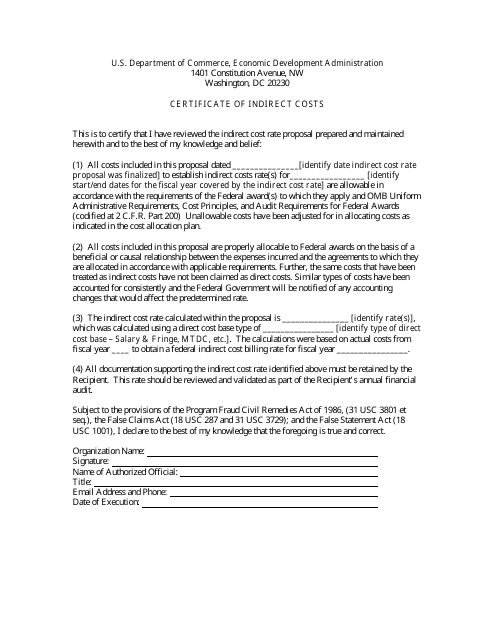

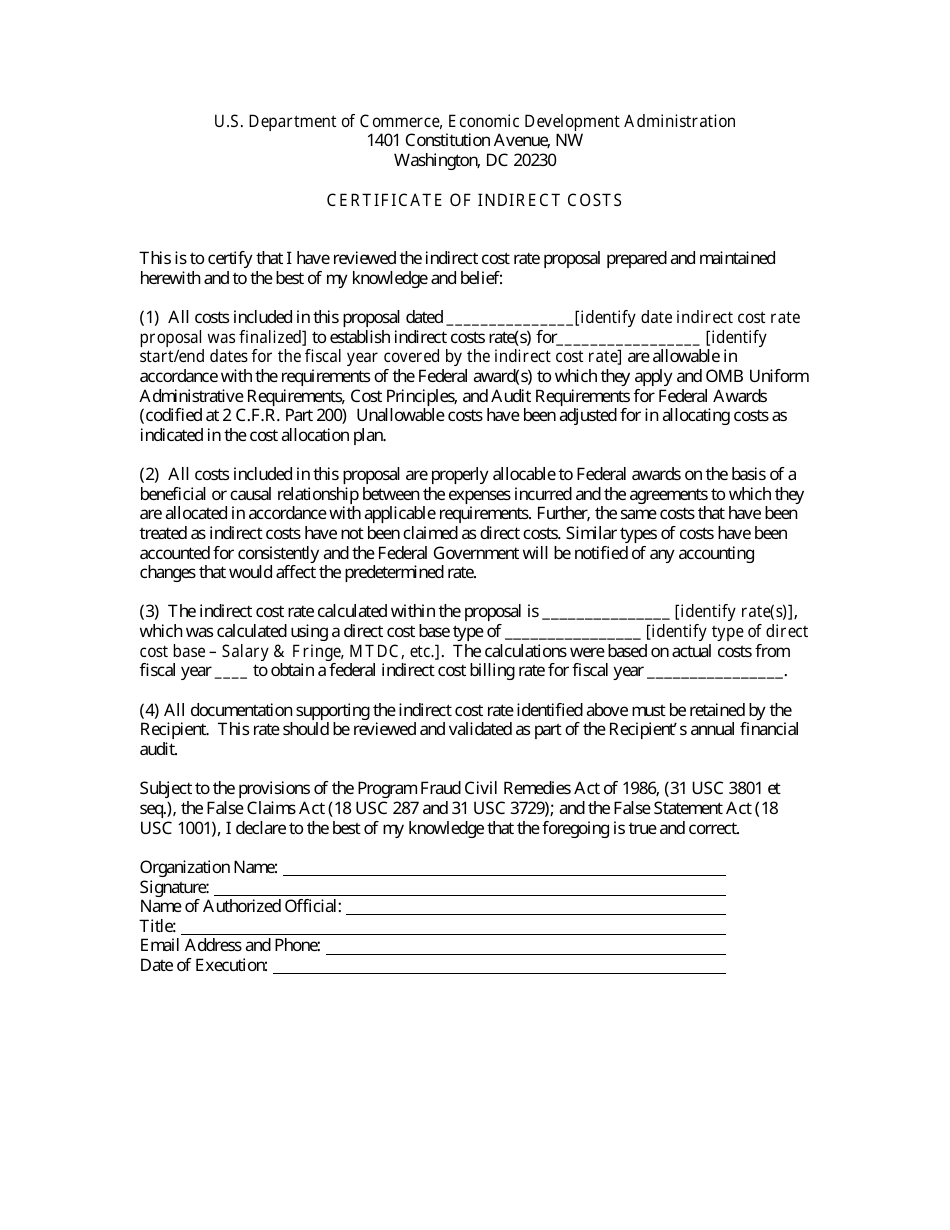

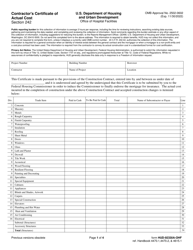

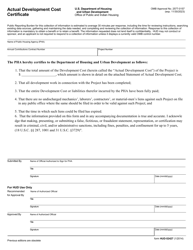

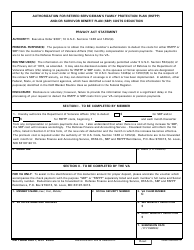

Certificate of Indirect Costs

Certificate of Indirect Costs is a 1-page legal document that was released by the U.S. Department of Commerce - Economic Development Administration and used nation-wide.

FAQ

Q: What is a Certificate of Indirect Costs?

A: A Certificate of Indirect Costs is a document that certifies the indirect costs incurred by an organization for a specific period.

Q: Why is a Certificate of Indirect Costs important?

A: A Certificate of Indirect Costs is important as it ensures accuracy and accountability in the allocation and recovery of indirect costs for federal funding.

Q: Who issues a Certificate of Indirect Costs?

A: A Certificate of Indirect Costs is typically issued by an organization's auditors or an accounting firm.

Q: What information does a Certificate of Indirect Costs contain?

A: A Certificate of Indirect Costs typically contains details of the organization's indirect costs, the period covered, and any specific terms or conditions.

Q: How is a Certificate of Indirect Costs used?

A: A Certificate of Indirect Costs is used to support reimbursement claims for indirect costs incurred by an organization.

Form Details:

- The latest edition currently provided by the U.S. Department of Commerce - Economic Development Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.