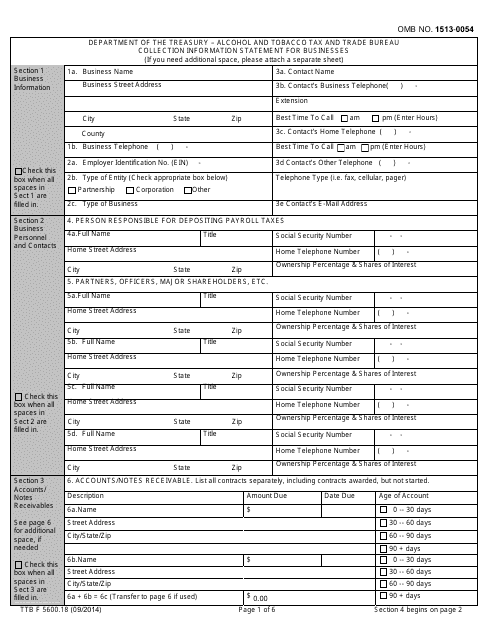

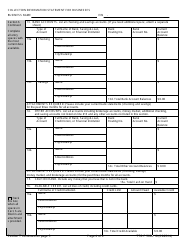

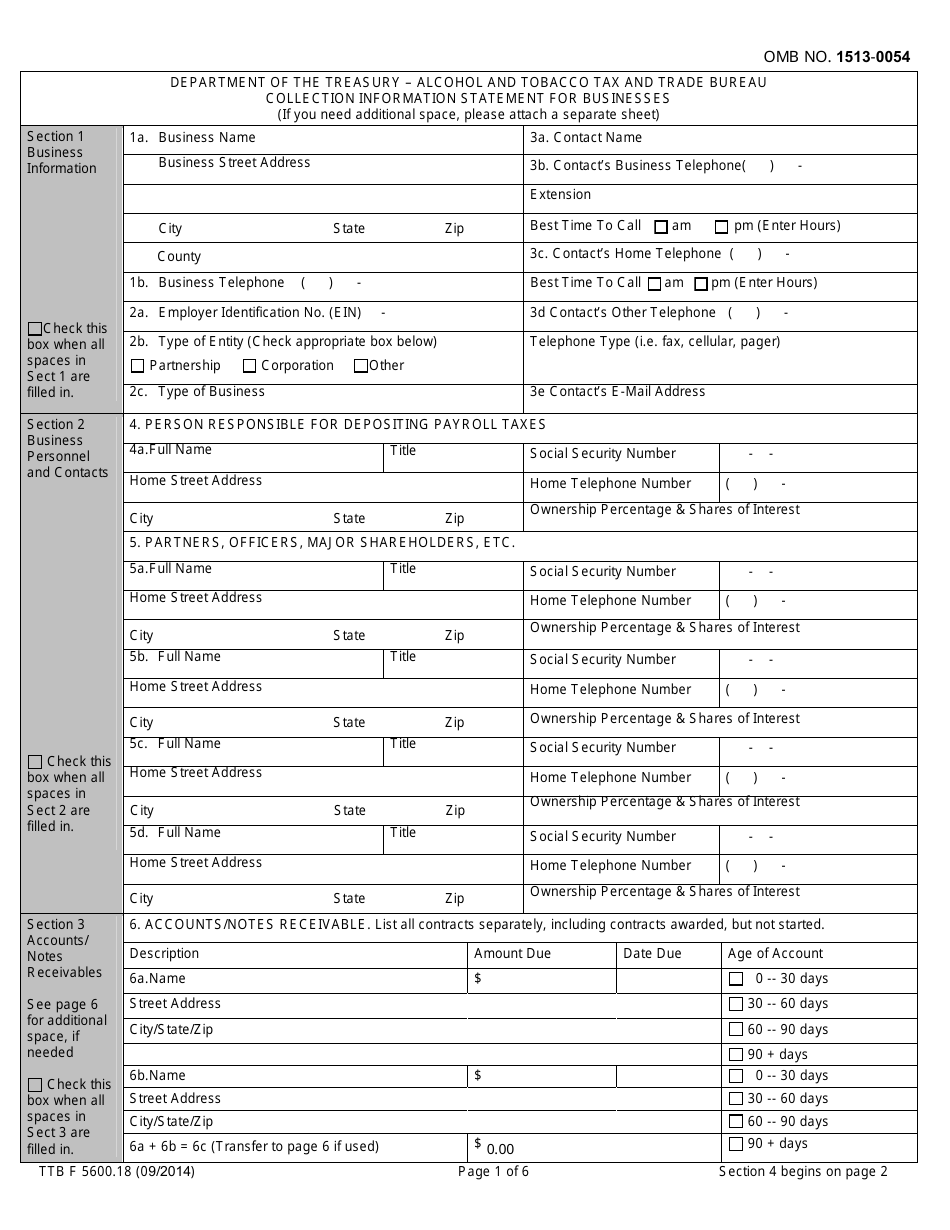

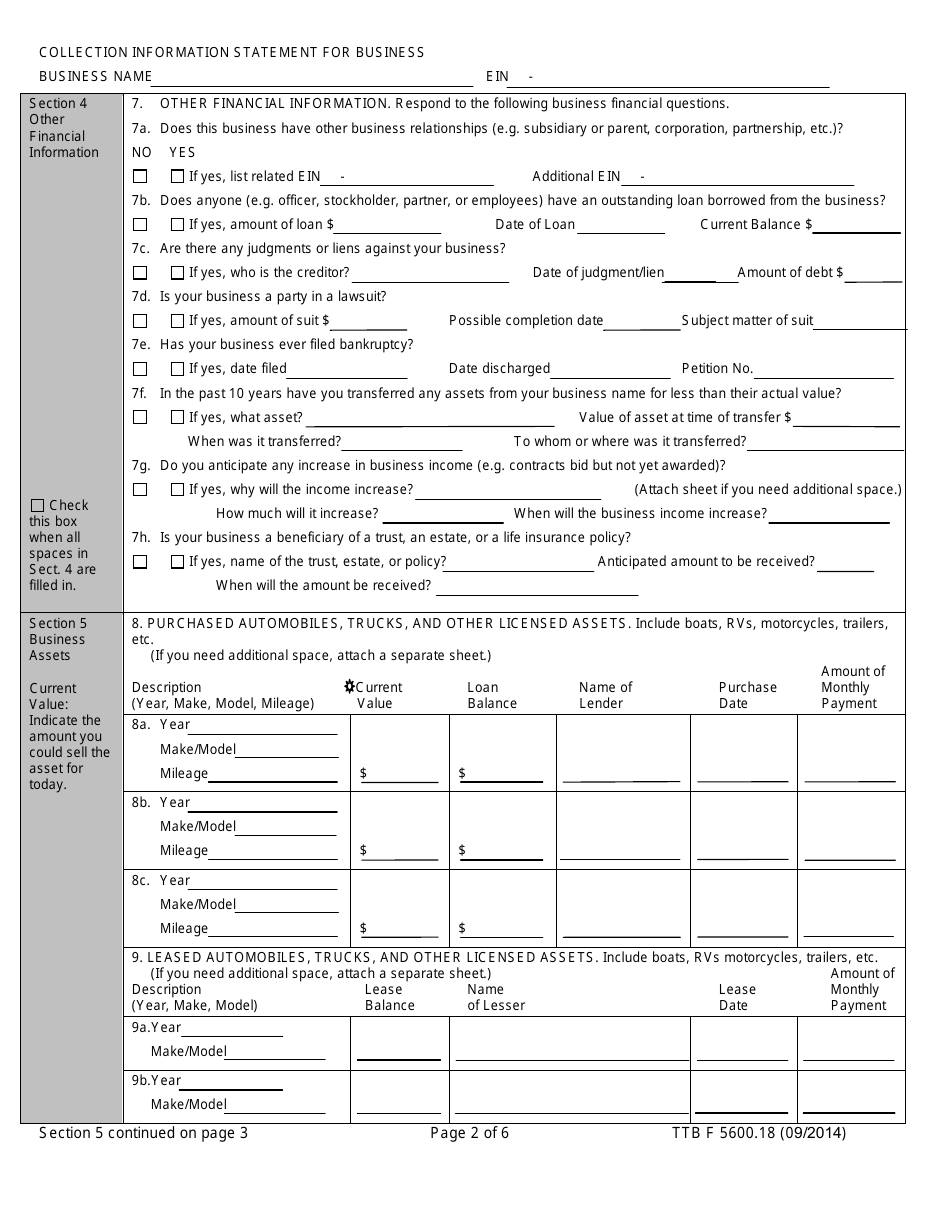

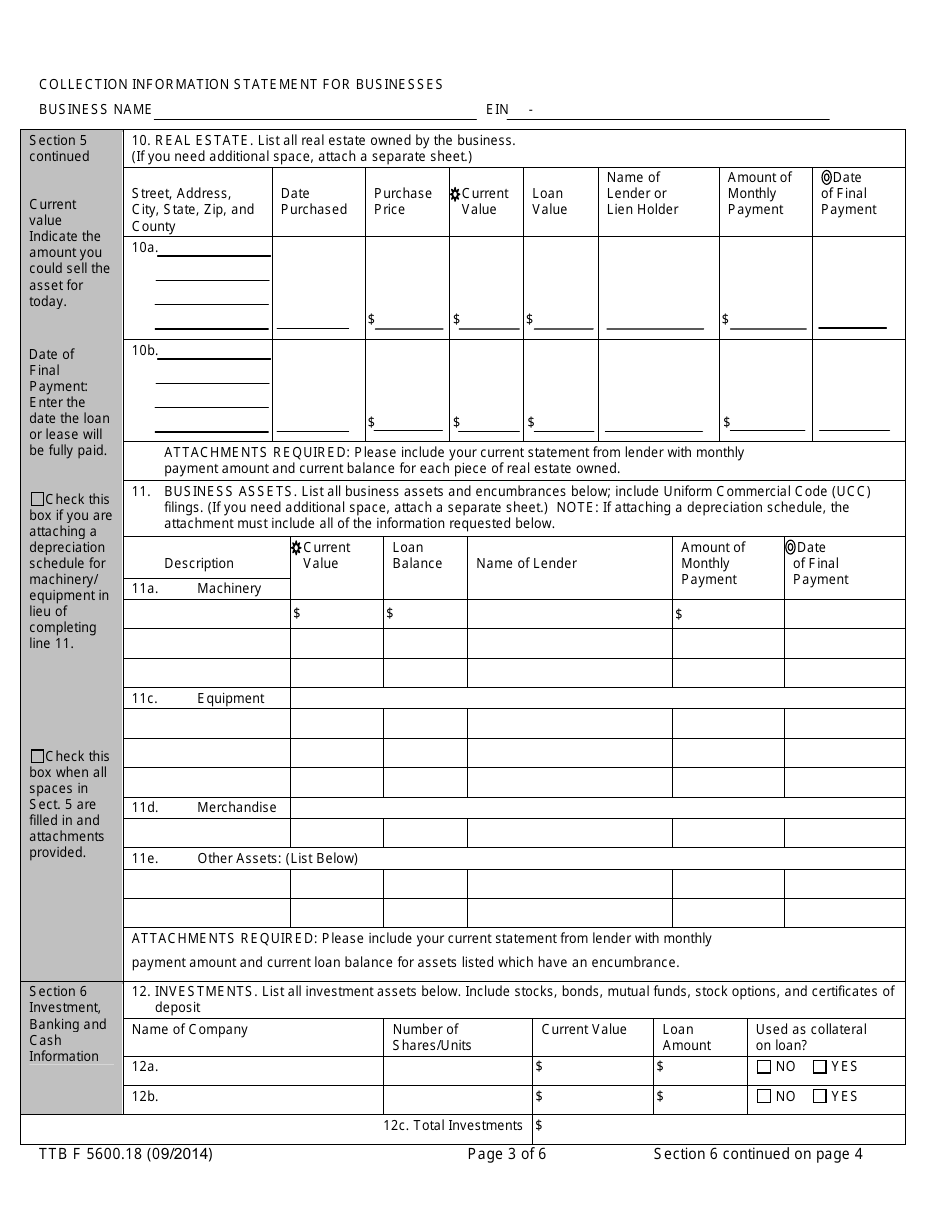

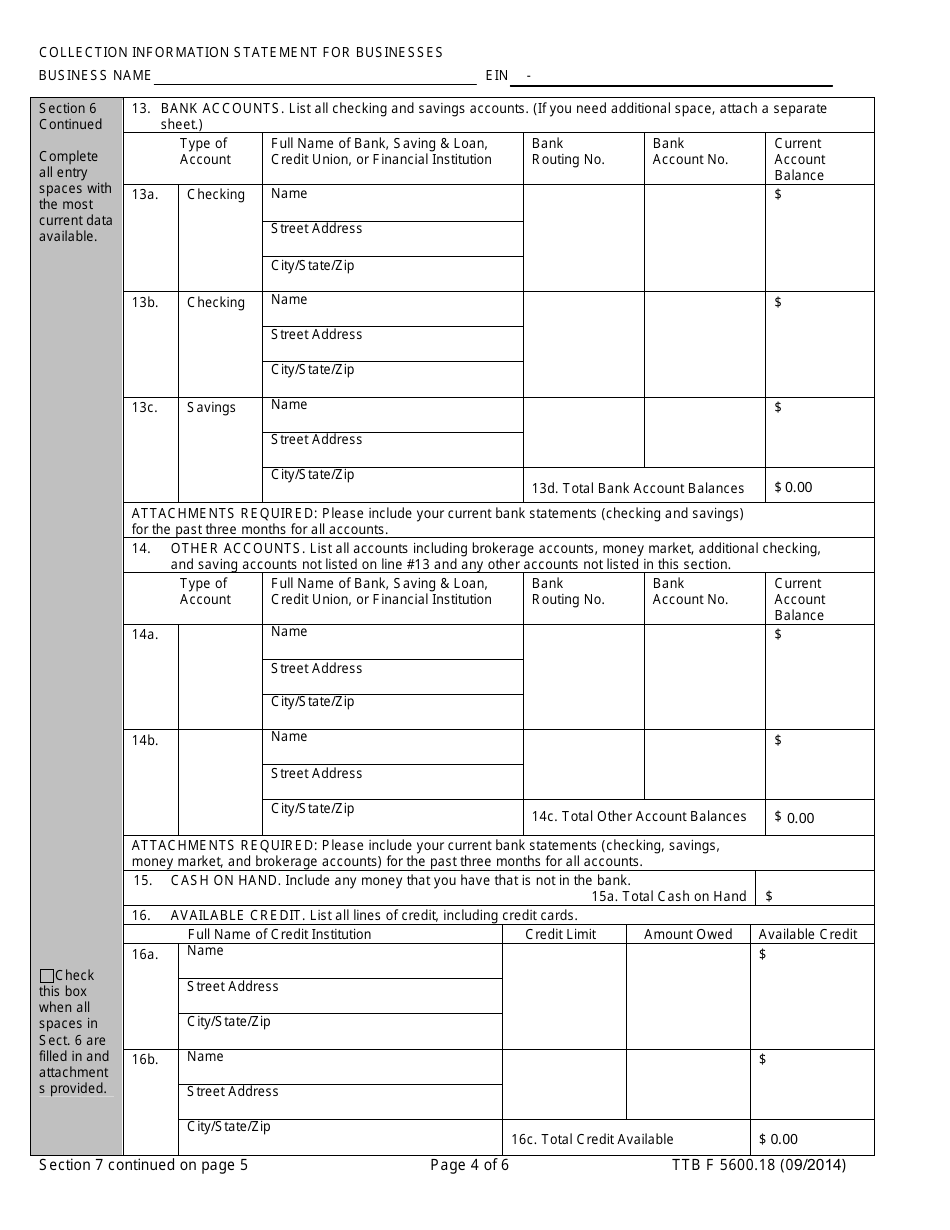

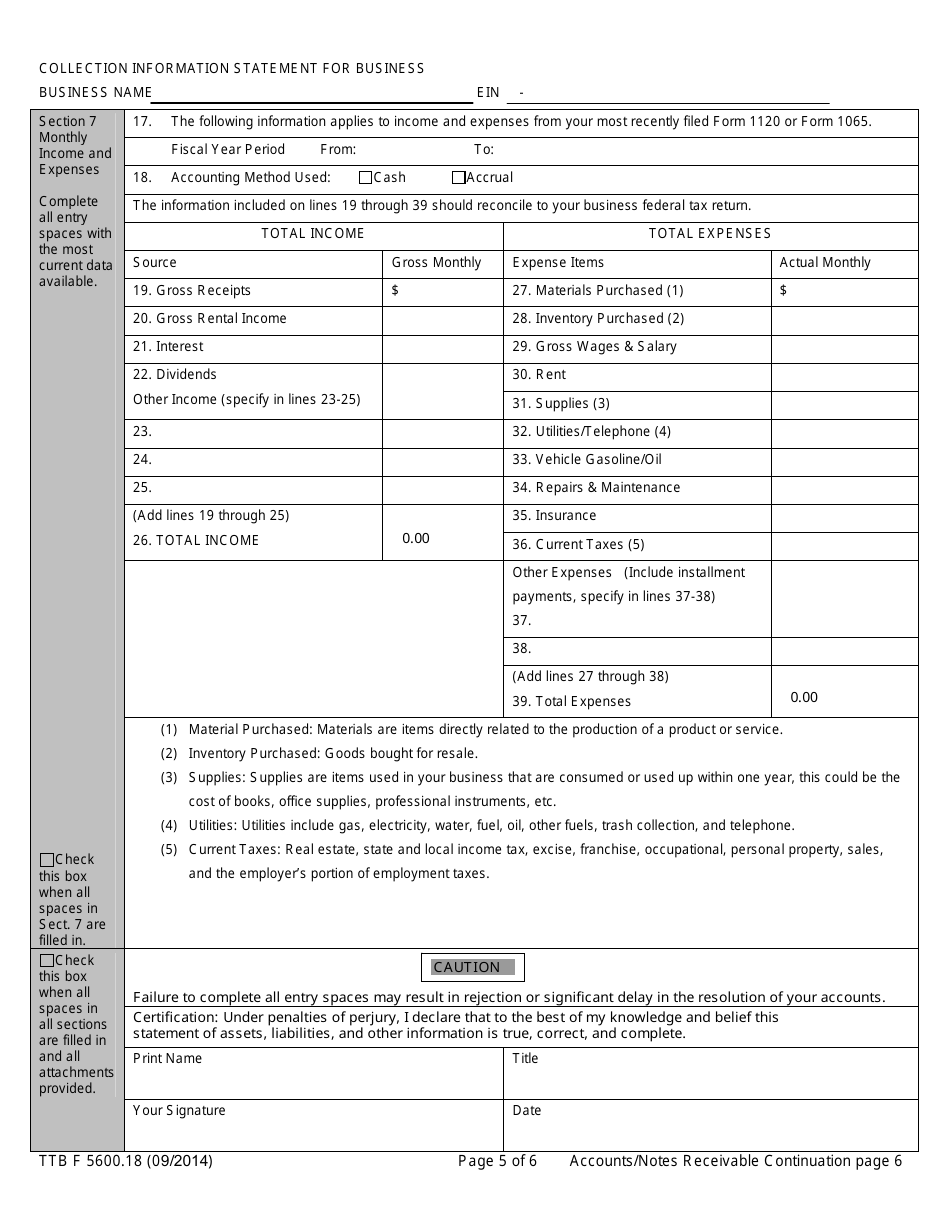

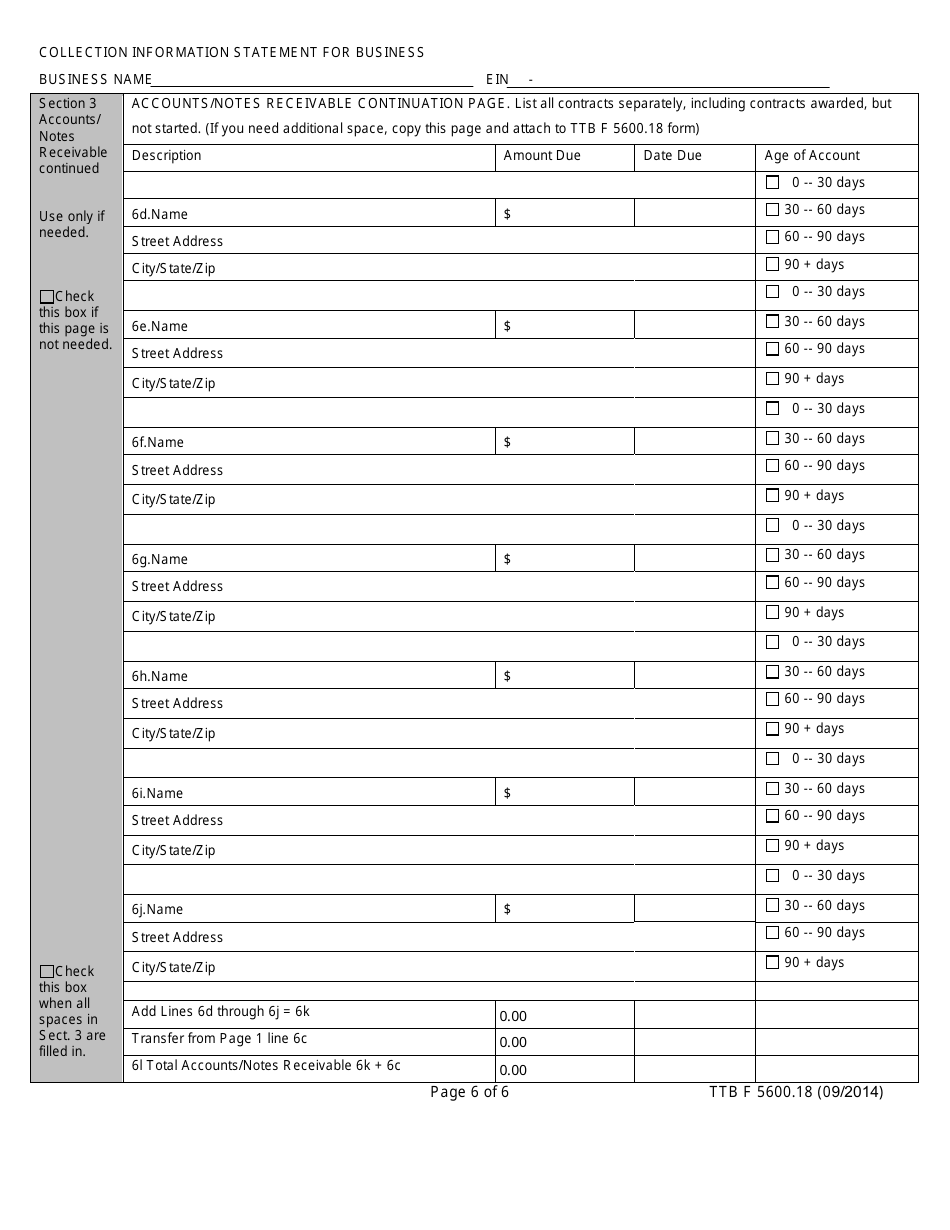

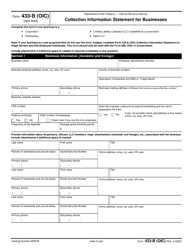

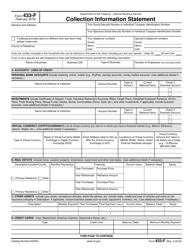

TTB Form 5600.18 Collection Information Statement for Businesses

What Is TTB Form 5600.18?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on September 1, 2014 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5600.18?

A: TTB Form 5600.18 is a Collection Information Statement for Businesses.

Q: Why is TTB Form 5600.18 used?

A: TTB Form 5600.18 is used to collect financial information from businesses regarding their tax liabilities.

Q: Who needs to fill out TTB Form 5600.18?

A: Businesses who are subject to tax liabilities in relation to alcohol, tobacco, firearms, or ammunition need to fill out TTB Form 5600.18.

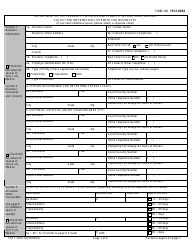

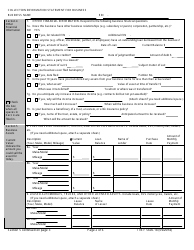

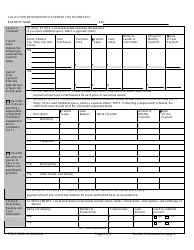

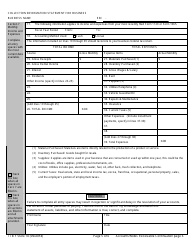

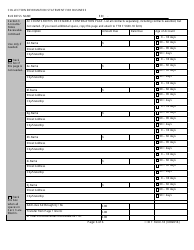

Q: What information is required on TTB Form 5600.18?

A: TTB Form 5600.18 requires information on the business's financial accounts, assets, liabilities, income, and expenses.

Q: Is TTB Form 5600.18 confidential?

A: Yes, the information provided on TTB Form 5600.18 is confidential and protected by law.

Q: What happens after submitting TTB Form 5600.18?

A: After submitting TTB Form 5600.18, the information provided will be used by the TTB to assess the business's tax liability and compliance.

Q: Are there any penalties for not filling out TTB Form 5600.18?

A: Yes, failure to provide the required information on TTB Form 5600.18 may result in penalties or other enforcement actions by the TTB.

Q: Can I get assistance in filling out TTB Form 5600.18?

A: Yes, you can seek guidance from the TTB or a tax professional to assist you in filling out TTB Form 5600.18.

Form Details:

- Released on September 1, 2014;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5600.18 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.