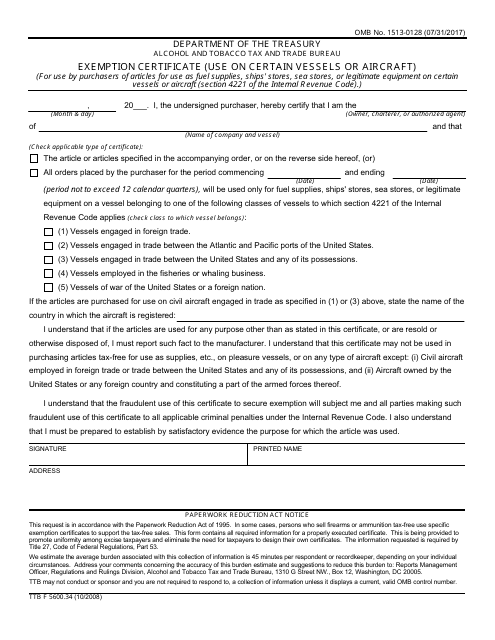

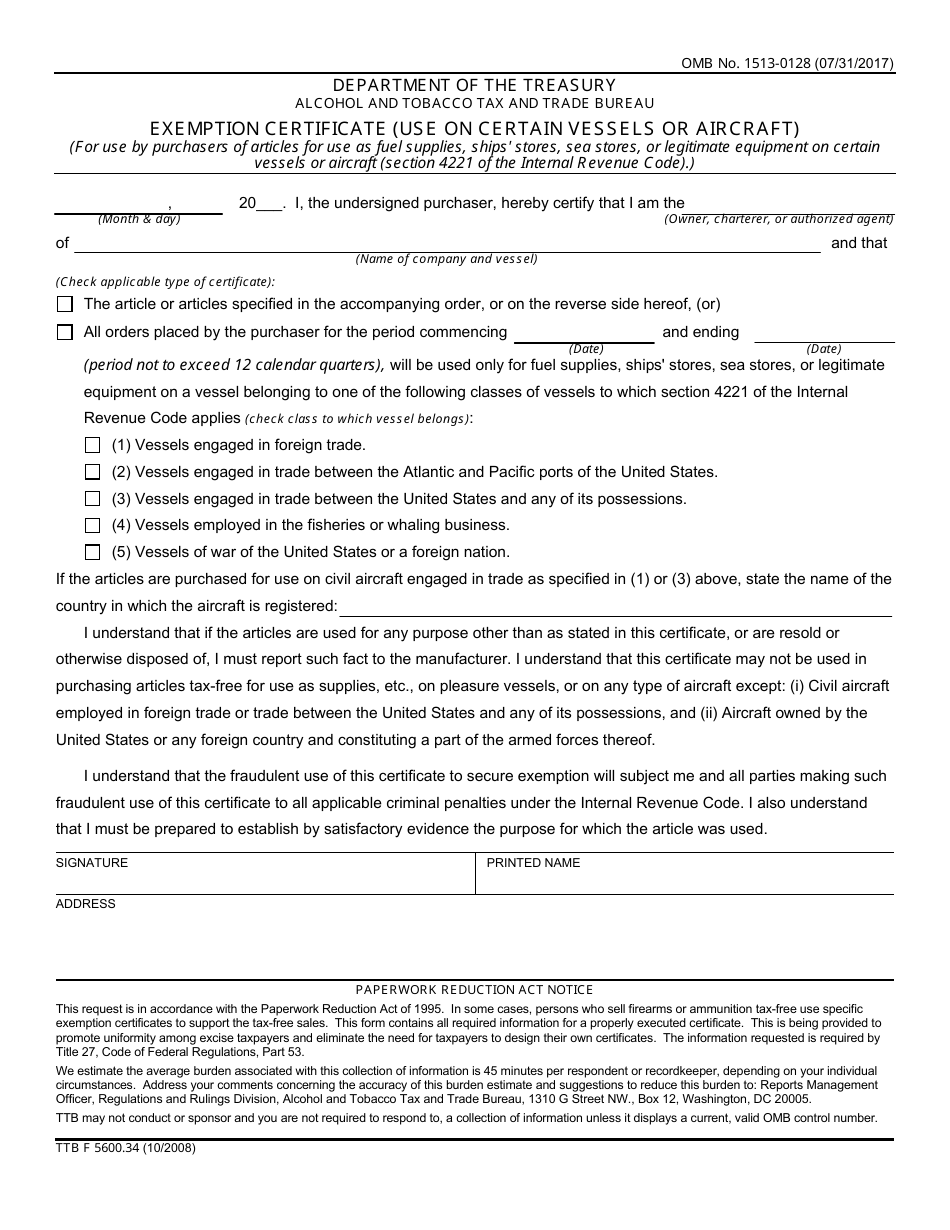

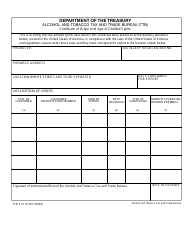

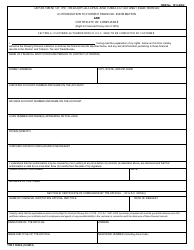

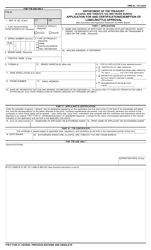

TTB Form 5600.34 Exemption Certificate (Use on Certain Vessels or Aircraft)

What Is TTB Form 5600.34?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on October 1, 2008 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5600.34?

A: TTB Form 5600.34 is the Exemption Certificate for use on certain vessels or aircraft.

Q: What is the purpose of TTB Form 5600.34?

A: The purpose of TTB Form 5600.34 is to certify that certain alcoholic beverages are not subject to Federal Excise Tax when used on certain vessels or aircraft.

Q: Who should use TTB Form 5600.34?

A: Vessel or aircraft operators who serve alcoholic beverages and want to claim an exemption from Federal Excise Tax should use TTB Form 5600.34.

Q: What type of vessels or aircraft are eligible for the exemption?

A: Certain vessels or aircraft engaged in international trade or transport, or in the internal waters or territorial seas of the United States, may be eligible for the exemption.

Q: What information is required on TTB Form 5600.34?

A: The form requires information about the vessel or aircraft operator, the type of vessel or aircraft, the ports or points of arrival and departure, and a declaration of the intended use of the alcoholic beverages.

Form Details:

- Released on October 1, 2008;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5600.34 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.