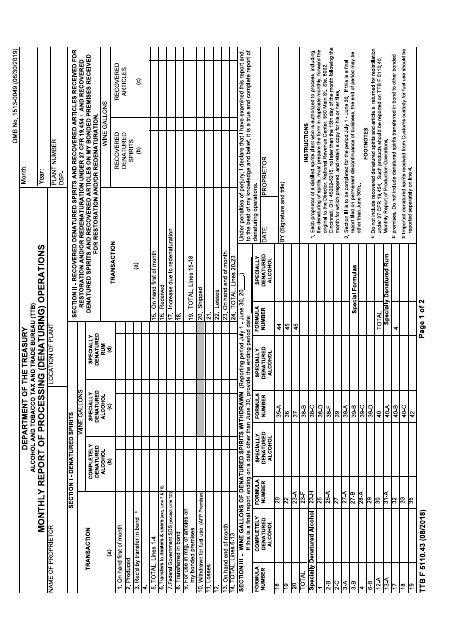

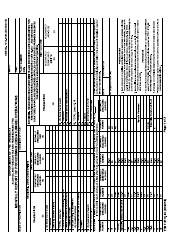

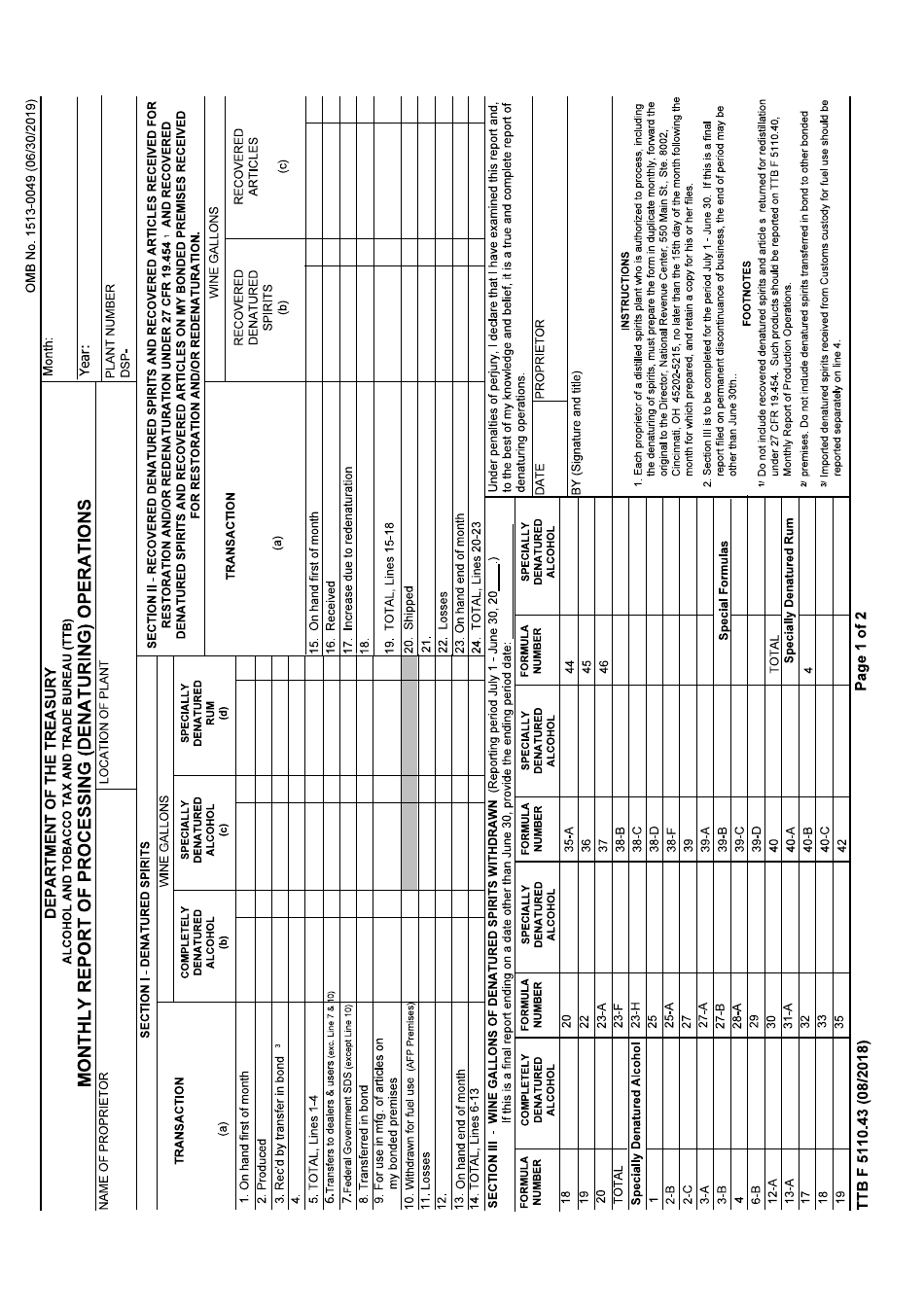

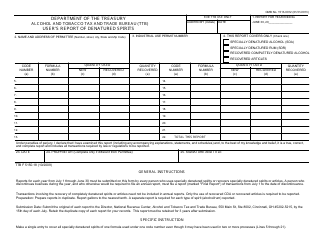

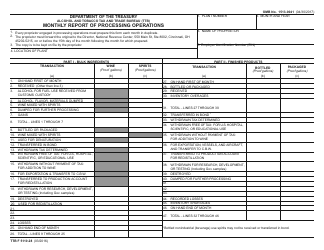

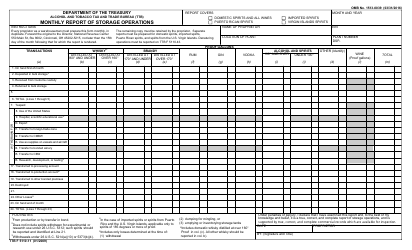

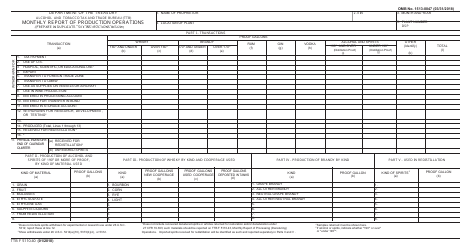

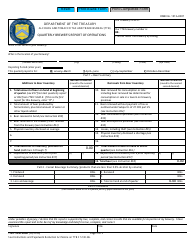

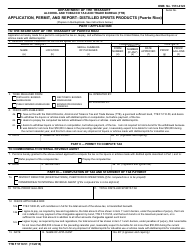

TTB Form 5110.43 Monthly Report of Processing (Denaturing) Operations

What Is TTB Form 5110.43?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on August 1, 2018 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5110.43?

A: TTB Form 5110.43 is a monthly report for denaturing operations.

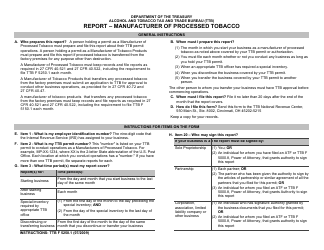

Q: Who needs to file TTB Form 5110.43?

A: Any business or individual engaged in denaturing operations must file this form.

Q: What are denaturing operations?

A: Denaturing operations involve making a product unfit for consumption by adding substances such as chemicals or dyes.

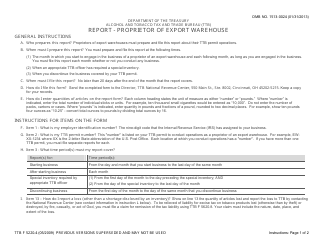

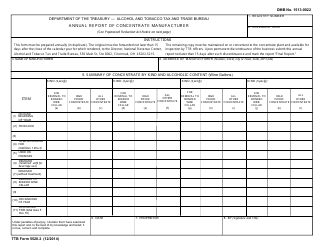

Q: What information is required on TTB Form 5110.43?

A: The form requires details about the denaturing operations, including quantities, types of substances used, and denaturing methods.

Q: When is TTB Form 5110.43 due?

A: The form is due by the 14th day of the month following the month in which the denaturing operations occurred.

Q: Are there any penalties for not filing TTB Form 5110.43?

A: Yes, failure to file this form may result in penalties, including fines and revocation of permits.

Form Details:

- Released on August 1, 2018;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5110.43 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.