This version of the form is not currently in use and is provided for reference only. Download this version of

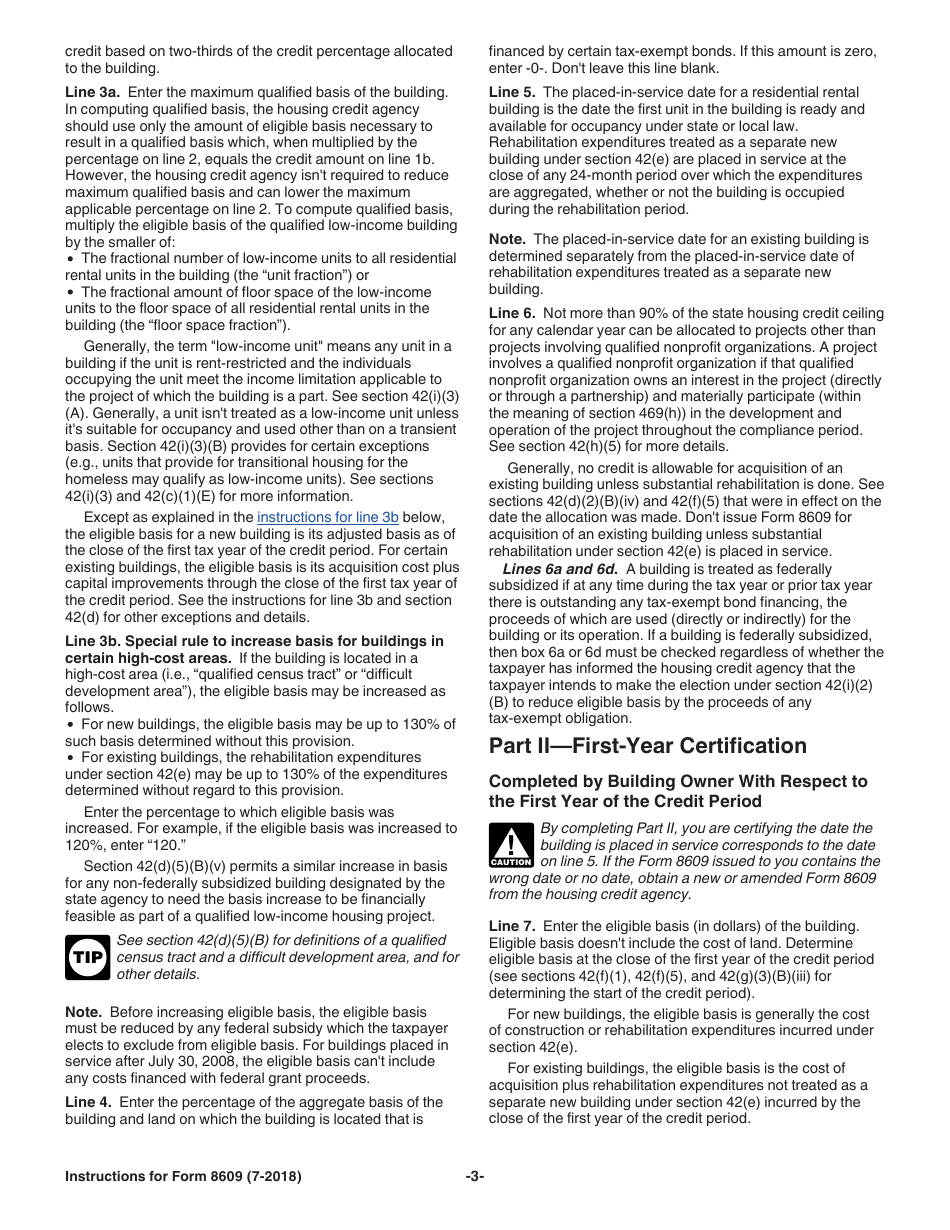

Instructions for IRS Form 8609

for the current year.

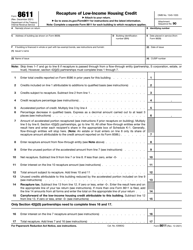

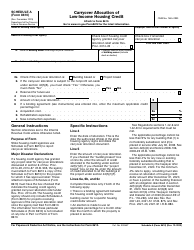

Instructions for IRS Form 8609 Low-Income Housing Credit Allocation and Certification

This document contains official instructions for IRS Form 8609 , Low-Income Housing Credit Allocation and Certification - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8609 is available for download through this link.

FAQ

Q: What is IRS Form 8609?

A: IRS Form 8609 is a form used for Low-Income Housing Credit Allocation and Certification.

Q: What is the purpose of IRS Form 8609?

A: The purpose of IRS Form 8609 is to claim the low-income housing credit for a qualified low-income housing project.

Q: Who needs to file IRS Form 8609?

A: Owners or operators of qualified low-income housing projects need to file IRS Form 8609.

Q: What information is required on IRS Form 8609?

A: IRS Form 8609 requires information about the project, the number of low-income units, and the amount of credit requested.

Q: When should IRS Form 8609 be filed?

A: IRS Form 8609 should be filed before the close of the calendar year following the year the building was placed in service.

Q: Are there any fees associated with filing IRS Form 8609?

A: There are no specific fees associated with filing IRS Form 8609, but there may be other costs involved in preparing the form.

Q: What happens after filing IRS Form 8609?

A: After filing IRS Form 8609, the IRS will review the form and determine if the low-income housing credit can be allocated to the project.

Q: Are there any penalties for not filing IRS Form 8609?

A: Yes, there may be penalties for not filing IRS Form 8609 or for providing false or incomplete information on the form.

Q: Can I amend IRS Form 8609 if I make a mistake?

A: Yes, you can amend IRS Form 8609 if you discover an error or omission in the original form.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.