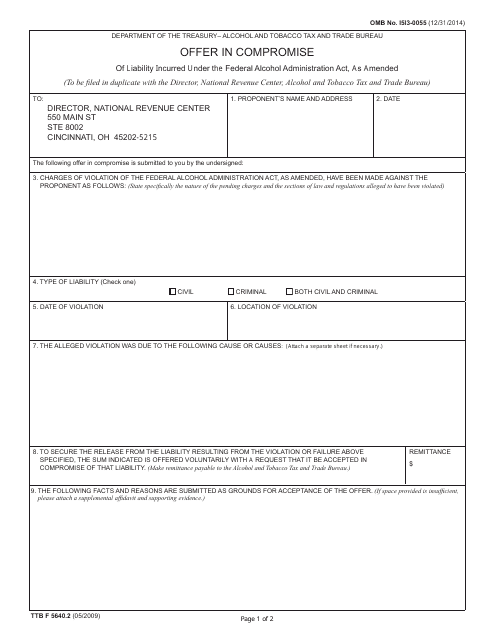

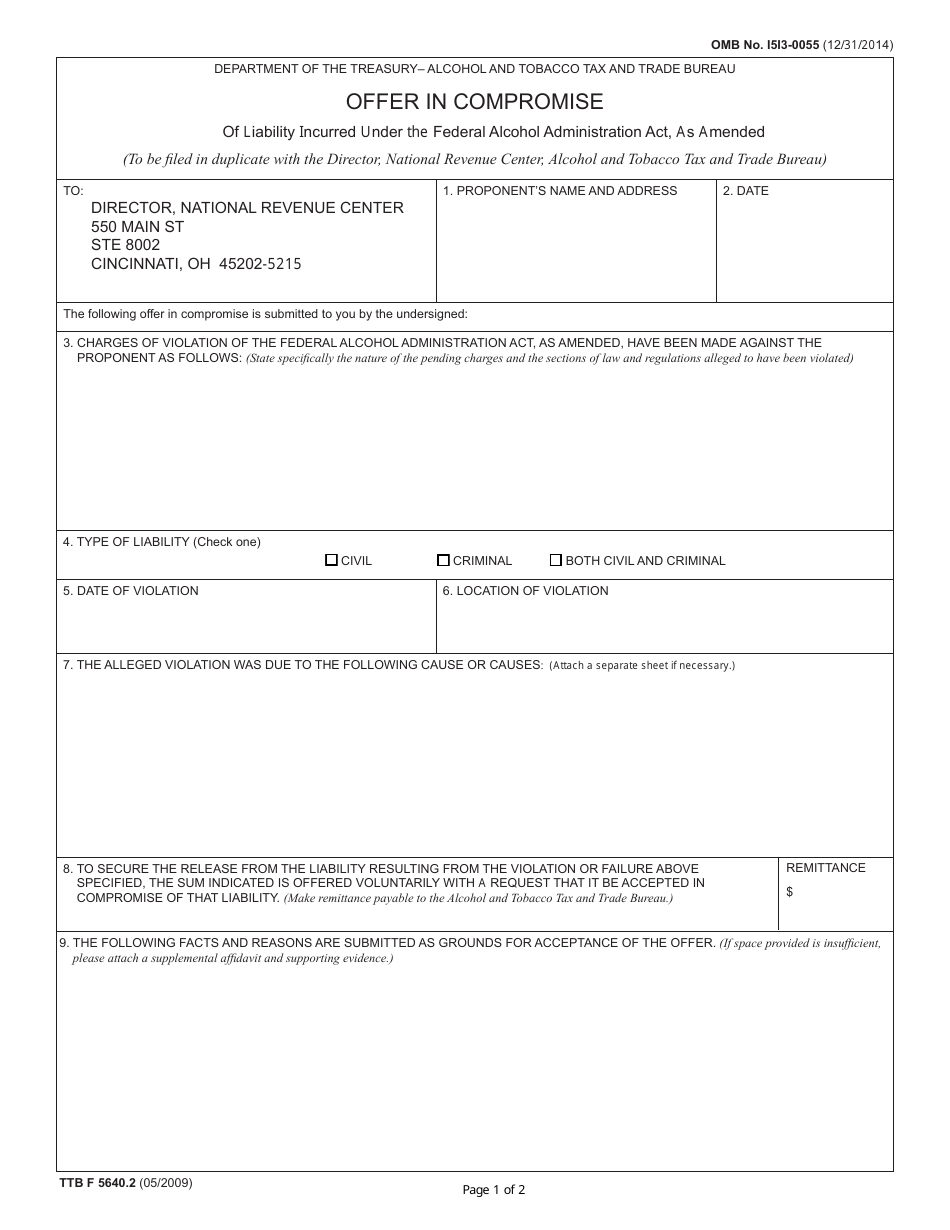

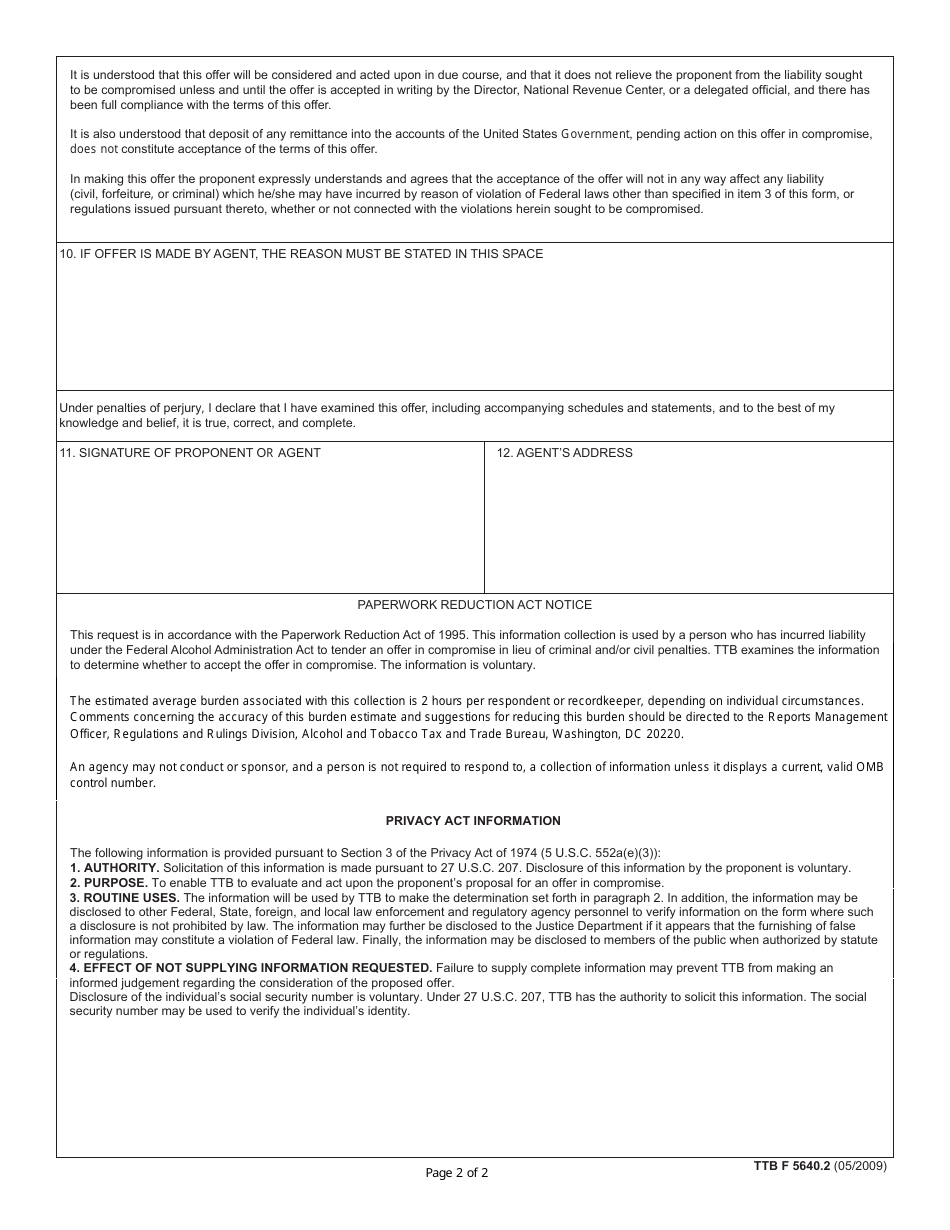

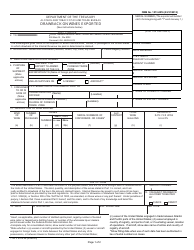

TTB Form 5640.2 Offer in Compromise for Federal Alcohol Administration Act (FAA Act) Violations

What Is TTB Form 5640.2?

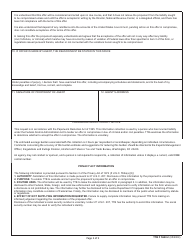

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on May 1, 2009 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5640.2?

A: TTB Form 5640.2 is a form used for an Offer in Compromise for Federal Alcohol Administration Act (FAA Act) violations.

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a settlement agreement offered by the taxpayer to resolve their tax liability for less than the full amount owed.

Q: What is the Federal Alcohol Administration Act (FAA Act)?

A: The Federal Alcohol Administration Act (FAA Act) is a federal law that regulates the production and distribution of alcohol.

Q: What are violations of the FAA Act?

A: Violations of the FAA Act can include selling alcohol without a license, selling alcohol to minors, or engaging in deceptive labeling or advertising practices.

Q: Why would someone file an Offer in Compromise for FAA Act violations?

A: Someone may file an Offer in Compromise for FAA Act violations if they are unable to pay the full amount of the penalties or fines imposed for their violations.

Q: How can someone file an Offer in Compromise for FAA Act violations?

A: To file an Offer in Compromise for FAA Act violations, the taxpayer must complete and submit TTB Form 5640.2 to the Alcohol and Tobacco Tax and Trade Bureau (TTB).

Q: Is approval guaranteed with an Offer in Compromise?

A: No, approval of an Offer in Compromise is not guaranteed. The TTB will review the offer and determine whether it is appropriate to accept.

Q: What happens if an Offer in Compromise is accepted?

A: If an Offer in Compromise is accepted, the taxpayer will need to comply with the terms of the agreement, which may include making partial payment and adhering to certain restrictions or regulations.

Q: What happens if an Offer in Compromise is rejected?

A: If an Offer in Compromise is rejected, the taxpayer will need to explore other options for resolving their tax liability, such as entering into a payment plan or appealing the decision.

Q: Can legal assistance be sought when filing an Offer in Compromise?

A: Yes, taxpayers may seek legal assistance when filing an Offer in Compromise to ensure they have a thorough understanding of the process and maximize their chances of success.

Form Details:

- Released on May 1, 2009;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5640.2 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.