Q: Can I request an extension to file IRS Form 1099-OID?

A: No, there is no automatic extension for filing IRS Form 1099-OID. It must be filed by January 31st.

Q: What are the penalties for not filing IRS Form 1099-OID?

A: The penalties for not filing IRS Form 1099-OID can range from $50 to $270 per form, depending on how late the form is filed.

Form Details:

- A 9-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-OID through the link below or browse more documents in our library of IRS Forms.