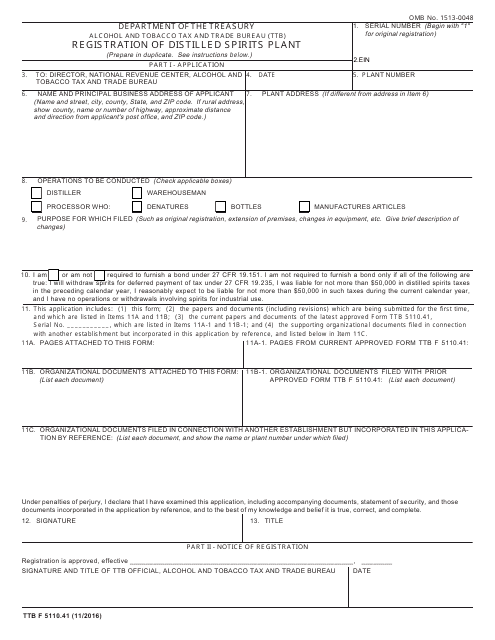

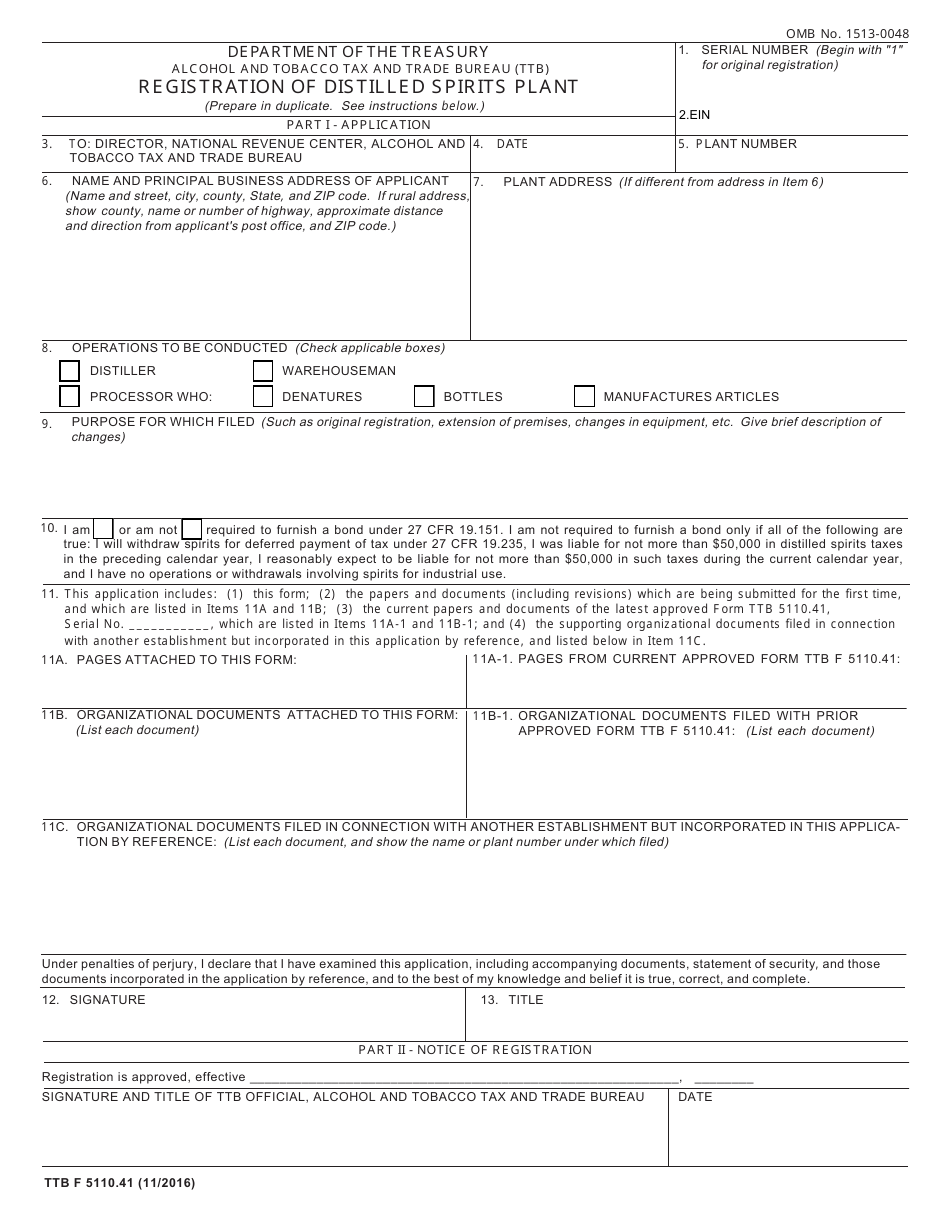

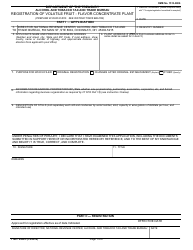

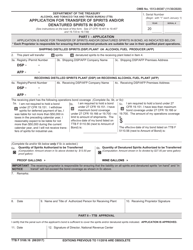

TTB Form 5110.41 Registration of Distilled Spirits Plant

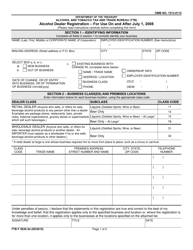

What Is TTB Form 5110.41?

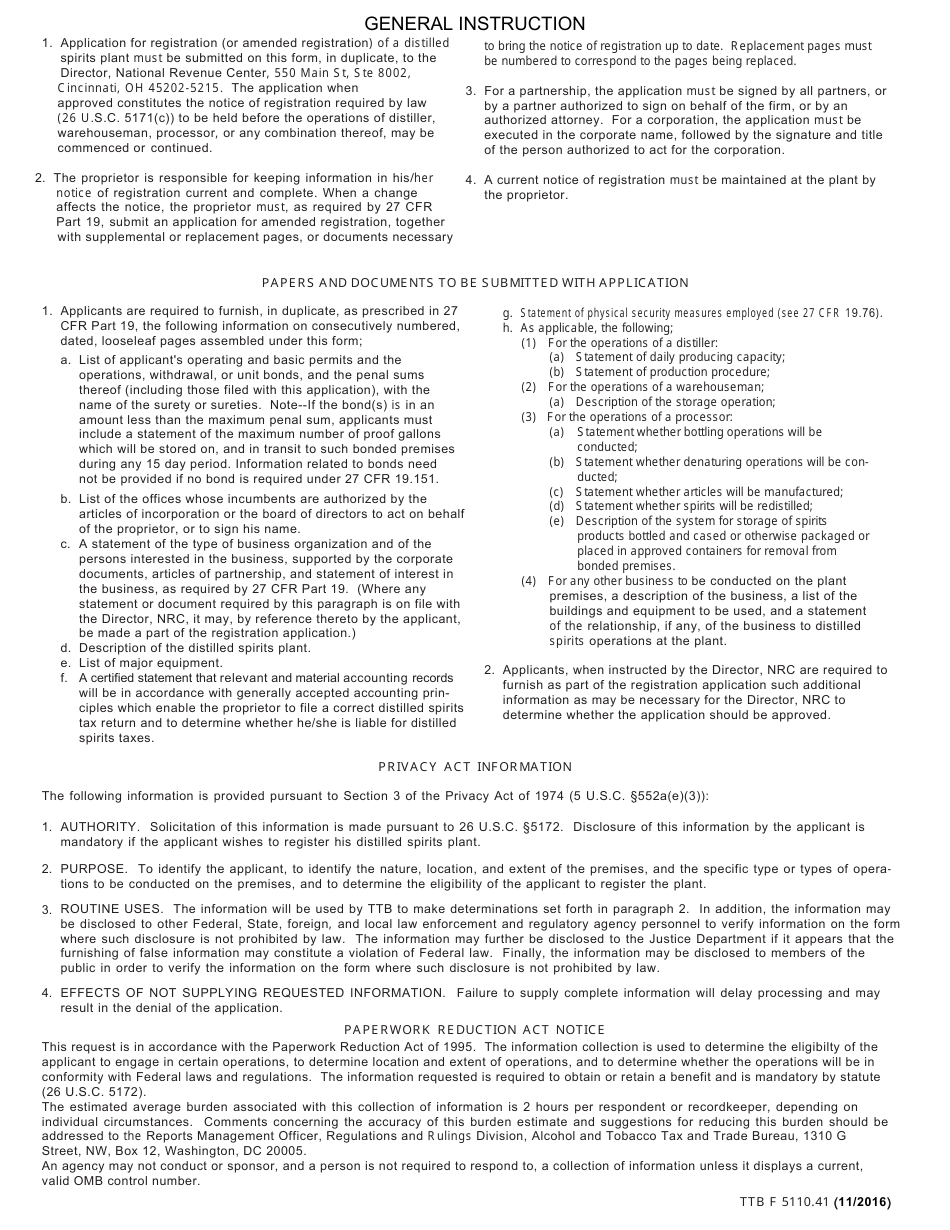

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on November 1, 2016 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5110.41?

A: TTB Form 5110.41 is a registration form for Distilled Spirits Plant.

Q: Who needs to complete TTB Form 5110.41?

A: Any person or business operating a Distilled Spirits Plant needs to complete this form.

Q: What is the purpose of TTB Form 5110.41?

A: The purpose of this form is to register and provide information about the Distilled Spirits Plant to the Alcohol and Tobacco Tax and Trade Bureau (TTB).

Q: Are there any fees associated with submitting TTB Form 5110.41?

A: Yes, there are fees associated with the registration of a Distilled Spirits Plant. The fees vary depending on the size of the operation.

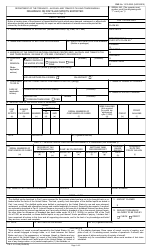

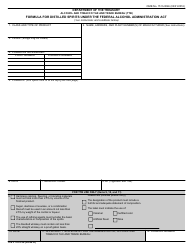

Q: What information is required to complete TTB Form 5110.41?

A: The form requires information about the applicant, location of the Distilled Spirits Plant, types of operations, and supporting documentation.

Q: Is there a deadline for submitting TTB Form 5110.41?

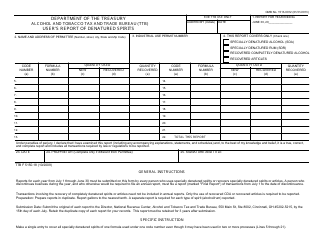

A: There is no specific deadline for submitting the form, but it is recommended to file it at least 60 days before the proposed date of operations.

Q: What happens after I submit TTB Form 5110.41?

A: After submitting the form, the TTB will review the application and may request additional information or conduct an inspection before approving the registration.

Q: Can I operate a Distilled Spirits Plant without completing TTB Form 5110.41?

A: No, it is illegal to operate a Distilled Spirits Plant without completing the necessary registration process and obtaining approval from the TTB.

Form Details:

- Released on November 1, 2016;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5110.41 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.