This version of the form is not currently in use and is provided for reference only. Download this version of

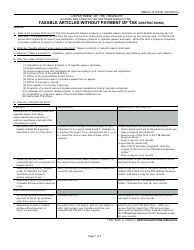

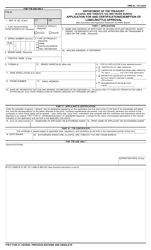

TTB Form 5600.38

for the current year.

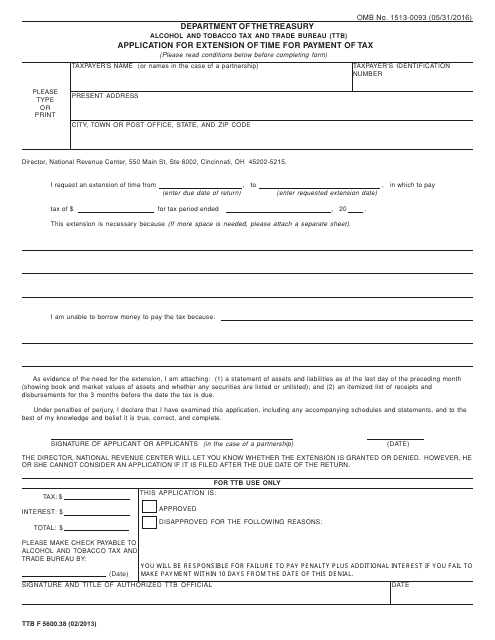

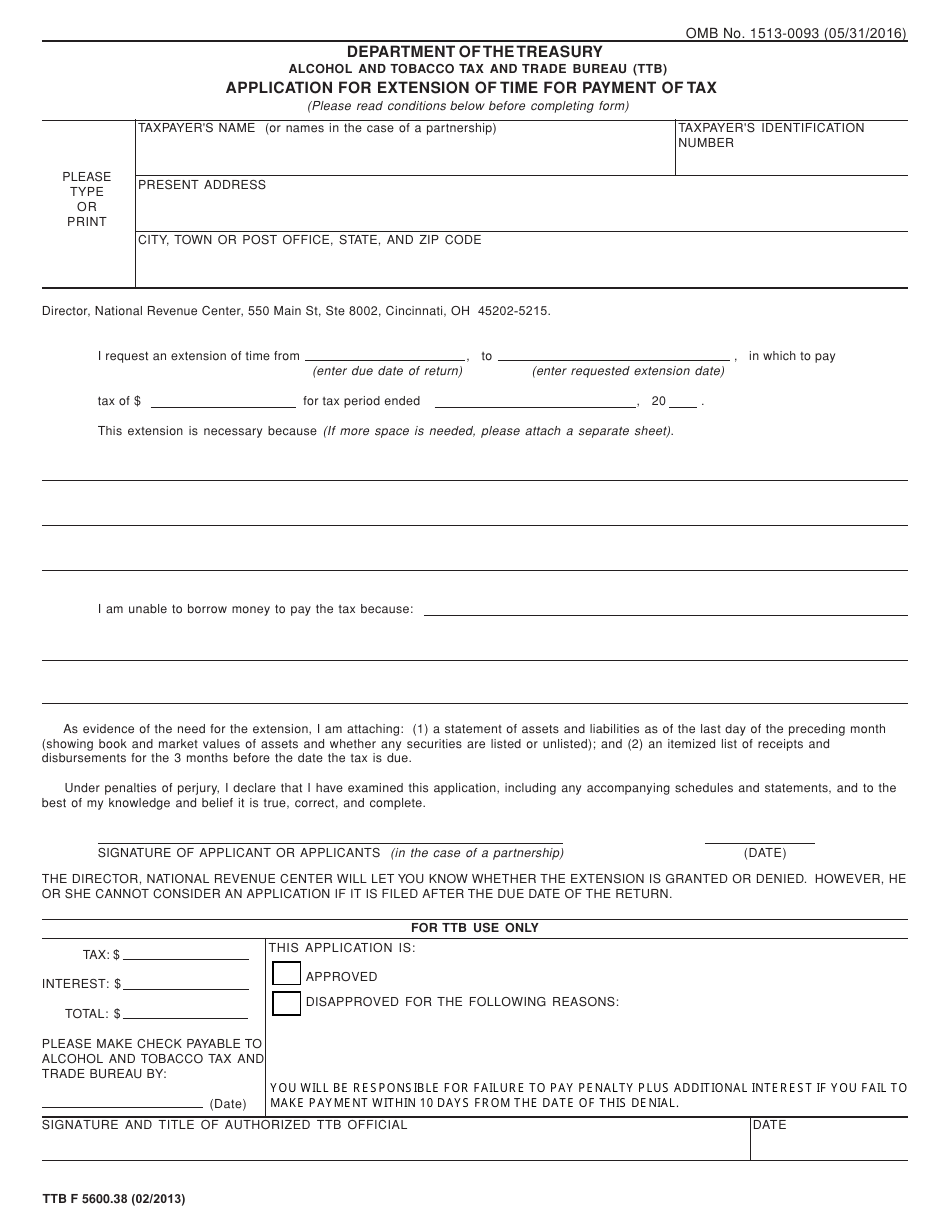

TTB Form 5600.38 Application for Extension of Time for Payment of Tax

What Is TTB Form 5600.38?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on February 1, 2013 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5600.38?

A: TTB Form 5600.38 is an application for extension of time for payment of tax.

Q: Who can use TTB Form 5600.38?

A: Anyone who needs additional time to pay their tax owed can use this form.

Q: Is there a fee for filing TTB Form 5600.38?

A: No, there is no fee for filing this form.

Q: What information is required on TTB Form 5600.38?

A: The form asks for basic information such as taxpayer identification number, tax period, and the reason for requesting an extension.

Q: How long is the extension of time granted?

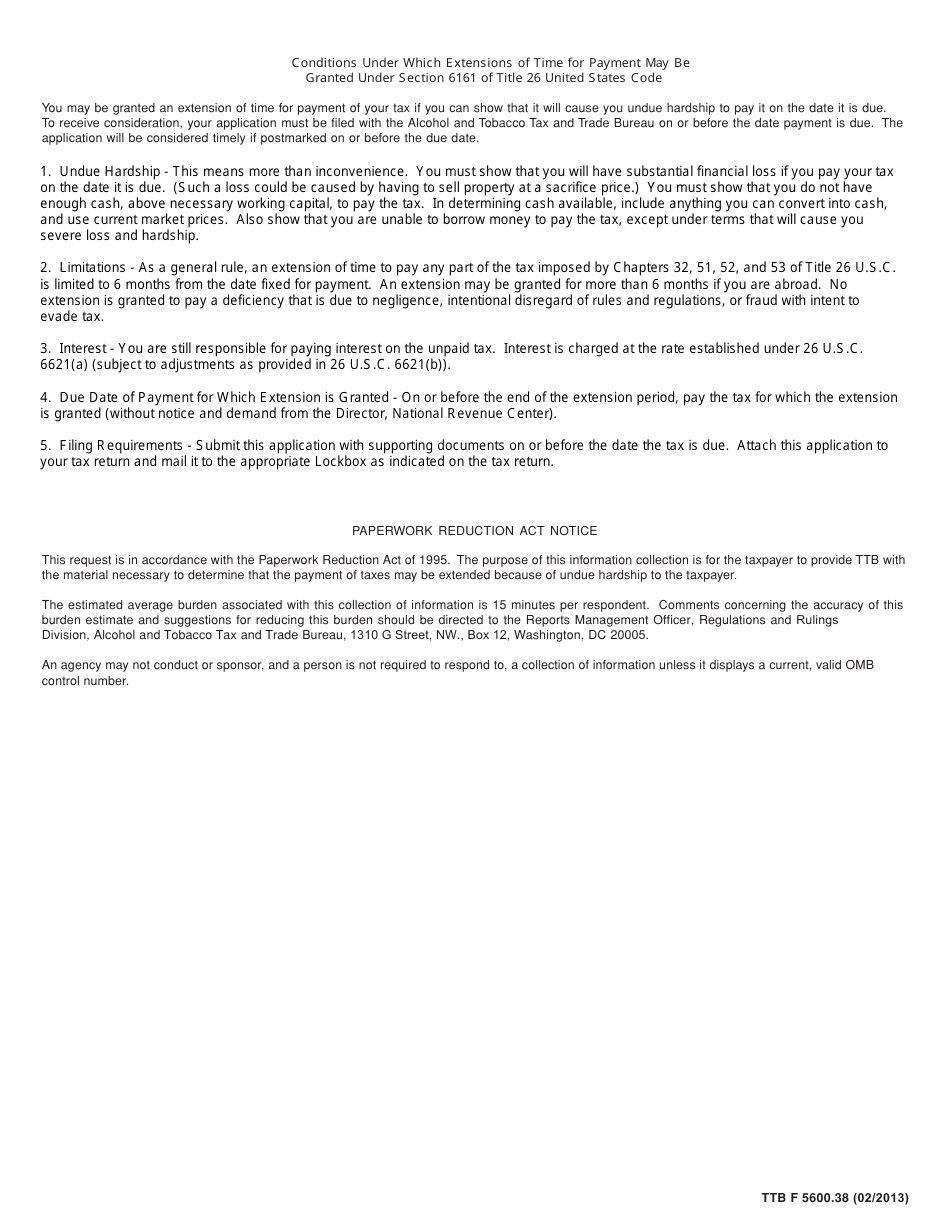

A: The length of the extension varies depending on the circumstances, but it is typically a few months.

Q: Can I file TTB Form 5600.38 electronically?

A: No, this form must be filed by mail.

Q: What if I don't submit TTB Form 5600.38 and miss the payment deadline?

A: You may be subject to penalties and interest charges for late payment.

Q: Can I request multiple extensions using this form?

A: Yes, you can request more than one extension using TTB Form 5600.38, but each request must be submitted separately.

Form Details:

- Released on February 1, 2013;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5600.38 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.