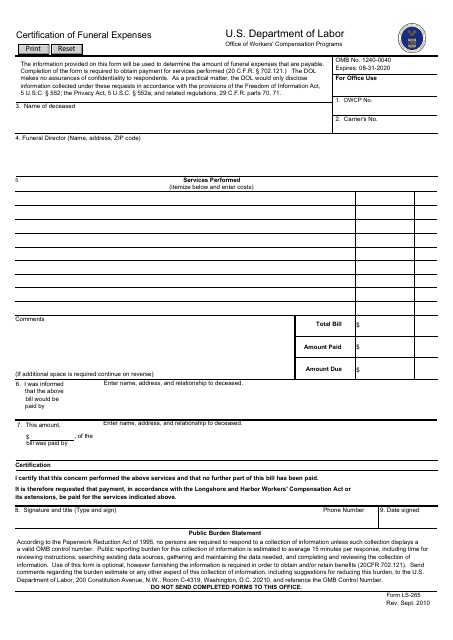

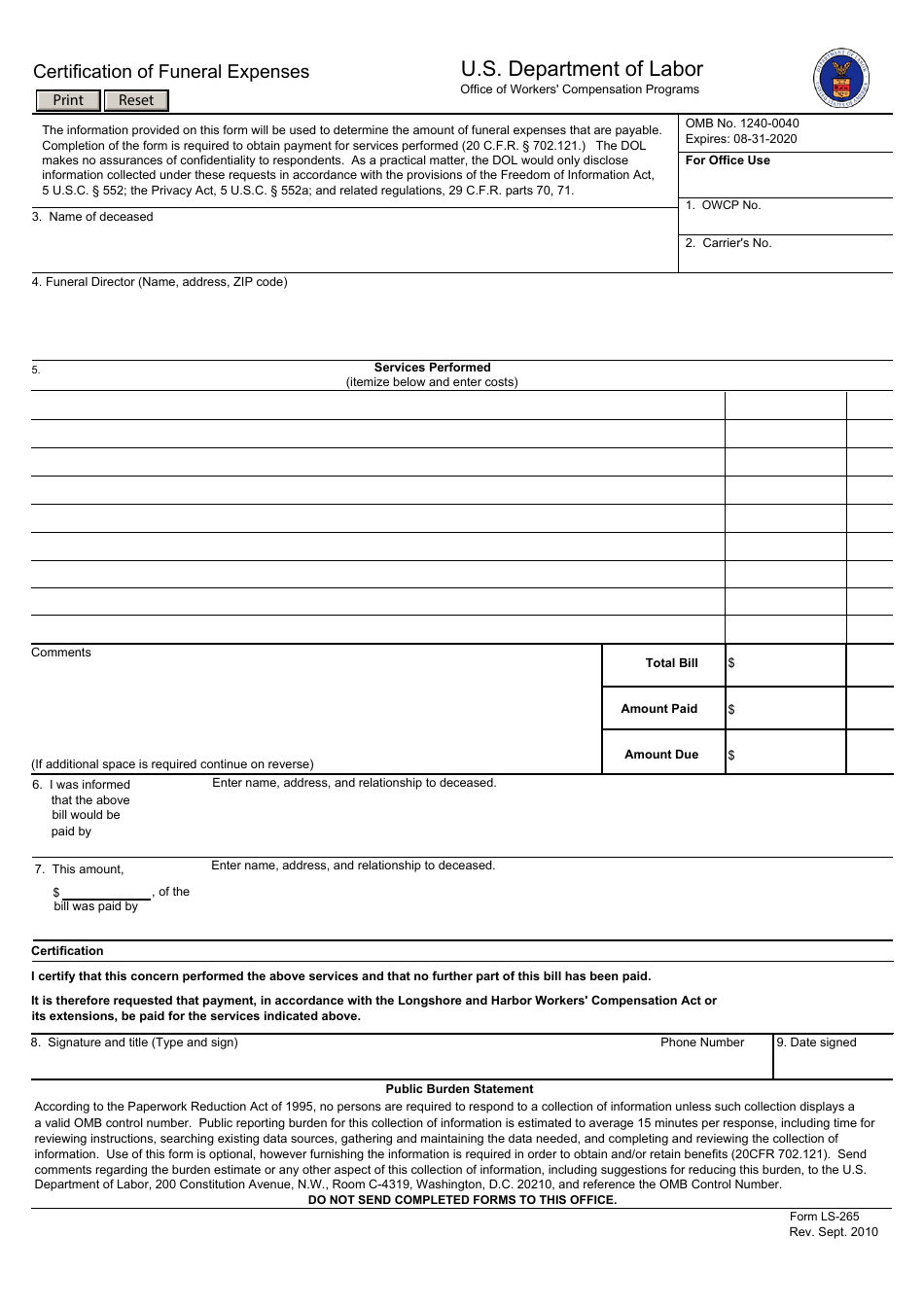

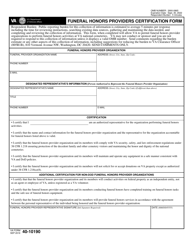

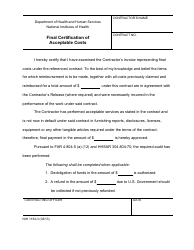

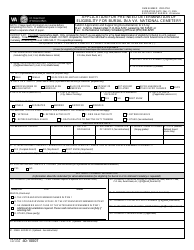

Form LS-265 Certification of Funeral Expenses

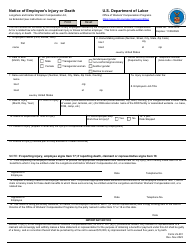

What Is Form LS-265?

This is a legal form that was released by the U.S. Department of Labor on September 1, 2010 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LS-265?

A: Form LS-265 is the Certification of Funeral Expenses.

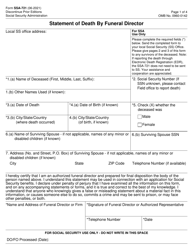

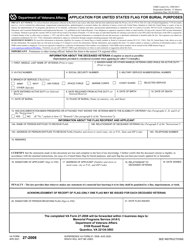

Q: Who needs to fill out Form LS-265?

A: Funeral directors or other individuals who have incurred funeral expenses can fill out Form LS-265.

Q: What is the purpose of Form LS-265?

A: The purpose of Form LS-265 is to certify the funeral expenses incurred by the funeral director or other individuals.

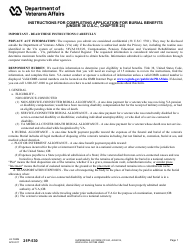

Q: How do I fill out Form LS-265?

A: To fill out Form LS-265, you need to provide details about the funeral expenses, such as the funeral director's name and address, the decedent's name, and the amount of expenses incurred.

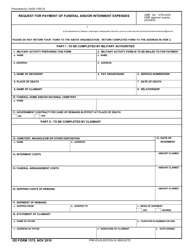

Q: Are there any fees associated with filing Form LS-265?

A: No, there are no fees associated with filing Form LS-265.

Q: What should I do with the completed Form LS-265?

A: The completed Form LS-265 should be submitted to the Department of Labor's Office of Workers' Compensation Programs.

Q: Can I claim funeral expenses on my taxes?

A: Yes, you may be able to claim funeral expenses as a deduction on your taxes. However, you should consult with a tax professional for specific guidance.

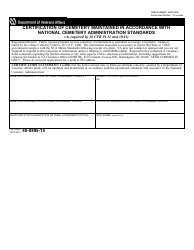

Q: Is Form LS-265 specific to a certain state?

A: No, Form LS-265 is a federal form and is not specific to any particular state.

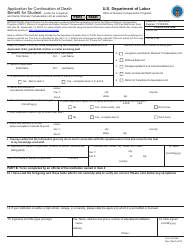

Q: What other forms do I need to submit along with Form LS-265?

A: You may need to submit other forms, such as the Application for Death Benefits and the Claim for Compensation, along with Form LS-265. It depends on the specific circumstances and the type of benefits you are claiming.

Form Details:

- Released on September 1, 2010;

- The latest available edition released by the U.S. Department of Labor;

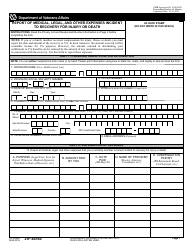

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LS-265 by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor.