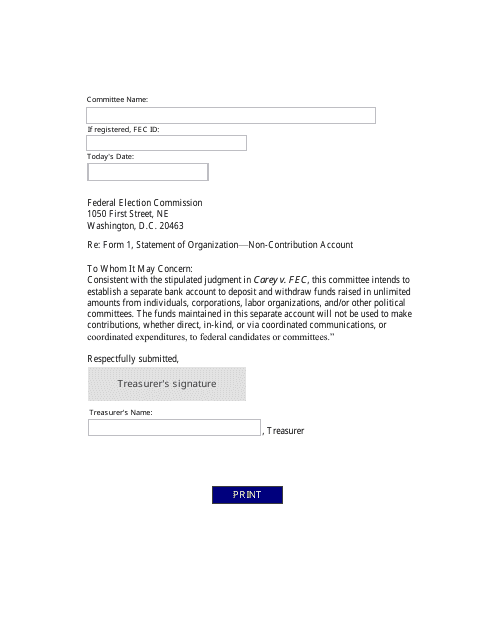

Non-contribution Letter

Non-contribution Letter is a 1-page legal document that was released by the Federal Election Commission and used nation-wide.

FAQ

Q: What is a non-contribution letter?

A: A non-contribution letter is a document that states that someone has not made any financial contributions to a specific cause or organization.

Q: Why would someone need a non-contribution letter?

A: Someone may need a non-contribution letter to prove that they have not financially supported a particular cause or organization.

Q: Who can provide a non-contribution letter?

A: The recipient of the contributions or the organization itself can provide a non-contribution letter.

Q: What information is typically included in a non-contribution letter?

A: A non-contribution letter usually includes the recipient's name, the date, a statement confirming that no contributions have been made, and contact information of the person or organization providing the letter.

Q: Is a non-contribution letter legally binding?

A: No, a non-contribution letter is not legally binding. It is simply a statement of fact regarding the lack of financial contributions.

Q: Can a non-contribution letter be used for tax purposes?

A: Yes, a non-contribution letter can be used as supporting documentation for individuals claiming deductions for charitable contributions on their tax returns.

Q: Can a non-contribution letter be requested by anyone?

A: Yes, anyone can request a non-contribution letter if they have not made any financial contributions to a specific cause or organization.

Q: Is a non-contribution letter the same as a donation receipt?

A: No, a non-contribution letter is not the same as a donation receipt. A donation receipt is issued to acknowledge and provide proof of a financial contribution, while a non-contribution letter states the absence of contributions.

Q: Can a non-contribution letter be used to refute a claim of contribution?

A: Yes, a non-contribution letter can be used as evidence to refute a claim of financial contribution if someone wrongly accuses you of making contributions to a cause or organization.

Q: How can someone request a non-contribution letter?

A: To request a non-contribution letter, contact the recipient of the contributions or the organization directly and provide them with your details and request.

Q: Does a non-contribution letter have an expiration date?

A: There is typically no expiration date on a non-contribution letter, as it reflects the absence of financial contributions up to the date of issuance.

Q: Can a non-contribution letter be used for legal purposes?

A: While a non-contribution letter is not legally binding, it can be used as supporting evidence in legal proceedings to demonstrate the lack of financial contributions.

Form Details:

- The latest edition currently provided by the Federal Election Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.