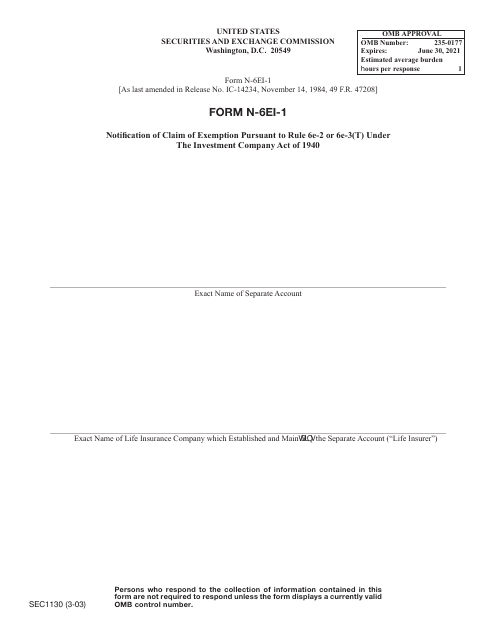

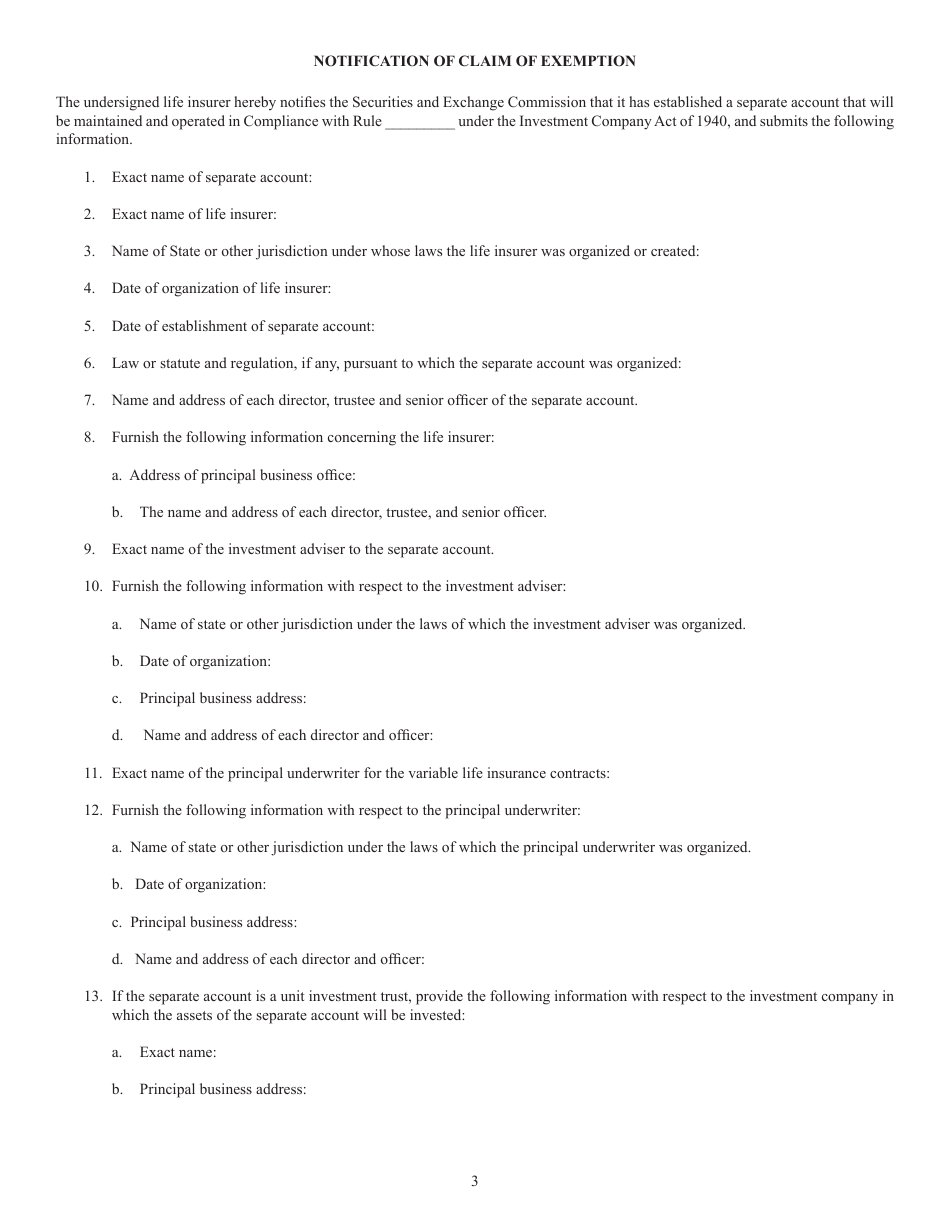

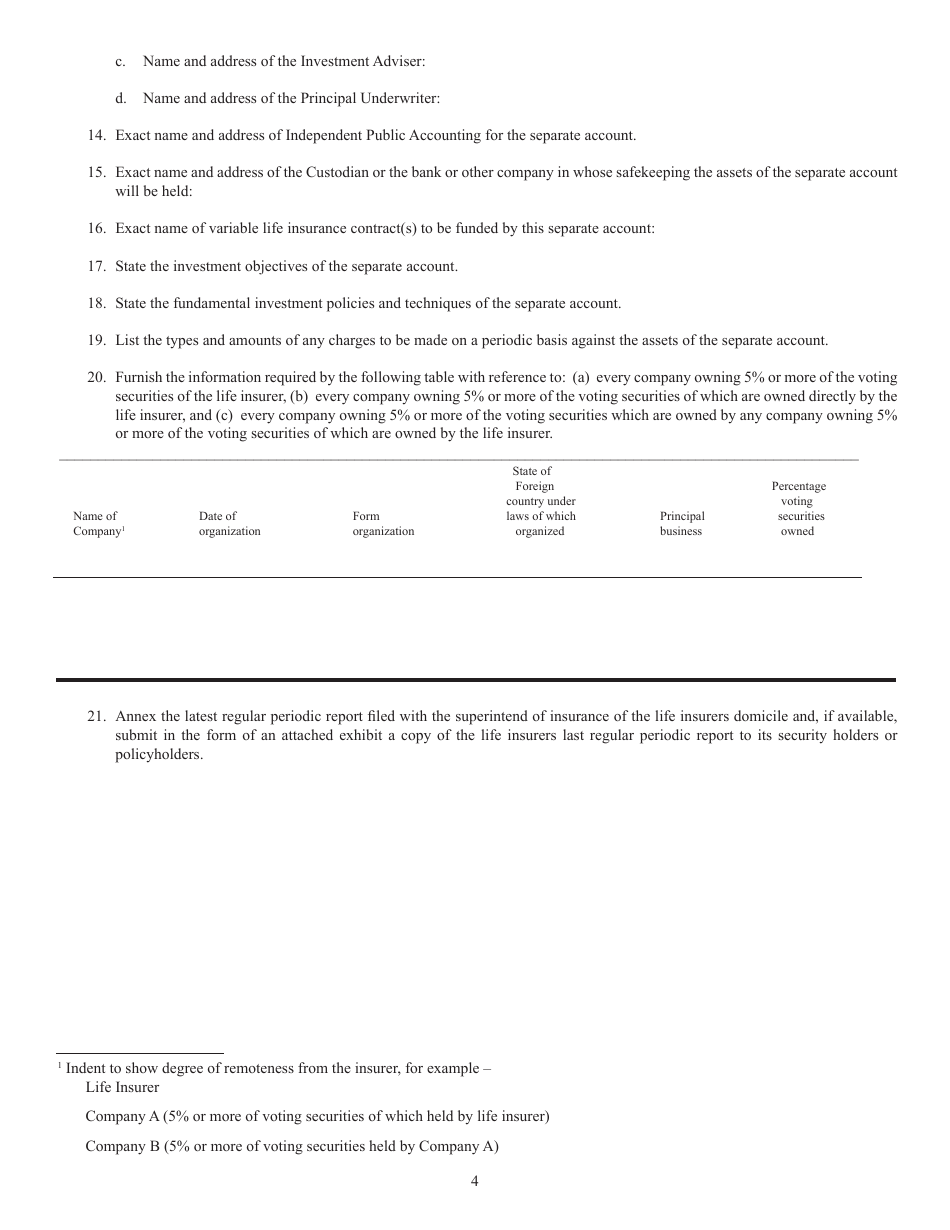

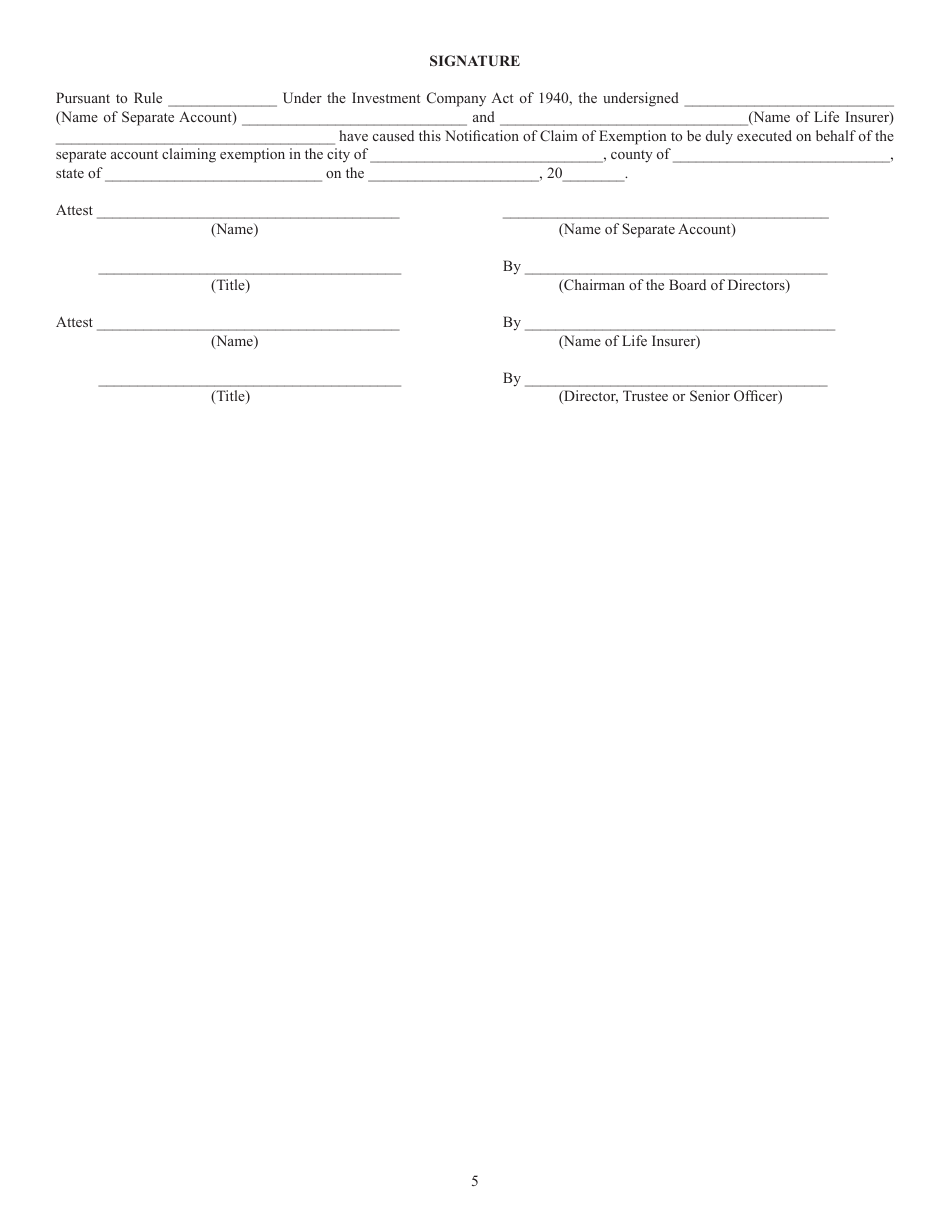

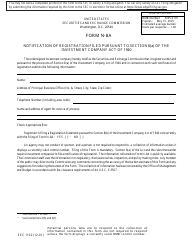

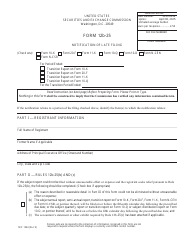

SEC Form 1130 (N-6EI-1) Notification of Claim of Exemption Pursuant to Rule 6e-2 or 6e-3(T) Under the Investment Company Act of 1940

What Is SEC Form 1130 (N-6EI-1)?

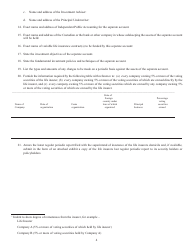

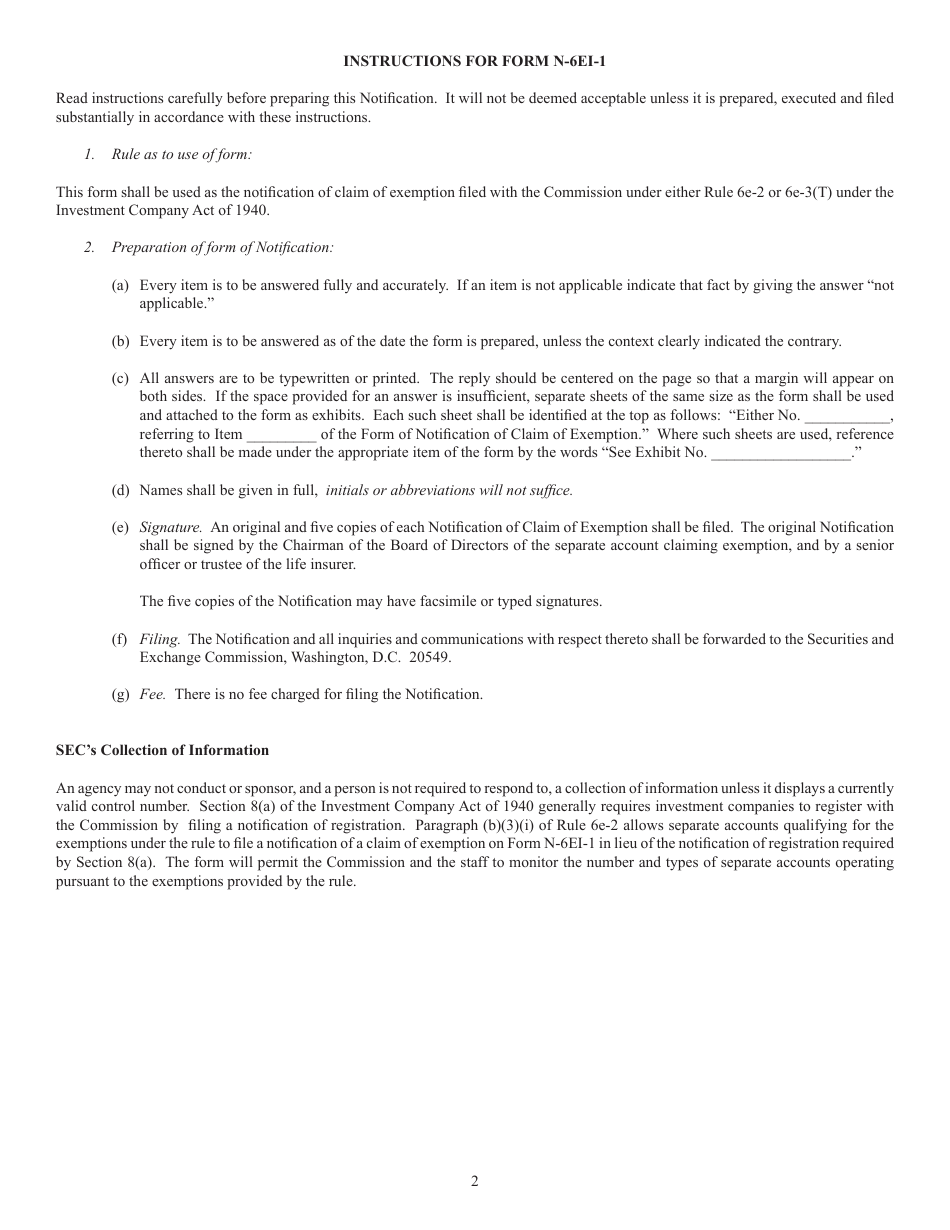

This is a legal form that was released by the U.S. Securities and Exchange Commission on March 1, 2003 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SEC Form 1130?

A: SEC Form 1130 is a form used to notify a claim of exemption under Rule 6e-2 or 6e-3(T) of the Investment Company Act of 1940.

Q: What is the purpose of SEC Form 1130?

A: The purpose of SEC Form 1130 is to notify the Securities and Exchange Commission (SEC) of a claim of exemption under specific rules of the Investment Company Act of 1940.

Q: What is Rule 6e-2 under the Investment Company Act of 1940?

A: Rule 6e-2 is a specific rule under the Investment Company Act of 1940 that provides exemptions for certain transactions involving insurance companies.

Q: What is Rule 6e-3(T) under the Investment Company Act of 1940?

A: Rule 6e-3(T) is another rule under the Investment Company Act of 1940 that provides exemptions for certain transactions involving interests in rental real estate.

Q: Who needs to file SEC Form 1130?

A: Individuals or entities claiming exemption under Rule 6e-2 or 6e-3(T) of the Investment Company Act of 1940 need to file SEC Form 1130.

Form Details:

- Released on March 1, 2003;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SEC Form 1130 (N-6EI-1) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.