This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 656-ppv

for the current year.

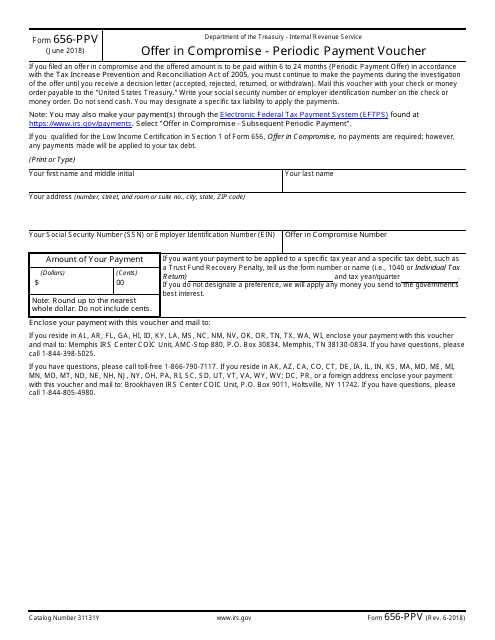

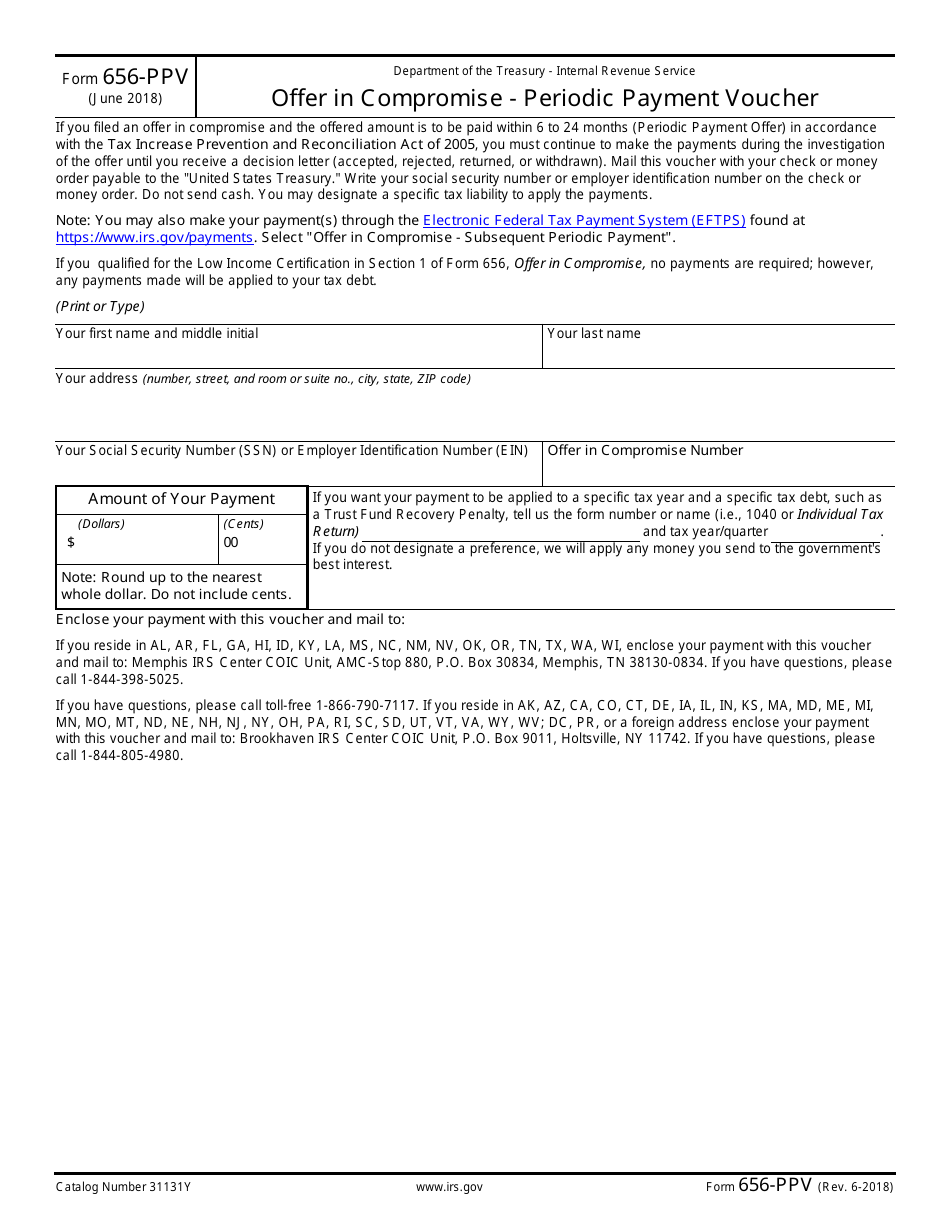

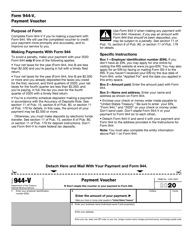

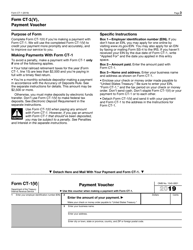

IRS Form 656-ppv Offer in Compromise - Periodic Payment Voucher

What Is IRS Form 656-ppv?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 656-ppv?

A: IRS Form 656-ppv is the Periodic Payment Voucher that is used in conjunction with Form 656 to submit periodic payments for an Offer in Compromise.

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a program by the IRS that allows you to settle your tax debt for less than the full amount you owe.

Q: Who can use Form 656-ppv?

A: Taxpayers who have been accepted into the Offer in Compromise program and are making periodic payments towards their settlement can use Form 656-ppv.

Q: What information is required on Form 656-ppv?

A: Form 656-ppv requires you to provide your taxpayer identification number, offer amount, and the installment period for your periodic payments.

Q: What happens after I submit Form 656-ppv?

A: After you submit Form 656-ppv, the IRS will review your periodic payment and apply it towards your Offer in Compromise.

Q: What if I can't afford the periodic payment amount?

A: If you can't afford the periodic payment amount, you may need to contact the IRS to discuss alternative payment options or adjustments to your Offer in Compromise.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 656-ppv through the link below or browse more documents in our library of IRS Forms.