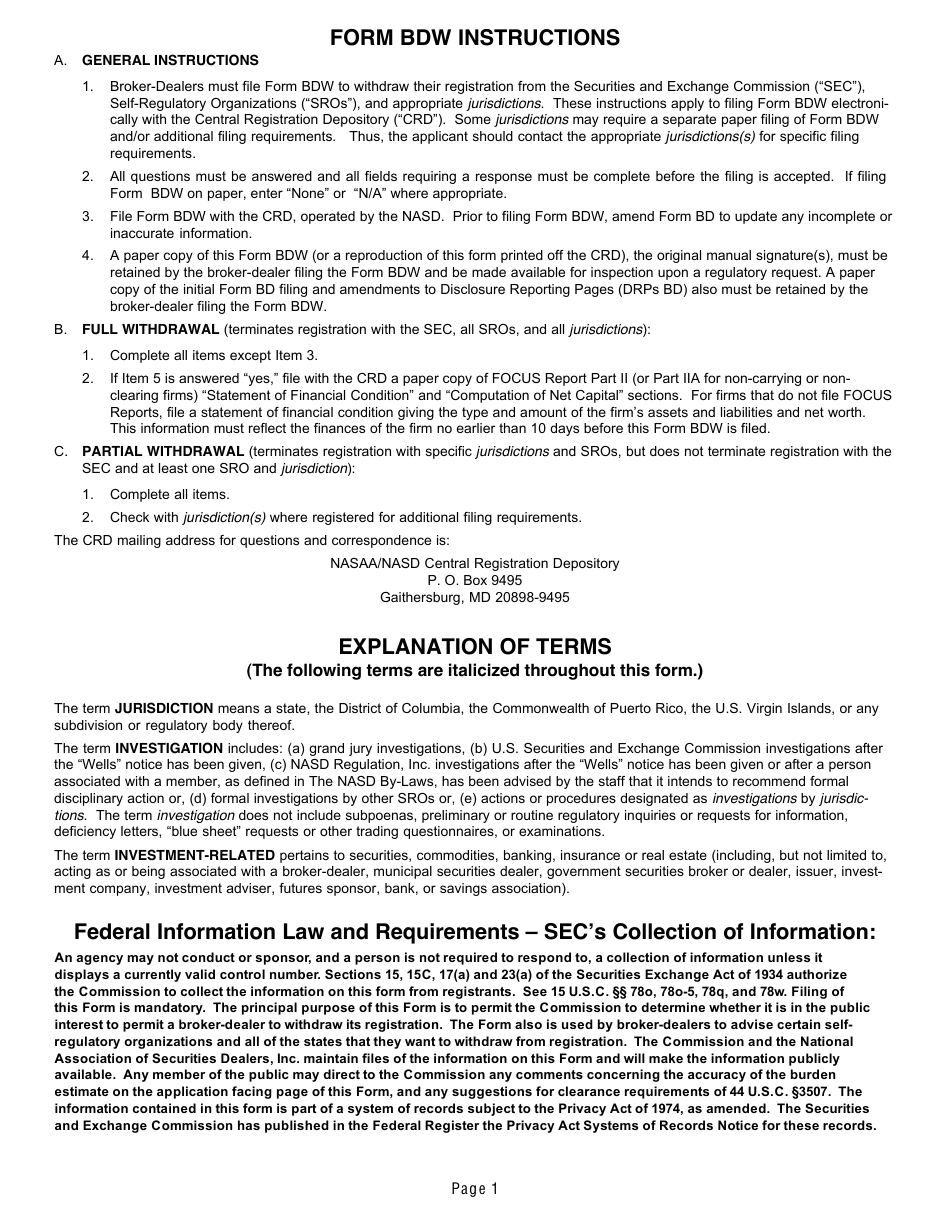

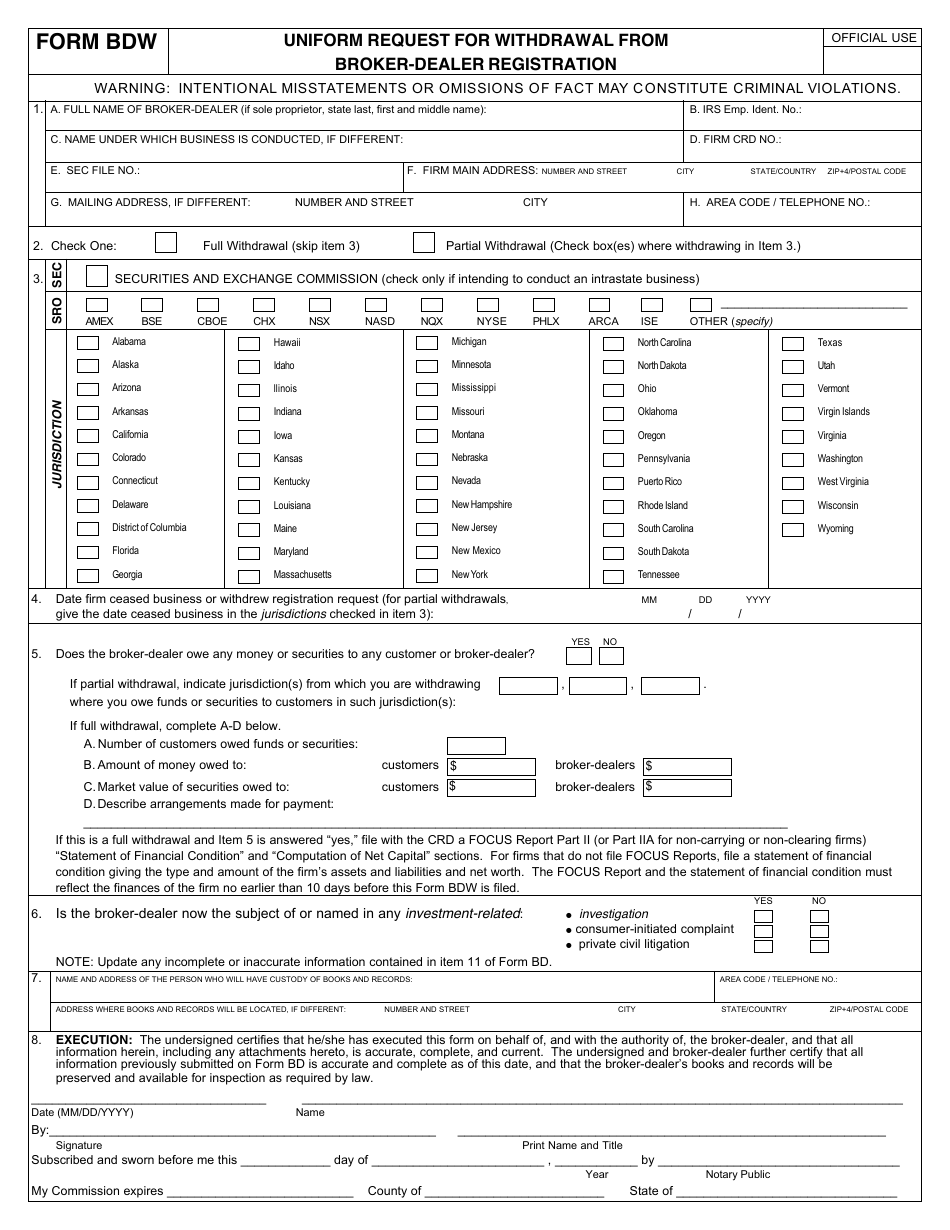

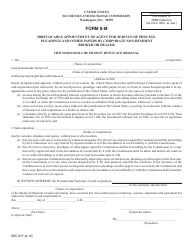

SEC Form 122 (BDW) Uniform Request for Withdrawal From Broker-Dealer Registration

What Is SEC Form 122 (BDW)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on April 1, 2007 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SEC Form 122 (BDW)?

A: SEC Form 122 (BDW) is a Uniform Request for Withdrawal From Broker-Dealer Registration.

Q: Who is required to file SEC Form 122 (BDW)?

A: Broker-dealers who wish to withdraw their registration with the Securities and Exchange Commission (SEC) are required to file SEC Form 122 (BDW).

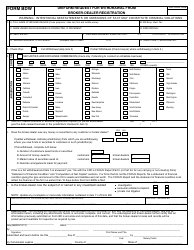

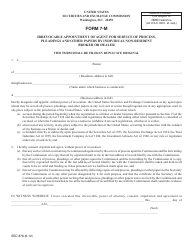

Q: What information is required in SEC Form 122 (BDW)?

A: SEC Form 122 (BDW) requires information such as the name of the firm, its CRD number, the reason for withdrawal, and the effective date of withdrawal.

Q: Is there a fee for filing SEC Form 122 (BDW)?

A: No, there is no fee for filing SEC Form 122 (BDW).

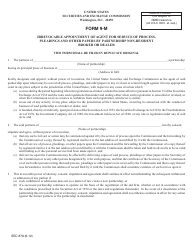

Q: What happens after filing SEC Form 122 (BDW)?

A: After filing SEC Form 122 (BDW), the SEC will review the withdrawal request and notify the broker-dealer of the status of the withdrawal.

Q: Can a broker-dealer withdraw its registration at any time?

A: Yes, a broker-dealer can withdraw its registration at any time by filing SEC Form 122 (BDW) and following the required procedures.

Q: Are there any consequences for withdrawing from broker-dealer registration?

A: Withdrawing from broker-dealer registration may have legal and regulatory consequences, including restrictions on future activities in the securities industry.

Q: Is legal advice required to file SEC Form 122 (BDW)?

A: While legal advice is not required, it is recommended that broker-dealers consult with legal professionals to ensure compliance with applicable laws and regulations.

Form Details:

- Released on April 1, 2007;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SEC Form 122 (BDW) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.