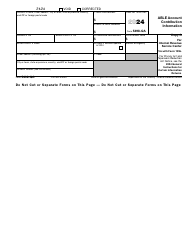

This version of the form is not currently in use and is provided for reference only. Download this version of

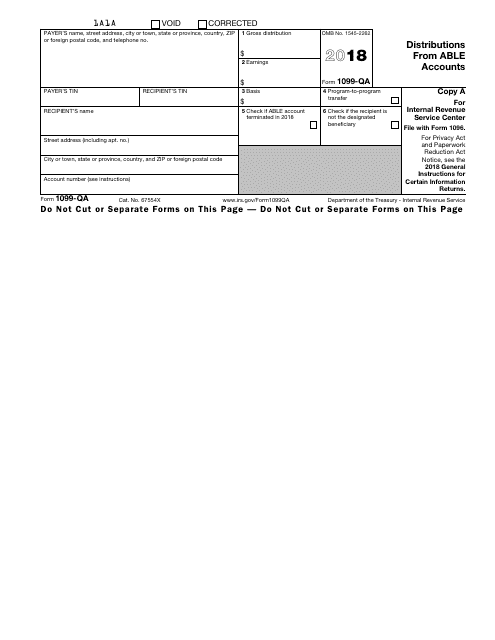

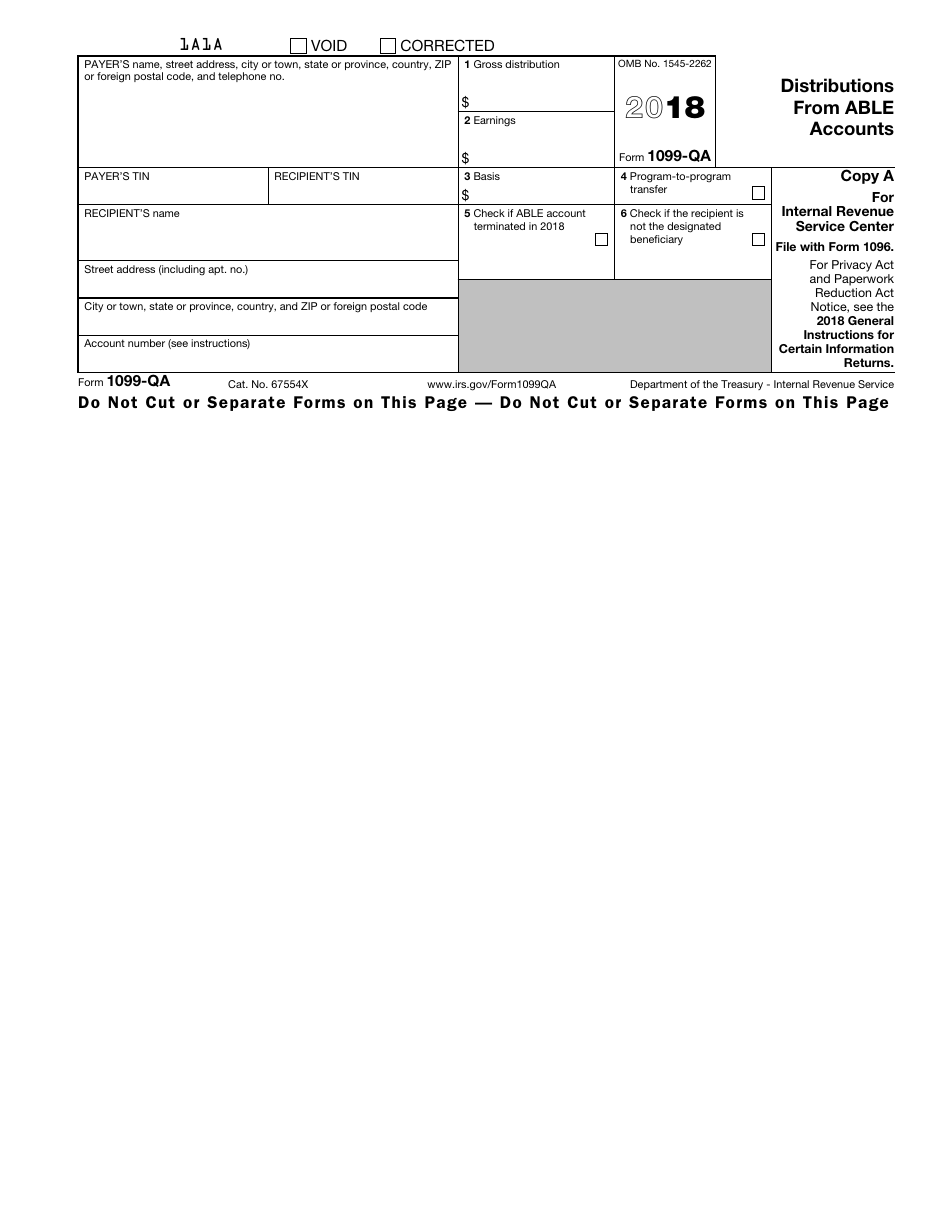

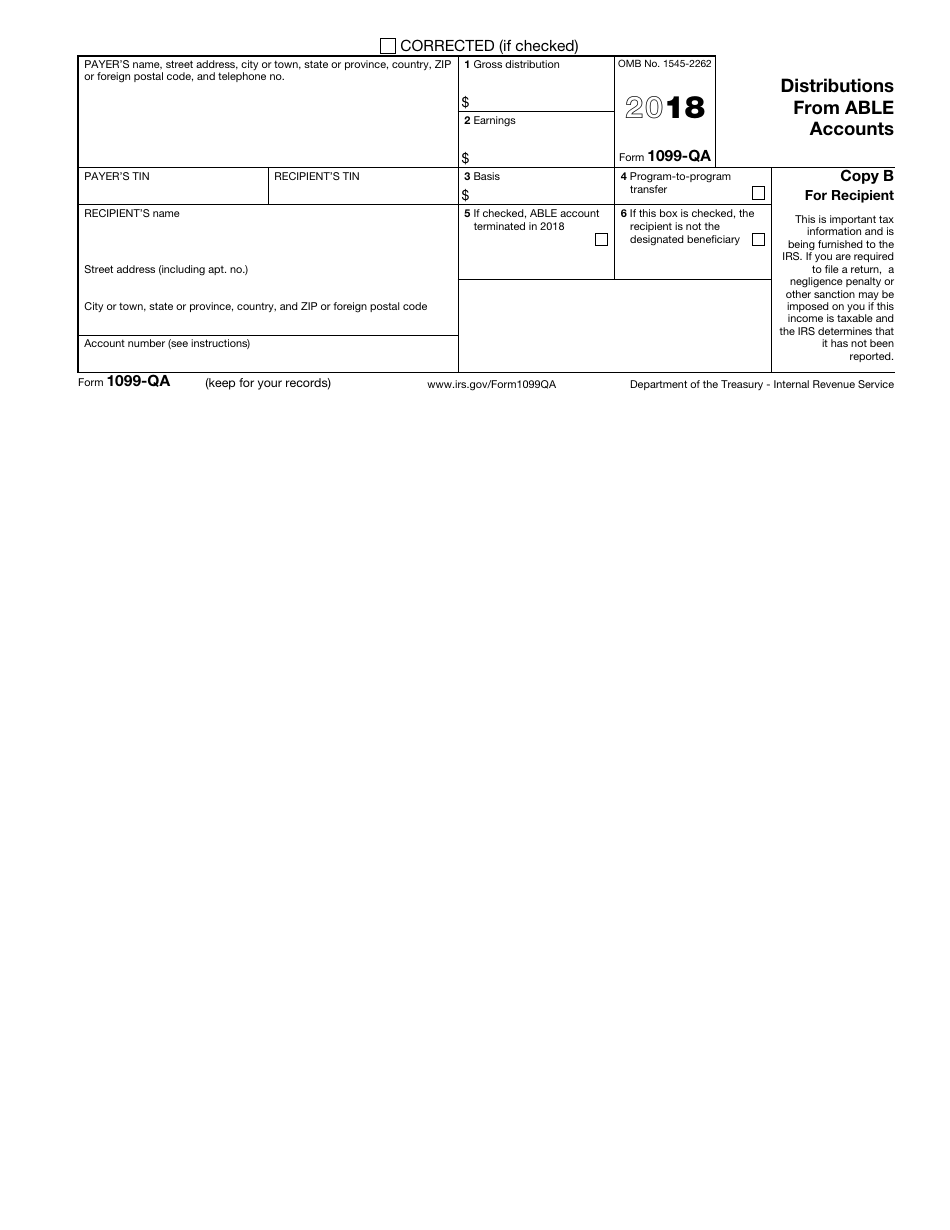

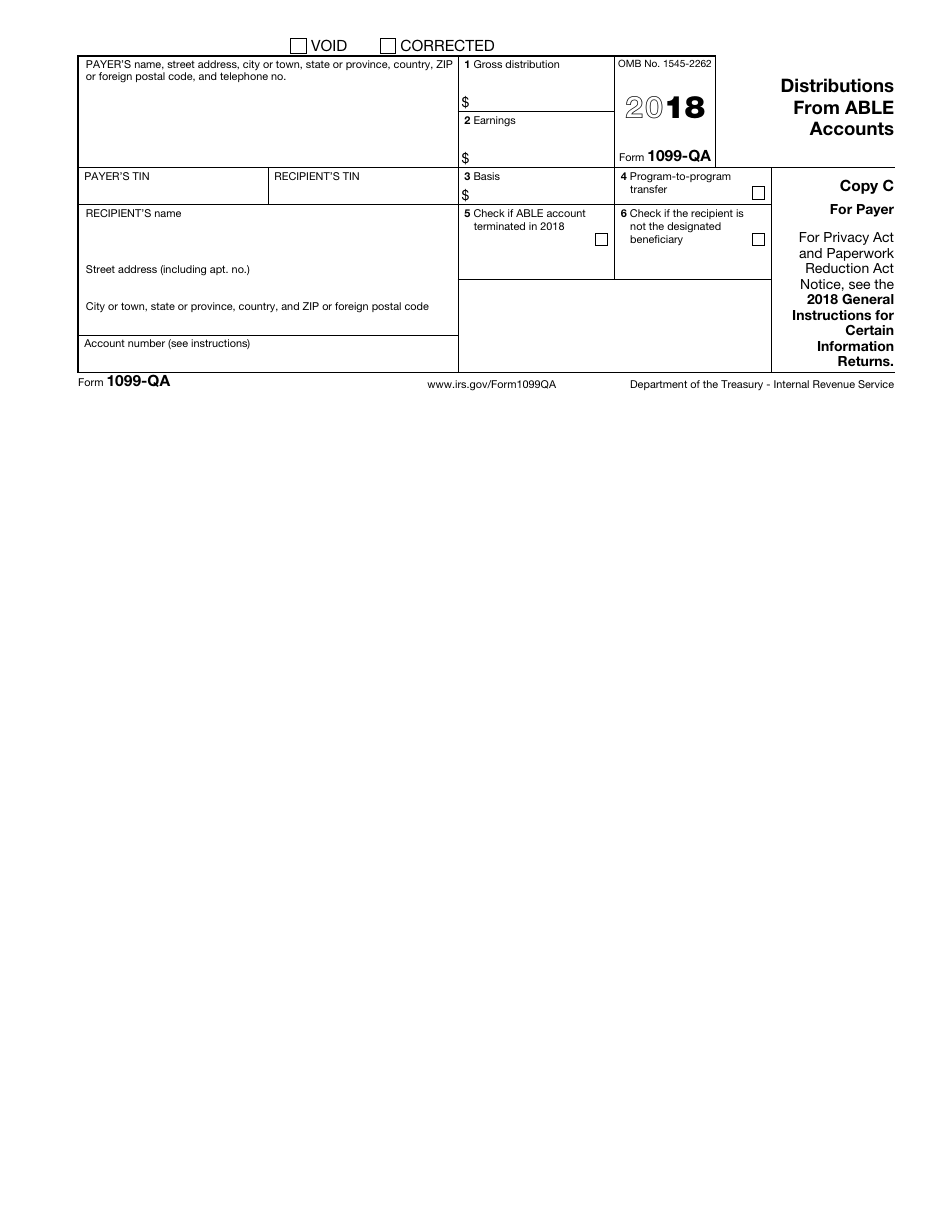

IRS Form 1099-QA

for the current year.

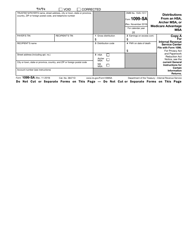

IRS Form 1099-QA Distributions From Able Accounts

What Is IRS Form 1099-QA?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1099-QA?

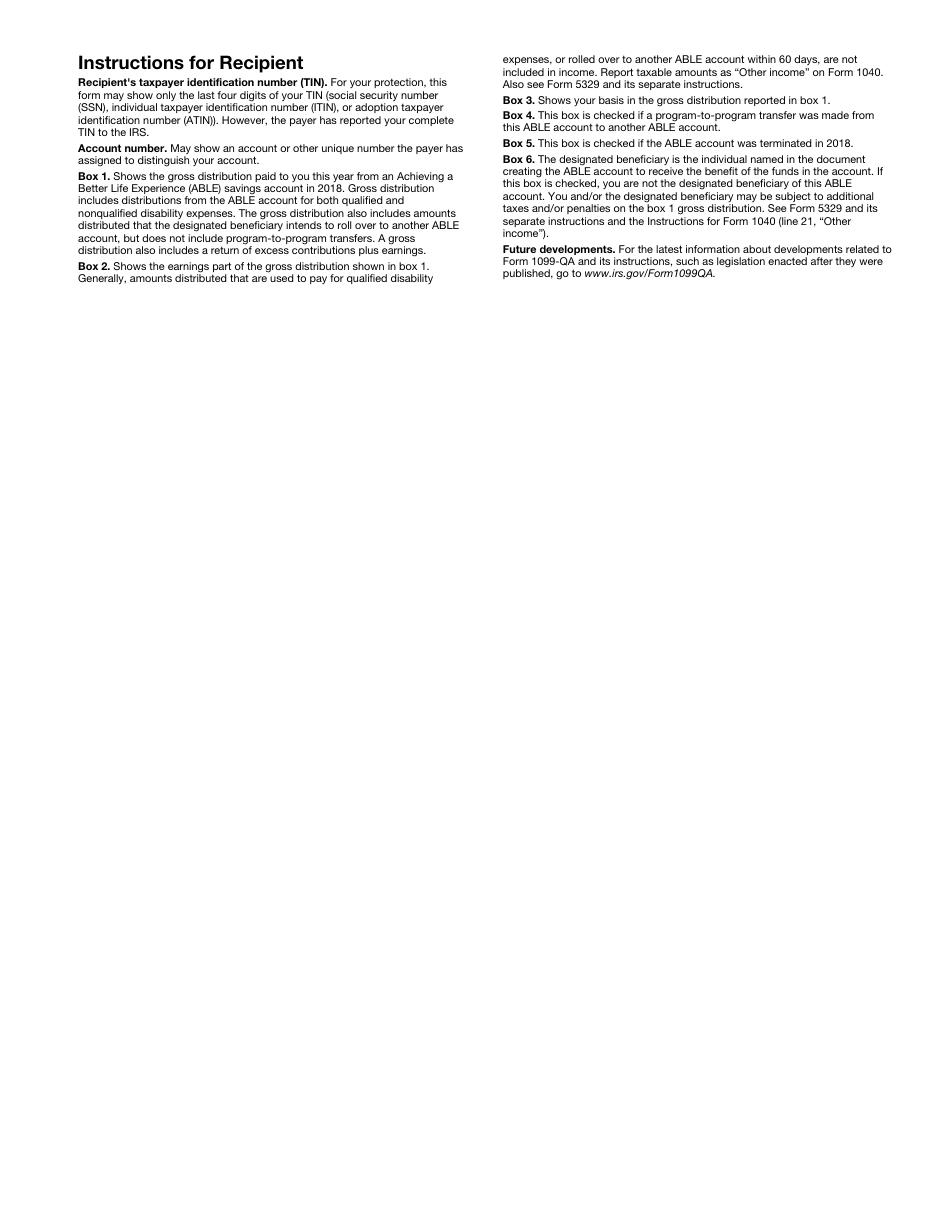

A: IRS Form 1099-QA is used to report distributions from Able accounts.

Q: What are Able accounts?

A: Able accounts, also known as Achieving a Better Life Experience accounts, are tax-advantaged savings accounts for individuals with disabilities.

Q: Who receives Form 1099-QA?

A: Individuals who receive distributions from Able accounts will receive Form 1099-QA.

Q: What information is reported on Form 1099-QA?

A: Form 1099-QA reports the total distribution amount and any earnings portion of the distribution from an Able account.

Q: Do I need to include Form 1099-QA when filing my taxes?

A: Yes, you need to include Form 1099-QA when filing your taxes to report the distribution from your Able account.

Q: When is the deadline for filing Form 1099-QA?

A: The deadline for filing Form 1099-QA is typically January 31st of the year following the distribution.

Q: What happens if I don't include Form 1099-QA when filing my taxes?

A: If you fail to include Form 1099-QA when filing your taxes, it may result in an incorrect tax return and potential penalties.

Q: Are distributions from Able accounts taxable?

A: The taxable status of distributions from Able accounts depends on how the funds are used. Qualified disability expenses are usually tax-free, while non-qualified expenses may be subject to taxes and penalties.

Q: Are there any limitations or restrictions on Able accounts?

A: Yes, there are certain limitations and restrictions on Able accounts. The maximum annual contribution limit is currently $15,000, and there are rules regarding the use of funds and eligibility requirements.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-QA through the link below or browse more documents in our library of IRS Forms.