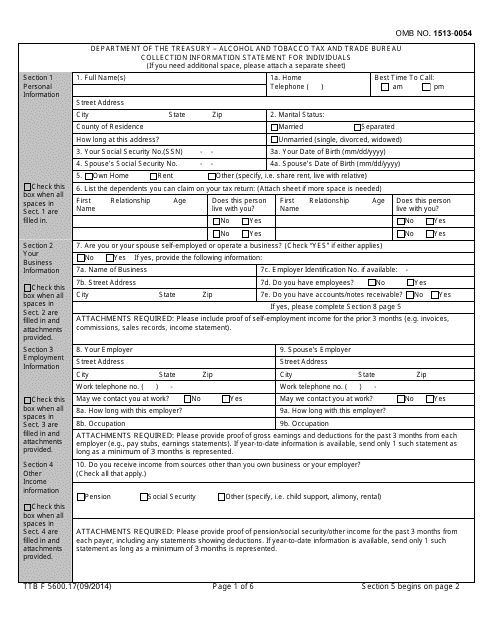

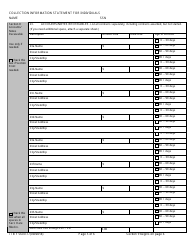

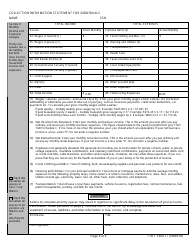

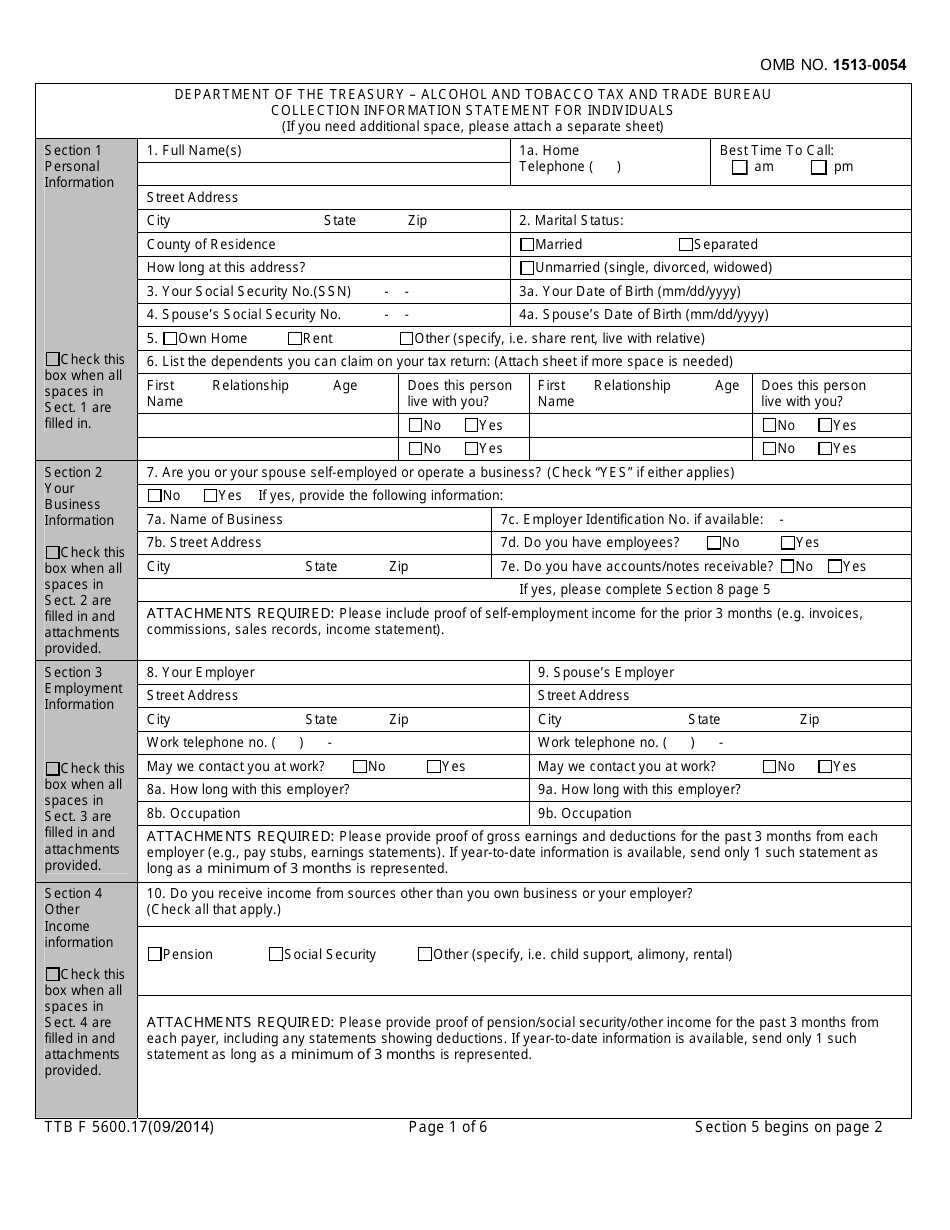

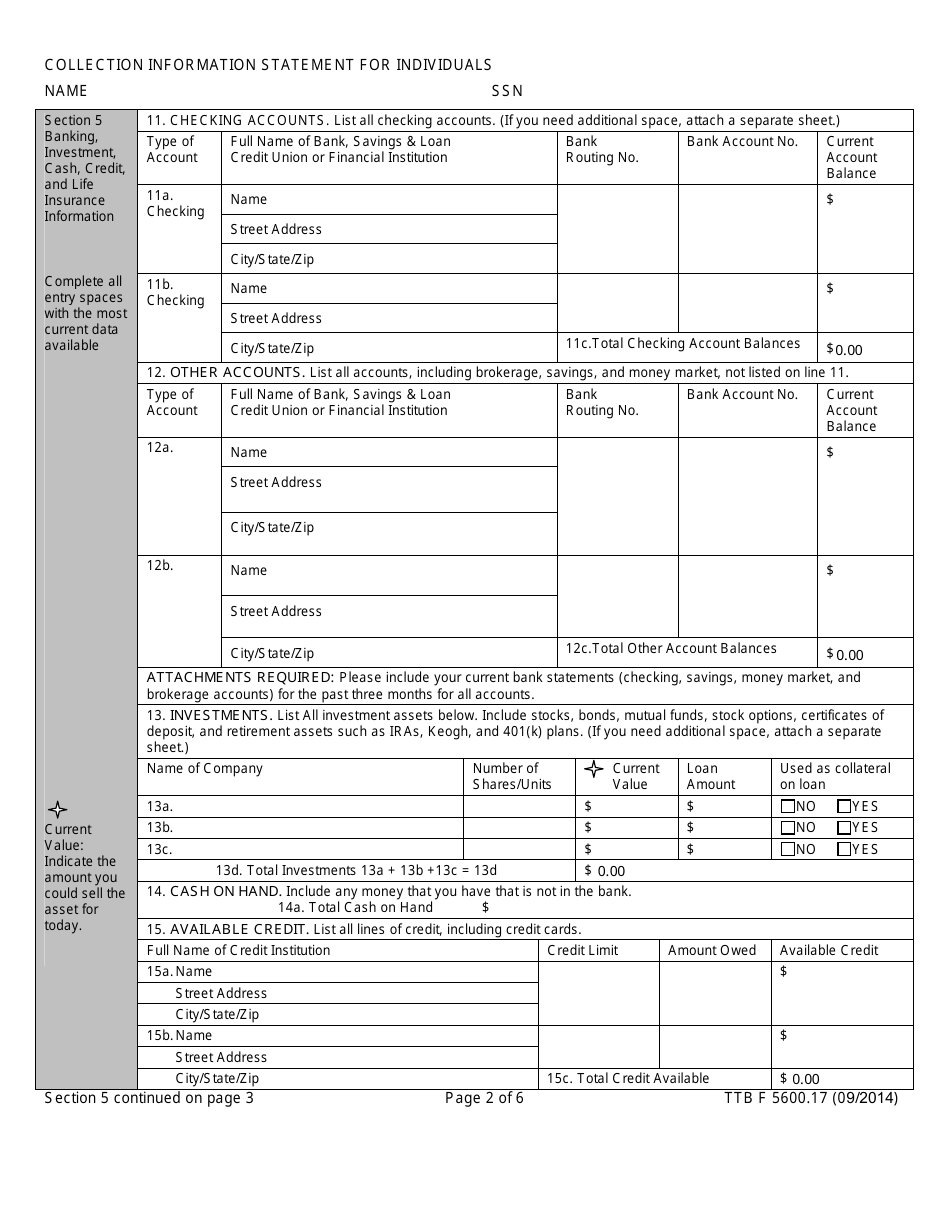

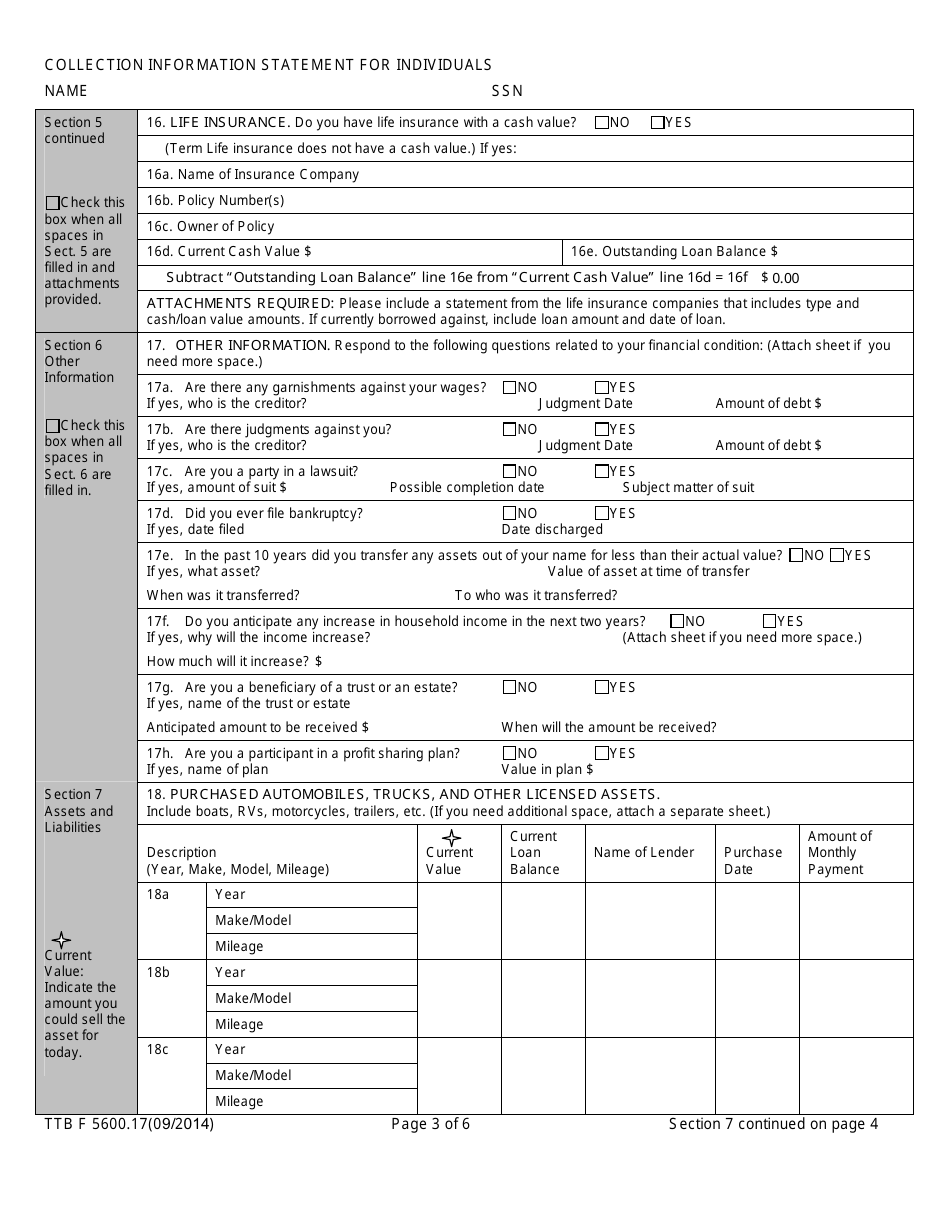

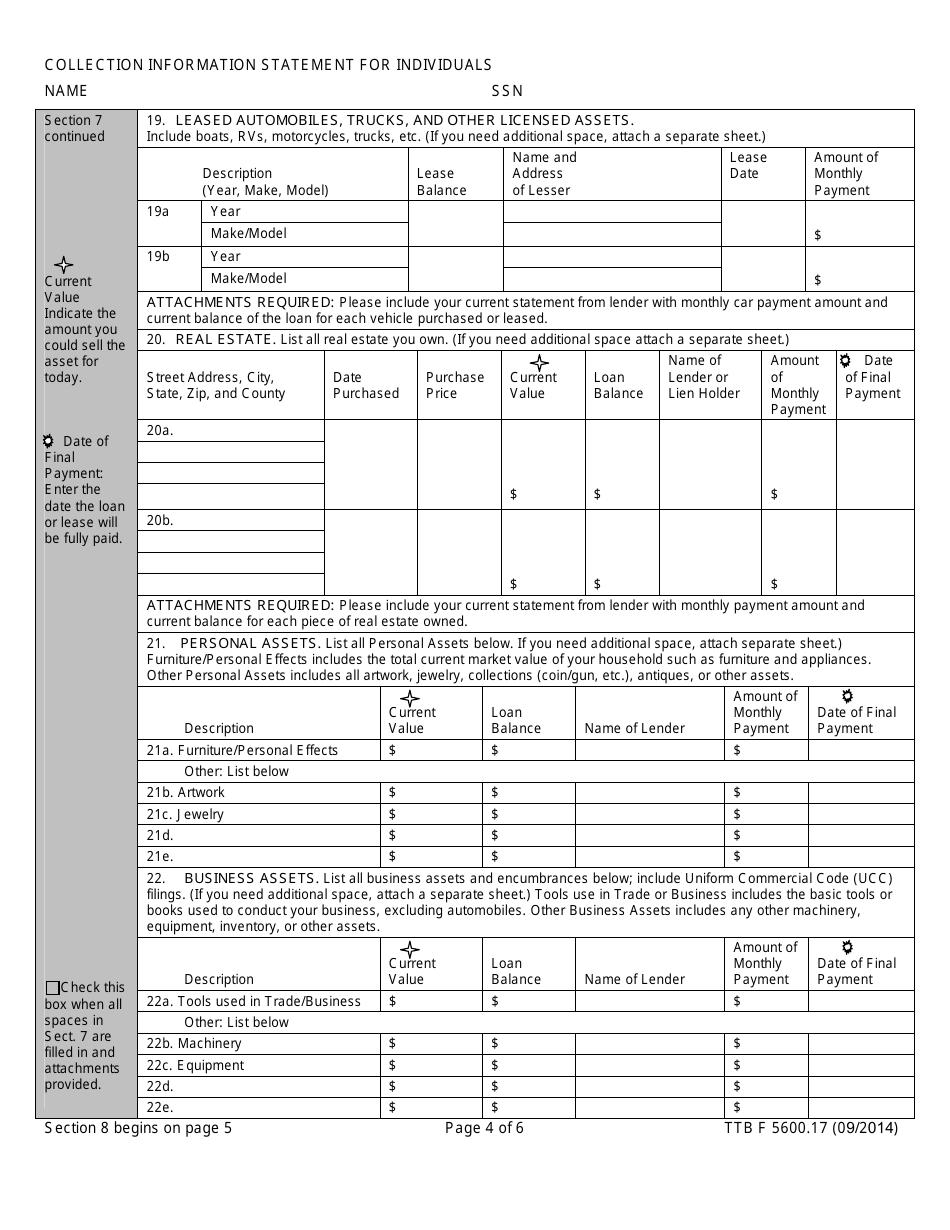

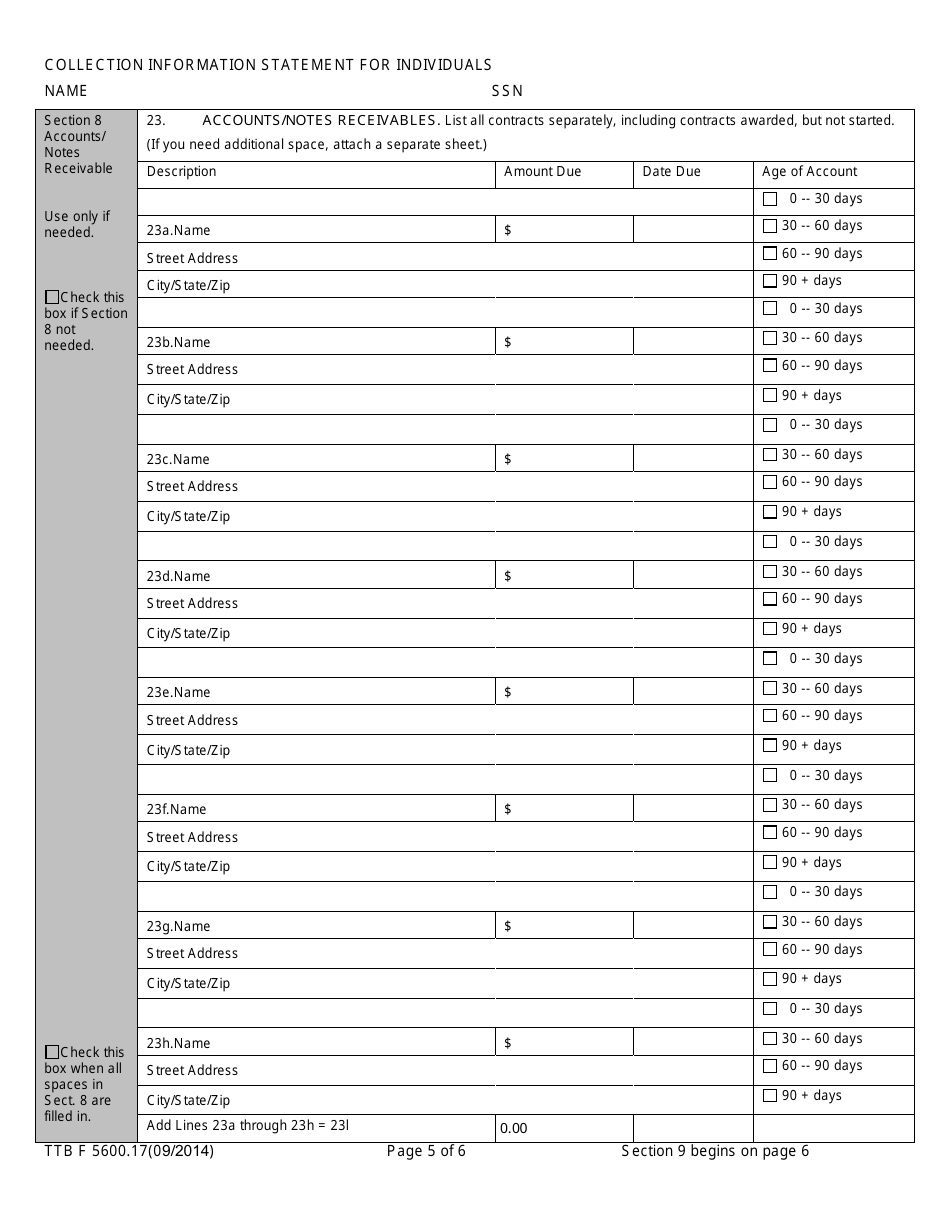

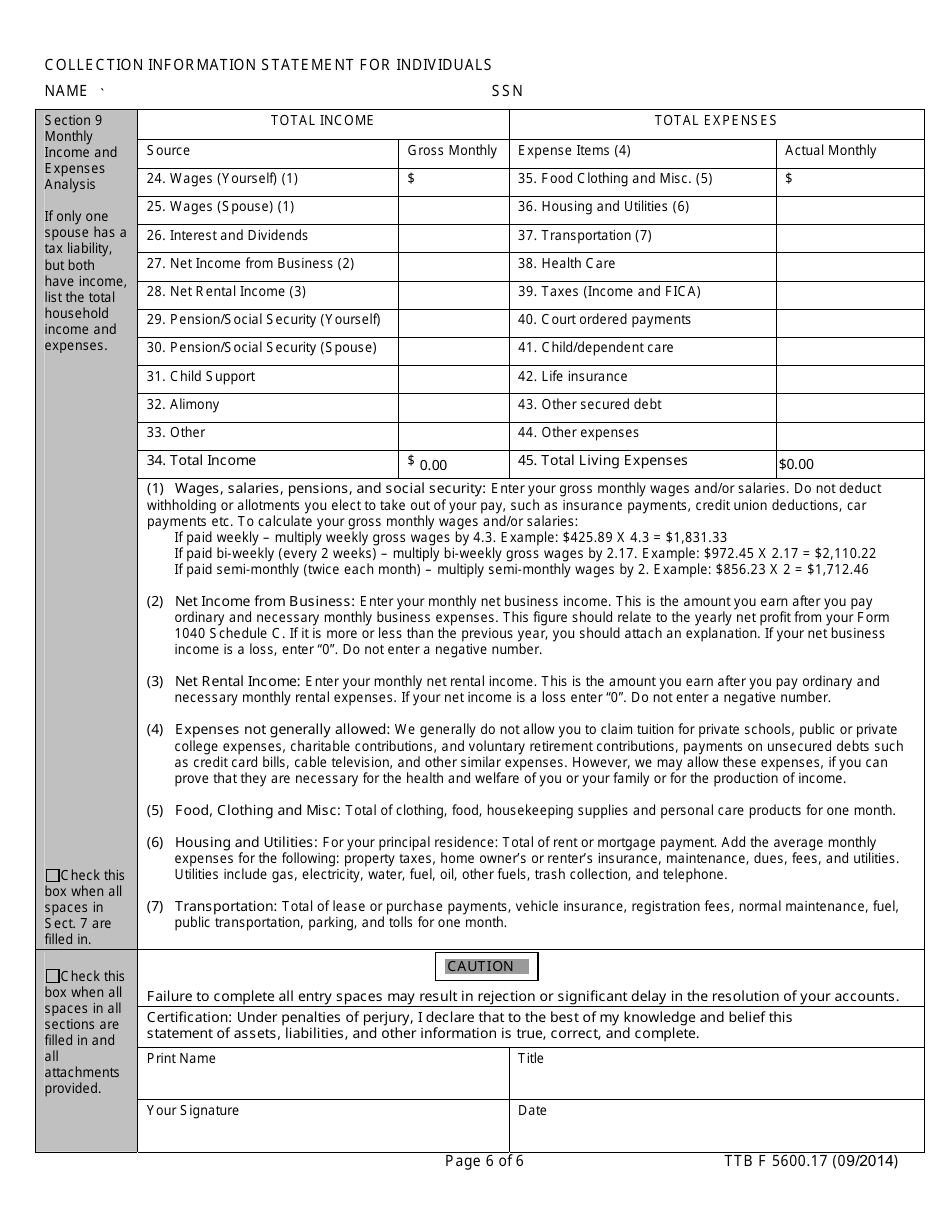

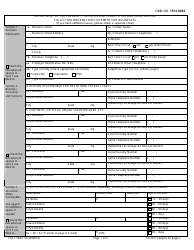

TTB Form 5600.17 Collection Information Statement for Individuals

What Is TTB Form 5600.17?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on September 1, 2014 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5600.17?

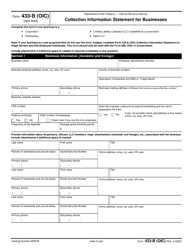

A: TTB Form 5600.17, also known as Collection Information Statement for Individuals, is a form used by the Alcohol and Tobacco Tax and Trade Bureau (TTB) to collect financial information from individuals who owe delinquent taxes or penalties.

Q: Why do I need to fill out TTB Form 5600.17?

A: You may need to fill out TTB Form 5600.17 if you owe delinquent taxes or penalties to the Alcohol and Tobacco Tax and Trade Bureau. It is used to collect financial information to help the TTB determine your ability to pay.

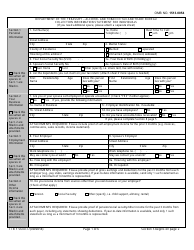

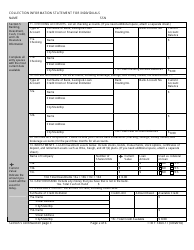

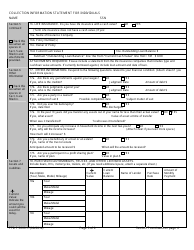

Q: What information is required on TTB Form 5600.17?

A: TTB Form 5600.17 requires you to provide personal and financial information, including your name, address, social security number, income, assets, and liabilities.

Q: Is TTB Form 5600.17 confidential?

A: Yes, the information you provide on TTB Form 5600.17 is confidential and protected by law. It will only be used for purposes authorized by the TTB.

Q: What happens after I submit TTB Form 5600.17?

A: After you submit TTB Form 5600.17, the TTB will review your financial information to determine your ability to pay the delinquent taxes or penalties. They may use this information to negotiate a payment plan or take other enforcement actions.

Form Details:

- Released on September 1, 2014;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5600.17 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.