This version of the form is not currently in use and is provided for reference only. Download this version of

Form SSA-308

for the current year.

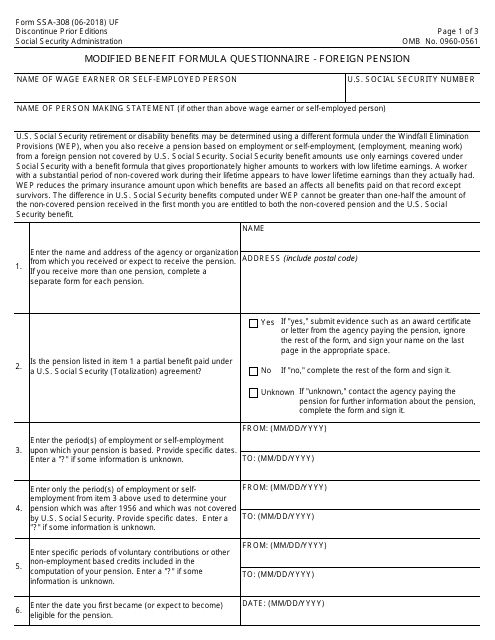

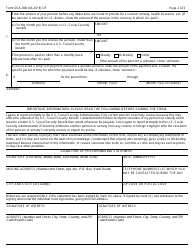

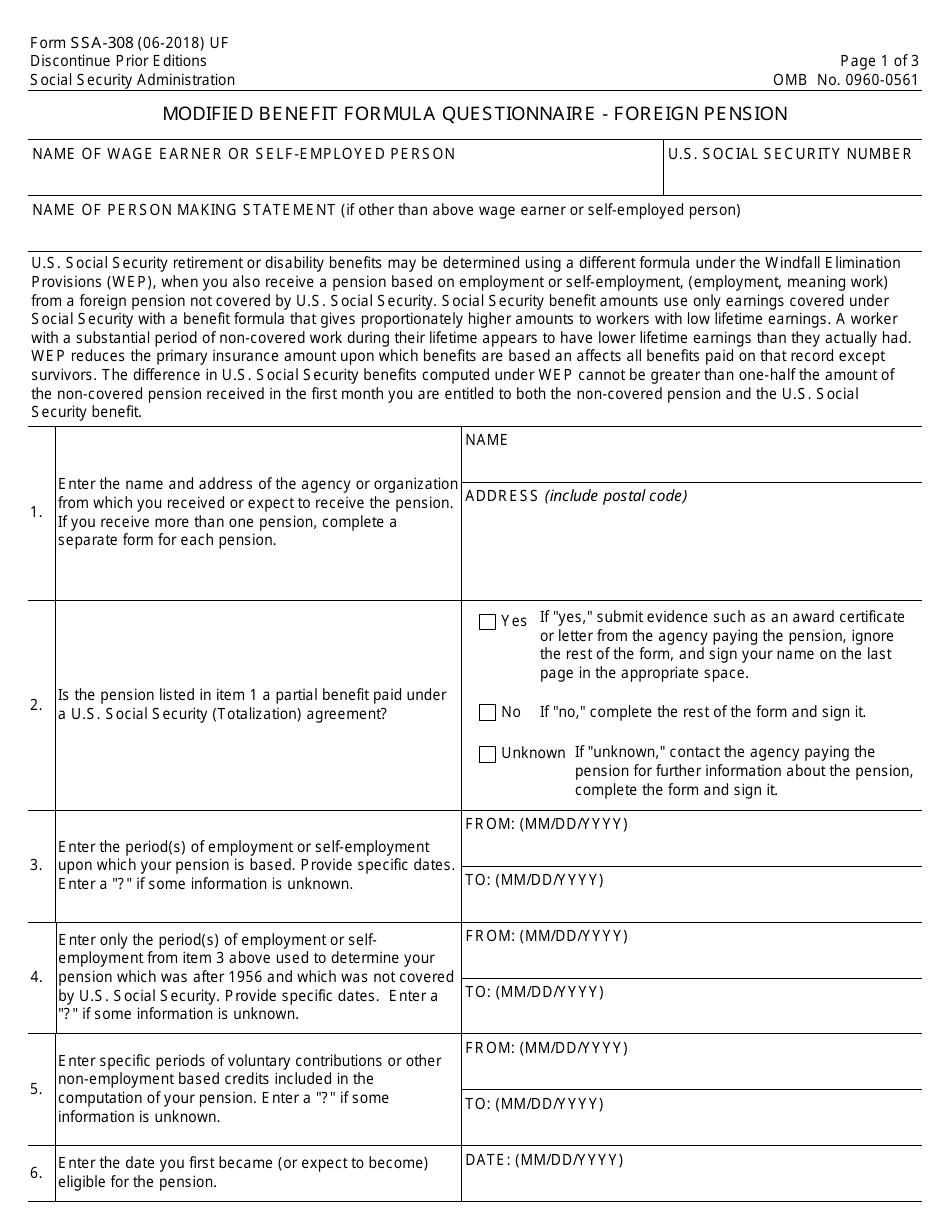

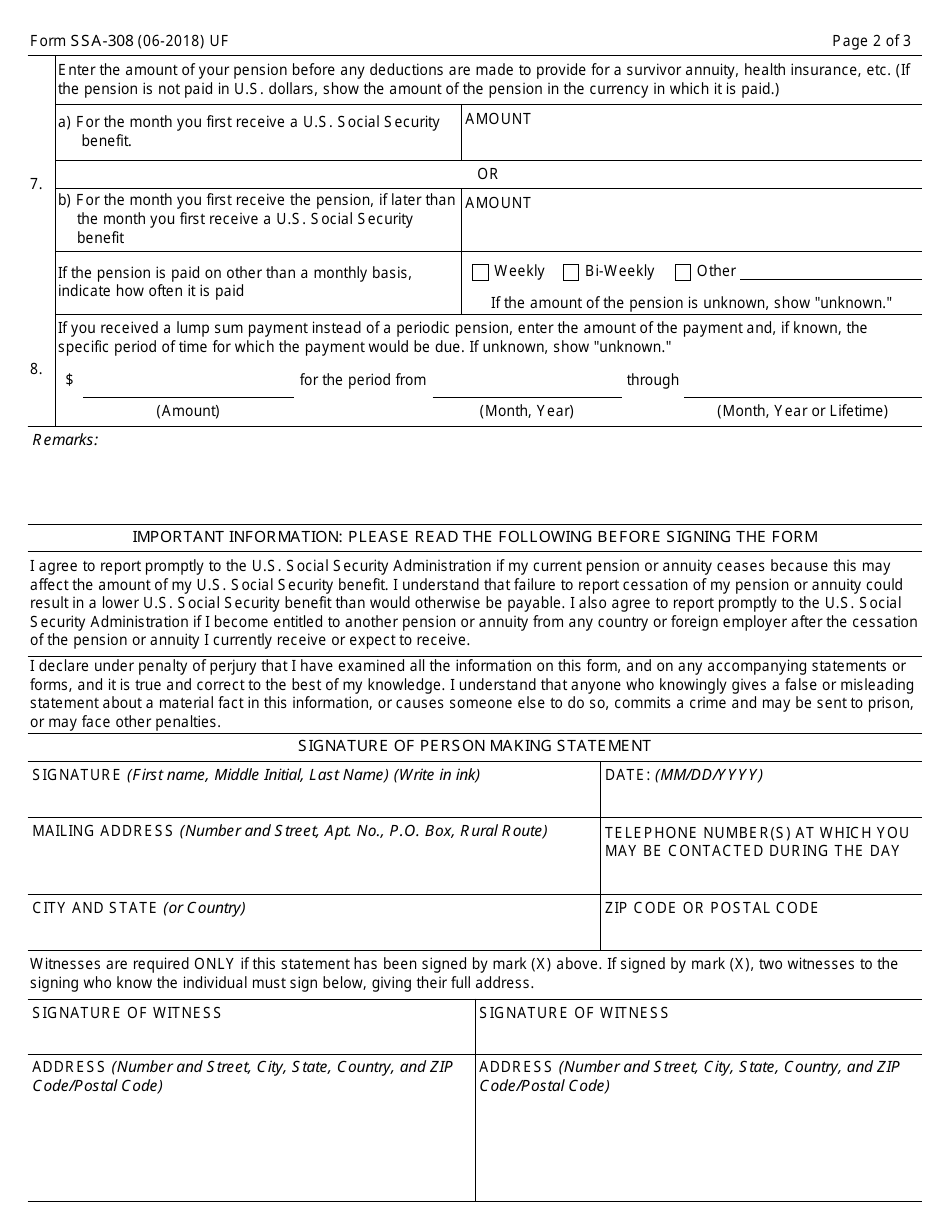

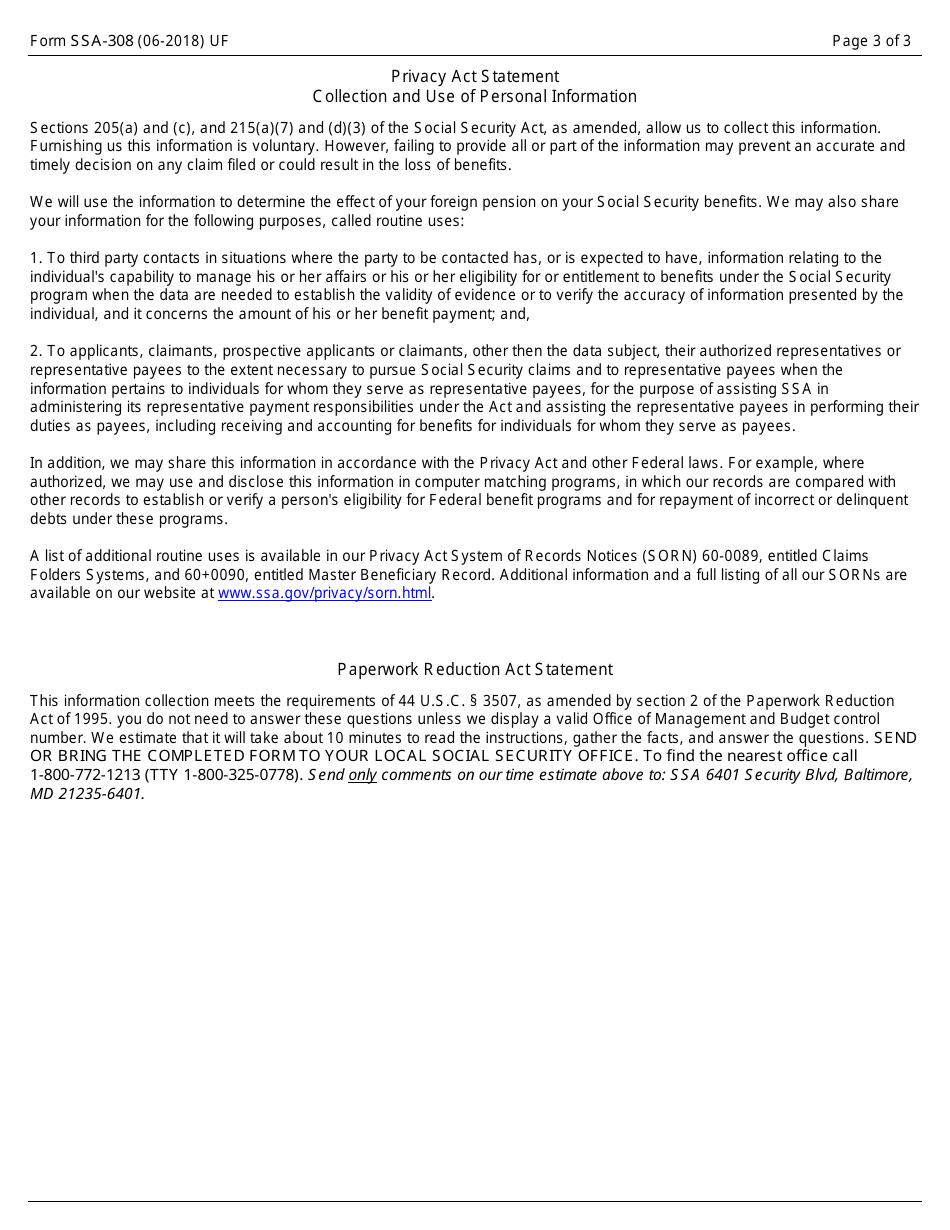

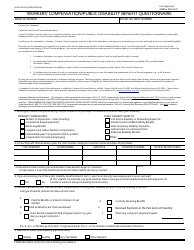

Form SSA-308 Modified Benefit Formula Questionnaire - Foreign Pension

What Is Form SSA-308?

This is a legal form that was released by the U.S. Social Security Administration on June 1, 2018 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SSA-308?

A: Form SSA-308 is a questionnaire used by the Social Security Administration (SSA) to gather information about foreign pensions.

Q: What is the purpose of Form SSA-308?

A: The purpose of Form SSA-308 is to determine if your foreign pension may affect your Social Security benefits.

Q: Who needs to complete Form SSA-308?

A: If you receive a foreign pension and are also eligible for Social Security benefits, you may need to complete Form SSA-308.

Q: What information is required on Form SSA-308?

A: Form SSA-308 asks for details about your foreign pension, including the amount you receive and how it is calculated.

Q: When should I submit Form SSA-308?

A: You should submit Form SSA-308 as soon as possible after you start receiving a foreign pension or become eligible for Social Security benefits.

Q: Are there any consequences for not completing Form SSA-308?

A: Failure to complete Form SSA-308 may result in an incorrect calculation of your Social Security benefits.

Q: Is Form SSA-308 only for residents of the United States?

A: No, Form SSA-308 should be completed by anyone who receives a foreign pension and is eligible for Social Security benefits, regardless of residence.

Form Details:

- Released on June 1, 2018;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-308 by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.